In 1636, Amsterdam hosted the first market bubble in recorded history.

Tulip bulbs became a statement of fashion and wealth.

A year later, the exorbitant prices reached for less than a pound of flower petals crashed back to Earth.

History is a powerful teacher if you know how to listen.

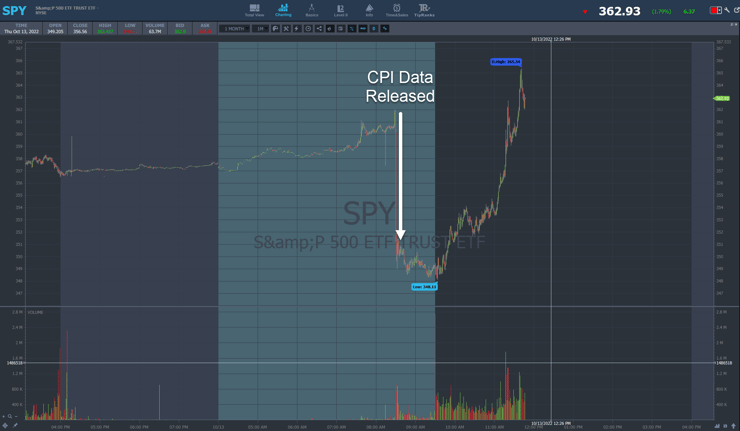

In yesterday’s newsletter, I warned everyone that the CPI data could wreak havoc on markets.

Unfortunately, price action validated my suspicions.

This is the premarket chart of the S&P 500 ETF (NYSE: SPY).

Now some of you are probably like, “Well, markets bounced back, so you made a bad call.”

Except I wasn’t calling for markets to crash.

If you read yesterday’s blog post, you’ll notice that I said we could crash from here.

However, the more important takeaway was to stay safe and avoid taking unnecessary risks.

You see, not all news events are created the same.

It’s up to us as traders to determine their importance and do so quickly.

Because being late is just as bad as getting the analysis wrong.

Now, I offer extensive education to my students about this subject.

I teach them how to zero in on the key points of a press release and determine its value and directional bias.

That might seem like a lot of work, but it’s much easier than you might think.

I want to offer some key insights into how to analyze and trade news that I learned over years of trading and teaching.

These can help you manage your risk and maximize potential gains.

Take a Step Back

2025 Millionaire Media, LLCPenny stocks like to dance to their own beat.

But, they are still influenced by the broader market just like every other stock.

It might seem crazy to some folks that I would worry about government inflation data when I trade OTC stocks.

Yet, when powerful moves hit, they can take everything with them.

That’s why I always have an idea of the major market events for each week.

You can find these calendars online quite easily.

Most major events include Fed speakers, employment reports, inflation, etc.

Here’s what you need to know about these macro data reports.

They only matter when the market cares. And the market tends to only care when things are bad.

Think back to before the pandemic. Can you recall anyone discussing inflation?

No. No one cared because we hadn’t seen any inflation for more than a decade.

Towards the later half of the last decade, job markets were so strong unemployment reports barely budged stocks.

The market back then was sitting on a beach at 5 p.m. with a Piña Colada in its hand.

Today, stocks are running on zero sleep, kids screaming in the background, and rent is past due.

You can literally feel the tension.

That’s why every macroeconomic data announcement holds so much sway over the market.

And as yesterday’s CPI price action demonstrated, it doesn’t mean things go in a straight line.

If I could describe this market in one word, it would be CHOP</\em>.

We see lots of swings in both directions. These get even wider and less predictable around news events.

That’s exactly why I told my students to keep position sizes small or even sit out altogether.

Don’t look at these huge market moves and think, “Man I wish I was a part of that.”

Look at them and say, “I’m glad I didn’t get ripped apart by that swing.”

Look for Promoters

2025 Millionaire Media, LLCI make no secret that I use promoters to my advantage.

These folks range from professional marketers to outright scammers.

But if you follow them, you can find opportunities in low-priced stocks.

Every morning, I look for stocks with news catalysts using our Breaking News feature in our StocksToTrade platform.

This team does a fantastic job of only delivering stock-moving stories.

If you don’t have it, I highly recommend you take the trial. It’s cheap and gives you a chance to take a test drive.

Promoters aren’t hard to spot. You can find them on Twitter or any other social media platform.

These folks talk up the stock regardless of whether there is a news story or not.

I like using these guys in my 7-Step Penny Stock Framework to trade panic dip buys.

You can combine news releases, promoters, and chart pattern frameworks like my Supernova to identify key points where tradeable opportunities could arise.

Promoters love to talk up garbage press releases to generate interest in a stock.

I use this to my advantage to trade alongside them for quick gains, knowing that their pumps will eventually fail.

The thing to remember with any news event, whether it’s a major earnings release, or a simple penny stock press release, the trade opportunities are after the news comes out, not before.

I can then watch the reactions and use my patterns and price action to guide my trading.

–-Tim

Leave a reply