Kyle Williams often says he’s so bearish, he’s bullish. What does he mean by that? And what can you learn from Kyle?

Read on, because in this post I’m sharing a long overdue update on Kyle, his growth in 2020, and his crazy work ethic.

Let’s do this!

Table of Contents

So Bearish He’s Bullish

2025 Millionaire Media, LLCKyle Williams has had an amazing year. His 2020 trading is a near-perfect example of preparation meets opportunity. Some of you reading this already know Kyle’s story. If you’re new to the blog, here’s Kyle’s story in a nutshell…

Inspired by “The Big Short”

In 2016, Kyle watched the movie “The Big Short” and realized he needed to learn about the financial markets. Penny stocks interested him. But whenever he looked into them he saw the typical warnings. (New to penny stocks? Start here with my FREE penny stock guide.)

He watched free videos on YouTube but admits the first few months he was lazy. He was also unprepared. According to Kyle, “My first trade was blind. I didn’t even have trading software.”

Some days he didn’t even wake up for the market open, especially if he didn’t have a trade due to being under the PDT. Eventually, he found me through a Google search. Like so many others, at first, he was skeptical.

June 2016: Welcome to the Trading Challenge

Kyle saw the potential in penny stocks. But he knew the market’s price of tuition would be high. Learning from somebody already doing what he wanted to do made more sense. So he applied for the Trading Challenge and got accepted.

Kyle lost around $1,000 over a couple of weeks and realized at that rate he wouldn’t be in the game long enough to learn. So he did two things…

First, he started studying. He watched all the DVDs over a six-month period. Then he started going through the video lessons. He watched every single lesson. According to Kyle, the DVDs gave him the basics, but the video lessons gave him experience in seeing it.

Second, he scaled down his position size — sometimes taking only 100 shares. His goal was to learn to trade, NOT make money. Kyle’s mindset during that part of his journey is so important…

Too many people try to go big too soon. Then, when they take a big loss, they lose more than money. They lose confidence. Kyle looked at every trade as a learning opportunity with limited risk.

How did he limit his risk? By determining how much he was willing to lose and then setting his position size based on that. Then he got to work refining until he was profitable.

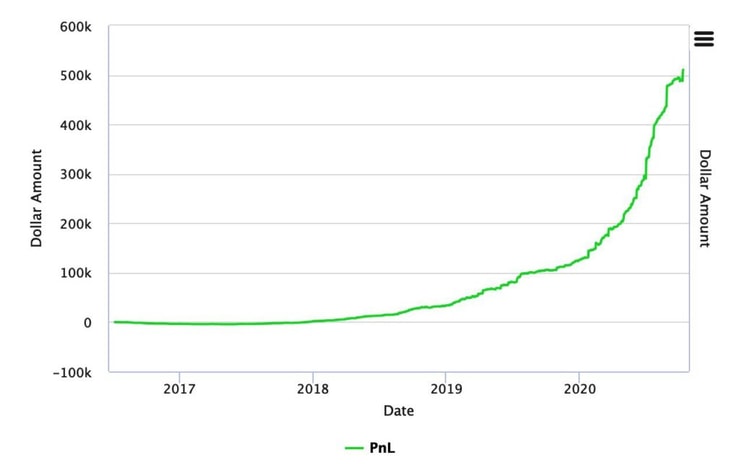

Kyle’s ‘So Bearish, He’s Bullish’ Profit Curve

I’m gonna go over Kyle’s beautiful 2020 growth in a bit, but first … here’s a little perspective.

Kyle lost money pretty much his entire first year in the Challenge. It took another six months after that to grind his way back to zero. In other words, Kyle made nothing in his first 18 months of trading.

And he continued to grind, making $32,282 in 2018.* This is where it gets interesting, so pay attention. In 2019, Kyle made $92,100.* When the stock market madness of 2020 came along, Kyle was ready to take advantage of the opportunity.

(*These results are not typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

His roughly three and a half years of study, practice, and refining paid off for him…

More Breaking News

- Lyft Stock Dips: Should You Worry?

- Applied Digital: A Surge of Interest or Simply a Mirage?

- Growth or Bubble? Decoding the Rise of APPN

2020: Kyle’s Year of Exponential Growth

Check out Kyle’s profit chart here. It’s pretty incredible. It’s awesome that some months Kyle makes as much as he made in his first full year of profitability. Sometimes MUCH more.*

For example, Kyle’s best month so far was in July 2020 when he made $79,585.* Keep reading for more on Kyle’s monthly recap videos. Watch Kyle’s July recap video here.

Note: if you look at Kyle’s numbers on Profit.ly, it looks like he made $81,334 in trading profits in July. One reason Kyle does his monthly recap videos is to show his borrow fees.

