Welcome,

My name is Tim Sykes.

I’m a transparent trader in an industry full of scammers, wannabes, and degenerate gamblers.

This is my blog. It’s where I reach out to students in an effort to inspire their success. Because, contrary to popular belief:

There is a process for consistent profits in the stock market.

Especially for small-account traders.

In case you don't realize patterns repeat, compare $IGPK morning panic and bounce to my https://t.co/4lKUY5B6aw blog post….surprise, this shit is real! Penny stocks aren't nearly as random or difficult as most people believe, sadly most people just don't study the past enough https://t.co/mbJsZRkUa5

— Timothy Sykes (@timothysykes) March 19, 2024

But a lot of people get swept up in the bull crud.

So let me say it again …

Welcome to my transparent-trading blog. It’s maybe the only one of its kind on the internet. And somehow you found it.

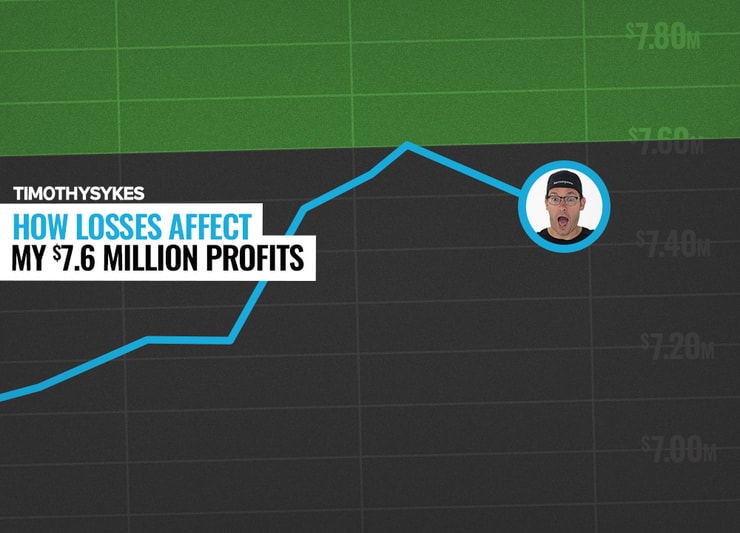

Now let’s get something straight, there are losses in trading. Even the best trading patterns will fail every now and then.

My strategy can help traders limit their losses, while revealing possible profit opportunities.

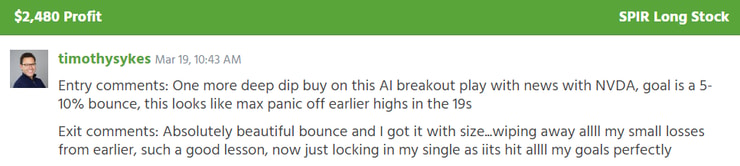

For example, yesterday Spire Global Inc. (NYSE: SPIR) spiked 50% before noon. I pulled a profit on it that helped me wipe away losses from earlier in the day.

Here’s a chart of the spike:

I’ll show you a real strategy.

With real profits and losses.

Now, let’s get to business.

Table of Contents

Small Losses

There were a few stocks that spiked yesterday.

I made a few trades, and the first handful turned out to be losses.

Let’s take a look:

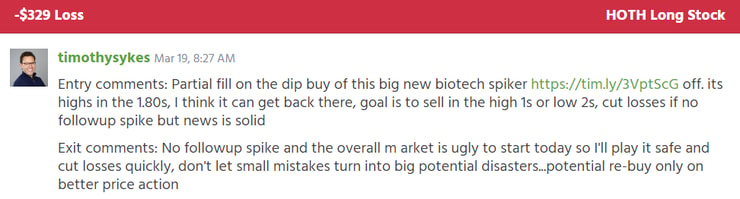

#1:

Here it is overlaid on a chart:

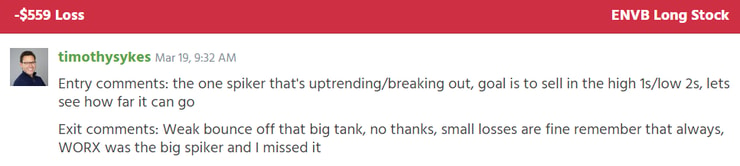

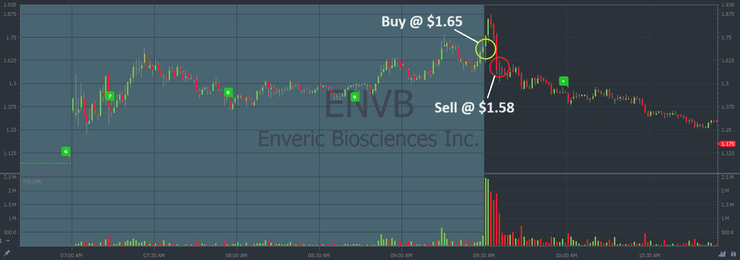

#2:

Here it is overlaid on a chart:

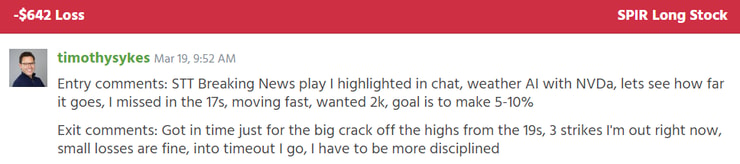

#3:

Here it is overlaid on a chart:

At this point, collectively, I was down $1,530 on the day.

I put myself in a timeout. But I remembered to stick to the process.

My next trade brought me all the way back to the green …

Profitable Discipline

Small losses are part of the process.

Any trade can fall apart at any time. There’s no such thing as a 100% profitable strategy.

And you can tell from the charts above, had I held my positions for longer I would have lost even more money. My discipline saved my overall account from unnecessary losses.

And when I found another good trade setup, I was ready to profit.

My starting stake was $60,200:

Here’s my trade on the chart:

My profits outweigh my losses.

The next time someone tells you trading is impossible. Show them this blog post.

Plus, I’m not the only trader making money right now.

I have over 30 millionaire students from all walks of life. The one thing they have in common: They’re disciplined enough to follow the rules.

I already mentioned that this industry is sketchy. Greed runs rampant. And it’s easy to get lost.

I think that’s why all of my millionaire students come from the Challenge. It’s where they find:

- My trade alerts.

- A huge library of live trade webinars.

- Access to upcoming live trade webinars.

- The Challenge chat room to mingle with millionaire students.

- Up-to-date watchlists.

- All of my trading DVDs.

It has everything. A complete and transparent review of my ongoing profit journey in the stock market.

To learn my trading process, apply for the Challenge.

There are new opportunities to profit every single day. Use my strategy to control your losses and target the best setups.

Cheers.

*Past performance does not indicate future results

Leave a reply