This question comes up pretty often: “Hey Tim, what are the top times to trade ?” or “When do you like to trade?”

If you’ve watched any of my DVDs, then you should know the answer. Trading Challenge students know the answer. They get a lot of strong suggestions about the best times to trade. One thing I want to make clear: It’s not only about the time of day. Yes, there are two periods during the day when I make most of my trades. But there are exceptions. I sometimes open or close positions at different times.

Why would I make an exception? Read the entire post and it will be clear.

Table of Contents

Power Hours

A lot of people talk about the stock market power hour. Technically, it’s 3–4 p.m. Eastern, which is the last hour of regular market trading. This is definitely a time when a lot of big moves happen.

I believe there are two power hours in a trading day. I’m different than a lot of people on this. I say the first hour of the day from 9:30–10:30 a.m. Eastern is very powerful. And the last hour of the day is powerful.

Here’s what you can learn from this…

A lot of people don’t have time to trade all the time. So figuring out the best times to trade is even harder. Many of you won’t be ready to trade full-time. You might prefer to trade part-time instead of full-time. If you can focus on these two hours, the power hours, that’s when the vast majority of volatility happens … and it’s when you might see the majority of opportunities.

Morning Power Hour

In the morning you get a lot of big moves such as morning spikes and morning panics. Obviously, sometimes a stock doesn’t do anything — nothing is happening. Those aren’t the plays I’m looking for.

I keep an eye out for morning spikes and morning panics. I research and set up my watchlist every day. Some of the stocks I watch do what I expect, others don’t. No big deal. If I’ve done my research and set up my watchlist, then I’ve prepared. After that, I wait for the stock to prove itself. My thesis is either confirmed or denied by the stock.

(By the way, if you want my daily watchlist you can get it by joining the Trading Challenge. I also send it out to TimAlerts and PennyStocking Silver subscribers. Remember it’s just a watchlist. You don’t have to trade any of the stocks on my list. The most important thing to do is to learn from it. Learn how and why I chose the stocks on the list. Someone else’s hot picks list probably won’t help you much. Learn to make your own watchlist.)

Morning Spike

These are the signs I search for to add a stock to my watchlist for morning spike consideration.

- Stock closes strong the previous day.

- Stock is hitting new highs on strong volume near the end of previous day.

- The company reported good earnings or another strong catalyst.

(Note: These indicators do not guarantee a morning spike will happen. They are common when a morning spike does happen. Sometimes morning spikes happen for no apparent reason.)

Let’s say a stock finishes strong, it’s in a hot sector, and it’s breaking out on strong volume. It might have legs going into the next day. It might have the momentum for a morning spike.

Morning Panics

What creates a morning panic? Often it’s when the stock finishes the previous day on a low. Let’s say the stock has had 4 or 5 green days in a row. Then it has a red day. Sometimes slower traders who didn’t recognize the momentum shift the day before, all sell at market open. This creates a panic. Then you get electronic stop losses kicking in and it feeds the panic.

This creates a couple of different opportunities. The first is overnight short selling (NOT recommended for beginners or small accounts). The other is dip-buying morning panics — which is, at the time of writing, my favorite pattern.

2025 Millionaire Media, LLCAfternoon Power Hour

The afternoon power hour is similar to the morning power hour. There’s an increase in trading volume and volatility. This translates to bigger moves. One caveat: sometimes this starts a little earlier, say, 2:30ish p.m. Eastern. It’s not an exact science.

Here’s an example of how I like to work during the afternoon power hour…

I like buying stocks that are close to hitting new highs. Maybe a stock is taking out day highs (high of day or HOD) around 2:30–3 p.m. Eastern. This scenario gives me the opportunity to sell again before the market closes.

I don’t have to hold it overnight. If I make 5% to 15% on my money there’s no reason to hold the stock longer. And I have the option to hold all or part of my position overnight if it looks good.

I may sell half my position into the close because it’s closing nicely but hasn’t hit all my goals. This takes some of the risk off the table. The other half I leave, ideally for a morning spike or gap up the next day.

Fridays are a little different. The last hour of trading on Friday is also the last trading hour of the week. Sometimes you see huge moves up or down as people don’t want to be stuck in plays over the weekend.

One thing I hope you take away from this post: I want you to start thinking about which stocks have legs — up or down. What kinds of catalysts create more upside? Which ones cause downward pressure?

First Green Days

I like to look for and trade first green days. What does that mean? Check out the video below:

You watched the video, right? If you haven’t, watch it now. It’s only six minutes long. Six minutes to burn something powerful into your brain if you give it a chance. Watch it.

Sometimes with the first green day you get the morning gap up and then a fast morning panic where it’s hard to get out. When you’ve witnessed enough of these panics you know it doesn’t matter as long as you take as much profit as possible. In other words, don’t sit there like a deer in headlights and wonder what’s happening.

