I was saddened to hear that Larry King passed away over the weekend … He was a true legend and one of the greatest interviewers of all time.

His CNN show “Larry King Live” had an incredible 25-year run. He interviewed pretty much anyone who’s anyone, including every U.S. president from Ford to Obama.

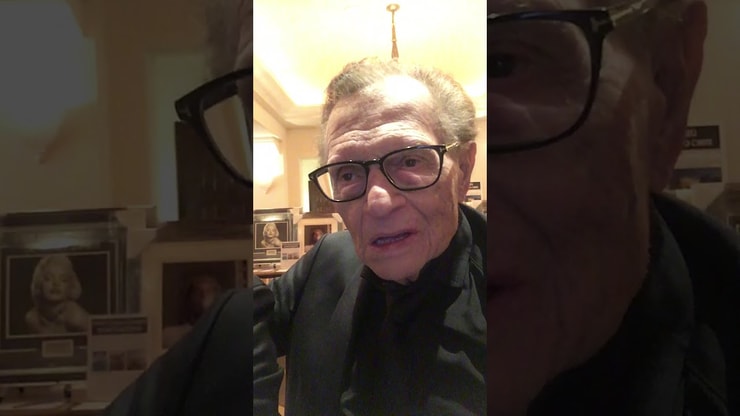

I had the honor of being interviewed by Larry King in 2015. I was blown away by him — and not just because he asked smart questions.

Not only was he an incredible interviewer, but he was kind, funny, sharp, humble, and incredibly knowledgeable. He was and continues to be an inspiration to me.

(I wasn’t the only one he inspired. This USA Today article features a ton of amazing tributes. Sadly, there was one notable naysayer — I wasn’t afraid to call BS on it. Be sure to scan to the end of the article to see how I defended my friend Larry.)

I’d like to take a moment to express my gratitude for some of the lessons he taught me…

Table of Contents

Lessons I Learned From Larry King

It was an incredible honor to be interviewed by Larry King — after all, he’s a TV legend. But I’ve gotta say that his fame isn’t what impressed me most. Here’s what really inspired me…

The Power of Authenticity

Just like in the world of day trading, the world of network TV is full of phonies, fakes, and huge egos. Larry King didn’t let it get to him.

Maintaining a strong sense of who you are can be really hard when you’re in the public eye, but Larry was always completely authentic.

As a teacher, I’m inspired by his authenticity. I think that transparency and being real are what set me apart.

I don’t portray day trading as glamorous to my students.

I want them to know that if they want this kind of life, they’re gonna have to work hard, and it’s not always gonna be fun. And I want them to know it’s not a get-rich-quick scheme.

I share EVERY trade publicly to demonstrate the real side of trading — I urge my students to be completely transparent too.

You’ve Gotta Stay Humble

One of the secrets to Larry’s success as an interviewer? His humility. No matter if he was interviewing a U.S. president, a celebrity, or a day trading teacher like me, he always approached his interviewee with the same level of respect.

He was genuinely interested in people. Larry King was curious about the world. He was humble and always ready to learn something new.

A lot of day traders could take a cue from this. I see so many people have one or two big wins then get a huge head … They get cocky, and that usually leads to trouble.

I always say that in the stock market, you’ve gotta stay humble or the market will humble you … But really, that’s a life lesson. Always stay humble, and always recognize that there’s more to learn!

More Breaking News

- GBTC Stocks: A Closer Look at Recent Trends

- Halliburton Stock Experiences Market Turmoil

- Sprott Trust Defies Expectations: Analyzing Recent Surge

Incredible Work Ethic

There was never a point where Larry King said, ‘OK, I’m famous enough, I can stop trying so hard.’

He had an incredible work ethic. He always did his research and showed up mentally. This was a guy who embodied the ‘no days off’ mindset.

It didn’t matter that he was rich or famous. He kept working hard every day.

As a day trader, I want you to be inspired by Larry King’s incredible work ethic. I want you to know that you’re always going to have to work hard.

If you think that trading is the type of job where you work hard for a little while, make millions, then retire, you’re wrong.

The ‘money mindset’ is a huge problem for so many traders. They don’t take the time to actually learn the rules or understand the process. They’re so blinded by the idea of money that they don’t have any idea what actually motivates them.

If you ask me, the most ‘successful’ traders are the ones who find a genuine passion for the process, stay motivated, and aren’t afraid to work hard.

Sometimes, your motivation will shift. For instance, I used to be motivated by money and things like expensive cars. Now that I have financial freedom, I’m motivated to make money trading so that I can give back through teaching my students and donating my profits to charity.

Larry King wasn’t a day trader, but his self-motivation and work ethic should be an inspiration to all of you. You’re never gonna find success in anything — whether it’s trading or anything else — if you’re not willing to keep putting in the work.

His Legacy Will Live On

Larry King was an incredibly inspiring man. I learned a lot from his amazing work ethic and attitude toward life.

I’ll miss him greatly — but I’m so thankful to have had the chance to be interviewed by him, and for the inspiration that he gave me and so many others.

Check out my full interview with Larry King here.

Larry, your incredible work will live on — rest in peace, legend!

Are you inspired to be authentic, stay humble, and work hard? Leave a comment … I love hearing from you!

Leave a reply