This market is CRAZY, and Twitter penny stock pumpers are playing their role. In the past couple of weeks, there have been so many blatant pumps it’s only right to warn you.

The volatility created by these pumps is off the charts. My students and I love it. But don’t buy into the hype. Take advantage … but don’t overstay your welcome. Never hold and hope. Take singles and trade conservatively.

To learn how to take advantage of this market, watch my no-cost “Volatility Survival Guide.”

Before I dig into the Twitter penny stock pumpers, here’s the latest…

Table of Contents

Lockdown Update

Many students are asking questions about when I might start traveling again. The simple answer is, I don’t know.

There are more cases every day. I’m in California, which has the second-highest coronavirus case total in the country. Last week it also had one of the highest numbers of new cases every day. Los Angeles is right at the top of both new and total cases in California.

I don’t really want to travel when there are so many cases. But it’s not just that I’m scared of it. It’s because I have no time.

Right now there are SO MANY crazy plays. In June, I’m averaging $13.5K every day.* That’s an average … it’s like $8K one day and $15K another. Some days have been over $20K.*

Also, students are on fire. When I’m making $10K in a day, some students report making $500K.* Remember, I trade very safely.

So when would I travel? Weekends? Thing is, on weekends I’m trying to catch up from weekday trading. It’s non-stop right now. It’s a good problem to have.

The point is, if I take a day off to travel, I’m basically giving up $10K to $15K. And I donate it all to charity, so that would suck for the charities.

(*Results are not typical. My top students and I have exceptional knowledge and skills developed over time. Most traders lose money, and trading is risky. Do your due diligence and never risk more than you can afford.)

Which leads me to Karmagawa’s Yemen fundraiser…

Support Karmagawa’s Yemen Fundraiser

First, I have a special post about the Yemen crisis coming tomorrow. Please share it when it hits the blog — it’s super important. The country’s civil war combined with the coronavirus pandemic is disastrous. They’re desperate.

To date, we’ve raised more than $373,000 with our Facebook fundraiser. But our goal is $500,000. I’m also donating all my trading profits in June — over $268,000 as I write. So we’re now over $640,000.

ALL donations — big or small — are going to support three charities:

- Doctors Without Borders

- Save the Children, Yemen

- Unicef Yemen

Please, if you haven’t already, donate today. Help us get it to $750,000 or more.

Now it’s time to answer…

Trading Questions From Students

The first question is about recent supernova Digital Locations, Inc. (OTCPK: DLOC). It’s one of many recent Twitter penny stock pumps.

Here’s the question…

“Was DLOC just a Twitter pump? How did it run almost 4,000% in one day?”

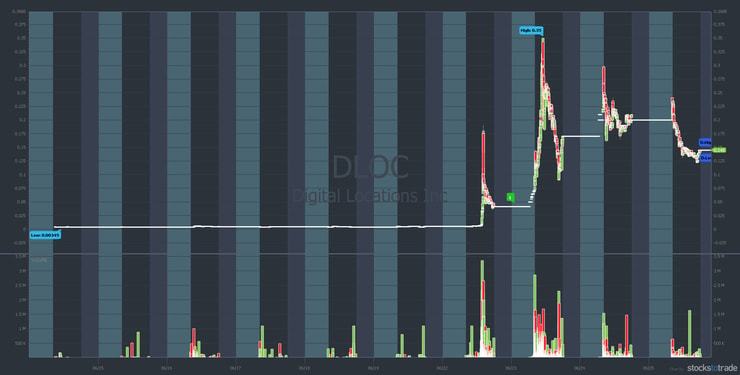

First, check out the DLOC 10-day chart:

To put the first spike into perspective…

On June 22, DLOC opened at $0.0049 and ran all the way to 19 cents before the hard pull back. That’s a 3,877% spike. And even though it closed at a little over 4 cents a share, it still finished up 849% on the day.