This is a prime example of why you should sell into strength at the close. At least reduce your position size to lock in profits. Some people reading this are thinking, Tim, why are you so conservative? Why not wait until the next morning to sell and sell right at the open?

I’ve seen enough day-two panics in 20 years to know it’s better to lock in some profits. Then you’re playing with house money when the market opens. It’s not an exact science. I can’t tell you right now one way is better than the other.

I can give you the pattern and tell you there are possible outcomes you need to be aware of. And I’ll show you a prime example in this post … keep reading to see my $745 loss on a day-two morning panic.

Trade When the Pattern is Right

I teach my students patterns — the same patterns I’ve been trading for the past 20 years. I keep seeing them. I don’t trade every pattern all the time. After all, markets fluctuate. Things change. Technology changes. Patterns evolve. You will have to adapt.

But the underlying patterns — I keep seeing them. They look very similar now to what I was seeing 10-years, 15-years, even 20-years ago. I’m not saying they’ll last forever. I call myself a glorified history teacher. I believe if you study patterns and prepare, you’ll start to see them.

More Breaking News

- IONQ’s Surge: An Opportunity or Risk?

- Core Scientific’s Untamed Rise: Buy or Beware?

- Luminar Technologies Makes Big Strides: Time to Invest?

Study Patterns … But Beware of Memorizing a Pattern

There’s more to it than memorizing patterns. Learning a pattern is an important step, but only the beginning. Patterns evolve, they mutate. They shift with the market. Not every supernova chart looks exactly the same. Patterns have variations.

Take dip buys, for example. What if a stock is panicking on a Thursday during afternoon power hour? Should you take a position? Is this a potential dip buy? No. Because that price action can lead to a morning panic the next day.

I don’t want to buy just anything on a dip — it’s like trying to catch a falling knife. I’m always thinking: What does this move that’s happening right now … what does this indicate is likely to happen the next hour or the next day?

Be Prepared

Preparation is key. Most traders lose because they aren’t prepared. So learn the patterns, be able to see them, and understand how they play out. How can the afternoon trading help you predict the next morning? How can a morning play turn into a potential afternoon play?

It’s all connected. Like I said, it’s not an exact science. But I hope you’ll begin to see how interrelated the power hours are. The key is being prepared. I want you to be prepared and I want to help you get prepared. That’s what Trading Challenge is all about.

I want you to see the pattern before you execute. Before you get into a trade. See it in your mind. This doesn’t mean the stock market is going to bend to your will — don’t take me wrong. It’s absolutely NOT going to do what you want … the stock market doesn’t care.

Sometimes I get the pattern right but my timing is off. FOR EXAMPLE: Like my recent $25* profit on CBD Unlimited Inc (OTCPK: EDXC). A measly $25 win … which could have been much more if I’d got the timing right. But instead of hold and hope with the possibility of losing a bunch of money — I took the miniscule win and took a step back.

Check out the chart:

EDXC chart: morning panic followed by massive bounce

Notice the morning panic and the huge — over 100% — bounce? Recognizing the potential for that is preparation. It’s not random. I misjudged the timing. And it just means I need to be prepared for the next one.

That’s what I want for you — to prepare for the next one. Who cares when it happens. The question is … will you be prepared? There are opportunities everywhere. In the stock market there are opportunities both long and short — if you’re prepared.

Cut Losses Quickly

I say this constantly. I write about it, tell you to do it in my videos, and tell my students to do it when I alert trades. This is rule #1 for a reason. This post fully explains when to cut trading losses. Remember: Whatever trade you’re in, it’s a moving target. Trade scared and you’ll never be scared to trade.

Understand Catalysts

Whether it’s pump and dumps, earnings winners, contract winners, or any other big news, you need to learn what drives price. You will lose some. But if you’re prepared — if you’ve studied and follow the rules — it can better help you trade the market the right way. Know and understand catalysts.

Check Out My Trader Checklist Guide

Trader Checklist is a no-cost video course — nearly 12 hours of content — to help you with planning trades. It describes in detail my 7 indicators for determining the potential of a trade. I call it the Sykes Sliding Scale. Watch it and take notes: Trader Checklist.

Trade Only When the Pattern Presents Itself

One thing I want to make clear: Don’t force trades. I have to repeat this to Trading Challenge students on a regular basis. So take it in — tattoo it on your forehead if necessary. (Ok, don’t do that. It wouldn’t look good. But remember it. Don’t force trades.)

If I don’t see anything worth trading, I don’t trade. Sometimes the best trade is no trade. Patience, while tough, is necessary to grow your account.

