A big part of trading is learning to recognize patterns — and a pattern I’ve noticed evolving over the past year is the rise of BIG short squeeze.

There have been a few other consistent patterns in the markets lately. As I discussed in this recent blog post, low-priced OTC stocks have been running strong for multiple days.

But let’s focus on the short squeeze…

The most recent example of this pattern is Xunlei Limited (NASDAQ: XNET), which started running last Friday and continued over the weekend.

So what caused this stock to triple without a solid catalyst? Surprisingly, newbie short sellers who don’t have a proper trading education got squeezed — and I totally underestimated the move.

Table of Contents

XNET Short Squeeze

Mind you, I thought XNET looked overextended on the first day of its run. But if I’m gonna trade it, I won’t just buy randomly and hold randomly. Especially into the close. Even though I would’ve gotten a nice gap up, the trade is just too risky.

Understand, I don’t like trading these types of plays. I’d call them overly liquid stocks. This thing traded over 60 million shares on the first day of its run. That’s a little too liquid for me. It makes the moves very choppy.

I know some people like to trade choppiness. But I cut losses quickly, so the choppiness would get me out … Even if I’d eventually be right on the stock’s direction.

The Best Play on XNET

Best-case scenario for me on this play? I’d look to buy the breakout in the afternoon around $4.05. Buying the high-of-day breakout is one of the most straightforward strategies I teach my Trading Challenge students. The strategy is high odds with lots of statistical support from years of data.

Buying a stock in the $2s and holding it through the $4s isn’t a strategy. That’s holding and hoping. That won’t work in the long run. Remember: Trading is a marathon, not a sprint.

Yes, XNET did go to the $6s. But you can’t judge the merits of a strategy based on any single trade.

In this case, yes, it would’ve worked. But if you take the same kind of trade 100 times, you might make money 30 or 40 times. And when you don’t make money, you can lose big … If the stock is up big, it could crash big.

For a trading strategy to be viable, you need proper risk management. You’ll never get that from holding and hoping.

Newbie Short Sellers

One reason I underestimated XNET is that I’ve been underestimating the number of short sellers getting squeezed lately.

I probably speak to more traders — especially newbie traders — than anyone in the world. I don’t say that to brag. I say that with great responsibility. I think the number-one problem with newbies right now is that they’re trying to short sell.

There are a lot of short-selling chat rooms and websites luring people in with big screenshots like…

Look, I made $30,000 in a day!

Meanwhile, they’re trading half a million shares of a stock at $3. So … they’re using $1.5 million to make $30,000. The percent gain is pathetic — and the risk is enormous. But too many newbies don’t see that. They just see a $30,000 profit.

WAKE UP!

I trade with a small account because I don’t want to mislead anyone. I strive to teach a strategy where you can build a small account over time, not overnight. Unfortunately, newbies everywhere are falling for the fallacy that they can make $30,000 in a day like these traders with large accounts.

To make matters worse, these “big” traders don’t even show all of their losses. Usually, I’d call them out. But I don’t know if I want their malicious practices to end. I’m conflicted. The fact that they’re luring people in allows students and me — if I ever get really good at this strategy — to buy these short squeezes.

Respect the Short Squeeze

I’m willing to tell you what’s happening in the market so you can learn…

If you look at my chat room commentary on XNET, all day Friday and Monday morning, I was saying this is a short squeeze.

First, from ProfiDing real-time alerts…

10/25 9:54:46 AM: $XNET spiking and trying to squeeze early shorts, but looks like a battle for every penny, I won’t chase.

10/25 10:02:16 AM: $XNET longs congrats, be sure to sell into strength, this is best case scenario.

And then Profit.ly user PapaD mentioned in chat that he hadn’t seen any news…

10:03 AM PapaD → timothysykes: I didn’t see any news or cat for XNET. Did I miss something?

10:04 AM timothysykes: PapaD SHORT SQUEEZE!

And more from ProfiDing…

10/25 10:09:06 AM: $XNET crushing newbie shorts, unreal.

10/25 10:42:38 AM: XNET 3.80s what a giant short squeeze, RIP to all of them but they like pain so maybe they’re happy with their losses…congrats to longs, be sure to sell into strength, this is best case scenario.

Again, I underestimated how high recent short squeezes can go…

10/25 10:32:03 AM: $XNET up to the 3.40s, what a squeeze, I def underestimated it.

