Whew! 2020 has been crazy. I hit two big profit milestones this year. I’ll share more about my milestones, but first, congratulations are in order…

(*Please note: My results, along with the results of my top students, are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

Table of Contents

- 1 Jack Kellogg Is My Newest Millionaire Trading Challenge Student

- 2 2020: The Year of Profit Milestones

- 3 2020 Is Officially My Best Profit Year*

- 4 Hitting a Profit Milestone Is Cool, But Know the Reasons

- 5 2014 vs. 2020: The Same But Different

- 6 Hitting the $6 Million Profit Milestone: One Trade at a Time

- 7 Follow the Process, Earn the Money

- 8 Two Profit Milestone Lessons and Your Next Steps

Jack Kellogg Is My Newest Millionaire Trading Challenge Student

Like I said, 2020 has been crazy. On November 5, Jack Kellogg passed $1 million in trading profits.* He didn’t even announce it. But everyone in the Trading Challenge chat room has been following his progress. Our trading community is awesome. Needless to say, the Challenge chat room blew up…

Trading Challenge Chat: Jackaroo Passes the $1 Million Profit Milestone

Here are just a few of the dozens of comments…

Trading Challenge Chat: Jackaroo Passes the $1 Million Profit Milestone

9:45 AM Kylehornback77 → Jackaroo: OMG you did!!! We’re so proud and happy for you!!!! Congrats!!!!

9:46 AM Chaddo → Jackaroo: Very, very well done Mr Jack!! Congratulations on an awesome achievement!! Thank you for all you do for us!! woohoo!!

And Roland Wolf, my last millionaire Trading Challenge student, had this to say…

9:47 AM RolandWolf → Jackaroo: WELCOME to the CLUB BROTHER!! Hard work and dedication baby!!

Jack, always a humble student of the game, shared a few thoughts…

9:47 AM Jackaroo: thanks guys, long time in the making… just one trade at a time.

10:11 AM Jackaroo: Funny thing is it doesn’t take huge gains to get here… just a simple $1200 single on a OTC panic dip buy… I did nothing special, but work hard and show up everyday following the 7 step framework of Multi-day runners.

THAT is how you crush a big profit milestone. Well done, Jack! Congratulations. I can’t wait to see how far you go over the next few years.

I have a post dedicated to Jack Kellogg’s incredible achievement and his journey coming soon. Get ready for it because Jack is a perfect example of keeping your eye on the prize.

Again, this year has been amazing…

2020: The Year of Profit Milestones

Not only do I have two new millionaire Trading Challenge students, but I hit two profit milestones, too.

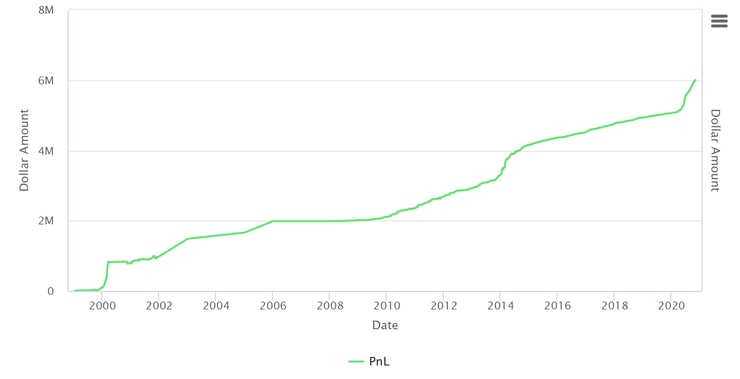

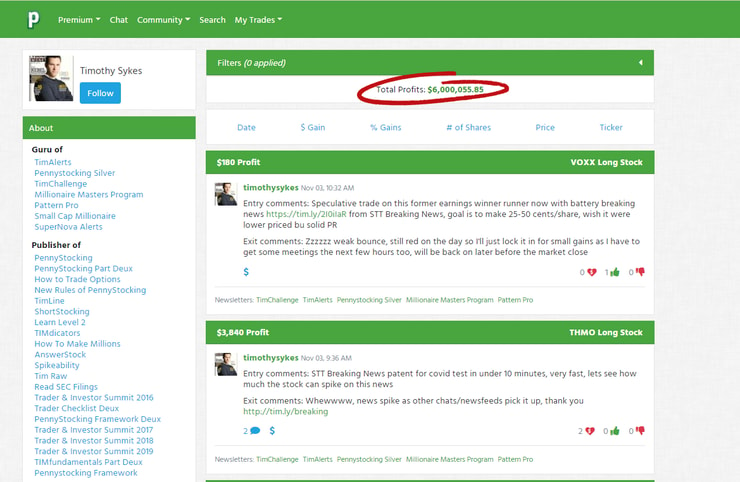

On October 1, I surpassed my previous best yearly gains. Then, on November 3, I passed $6 million in career trading profits.*