Trade When Your Head Is Straight

I can’t stress this enough. Yes, this post is about my favorite times to trade. But I also want to make it crystal clear that there are times when you shouldn’t trade. Don’t trade when your head isn’t right.

Don’t trade if/when you’ve been drinking or taking drugs. It’s a recipe for disaster. Keep a clear head during trading hours. Enough said. Heed this advice. Ignore it at your own risk. You’ve been warned.

Another time when your head is not straight is when you’re sick. It messes up your perspective. I had a bad loss back in 2016 trying to short a stock I should never have been trading. I got biased and broke my own rules. The price I paid? Roughly $37K. Painful lesson. If you’re going to step in front of a freight train, you’d better be sure it’s worth it.

Trade Cowardly

I’ll repeat this because it’s important. Trade scared and you’ll never be scared to trade. I trade conservatively. I have my hand on the button to get out of a trade at any moment. See my previous point about cutting losses quickly.

Stay Nimble

Be ready to get in or out of a trade at any moment. FOR EXAMPLE: I recently had a trade where I lost $745 on Medicine Man Technologies Inc (OTCQX: MDCL). I explained the trade in more detail in this week’s Millionaire Mentor Update. I couldn’t get my sell order executed. Sometimes this happens. If I’d set an electronic stop or not been nimble it could have been a lot worse.

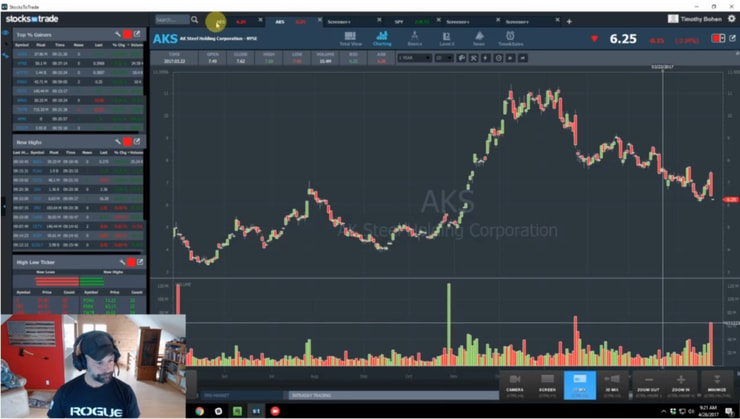

Here’s the chart so you see what I mean:

My exit on the morning panic was captured live during a Trading Challenge webinar. It was a bit hairy. I was hoping for the morning spike or a decent gap-up. No biggie on the loss and a good example of why being nimble is very important.

Think Like A Sniper

Watch the movie “Enemy At the Gates.” It’s a great movie. It can teach you things about trading. Sniper versus sniper. You have to learn to think like this with trades. What’s your target? Go only for that target. Win or lose, know when it’s time to get out. Focus.

Part of this concept is trading when your schedule allows. In other words, I don’t freak out if I can’t trade because I have another commitment. Nor should you. Don’t try to trade and do something else at the same time. Either trade or don’t trade. But don’t trade and do something else. It’s usually a bad combination.

Trading Challenge

The Trading Challenge is my best, most complete system for teaching you to trade. It’s everything you need to know. And it’s comprehensive. It’s not a ‘learn it in a weekend’ BS course that will teach you only enough to be dangerous to yourself.

What does it include?

- Thousands of video lessons. Everything you need to know about trading penny stocks is in these lessons. They’re all categorized. You can go through in order starting at the beginning or go by category. Whatever suits you and your schedule.

- Two to four live webinars per week with me and Trading Challenge mentors.

- The Trading Challenge chat room — an incredible real-time learning experience. Top students, Trading Challenge mentors, and newbies all interacting during trading hours. When you get there, follow the rules. No BS.

- Webinar archives. A treasure trove of questions answered, trades dissected, and observation of live trading.

- Access to my DVDs with a syllabus to take you through them in the right order. Don’t skip this. Don’t overlook it. This is the foundational knowledge you need for success.

- A 60-video intro course. It’s a great way to get started with the video lessons. It can teach you a lot of the most important lessons you need to understand right away. Each day you’ll receive an email with a link to the lesson for the day. PennyStocking Silver subscribers also have access to this.

Apply for the Trading Challenge here. Not everyone gets accepted — so come ready to tell my team why you should be accepted. Tell them how hard you’re willing to work. Laziness is not allowed.

Conclusion

Time of day is important to consider when trading. But it’s not the be-all and end-all. Sometimes it’s better to just sit on the sidelines.

The two power hours are my favorite times to trade. If something perfect happens at another time, I sometimes take a trade. For example, a late morning spike with volume and a news catalyst. When things aren’t right or I don’t see the perfect pattern, I stay away.

Leave a reply