Then, on October 28, XNET kept going…

10/28 9:46:10 AM: $XNET impressive comeback, short squeeeeze.

And it wasn’t only XNET…

10/28 10:05:51 AM: $CNET squeezing early shorts just like $XNET on Friday

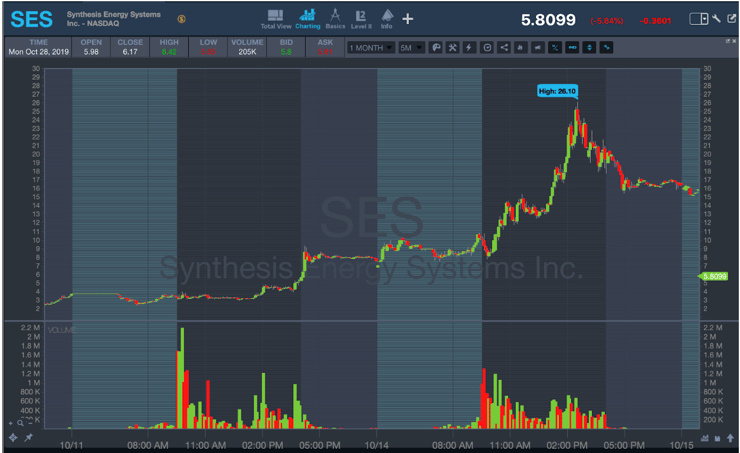

This XNET squeeze is no different from SES. It’s pretty crazy. Profit.ly user Crypto_M got it…

10:43 AM Crypto_M → timothysykes: XNET is the SES of 2 weeks ago for shorts. Sucks to be them.

Note: As I write, XNET is finally coming down and SES is once again squeezing. I traded XNET today — dip buying the morning panic. I’ll go into more detail about that trade in tomorrow’s post. Meanwhile … will over-aggressive early shorts ever learn?

If you know a short seller, don’t tell them to change their ways. Well … I guess it depends on how close you are with them. If you’re close to the short seller and they’re a good person, maybe tell them…

“You shouldn’t do this. Tim Sykes is teaching about short squeezes the past few months, and he doesn’t want you to go down the tubes.”

But if they’re a frenemy or someone you hate, don’t say anything. Let them blow up. Let them lose and be a stupid short seller. I want people to still short sell so this pattern will continue to work.

If You’re Reading This, You’re My Students

It’s in my own best interest to make you as successful as possible. Remember, I donate all of my trading profits to charity, and I trade with a small account, so this isn’t for me.

Why would I do these crazy things? Because successful teaching and successful students propel my business forward. That’s why I have to tell you what’s going on. Hopefully, you’ll listen.

Recent Tweets, Comments, and Trades from Students

Here’s a look at some of my students’ chat room comments during the XNET short squeeze. And these are just from Friday, October 25…

More Breaking News

- Credo Technology Unveils AI Innovation and Announces 3M Partnership

- ALAB Stock Climbs Amid Strategic Moves and Strong Financial Indicators

- MNTS Stock Surges Amid Strategic Expansion and Financial Insights

- QuantumScape Launches Eagle Line for Solid-State Battery Pilot Production

From the Trading Challenge Chat Room

10:44 AM Gawdzlla: $xnet 100 long 3.25 out 50 @3.65 and 50 @3.95 didn’t want to get greedy.

10:45 AM J_Freedom: in @ $3.4 and out at $3.93 +15%.

10:46 AM tstinson: I bought XNET @ 3.63 and locked profits 3.904.

10:53 AM Ltmoney: XNET Long @ $3.18 out at $3.79 +19% gain.

11:07 AM Jastaff: First trade $xnet in@3.25 out @3.80.

12:02 PM LKScientist: Traded XNET.. In at 3.38 and out at 3.52.

12:23 PM Sierra3: had some buys on XNET in 3.20 and 3.30 but sold too damn soon.

12:42 PM the_tipsy_nomad: Long 1900 shares XNET at 3.6.

12:44 PM the_tipsy_nomad: jtran out at 3.7, quick buck 90.

12:54 PM dead_bonsai: out XNET 850 +$170 jtran jinxed it lol.

01:32 PM InceNY: im out XNET With $3800 have a good weekend guys.

02:15 PM bobbythek: XNET in $3.60. exit $3.80…. exit was early as is my way…. 🙂

02:43 PM the_tipsy_nomad: Congrats to all who anticipated the short squeeze and were patient with XNET. Rebought in the 3.6s and sold half at 3.9 and the other half at 4.1.