The funny thing is, I didn’t even realize I’d passed the yearly gains milestone until a member of my team showed me. That might surprise you, but my focus isn’t on the money. It’s on teaching and showing the process.

In this post, I’ll compare this year to my previous best year so you can see what’s changed and what’s the same. Then I’ll show how passing the $6 million profit milestone is a perfect example of taking it one trade at a time.*

I want to point out that a lot of my haters like to claim, “Sykes only made a lot of money back in 1999 and 2000.” That’s not true. I made more in 2014.

And now…

2020 Is Officially My Best Profit Year*

In 2014 I made $844,813 — and that was a fantastic year.* I’ll get more into what’s changed since then. But first, it’s official…

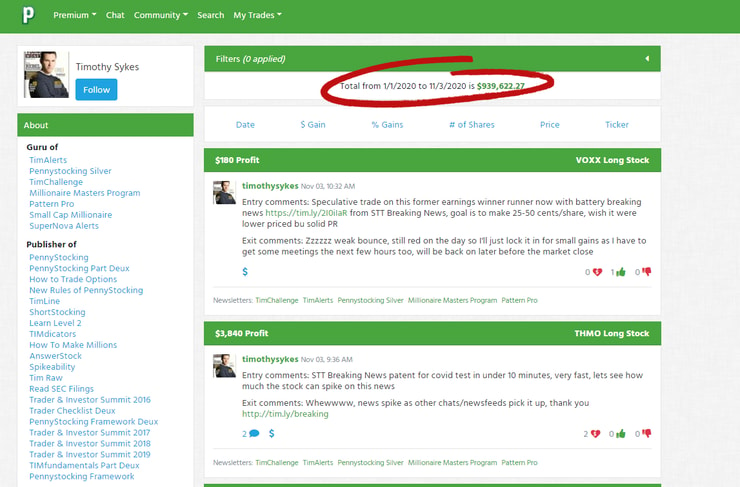

I finally surpassed 2014 when a $9,240 win took me over the top. (Keep reading for details of that trade.) As I write, I’ve made $939,622 in 2020.*

This time around I’m donating 100% of my trading profits to charity. With two months left in the year, every win is a new profit milestone and more to help make the world a better place.

Hitting a Profit Milestone Is Cool, But Know the Reasons

If you’re gonna stay in this game for the long run, it’s important to understand why some years are better than others.

The main thing to understand this year is what drives volatility. Because without the volatility I wouldn’t be talking about a new profit milestone. Watch my no-cost “Volatility Survival Guide” for top tips on thriving in market madness.

The main drivers of volatility this year are the pandemic and new promoters. The promoters use Discord chat rooms, Telegram, and Twitter. They have all kinds of new tools to promote penny stocks…

2014 vs. 2020: The Same But Different

2014 was fantastic mainly because Seeking Alpha was such a big mover of stocks. In its heyday, Seeking Alpha was influential enough to feature in this academic study.

The study looked at Seeking Alpha’s ability to influence stock prices. It backs up what I often say about sketchy promoters luring newbies on social media with their BS…

While newbies brainwashed by promoters hold & hope story stocks with absolute SHIT price action, meanwhile my https://t.co/fYoUSWX5LK students & I are cleaning up on big % gainers like $SFOR $INNO $WEI $ISIG & like I always say, ignore my rules/patterns at your own risk…enjoy!

— Timothy Sykes (@timothysykes) October 27, 2020

That study could almost be the Twitter pump playbook. Especially if you look past the authors’ holding period. They used a three-month period to measure social media influence on stock prices. But as we’ve seen this year, most of the pumped stocks spike for a few days or weeks — not three months.

More Breaking News

- Quantum Leap: Is IonQ’s Stock Set to Skyrocket?