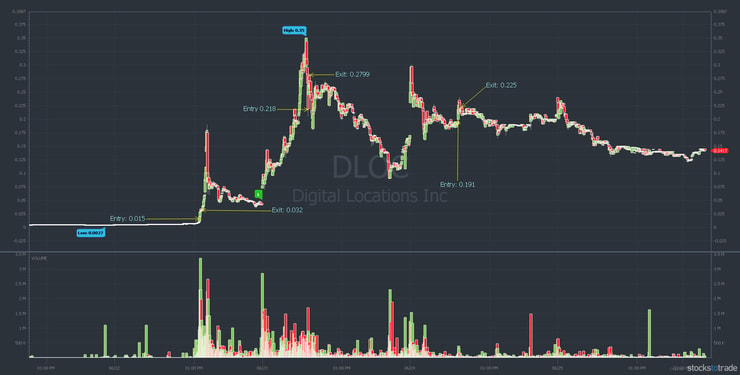

The crazy thing is, I thought it was over after the first day. Take a look at the three-day chart. I’ve included three trades:

The first trade I bought at 1.5 cents and sold at 3.2 cents for a 103.33% win.* The StocksToTrade Breaking News tool alerted me…

“$DLOC(0.05/ + 20.19%) low priced name being pumped on twitter.”

So it wasn’t even a traditional news catalyst. It was a Twitter penny stock pump.

Notice the green news icon on the chart? Overnight, Digital Locations announced it joined an experimental 5G wireless network. It spiked all the way to 35 cents the next day. Then it dropped back down to 9 cents a share.

This is sketchy…

More Breaking News

- FuboTV Faces Roller Coaster Ride Amid Ongoing Business Turmoil and Legal Scrutiny

- Quantum Leap: Is IonQ’s Stock Set to Skyrocket?

- From Dreams to Reality: Can Lucid Group Power Through Market Setbacks?

The Twitter Penny Stock Pump Came Before the News

It’s pretty crazy when you think about it. Did the pumpers get the timing wrong? Was the press release to keep regulators from looking into the incredible spike? We may never know. And it doesn’t really matter because my students and I trade the volatility these pumps create.

I dip bought DLOC several times after the initial spike, recognizing it could bounce. Again, I only showed three trades on the chart, but I took over 20% on every trade except one. The second trade on the chart was a morning panic dip buy for a 28% win and $1,548 in profits.*

The third trade on the chart above is another credit to the STT Breaking News Chat. Again, the Breaking News guys alerted more Twitter penny stock pumping. My thesis: it was one last shot at spiking the stock.

I traded DLOC seven times from June 22–24 for a total of $12,007.50 in profits.* View my DLOC trades here.

(*My results are not typical. I have exceptional knowledge and skills developed over time. Most traders lose money, and trading is risky. Do your due diligence and never risk more than you can afford.)

Next question…

“You sized down after a loss on $MARK on Monday. Were you adjusting to the market or was it overtrading?”

Yeah, it hasn’t all been rosy. I’m having my best month in years but it’s not like every day in June has been amazing.

There have been some pockets where you just didn’t get the big spikes. Early last week and the previous week, some of the big gainers weren’t spiking as much. I’m not sure if they’re tired because they were spikers in May and their story has played out, or if it’s the overall market. But some of the recent spikers like XpresSpa Group, Inc. (NASDAQ: XSPA) and Remark Holdings, Inc. (NASDAQ: MARK) didn’t do as much last week.

Regardless…

Every day is a little different, so I size up or size down accordingly. The crazy thing is that when the Dow closed down 695 points on June 24, I made $9,611. And when it closed up 329 points on June 25, I made $8,097.*

Last week that loss on MARK was my only loss between Monday and Thursday. See all my trades from last week here. The point is, I take it one trade at a time. I modulate and adapt one trade at a time. And I always follow rule #1: cut losses quickly.

MARK was another big twitter penny stock pump. I don’t have anything against Remark’s technology — it’s irrelevant to me. And I don’t know specifics. What I do know is this: it was pumped up blatantly.

It’s another clear example of the…

Rise of the Twitter Penny Stock Pumpers

I don’t know what’s going on behind the scenes with these pumps. But I do know there’s a whole lot of BS. And when I try to call it out — because it’s my job as a teacher — people say, “Come on Tim, you haven’t done your due diligence.”