Watch the video and you’ll see that Kyle’s borrow fees for July were $1,749. Add that to $79,585 and, voilà, you get $81,334. In other words, Kyle goes the extra mile for transparency.

How much has Kyle made so far in 2020? Over $524,000.* His total career earnings are now more than $650,000.*

I’m SO proud of Kyle. He’s self-sufficient and profitable, but more importantly…

Kyle Gives Back to the Community

When successful students give back through teaching and sharing their knowledge, everyone benefits. That’s another reason I’m so proud of Kyle.

Trading Challenge Chat Moderator

Kyle is a moderator in the Trading Challenge chat room. He shows up every day, alerts trades, answers questions, and inspires others to be better. I can’t tell you how much that helps me.

Caveat for you who ask questions during market hours: please let Kyle trade. That goes for the other moderators, too. Don’t badger them with questions while they’re trading. Show some respect. Save it for the webinars, premarket, or after hours. At the very least, make sure they’re not in a trade.

Kyle’s great in the chat room, and if that was all he did to give back, it would be amazing. But it’s not. Check this out…

So Bearish He’s Bullish: Monthly Recap Videos

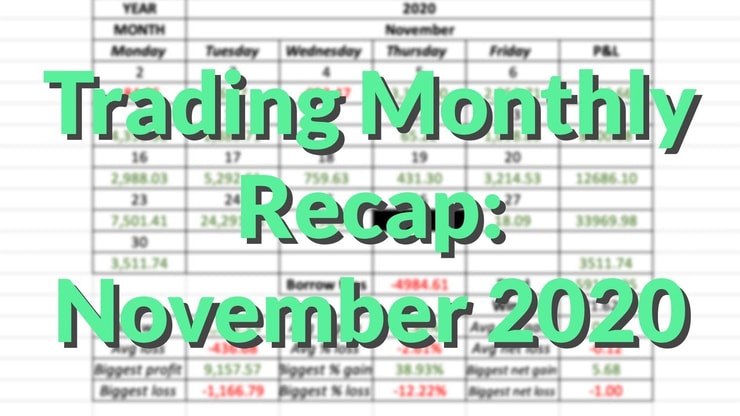

Kyle records monthly recap videos where he shares all his major statistics. Then he meticulously reviews the important trades of the month. Not only should you watch Kyle’s recaps, but you should also watch them more than once. And take notes.

Here’s Kyle’s latest monthly recap:

Did you watch it? Kyle made $59,129 in trading profits in November.* He recorded his recap on December 1. If you watched his recap you know he made as much on December 1 as he did the entire month of November.* (Again, Kyle’s monthly recap video shows Kyle’s borrow fees. Profit.ly doesn’t calculate borrow fees.)

Let’s put this into perspective…

In November, Kyle made the equivalent of an annual salary in one month. On December 1, he made annual-salary-in-a-day type profits. How awesome is that?

Here’s another way Kyle gives back to the community…

TWIST: This Week In Steady Trade Podcast

Kyle co-hosts the TWIST podcast with Jack Kellogg and Matthew Monaco. Every week they share trades, mindset, wins, and losses. Some episodes feature guests like Tim Grittani or Stephen Johnson. Or this episode with me from June.

I can’t recommend the TWIST podcast highly enough. I asked Kyle which episode to feature for this post. He said the recent episode with Stephen Johnson was good. So here ya go…

TWIST: Is the Trading Grind REALLY Worth It? With Stephen Johnson

If you don’t know Stephen, he’s a long-time student who used to have a bad overtrading problem. Once, I even tied him to a chair to stop him from touching his laptop and trading.

You can also download or listen to TWIST episodes here.

Finally, one more way Kyle gives back to the Trading Challenge community…

Kyle’s ‘So Bearish He’s Bullish’ Trading Challenge Webinar

Over the summer I invited Kyle to give a webinar to Trading Challenge students. On September 1, Kyle gave an excellent webinar where he shared SO many knowledge bombs…

Knowledge Bomb #1: Value Consistency Over Time

Kyle said when he was first studying, consistency was more important than cramming in a lot of hours. He didn’t want to study all day, every day, and burn out. His goal was three hours of video lessons per day and one hour of webinars.

SO many knowledge bombs from @traderkylec on this https://t.co/EcfUM6l2S3 webinar detailing how he's now made nearly $500k in profits, lesson on studying: choose quality over quantity, 3 hours of video lessons + 1 hour of webinar studying PER DAY, so only 4 hours, don't burn out!

— Timothy Sykes (@timothysykes) September 1, 2020

For Kyle, that was his attention span. His tip for traders is to find the right amount of time to make it consistent over time. He compared it to lifting weights or dieting. He’d much prefer to do it every day than falling off and not getting back on.