03:05 PM MoonShot: caught that last squeeze. 1k sh 4.25 to 4.45. couldn’t pass up that crazy volume.

03:08 PM bobbythek: XNET…HA! Okay, so next time I only sell 1/2 & hold 1/2 for the real deal! lol……Kudos’ to the XNET longs, very nice!

03:11 PM SurfinWaves: I just did a quick trade on XNET for a small gain. In at 4.36 out at 4.50. Very exciting. Even if I am just still paper trading 🙂

03:22 PM keeyongtn: XNET Long in at 3:17 PM at $4.35 out at 3:21 PM $4.50 150 shares, $22 Profit.

04:04 PM David_F: have a great weekend folks. Still paper trading, but a good day today. 21% on $Xnet and 28% on RBZ. Maybe Nnext week I’ll venture into real money…

You’ve probably read posts or watched videos where I talk about how some chat rooms are sketchy. The TimAlerts and Trading Challenge chat rooms are different. Here’s what SatelliteIncomeUnlimited had to say…

04:04 PM SatelliteIncomeUnlimited: I wonder if this is the best stock chat room there is? It’s got to be in the top.

04:04 PM David_F → SatelliteIncomeUnlimited: Its a great place to be!

04:05 PM The_tipsy_nomad: Going into the weekend with all cash. Closed the day and the week green. Have a great weekend ladies and gents. Don’t forget to study and see yall back on Monday.

More Comments from the TimAlerts Chat Room

10:03 AM nburton20: XNET in at 2.8 out at 3.15. quick easy profits and playing safe.

10:10 AM prado_sara93: Made exactly 10% on XNET. Even though it’s continuing to go up, I was rigid on my rules and plan and flexible in my expectations.

10:32 AM StephT: just caught some of that XNET spike. $3.18-3.39.

10:42 AM Skiddum: 10%gain on XNET. I should have been more patient. But i wanted 10% today and I got it a little over 10% in at 3.19 out at 3.5.

10:43 AM InceNY: im still in since 2.77.

I jumped in here to remind InceNY to take profits along the way. It’s super important — you never know when the squeeze might fail…

10:45 AM timothysykes → InceNY: be sure to lock in gains, don’t be a gunslinger.

10:46 AM viren0730: XNET quick gain $200.

10:50 AM Skiddum: Definitely fallowing plans. I’ve won 2/3 this week cause I had a plan. Nothing massive but growing slowly. 50 bucks here 100 there my little 1000 dollar account is up to 1300. Thanks Sykes.

It’s awesome to see traders like twist89 be fully transparent, sharing wins and losses. Transparency and accountability can both be a huge plus for long-term trading careers.

10:52 AM twist89: lost $5000 wednesday compounding on all the dumb mistakes in the book, took a day off, nailed XNET long and short +$1266 not getting greedy again…calling it a day. take profits everybody don’t compound on mistakes.

11:43 AM twist89: ok I’m out…XNET went long on the front end took small gains and then hammered short every bounce and covered each crack $+2500.

01:46 PM Lowkeytrader: OMG this chatroom is so useful i learned so much just by the first 5 mins.

02:44 PM vnickn: XNET 5000 shares at 3.59, out at 4.30 +3550.

02:45 PM brazin: $xnet in $3.96 out $4.24!!!! first profit on a trade in a few weeks, needed that for my confidence. 250 shares.

03:08 PM daleelmore: XNET in at 4.35 out 4.45, 1000 sh. Im done for the day. Nice $366 day for me. Small, consistent gains.

I love this one from Lowkeytrader thanking TT94TT945 for some solid advice…

03:20 PM Lowkeytrader → TT94TT94: thanks you saved my gain on XNET with a lil take profit!!!! up finally so excited realized im still learning so im just gonna take my profit here.

Last, an awesome Tweet from one of my students:

Caught a small percent on the $XNET move today after not trading all week. Wait for the best setups! Fridays are special! @timothysykes

— Stephanie Thompson (@StephT_15) October 25, 2019

[Please note these results are not typical. These traders have exceptional knowledge and skills that they’ve developed with time and dedication. Most traders lose money. Trading is risky. Do your due diligence and never risk more than you can afford.]

What do you think of all the recent short squeezes? Comment below — I love to hear from all my readers!

Leave a reply