No two trading journeys are alike.

I like to say that my teaching style is like training wheels. I’m just here to teach my Trading Challenge students how penny stocks work and the basics of trading.

I don’t want anyone to copy me. Instead, I want my students to watch my DVDs, study my lessons, and learn from my trades (I post ALL my trades publicly).

I want traders to use my trading education resources to build their knowledge accounts so that eventually, they can develop their own strategy.

A lot of people don’t get it. They just want hot stock picks.

But plenty of students do get it. I’ve gotta say, it’s a beautiful thing when I see students working hard and getting to the point where they’re ready to ditch the training wheels.

I’ve got three inspiring student milestones to share…

Dan may have crossed the $1 million-dollar mark in April* … But his career started with $12,000 in losses.

Evan recently passed $500,000 in trading profits — as of May 2021, he’s over $536,000.* He credits obsessive data-tracking as the key to his profitability.

Kyle V. just passed $75,000 a few months ago. But thanks to refining his process and cutting losses quickly, he’s now over $211,000 in late May 2021.*

I want you to read their stories and learn from all of them…

Table of Contents

Dan’s Million-Dollar Trading Milestone

When I started teaching, I had a clear goal of helping traders become millionaires.

My dream became a reality when Michael Goode, originally a hater, crossed the million-dollar mark.* But it wasn’t enough!

Since then, I’ve welcomed many more millionaire students to the fold: Tim Grittani, Mark Croock, Roland Wolf, Jack Kellogg, Mike “Huddie” Hudson, Matthew Monaco, Kyle Williams, Mariana, and Jack #2*…

Now I’ve got another one to add to the mix: Dan. He crossed the million-dollar mark in April of 2021.*

Dan’s Trading Story

According to Dan, “Desperate times got me into trading.” He was at a low point and looking for opportunities — that’s how he found me on YouTube.

Soon after, he opened his first account. He deposited $30,000 into a margin account so he could be over the PDT rule.

He didn’t think he’d lose at first … But he did. Dan spiraled out of control chasing losses and taking risky positions. Within about three months, he’d lost around $12,000 of that initial account.

It put a huge dent in his life savings and caused him “unbearable” emotional pain. Luckily, it also made him realize he needed to change his ways to avoid blowing up entirely.

He withdrew his account but didn’t stop trading. Instead, he switched to paper trading.

Dan was so dedicated that he dropped out of college to become a full-time paper trader, devoting full weekdays and some weekend hours to the process.

This might sound extreme, but it was actually a game-changing act. Before this shift, he traded to escape reality. Now, he made trading his reality. He also ditched toxic friendships to focus on his trading career.

After eight months of paper trading, he started again with a $10,000 cash account. He played poker on the side to earn more trading money.

By this point, he knew how to trade. But going from paper trading to real trading was still tough.

He lost about $3,000 at first, but these were “good” losses — controlled, responsible, and within his strategy.

After a challenging first three months, things started shifting. Dan started to figure out what worked for him and refine his process. His strategy began to come together.

Dan’s ‘Aha’ Moment Trade

One of Dan’s most memorable trades happened early in his career. It was a $1,007 win on X T L Biopharmaceuticals Ltd (NASDAQ: XTLB).*

At the time, that was a big win for Dan. But the dollar amount wasn’t the only reason it was a memorable trade. For him, it was one of the first times he completely trusted his strategy and process and allowed the trade to unfold.

Happily, it resulted in a win. But the most important part? Dan followed his plan entirely.

How Dan Studies and Trades

Talk about dedication. Dan tells me, “I estimate in total I’ve devoted around 12,500 hours into my career so far over a span of four and a half years.”

His go-to strategy is longing bullish structures that he finds predictable. Typically, he looks for stocks that have a history of being explosive. Dan tries to time his entries with what he has determined is his best risk/reward.

But even with a clear-cut strategy, he understands the importance of adapting. He flows with whichever sector is working best, and he’s constantly making adjustments to his strategy as needed.