Two decades. That’s how long I’ve been doing due diligence in this niche. I know how news can be manipulated or even faked. Even when a company does sign a big contract they’re likely to screw it up somehow. Trust nobody. Expect the worst out of everybody.

To learn how to spot a penny stock pump, watch this video…

How Can You Spot a Penny Stock Pump?

You can’t afford to be naive. You MUST understand…

It’s All a Smokescreen

What you need to know is the press releases, contracts, and Twitter pumps are all a smokescreen. It’s all irrelevant compared to what’s really going on.

What’s going on? Penny stock companies do financings and sell shares to raise money. Insiders sell at inflated prices. They raise enough money so they can pay management’s salary for a few years. Then they go out and pitch their ‘miracle technology.’

And it’s not just MARK. Right now, Twitter penny stock pumps are blatant…

CRAZY how people risk their hard-earned $ on pumps like $IDEX $DLOC $GNUS $MARK $SHIP $GAHC $JAKK $SPOM $CTRM without knowing how this works. Don't make it your funeral, read my FREE https://t.co/LZD2Yz9Opu & FREE https://t.co/SKdarBuL7k & https://t.co/QTYT7tQ5da too, stay woke! pic.twitter.com/JErZuQeMfv

— Timothy Sykes (@timothysykes) June 25, 2020

How do I know they’re pumps? I use…

StocksToTrade Breaking News and Social Media Search Tools

You can literally see the pumps happening using these tools. The social media search tool lets you scan for any tweets with cashtags. (A cashtag looks like this: $MARK.) You can filter the scan using the same criteria as the other StocksToTrade scans.

The Breaking News Chat tool is awesome. Two very experienced traders curate only the best news. It’s been a game-changer for me.

(Full disclosure: I helped develop StocksToTrade and I’m a major investor in the platform. That said, it’s my dream stock-scanning tool. It’s designed to help save time in finding the best stocks that fit my patterns and strategy.)

Respect the Pumpers

I have nothing against promoters and pumpers. My goal is to help you understand how the game works. Even though I don’t believe the hype, I understand and respect it can influence a stock’s price.

Especially when they get spread around by promoters. Whether it’s a Twitter penny stock pumper or an email list owner…

… if someone has offered to pay for promotional services, that means it’s a pump. It doesn’t matter whether it’s cash or in shares.

This is so important that I’m writing a dedicated post about dilution and why penny stocks get pumped. Watch for it. It will go into more detail about the financing/offering angle.

Again, I want the pumps to be good. The best pump ever. Why? Because that makes the stock more volatile. It gives me more trading opportunities.

Millionaire Mentor Market Wrap

This is an amazing market. Learn from it, enjoy it, and profit from it. But understand this is not normal. The market won’t always be this way so take advantage of it every single day.

And keep an eye out for those Twitter penny stock pumpers … It’s actually kinda fun once you see what they’re doing. Just don’t fall for the hype.

If they say, “To the moon!” You focus on the process, take singles, and lock in profits.

If they say, “It’s going to $100…” don’t believe it. It’s not. And if it does, it’s a short squeeze.

If you’re brand new to penny stocks start here with my FREE Penny Stock Guide. The next step after that is “The Complete Penny Stock Course” by my student Jamil. Then, when you’re ready to learn the nuances and become a self-sufficient trader…

Apply to Join the Trading Challenge

What’s the Trading Challenge? It’s my most comprehensive trading education course. As a member you’ll get access to:

- 16 DVDs teaching my strategies. From patterns to SEC filings, you’ll learn all the basic concepts that have made me millions.

- Over 6,000 video lessons. This growing library is fully categorized so you can focus on specific trade setups — one at a time.

- Thousands of hours of archived webinars. When you get in, watch them. Discover how history seems to repeat in the penny stock niche.

- Live weekly webinars with me and the Trading Challenge mentors. Get your questions answered by some of the best traders on the planet.

- Your seat in the Trading Challenge chat room. I consider it the best trading community anywhere. (Hint: this alone is worth the price of admission.)

Apply for the Trading Challenge today. But no lazy losers allowed. Come ready to study your butt off.

What do you think of the Twitter penny stock pumpers? Comment below, I love to hear from all my readers!

Leave a reply