- Archer Aviation’s Unexpected Surge: What’s Fueling the Takeoff?

- A Surprising Surge: Will EONR Maintain Its Upward Momentum?

2014: The Rise of Social Media

Social media was already powerful for influencing stock prices leading into 2014. But that year was exceptional.

If you look at a lot of my trades from 2014, I was buying into the close because of Seeking Alpha. A lot of its audience wouldn’t see the news until after hours or the next day. They’d push up the price overnight. They’d put in huge buy orders at the open, and I’d sell into that strength. So I was selling into the less meticulous, less savvy, Seeking Alpha crowd.

For me, it was really easy.

2020: Welcome to Breaking News Chat

Now Seeking Alpha is almost irrelevant. I don’t know all the details, but it used to have a distribution deal with Yahoo! Finance. That deal is part of what made it so big. The deal ended in July 2014 and Yahoo! Finance isn’t as powerful anymore.

Even though Seeking Alpha isn’t as influential, it still has some influence. My first short play in a few months — shorting Wrap Technologies, Inc. (NASDAQ: WRTC) was due to this exposé on Seeking Alpha.

The big difference in 2020 is that there are so many different promoters and platforms. Thank God for StocksToTrade Breaking News! I wouldn’t be able to track all the promoters and pumps without this tool.

I would say between a third and half of my profits this year are due to me using StocksToTrade Breaking News Chat. It’s like my new organizer. It’s been a huge benefit for me. Get it. Use it. Thank me later.

(Quick disclaimer: I helped design and develop StocksToTrade.)

What a Difference a Year Makes

To put things into perspective…

In 2019, I made $125,513 in trading profits. (100% donated to charity.) There weren’t as many promoters, and the markets weren’t nearly as volatile. But also, we didn’t have StocksToTrade Breaking News.

So we’ve seen some innovation in 2020. First, in the pumping business with all these promoters on different platforms. And also in the news curation business with StocksToTrade Breaking News. I’m just taking advantage of it.

Hitting the $6 Million Profit Milestone: One Trade at a Time

Hitting a new profit milestone is not about swinging for home runs. And it’s not about focusing on any specific dollar amount.

Memorize those last two sentences. The reason I hit two new profit milestones is because I was ready when the market gave me the opportunity. I just take it one trade at a time.

This is another case for why you really need to study. Study hard. Check this out…

How Two Words Can Make You a Better Trader

Pay particular attention at the 6:40 mark in this video. It’s essential learning…

Hopefully, that video inspires you to study hard. Let’s get back to comparing 2014 to 2020. Both years are about taking advantage of the volatility. Trade by trade, it adds up.

But, frankly, I think I’ve become a better trader. It’s not any single thing, but a combination…

- More trading experience. Like small wins, experience adds up over time. There’s no getting around that.

- It’s not my first rodeo. I’ve seen bubble markets before. Whether 2020 is truly a bubble market is up for debate, but there are signs.

- Donating to charity has changed my trading mindset. In 2014 I donated a small percentage, but I was just getting into charity. Now I’m more inspired than ever to make and donate more.

- Having more students means I’m focused on showing the process. That helps me to follow my rules and avoid overtrading.

Why I’m More Proud of Students Hitting Profit Milestones

When I passed my 2014 gains, it wasn’t some kind of big celebration. And when I passed $6 million, I had meetings to attend. Thing is, I get more excited when students do well.

For example, I’m very excited that Jack Kellogg has passed the $1 million profit milestone. But it’s also his best year ever. He’s made roughly $840K so far this year. His previous best year was 2019 when he made $122,416. See Jack Kellogg’s profit chart here.*

I’m pumped that Tim Grittani has made over $3.6 million this year. His previous best year was in 2017 when he made $2.2 million. See Tim Grittani’s profit chart here.*

So why am I more proud of them? Because they prove that following the process pays off. They aren’t doing anything special. Yes, they have exceptional skills. But their skills come from hard work — NOT some innate ability. Their big gains this year are an example of preparation meets opportunity.

Follow the Process, Earn the Money

Once you learn the basics and find what works best for you, it’s a matter of continuing to refine. For me, every year I’m thinking “OK, what’s going to move these stocks? What’s the key pattern?”

