The cup and handle is a technical chart pattern. It was first defined by William O’Neil in his classic book “How to Make Money in Stocks.” O’Neil called it a “cup with handle” pattern. He had clear criteria defining this pattern. I’ll cover that in this post. But fair warning…

I get a lot of questions about chart patterns. Some students come into the Trading Challenge with preconceived ideas about patterns. Sometimes that’s a bad thing because my top students and I trade penny stocks based on volatility.

It’s not that there aren’t penny stock patterns — there are. Watch my “Pennystocking Framework Part Deux” DVD. It explains the entire seven-step framework we use to make smarter trades.

It’s important to know the classic chart patterns — and recognize them. But understand this is about giving you a broad education. It’s like stock trading 101.

(As an Amazon Associate, we earn from qualifying purchases.)

Table of Contents

- 1 What Is a Cup and Handle?

- 2 Cup and Handle Chart Pattern

- 3 Example of How to Use the Cup and Handle Chart Pattern

- 4 Structure of the Cup and Handle Technical Pattern

- 5 Conclusion

- 6 Further Educational Resources

What Is a Cup and Handle?

It’s a continuation pattern. It’s pretty simple: the pattern looks like a cup with a handle from the side. Here’s an example from 2019…

Cup and Handle Chart Example: Rare Element Resources Ltd. (OTCQB: REEMF)

Before I go any further … Some people will look at the chart and say, “Tim, that doesn’t fit William O’Neil’s perfect cup and handle description.” Right. Neither did any of the chart examples in his book.

Remember, trading is not an exact science. Let’s get into the cup and handle pattern as defined by William O’Neil.

Cup and Handle Chart Pattern

Here’s the basic definition of a “cup with handle” according to O’Neil in “How to Make Money in Stocks.” (A worthy book to add to your collection. I did a book review in my “Tim Raw” DVD and mentioned this book. It’s a classic.)

“Cup patterns can last from 7 weeks to as long as 65 weeks, but most of them last for three to six months. The usual correction from the absolute peak (the top of the cup) to the low point (the bottom of the cup) of this price pattern varies from around the 12% to 15% range to upwards of 33%. A strong price pattern of any type should always have a clear and definite price uptrend prior to the beginning of its base pattern.”

— William J. O’Neil, “How to Make Money in Stocks: A Winning System in Good Times and Bad,” Fourth Edition (p. 88). McGraw-Hill Education. Kindle Edition.

O’Neil then goes on to say that sometimes the cups are deeper — even 50% to 75%. He also talks about cups without handles and cups with uptrending handles. I mention this for three reasons…

What You Need to Understand About the Cup and Handle Chart Pattern

First, many online sources give precise definitions of the cup and handle. “For it to be a cup and handle, the stock has to do this, then this.” Blah, blah, blah. That’s a bunch of blowhards trying to get you to follow them. They probably haven’t even read the book.

Second, O’Neil basically says it’s not an exact science. He observed hundreds of variations — both successful and failed cup and handle patterns.

Third, in the book, O’Neil talks about other important indicators when you spot a potential trade. And not just in other parts of the book. It’s right there on the same page with the cup and handle pattern (emphasis mine):

“You should look for at least a 30% increase in price in the prior uptrend, together with improving relative strength and a very substantial increase in trading volume at some points in the prior uptrend.”

Here’s another example. It’s not textbook cup and handle, but the pattern is still obvious.

Plug Power Inc. (NASDAQ: PLUG)

I can’t emphasize enough that pattern/price action is only ONE of my seven indicators. (You’ll find the seven indicators on my “Trader Checklist Part Deux” DVD.)

Example of How to Use the Cup and Handle Chart Pattern

Again, I have my favorite patterns to trade. So I don’t go on the hunt for the cup and handle pattern. But — and this is super important — a lot of traders do. And that means it can be a self-fulfilling prophecy.

In other words, if enough traders see the cup shape, they can get interested. Then they see the pullback handle. And then it can turn into a breakout just because so many people believe it will happen. They all buy together and drive up the price.

Cup With Handle Signal

The cup with handle signal is another way of saying the pattern is a bullish chart pattern. The pattern signals technical traders about a potential breakout. Technical traders often buy right when the stock climbs back to the pivot price. (The pivot is the top of the handle. Keep reading to see what I mean.)

