Delta is a risk measure used by options traders. It’s one of four major measures called the option Greeks, which also include gamma, theta, and vega. Traders examine an option’s delta before making trading decisions to manage risk. They also use it to adjust their options trading strategies.

I think risk is the biggest thing a trader should pay attention to. Though I’m usually talking about the simpler risk of stock trading, that doesn’t mean I don’t understand how to use more complicated measures like delta …

I believe in keeping trading simple — but that doesn’t mean I believe in ignorance. You should know about all parts of trading before you narrow down your strategy to what you’re good at.

What is delta in options trading, and how can you use it to your advantage? Read on to learn more!

Table of Contents

What Is Delta in Options Trading?

2025 Millionaire Media, LLCDelta measures how much an option’s value changes when the underlying asset’s price changes. It specifically measures how much the option’s price will change with a $1 change in the market price.

Here’s an example:

Say, you have Company X stock worth $45 per share and a call option worth $3. Assume the delta is 0.4. This means for every $1 increase in the asset price, your call option’s value rises by 40 cents. If the underlying security gains $2 and becomes worth $47, your call option will be worth $3.80.

Not so hard, right? Good, there’s a bit more…

Deltas can be positive or negative. Here’s how they differ:

- Positive: You can find positive deltas on call options, ranging from 0 to +1. This is because an increased stock price will increase the option’s value, reflected in the delta value.

- Negative: You can find negative deltas on put options, ranging from -1 to 0. An increased stock price will decrease the option’s value. The stock price is reflected in the delta — increases take it closer to 0.

Brokers use computer algorithms to calculate delta in real time for their clients. These algorithms are based on a concept called the Black-Scholes model.

As a trader, you’ll likely be looking at an option’s delta to assess your strategy. They are also other option Greeks you should know:

- Vega: Measures the impact of volatility changes

- Theta: Measures time decay

- Gamma: Measures change in delta

These are mostly used in advanced options strategies. If you’re just starting out, learn how to enable options trading on Robinhood in this post.

Or you can check out my full guide to trading options on Robinhood here.

How Is Delta Used in Options Trading?

2025 Millionaire Media, LLCDelta is mainly used to help options traders tie a contract’s value to its underlying asset. This is seen most clearly when in-the-money (ITM) calls get close to expiration.

If a call option is definitely going to expire in-the-money, then any gains the underlying asset makes should be equally reflected in the price of the option, right? That’s why ITM calls get closer to 1 as their expiration date approaches.

Following this logic, here’s how other call deltas map out:

- At-the-money (strike price equaling the stock price) call options have a delta of 0.5. They can either expire in-the-money or out-of-the-money, and the delta splits the difference.

- Out-of-the-money call options get closer to 0 as expiration approaches. They’re most likely going to expire worthless, so any gains in the underlying asset won’t be reflected in the option. That’s because it likely won’t be executable.

You can also connect a put option’s price to its delta. Here’s a detailed breakdown:

- At-the-money put options have a delta of -0.5.

- In-the-money put options get closer to -1 as expiration approaches.

- Out-of-the-money put options get closer to 0 as expiration approaches.

More Breaking News

- MicroAlgo’s Quantum Leap: What Investors Need to Know

- Rivian Stock’s Unexpected Leap: What’s Driving It?

- Why DXC Technology Might Rebound Soon?

Key Examples of Delta Values

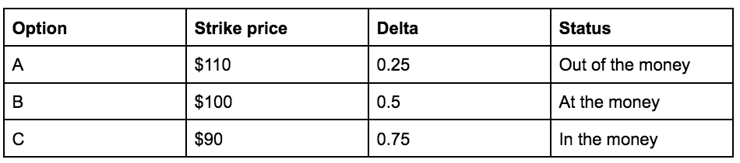

What do delta values look like? Here’s an example of a call option that’s out, at, and in the money, assuming the asset’s current market price is $100.

We’ll interpret these delta values in the next section.

How to Interpret Delta Values

2025 Millionaire Media, LLCFrom the table in the previous section, we get these interpretations:

- Option A has a delta of 0.25. Every time the current price increases by $1, the option’s value increases by $0.25.

- Option B has a delta of 0.5. Every time the stock price increases by $1, the option’s value increases by $0.50.

- Option C has a delta of 0.75. Every time the stock price increases by $1, the option’s value increases by $0.75.

These interpretations assume no other factors change, but the delta value is fluid and will change with its underlying security. The closer expiration gets in this example, the closer the delta will get to a final confirmation of 1 or 0.

Deltas close to 1 or -1 will have options whose value gain or loss roughly matches that of their underlying assets. At 0, the option doesn’t change its value even when the underlying asset moves.

Check out this guide on how to learn options trading if you’re missing the fundamentals.

Key Factors to Consider

2025 Millionaire Media, LLCWhat do you need to think about when buying an option? Here are two important factors:

Stock Sensitivity

Many factors influence stock prices. In the world of options, they measure this in “sensitivity” — how an asset changes in response to other factors.

One of the big measures of stock sensitivity is implied volatility — a stock’s volatility through the life of an option.

Many traders are scared of volatility. Personally, I love it.

You can check out my “Volatility Survival Guide” here.

Probability of In-the-Money Expiration

The more likely an option is to expire in the money, the more valuable it is. Looking at an option’s delta can give you a quick read on its value.

Delta vs Delta Spread

A delta spread strategy involves trading options contracts that cancel each other out with a delta neutral ratio. Delta neutral means their delta is 0.

Traders who use delta spreads expect a small profit when stock prices are static. But there’s still potential for big gains or losses if the stock price moves significantly.

Calendar spreads are one of the most common delta spreading strategies. This strategy works by buying and selling options with different expiration dates.

In a simple example, a trader sells a call option with a nearer expiration than the call they’ve bought. As the call that they’ve sold loses value closer to its expiration, they can sell the later-term call and net a small profit.

Traders use the delta spreading strategy to offset risk. However, advanced options strategies like this can be risky in themselves. It’s best to learn from a more experienced trader, like my former student Mark Croock.

Mark has taken my penny stock strategies and applied them to options trading — making $3.9 million in career earnings in the process! He teaches them in his Evolved Trader program.

Here’s a sneak peek of Mark’s curriculum:

Leave a reply