Even if it’s not a lot, study consistently.

I couldn’t agree more.

Knowledge Bomb #2: If You Lose Confidence, Trade Small

When Kyle’s account went from $6K to $2K in the beginning, he realized he needed to size down. He needed to learn to trade instead of taking big positions. He sized down to the point where losing the money was nothing.

Another @traderkylec lesson from his https://t.co/nGhRtVizxX webinar: if you lose big/lose confidence, go back to trading so small your losses & gains don't matter, get discipline/confidence back! And right now $GAXY $ALYI $PASO $BANT FGD OTC + morning panic dip buys are the best

— Timothy Sykes (@timothysykes) September 1, 2020

One thing Kyle mentioned was that he thinks paper trading is OK, but it can give you a false sense of confidence. He wanted to stop being scared. So he focused on getting experience with real money on the line. But he was trading small so losses wouldn’t hurt his confidence.

Knowledge Bomb #3: When Trading Is Slow, Build Your Knowledge Account

Kyle said that the end of 2019 was tough. There weren’t as many plays so he focused on becoming a better trader. For him, milestones are milestones, but he trades because he loves it.

“I first realized I love the game when I was making money, but I was still upset. I could have a green day that 90% of traders would love, but I was upset. I wasn’t ungrateful, it’s better than losing, but at the end of the day I’d reflect and say ‘I made these three mistakes.’” — Kyle Williams, TWIST podcast episode featuring Stephen Johnson

Another great @traderkylec lesson on his https://t.co/EcfUM6l2S3 webinar, he made only $5k in the last 3 months of 2020, trading was slowwwwwww. Now in 8 months of 2020, he's made more than he's ever made in all his years previously combined, his profit chart has gone parabolic!

— Timothy Sykes (@timothysykes) September 1, 2020

From COVID runners to massive volatility, 2020 has been a MUCH better year. The lesson here is that Kyle prepared for the opportunity. Again, for Kyle, 2020 is an example of what can happen when preparation meets opportunity.

Kyle made more in the first eight months of the year than all his previous years combined. Even though September was slow, he still made $5,432.* His patience and focus paid off in October when he made $43,570.* (Again, due to borrow fees, these numbers don’t match Kyle’s account on Profit.ly. On Profit.ly, it appears Kyle made more.)

Knowledge Bomb #4: Your Knowledge Curve ALWAYS Leads Your Money Curve

Kyle talked about how his knowledge curve is always ahead of his money curve. He compared learning his first profitable pattern — dip buys — to learning a language. He said, “Your first language is more difficult to learn. But once you learn one, it gets easier because you learn the process of how to learn.”

One more @traderkylec lesson on his https://t.co/EcfUM6l2S3 webinar, your trading knowledge will always be a leading indicator compared to your $ profits, you MUST get enough knowledge & then record trading profits can follow, it doesn't work the other way around like people want

— Timothy Sykes (@timothysykes) September 1, 2020

“Put yourself in good risk/reward setups. Not only is your money compounding on itself, your knowledge is compounding. Your knowledge account is still building…” — Kyle Williams, Trading Challenge webinar.

OK, so what does Kyle mean when he says he’s so bearish, he’s bullish?

The Higher They Go, the More They Fall

Kyle’s primary strategy is short selling. Fair warning: short selling is a risky strategy right now. Especially for newbies and those trading small accounts. Kyle spent a lot of time studying and trading small to learn. AND… he did it after he was consistent with a long setup.

Back to why Kyle is so bearish, he’s bullish…

When something spikes he wants it to stay high or go higher. The more extended a stock gets, the better chance he has to profit on the backside. He even likes to see late-day breakouts so there’s more potential downside the next day.

Why I’m a Proud Teacher

2025 Millionaire Media, LLCA lot of people congratulate me on my wins. But I’m MORE proud of my top students. And I’m never jealous or upset when they do better than me. I WANT them to do better than me. So I’m loving that Kyle is becoming a great trader.

Kyle’s success isn’t magic — it’s hard work and dedication. Congratulations, Kyle! Keep up the great work and let’s see how far you can take this.

Educational Resources

If I’ve said it once, I’ve said it a thousand times. All my top students — the most profitable students — are in the Trading Challenge.* That should be your goal if you’re serious about trading to break free.

It won’t be easy. Like Kyle, you’ll have to study hard. As Kyle said, you’ll have to be consistent over time. It’s NOT a get rich quick scheme. But every day you don’t study slows you down. So get on it.

Apply for the Trading Challenge Here

Again, congrats to Kyle. Please, give him some love in the comments…

Do you want more Trading Challenge webinars from Kyle? Congratulate Kyle and let me know when you comment below. I love to hear from ALL my readers!

Leave a reply