In the case of an inverse cup and handle, it’s bearish. It signals a potential breakdown.

More Breaking News

- RH Stock Surges: What’s Next?

- Intel and Silver Lake’s Strategic Dance

- TeraWulf’s Surging Stock: What’s Happening?

Cup and Handle Pattern Failure

Again, it’s not an exact science. Patterns fail all the time and for a variety of reasons. That’s why it’s essential to plan your trades and follow rule #1: cut losses quickly. Let’s take a look at a chart with several examples.

Interestingly, this chart shows both successful and failed patterns. The stock was featured on my Top Penny Stocks to Watch for July 2020 list.

Failed Cup and Handle Example: ElectraMeccanica Vehicles Corp. (NASDAQ: SOLO)

First things first … This doesn’t fit the “7 to 65 weeks” cup definition I quoted from O’Neil’s book above. This pattern can happen in shorter time frames, too.

In the penny stock niche, it’s important you don’t get too attached to traditional or long-term patterns. That’s not to say they don’t happen. It’s just that my seven-step framework is more accurate for this niche. (Again, refer to “PennyStocking Framework Part Deux.”)

On the chart above, I’ve drawn three arcs to represent cups. The small cup on the left is messy. And it’s a good example of a cup and handle pattern failure. The bounce out of the handle was very small before continuing downward.

Then the stock formed a nice cup from the high of day on June 30 through July 1. Looking at the chart, you could argue the pullback at the end of the day on July 1 is a handle…

But look at the bigger arc. That shows the entire pattern more clearly. It’s a kind of double cup, a clear handle, and a clean breakout.

Structure of the Cup and Handle Technical Pattern

The let’s look at the structure of the pattern with this example…

Cup and Handle Structure Example: Night Food Holdings (OTCQB: NGTF)

The following details refer to the numbers on the NGTF chart above:

- Upward momentum. O’Neil said to look for a 30% upward move to the rim of the cup.

- A pullback forming an arc or U shape. The base length can vary — and does. Pure long-term technical traders tend to follow the seven weeks or more rule. You won’t always have that luxury with penny stocks.

- Ramping up to the rim on the right. The great Jesse Livermore called this the high pivot.

- A pullback to form the handle. O’Neil liked a downward handle as opposed to an uptrending handle. His backtesting showed uptrending handles often lead to cup and handle pattern failure.

- Strong upward momentum to breakout above the high-pivot (i.e., the breakout).

(IMPORTANT NOTE: Don’t confuse this with my seven-step pennystocking framework. The numbers don’t represent the same moves.)

Bullish Cup and Handle Pattern

A bullish cup and handle pattern is what most people are talking about when they say cup and handle. Again, it’s considered a bullish signal for a potential breakout.

Bearish Cup and Handle Pattern

Almost every pattern has its opposite. The cup and handle is no different. The easiest way to describe it is that it looks like a teacup turned upside down.

In other words, look for a roughly 30% downward move, an inverted U-shaped correction, a bounce handle, and breakdown. For me, I look for big panics to dip buy. Sometimes they look like a bearish cup and handle breakdown. But that’s not my focus.

Cup and Handle Formation in Penny Stocks

Penny stocks are beautiful because they’re so volatile. This means the big moves usually happen much faster than expensive stocks like blue-chips.

Not sure how to trade through volatility? Access my NO-COST “Volatility Survival Guide” here.

One consequence is that patterns tend to speed up, too. Three of the example charts you’ve looked at so far fit the traditional time frame. REEMF, PLUG, and NGTF formed a cup over roughly seven weeks. But SOLO formed a messy cup and handle over only three days.

Now take a look at an intraday cup and handle…

Intraday Cup and Handle Example: Polymet Mining Corporation (AMEX: PLM)

PLM didn’t have a strong breakout from the handle. It was choppy. Again, there are other indicators to consider. For example, the big increase in trading volume. I don’t like choppy stocks — I’m too impatient. But the chart shows how this pattern can form intraday.

Take a look at another example of a recent runner. This time the cup and handle pattern formed over one day. I wrote extensively about this stock in “The Truth About Promoted Penny Stocks.”