More Breaking News

- Growth or Bubble? Analyzing the Rapid Movement in Intuitive Machines’ Stock

- Is TeraWulf Inc.’s Stock Worth the Hype After Its Recent Moves?

- Can RAPT Therapeutics Defy Today’s Market Trends? An In-depth Look

Dan’s Favorite Trading Resources

Dan says that some of his best trading lessons came from my “Trader Checklist Part Deux” guide. He watched it all in one day because he was so motivated to learn!

For him, the guide helped him realize that trading is like a math equation — sort of. Yes, stocks follow patterns, but it’s not an exact science. You must consider all the details surrounding the trade at the moment.

Understanding this allowed him to build the framework for his own strategy.

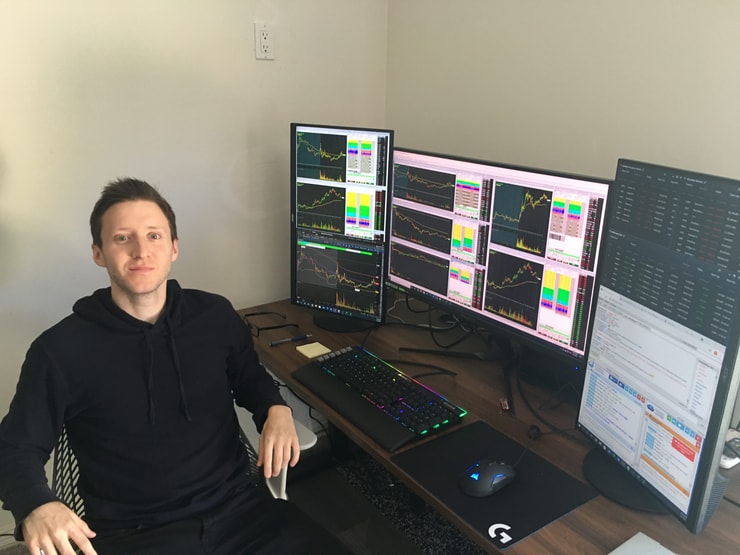

Another tool Dan can’t live without? The StocksToTrade platform.**

When he became a full-time paper trader, he relied on STT’s paper trading program to learn. These days, he says the all-in-one platform makes it easy for him to quickly find charts as well as all of the news, filings, Twitter responses related to a stock. Having access to that kind of information helps him continue to refine his trading.

What’s Next For Dan?

These days, Dan’s more motivated by protecting his capital than the desire to make money.

His next goals? “Optimizing my process, scaling up, and most importantly to continue trading responsibly.”

Evan Passes $500,000 in Trading Profits

Recently, my student Evan passed $500,000 in trading profits. Things move fast — by the time I’m writing this post in late May 2021, he’s already over $536,000.*

Evan’s Trading Story

Evan knows exactly when he started trading in earnest — April 13, 2018. That was the day he was accepted to my Trading Challenge and got access to all of my materials.

He’d tried to buy stocks while he was in college studying anthropology, but he didn’t understand the market. So he’d do things like buy before earnings or hold and hope.

When he graduated in 2017, Evan knew he didn’t want to become an anthropologist. Then again, he didn’t know what he wanted to do. He tried for his Series 66 (a test to become an investment advisor representative) … But he failed the test twice. The second time it was only by one question…

Then, by chance, he saw me on TV with Steve Harvey…

He immediately Googled me and immersed himself in the world of day trading. After shopping around for educational programs, he decided to go for my Trading Challenge.

Evan’s Journey: A Rough Start

Evan, who is primarily a short seller, started studying and trading right away.

But today, he says that if he could go back in time, he would definitely size way down. In fact, that’s his advice to newbie short sellers: “Whatever size you think is a good small size, go smaller.”

Despite devoting 8–12 hours a day to trading and studying and watching just about all of my DVDs, his first 20 months were rough. He says that he lost about $10,000. There were times he thought about stopping.

