I truly believe that ANYONE can become a profitable trader and build wealth through the stock market.

Over the years, I mentored over two dozen students who became millionaire traders in their own right.

So, it’s no surprise that when you see someone like my student Jack Kellog of Breakouts & Breakdowns pull in almost $300,000, people assume that it’s all about hitting homeruns.

Nothing could be further from the truth.

Let me throw you some stats from my trading account this year:

View every single one of our trades here at profit.ly

My average winning trade is $648.44 while my average losing trade is $341.98.

These aren’t big numbers by any stretch.

But who wouldn’t be happy pulling in over $100K a year trading the market?

I talk a lot about cutting losses quickly and locking in profits.

Now, I want to show you trades that illustrate this point.

You’ll see how I evaluate and manage trades to keep my losses small while maximizing my gains.

And these same techniques can be used by any trader to improve their performance.

TOMI Environmental Solutions Inc. (NASDAQ: TOMZ)

While some traders like to make dozens of trades every day, I keep things simple.

I look for stocks that fit my chart patterns and then signals for an entry.

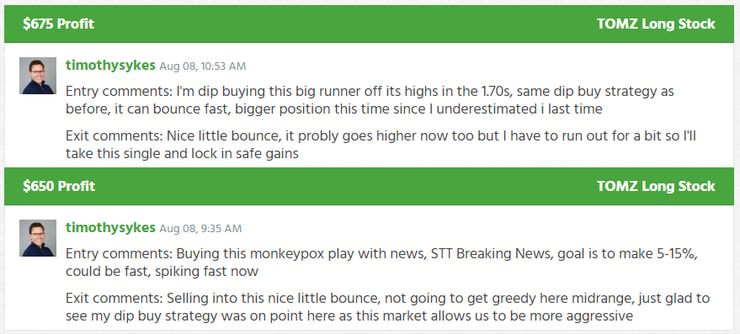

TOMZ is a perfect example of a stock where I took two tiny trades for a couple of nice wins.

At 8:30 a.m. EST, the busiest time for news and data drops, TOMZ released a statement that their Steramist provides protection against Monkeypox and other pathogens.

For anyone who hasn’t read the news, Monkeypox outbreaks continue to climb. While it’s at serious levels, it’s by no means a pandemic.

Plus, we already have vaccines to deal with the disease.

Nonetheless, before this year, it was rare to see cases outside of developing countries.

Now, it’s gotten bad enough that the mayor of NYC declared an emergency.

As you can imagine, anything tied to Monkeypox, like SIGA Technologies Inc. (NASDAQ: SIGA), pops on the slightest news.

So, I had a catalyst for a name that’s a Supernova from 2020.

Now that I have the stock identified, I look for a setup in the name.

I’m a big fan of either buying pullbacks or breakouts that push past important resistance levels.

In this case, I bought shares of TOMZ once the stock broke over the open of the day after a quick dip at a price of $1.40.

Unfortunately, shares didn’t follow through. However, I added to my position on a dip to $1.31, giving me an average price of $1.355.

I used the next major spike to sell into strength and lock in my profits at $1.42.

By no means was this a big win. But these little base hits add up over time.

Had the stock dropped below the low of the day I would’ve exited and cut my losses.

Now, as the day went on, I saw another opportunity with shares starting to break out on decent volume.

So, I waited a few minutes for the dip and bought on a pullback at $1.57.

I used the next spike to sell into strength at $1.66.

Neither of these were huge trades.

Yet, I waited for the stock to come to my entry, focused on getting the right price, and used my chart patterns and dip by strategy to lock in a profit.

After either entry, if the stock failed to move higher, trading sideways or drifting lower, I would immediately cut the trade.

I’m not one to give trades a lot of time. With the way I trade, I expect things to work out very quickly.

So, if a stock doesn’t act the way I want, I cut it loose.

That’s specific to the way that I trade. Some traders use strategies that require more time.

However, if you’re going to give a trade more time, you need to be aware of the additional risk involved and size your position accordingly.

Final Thoughts

The key here is to develop a trading method that minimizes risk and maximizes profits.

I do this by watching for bounces to occur almost immediately.

I’m very particular about where and when I enter.

You should be too.

Don’t chase trades. Instead, wait for them to come to your price targets.

That way, your entry is close to risk, limiting your downside while increasing your upside.

—Tim

Leave a reply