As I warned in this tweet:

My #1 New Year Resolution is to create more millionaire students so get ready as I’ll be trying some weird ass stuff to make it happen!

— Timothy Sykes (@timothysykes) January 3, 2016

2016 my New Year’s resolution is to create more millionaire students like this guy and this guy (who now both give webinars to other trading challenge students, the power of community/paying-it-forward) and a few other millionaire students who prefer their privacy so my checking myself into prison right now is my biggest, boldest and weirdest tactic in my pursuit of more millionaire students.

I explained a little in my latest episode of Answerstock posted this morning:

But allow me to explain some more…

…I don’t mean I’ve actually checked myself into a real jail, I mean I checked myself into a figurative prison as despite my solid now eight-figure net worth, in 2016 I’m re-starting my trading accounts with just $12,000, wayyyyyyy under the dreaded pattern-daytrader rule minimum of $25,000, thus preventing me from being a free trader that too many rich people take for granted as those under the PDT rule are limited to only 3 day trades per week…aka prison.

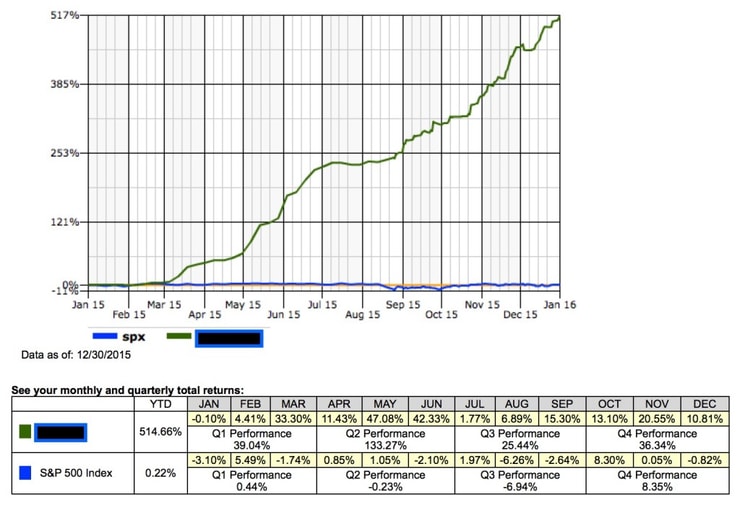

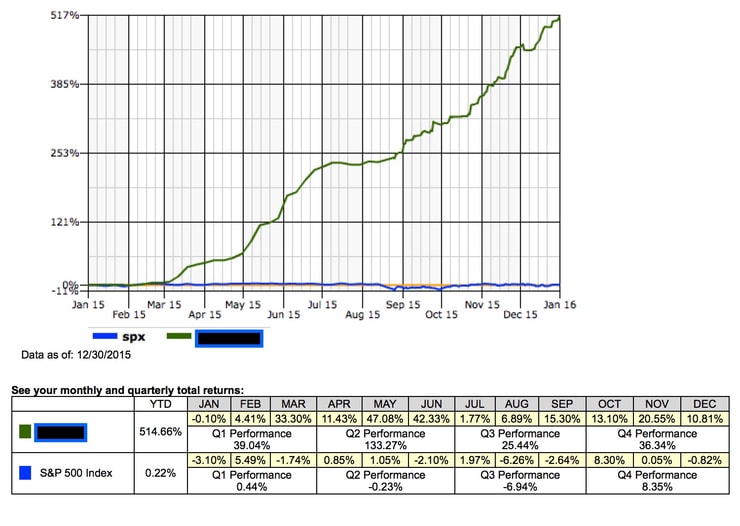

After making nearly $1 million in trading profits in 2014, see all trades here, my best trading year ever, even more than my best years during the tech bubble (so much for my critics saying I can’t or don’t trade anymore, see this one crazy week where I made nearly $200,000 in trading profits), and earning several hundred percent on various accounts in 2015 even as the overall US stock market indices were basically breakeven on the year:

…many people have been asking why am I doing this now when I should be taking bigger positions than ever given how well my trading strategies are working?

I explain more in this video:

Long story short, while I love making big time trading profits and posting ALL MY TRADES publicly HERE, especially the big ones like these trades below to inspire upcoming traders:

…but as I explained here, teaching is much more fulfilling, it’s my main business now and because of that I’m FAR more interested in creating more millionaire trading challenge students from scratch — hence why we’re adding several new features to the the trading challenge curriculum in 2106 as I mentioned here — and while trading under the PDT rule is endlessly frustrating for me, and everyone else, as a trader, being restricted by it the SINGLE BEST THING I CAN DO FOR MY STUDENTS TO HELP THEM LEARN HOW TO GROW THEIR ACCOUNTS EXPONENTIALLY AND OVERCOME IT LIKE MY TOP STUDENTS AND I HAVE.

Monkey see, monkey do.

More Breaking News

- Is Palantir Stock Ready for Another Skyrocket After AI Revolution Buzz?

- Is Rocket Lab Skyrocketing Toward New Heights After Recent NASA Contract Win?