But he didn’t…

Finding His Stride

Everything changed for Evan once he started tracking his data.

It was keeping meticulous notes that helped Evan realize which patterns worked for him and why.

He was extremely detailed. Was there dilution or resistance? What was the volume on the day? How high did the stock go?

That helped him identify which plays had better odds of working with his style. And that’s what helped him go from this milestone in July 2020*…

Please congratulate my latest six-figure https://t.co/EcfUM6l2S3 student Evan as HARD WORK PAYS OFF! eschunk8 → timothysykes: Its official now Tim, crossed $100k career trading profits today. Also a record day for me. Flat on the day now. $SCKT +$5,765 $TCRR +$9,309, +$15k day!

— Timothy Sykes (@timothysykes) July 27, 2020

… to over $500,000 in less than a year.*

His trading turnaround wasn’t only about data tracking, though.

Evan also knows how important it is to adapt to the current opportunities in the market. About six months ago, he switched up his strategy to focus more on OTCs — he loves shorting first red days.

While he’s mainly a short seller, he’s also been finding success with morning panic dip buys, too.

Evan’s Favorite Trading Resources

Evan is a huge Tim Grittani fan. He says that Tim Grittani’s “Trading Tickers” is really what made trading make sense to him. (Note: Did you know that “Trading Tickers 2” just came out? Don’t miss it!)

He also learned a lot from Roland Wolf and gets a lot from the Trading Challenge chat room community.

Kyle V. Blows Past $200,000 in Trading Profits

I wanted to write about Kyle V.’s (not to be confused with my other student, Kyle Williams) $50,000 milestone in late 2020 … By the time I got around to putting up the blog post, he was already up $74,000.*

Now, just a few months later, he’s hit a new milestone. As of late May 2021, he’s over $211,000 in trading profits.*

The not-so-secret to his success? Refine, refine, refine.

It’s been largely doing the same thing that clicked for him in December 2020 — dip buys on OTCs.

Kyle tries to figure out when a stock has gone down too fast, too quickly and tries to trade the bounce. It’s not quite scalping, but his trades are quick and small. His average win and loss are small — but singles add up.

Mostly, Kyle has been trying to refine his strategy by getting smart about how and when to size up.

He’s also gotten super geeky about timing his entries and exits. A lot can change in seconds in the stock market…

Tracking his data helps. Kyle tracks his data on Profit.ly, tracking each trade while it’s still fresh.

Another big shift? Kyle’s gotten a lot more disciplined about cutting losses. It’s been challenging while sizing up. But he’s noticed that the quicker he cuts losses, the less impact they have on his account’s bottom line…

Kyle’s Favorite Trading Resources

Kyle’s all about increasing his knowledge.

He’s a fan of “The Complete Penny Stock Course” by my student Jamil … He’s also gotten a lot from DVDs as well as Tim Grittani’s “Trading Tickers.”

He’s also very involved in the chat room community — he tries to pick up new skills from everyone he encounters.

From Training Wheels to Trading Freedom…

One of the greatest things about trading is that you can make it the type of career you want it to be.

There’s more than one way to trade. There are countless strategies … and countless possibilities.

The three traders in this post prove that there’s not just one path to success in trading. It’s all about what works for you.

But they also prove that no matter which path you choose to take, you’ve got to start by learning the basics before you fly on your own.

Additionally, no matter what your strategy, you’ve got to be disciplined, willing to adapt, and willing to CUT LOSSES QUICKLY.

I want traders to see the potential freedom that trading can bring. But I also want everyone to understand that it requires a lot of hard work and discipline!

What’s your approach to trading? Is it at all similar to any of the traders in this post or totally different? Leave a comment below!

Disclaimers

*Please note that any reported trading results are not typical and do not reflect the experience of the majority of individuals using our products. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit. This figure is taken from tracking user accounts on Profit.ly, a trading community platform.

It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.

**Tim has a minority ownership stake in StocksToTrade.

Leave a reply