There will always be new promoters, new catalysts, and new drivers of volatility. This year, obviously, the pandemic was a big driver of volatility downward. And then there was a huge bounce.

The game has changed a little bit, but not much…

You ask what does weed stock promo from 2014 have to do with $SPAQ or $IDEX $ZOM $GNUS $BOXL $XSPA $SESN $BIOL $TTOO ? To answer I quote Jesse Livermore: The pockets change, the suckers change, the stocks change, but Wall Street never changes, because human nature never changes!

— Timothy Sykes (@timothysykes) October 27, 2020

You have to focus on the process and then take advantage of the same kinds of things. The trade that helped me hit a new yearly profit milestone is another good example…

Aspen Aerogels, Inc. (NYSE: ASPN)

On October 1, Aspen Aerogels was spiking on news of a new lithium battery patent. The news was solid, but it’s a big market cap company — a little outside my comfort zone.

Here’s the ASPN chart from October 1 along with my entry and exit commentary:

You can see on the chart where there was a volatility halt. I didn’t expect the stock to go all the way to the $14s. My goal — as I put on my entry commentary — was to sell in the $12s or $13s. But it spiked so fast and then halted, so I had to wait.

At first, I thought I sold at $14.63 — which is what my commentary says. Actually, I got $14.36 and not $14.63. (I read it wrong and was typing fast.) But I’ll take it.

If there wasn’t a halt, I never would have held this from the $11s to the $14s. It halted at $13.03, so it had already hit my goal. If you get in with the news before a stock gets halted due to volatility, you can potentially be more aggressive. Especially if the volatility is due to so many people putting in orders.

In this case, the volatility halt helped me. But I don’t like trading through halts as they’ve hindered me in the past.

What about the trade that took me over the $6 million profit milestone? It’s funny in a way. This trade took me over the mark but it was more about protecting gains than getting a big win.

Check it out…

VOXX International Corporation (NASDAQ: VOXX)

VOXX was spiking on news of a backup battery system for electric vehicles. This was another StocksToTrade Breaking News play.

Check out the VOXX November 3 intraday chart with my buy and sell alerts:

I tried to give it time, but the spike was weak and then failed. This is a perfect example of cutting quickly for a small profit rather than hold and hope. And you can see that if I’d held, it would have been a loss.

This trade was a little speculative. VOXX ran 147% between September 9 and October 23 before trending back down. Here’s the VOXX six-month chart…

In dollar terms, my VOXX trade is basically a scratch — I only made $180. But it shows how small wins add up over time. And as you can see below, this one got me over the $6 million profit milestone.*

So … what are the most important lessons from hitting two profit milestones in just over a month?

Two Profit Milestone Lessons and Your Next Steps

Every year is a little different. You can’t just compare the money from one year to another. But whether you make $844K or $939K, it doesn’t matter. Even if you make $549K … you can be making six figures trading from almost anywhere in the world. And you’re taking advantage of market volatility.

Take it one trade at a time. Whenever I get close to a profit milestone, students start messaging me. They say things like, “Oh, you must be so excited. How will you celebrate?” It’s like they anticipate it more than me. But to grow your account you have to focus on one trade at a time.

Jack said exactly the same thing in chat right after he crossed $1 million. “Thanks guys, long time in the making… just one trade at a time.”

As always, the key is preparation, studying, and experience. There’s no easy button and no shortcut. I know a lot of people want that, but you have to remember this is a marathon and not a sprint.

So if you want to hit profit milestones…

- Stop thinking about profit milestones. They’ll come when they come because you take it one trade at a time. The day before Jack Kellogg passed the $1 million profit milestone, he had this to say in chat: 09:55 AM Jackaroo → timothysykes: it will happen when it happens.

- Focus on the process instead of monetary goals.

- Learn the rules and develop the self-discipline to follow them.

- Test, test, and test again. Once you find what works best for you, continue to test so you can adapt when the market changes.

If you’re new to penny stocks, start here: FREE penny stock guide.

If you’re ready to create a solid trading foundation, start the 30-Day Bootcamp today. (You get lifetime access, so you don’t have to worry about completing it in 30 days.)

And if you’re ready to learn everything I’ve learned over the past 20 years…

Apply for the Trading Challenge today. But come ready to work your butt off.

What do you think of Jack’s and my recent trading milestones? Please congratulate Jack in the comments below!

Leave a reply