- IREN’s Unexpected Surge: Breaking Down the Latest Performance Data

If I make $20,000, $50,000 or even $70,000 on any one trade with an account size of $100,000 or $500,000 or even $1,000,000, that’s great to inspire newbie traders to keep studying and learning, but it’s also pretty irrelevant for them right now given their small account sizes and most of my students only start with $2,000-$10,000…so it’s far better I trade with a similar-sized account as they do so they can see what kind of trades/position sizes can work:

Remember, the vast majority of the world thinks it’s impossible to consistently make more than 10-20%/year returns so everyone eats up boring, conservative, diversified mutual funds and long-term investments, at their most speculative being in giant companies like Apple (AAPL) and Google (GOOG)…viewing inspirational stories like this turning $1,500 into $1 million and and this international trader and this teenager with skepticism…

…many mistakenly believe that this type of success is not possible. You wouldn’t believe how many times I’ve heard short selling stocks under $5/share isn’t possible) — or just have gotten lucky…despite my showing live trades like these on patterns outlined in my DVDs/video lessons that haven’t changed much over the past 2 decades and us showing ALL our trades publicly HERE and HERE and HERE and HERE

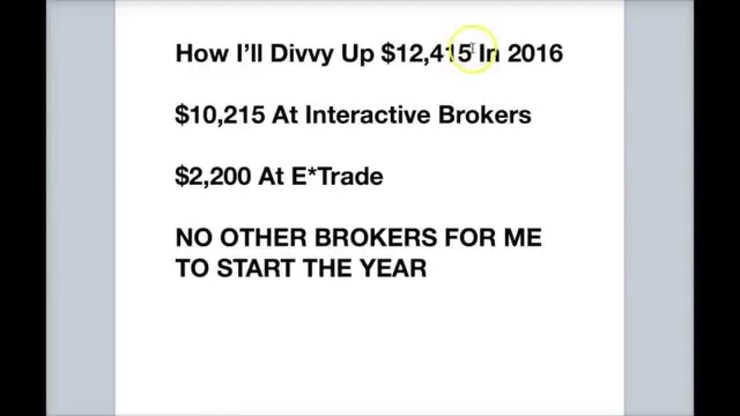

Remember, this isn’t the first time I’ve returned to my $12,415 Bar Mitzvah gift money roots, in my first 4 years of trading I turned it into $1.65 million, but as you might’ve read here, a lot of that was due to the tech bubble and being in the right place at the right time…when I first began teaching in late 2007, I went back to initial $12,415 roots and turned it into nearly $100,000 in 2 years, see this blog post with a blueprint for growing an account 8x in 2 years…and in year 3 I got up to $230,000+, that feat making me the #1 ranked trader out of 60,000+ on Covestor at the time (here’s why I’m not on Covestor anymore.)

But then after my 2nd time growing a small account into six or seven figures within a few years, I got fed up with small gains and decided to take advantage of all the opportunities this latest now 7-year-old bull market created and I began trading each year with various larger amounts like $300,000 or $600,000 with my nearly $1 million trading profit year in 2014 coming from a $500,000 starting amount…my nearly 200% overall gains in 2015 happening after I started the year with $100,000 (actually I began on February 1st, 2015 since I wasn’t fully prepared to withdraw $1+ million from my accounts so quickly)

In hindsight, I probably shoulda woulda coulda just stuck with growing my $12k into $1.65 million again, but trading, the stock market and myself most of all are not perfect…I start with different amounts each year with a different focus.

…this year my ego/patience will take hits trading with such a small dollar amount, but my students will benefit greatly from seeing my trades in realtime, along with video lessons on every meaningful trade and that’s what matters.

Some people are asking why does it matter what I begin with each year, it’s all the same strategy, right?

Yes, but the PDT rule prevents me from taking so many intraday positions as I currently have done — which is probably a good thing given my lack of patience/skepticism of this bull market lately — and also different brokers have different minimums and different abilities to borrow stocks to short, especially on pump and dumps, which is my specialty. ..remember this video I made “No Borrow, No Cry” as while short selling penny stock pump and dumps IS legal, most brokers don’t have borrows available, which I’ve taught since the beginning of time

That’s why I’m starting the year with $2,000 in my E*Trade account (the minimum required in order to short sell) and $10,000 in my Interactive Brokers account (the minimum required to have an account with them) as E*Trade is best for shorting stocks $2-10/share and Interactive Brokers is better for shorting stocks under $2/share.

There are mannnnnnnnnnnny more brokers out there, but for now these are the best 2 for short selling and trading penny stocks, EVERY other broker has let me down for one reason or another so they’re not even worth mentioning…although I will make an exception for Robinhood as I’ve heard SO many complaints about execution problems, inability to short sell AT ALL, and their lack of after-hours trading.

Robin hood has made a big splash with their zero brokerage commissions, but I have NEVER worried, nor will I ever worry, about fees and commissions, they’re all negligible if you focus on the best trading setups like THESE and THESE where you can make 20-30-40-50%.

Robinhood lures in the financially naive who are hoping for small returns. However, this type of thinking won’t grow your account exponentially.

So, get excited for 2016, many people are asking for my predictions….sorry, but I gotta go get fitted for my prison outfit (my analogy to explain that I’m not a talking head with bullshit stock market predictions, I take it one trade at a time when my patterns/predictable setups appear).

Tomorrow I’ll begin trying to grow my $12,000 accounts one trade at a time as always, with my students getting alerted in realtime very time I make a new trade, learning more every day.

I don’t make stock market predictions and I don’t have ANY specific goals on what I think I’m capable of, but let’s have a fun guessing game, leave a comment below with your guess as to what my year-end 2016 accounts will be, the person closest to the actual dollar amount on December 31, 2016 will win a prize, and I promise I won’t add or subtract any $ from the accounts over the course of the year

To aid you in your guess, here is one last screenshot of what I did with my $30,000 E*Trade account began just 11 months ago, a 500%+ return, but keep in mind I wasn’t limited by the PDT rule so let’s see what your guess is and let’s make this a great 2016!

Leave a reply