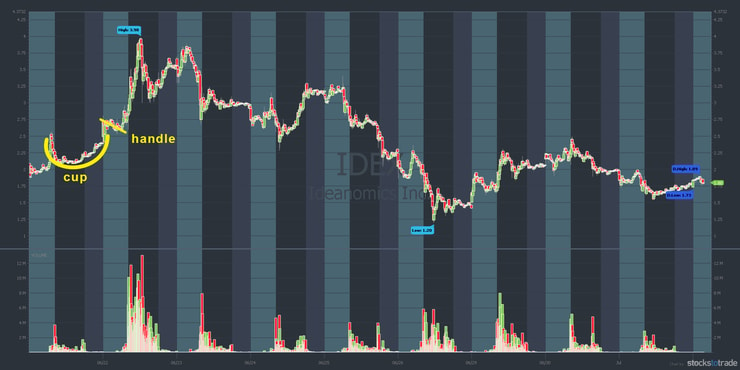

One-Day Cup and Handle Example: Ideanomics, Inc (NASDAQ: IDEX)

Again, this isn’t an exact science. IDEX formed a decent pattern over one day from premarket trading on June 21. Then it had a clean breakout at the market open on June 22.

Here’s one final example for your knowledge account…

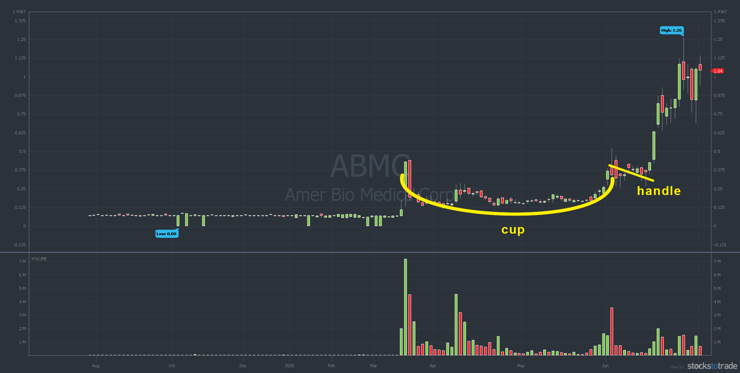

Penny Stock Cup and Handle Example: American Bio Medica Corp. (OTCPK: ABMC)

The ABMC chart is an ugly cup and handle. The handle on the chart is also a good example of a bull pennant pattern.

Conclusion

The cup and handle pattern is one of the classics every trader should know. While I don’t actively search for it, I do think you need to recognize it. Why? Pattern recognition can signal a potential trade.

Remember, there are a lot of traders who focus on technical patterns. The more you know about how they think, the smarter you can start to trade. Trading is a battlefield — know your opponent.

Also, remember smart trading requires more than just knowing a pattern. I’ve given you hints in this post about how to trade the cup and handle pattern. But if I gave you only “buy here, sell here” I’d be doing you a great disservice. Why? Because the perfect pattern is rare.

You MUST understand the other indicators. You have to be meticulous. Otherwise the market will determine the cost of your education.

Here’s an example…

The SOLO chart in this post showed a pretty clean breakout. But do you know why the stock broke out? The catalyst is another important indicator. In the case of SOLO, it was all about sector momentum. The entire electric vehicle sector was going crazy that week. Self-sufficient traders know and use ALL the information at their disposal.

Further Educational Resources

For an introduction to penny stocks, access my FREE penny stock guide here.

To learn all the basics of my strategies, read “The Complete Penny Stock Course.” It answers most of the questions new traders ask me.

Use a stock screener designed for trading penny stocks: StocksToTrade. Be sure to check out the Breaking News Chat add-on. (Full disclosure: I helped design StocksToTrade, and I’m an investor.)

And when you’re ready to go deep and become a self-sufficient trader, apply for my…

Trading Challenge

The Trading Challenge is the most comprehensive trading course I offer. You get access to DVDs, archived webinars, and video lessons.

Plus, each week you’ll get two to four live webinars with some of the top trading mentors in the business. The syllabus takes you from complete newbie through all the strategies I teach.

Finally, the Trading Challenge chat room is, in my opinion, the best chat room on the interwebs.

Apply for the Trading Challenge today. (No lazy people allowed. Self-sufficient trading requires a ton of studying, discipline, dedication, and effort.)

What do you think of the cup and handle pattern? Comment below, I love to hear from all my readers!

Leave a reply