My email and DMs are blowing up asking about Ideanomics, Inc. (NASDAQ: IDEX). It’s time to learn the truth about promoted penny stocks.

Before I get too deep into this … On June 21, I had a buy alert for IDEX in one of my newsletters. The buy alert was in the $1.70s on a big first green day. The sell alert was for the $2s. The stock ran all the way to the $4s — so I underestimated it. But now it’s collapsed from the $4s down to the $1s.

My point in sharing the buy alert is full transparency. That will make complete sense by the end of this post, so keep reading…

Table of Contents

“$IDEX I’ll See You Guys On the Moon”

That’s a direct quote of a tweet by a penny stock promoter. IDEX is one of the most promoted penny stocks of the past few weeks. It’s a massive battle between longs and shorts.

Longs are all over Twitter, WhatsApp, Discord, Telegram, and Stocktwits saying “This company has so much potential.” At the same time, shorts are saying “This company has big flaws.” More about that fight in a moment.

First, what you need to understand is that this stock is getting pumped. It’s a blatantly promoted penny stock.

If you’re new to penny stocks — read this FREE penny stock guide as soon as you finish this post. It’s essential to read and understand it to avoid getting sucked into one of these pumps.

How do I know IDEX was blatantly promoted?

Promoters Publicly Admitted Offer of Money to Pump IDEX

The promoters talked about it publicly. One of them admitted to being offered money to promote the stock by tweeting about it. Then they said they didn’t accept the money and didn’t support that kind of activity. I don’t know whether they did or they didn’t.

But … and this is the important takeaway…

The same people who are so high and mighty about IDEX are saying someone offered them money to promote it. What does that mean?

A Pump Is a Pump

I’ve been talking about promoted penny stocks for well over a decade. This is nothing new. Not sure what a penny stock promoter is? Check out this infographic.

Then watch this important video:

How Penny Stock Pumpers Work

The fact that someone is funding advertising of a stock instead of funding the company … that’s a terrible sign. That makes it a blatant pump. It doesn’t matter if the stock goes to $10 per share … A pump is a pump.

IDEX isn’t the only one. I’ll come back to it. First, look at these charts of other recently promoted penny stocks. As a trader, it’s more powerful if you see the pattern. Look for the similarities in these charts. Burn it into your brain….

Remark Holdings, Inc (NASDAQ: MARK) six-month chart:

I was buying MARK around 30 cents a share back in April. It went to over $3 — ten times your money if you held. Remember ten times your money — it’s a recurring theme.

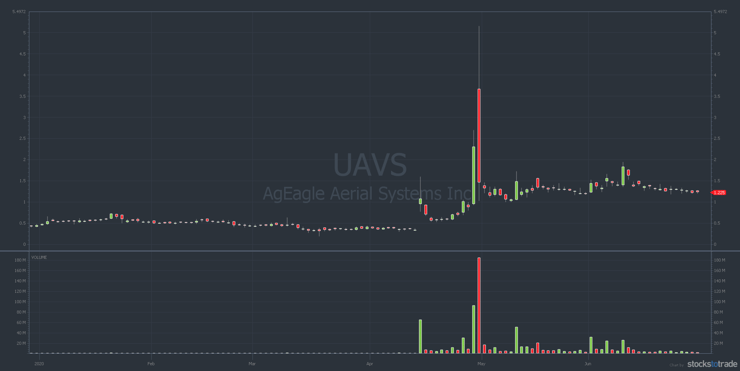

AgEagle Aerial Systems, Inc (NYSE: UAVS) six-month chart:

UAVS went from roughly 50 cents to $5. Again, ten times your money.

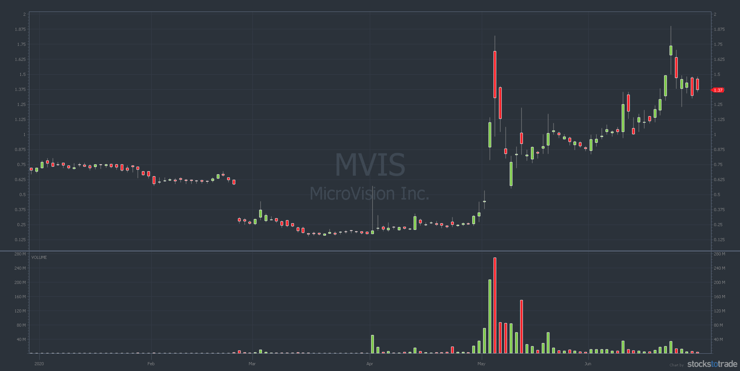

MicroVision, Inc. (NASDAQ: MVIS) six-month chart:

MVIS went from roughly 18 cents in mid-March to $1.80. Again, 10 times your money. MVIS has actually held up. Not all promoted penny stocks completely collapse … right away.

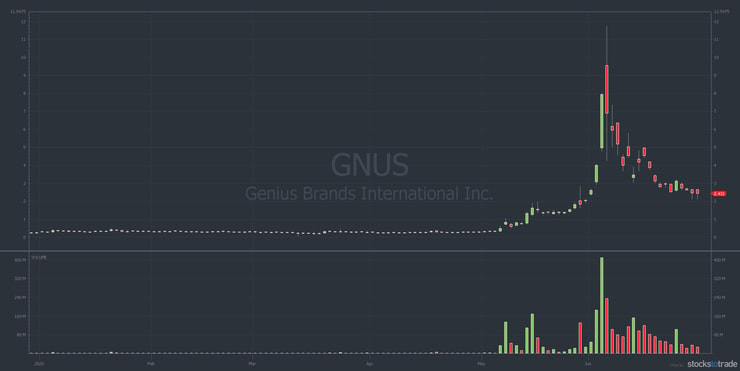

Genius Brands International, Inc. (NASDAQ: GNUS) six-month chart:

GNUS went from roughly 33 cents to the high $11s. It was even better than the others at nearly 35 times your money. Thanks to overaggressive shorts there was a big short squeeze.

Every one of these is a recently promoted penny stock. And those with the biggest pumps have the biggest collapse.

Like IDEX. Check out the IDEX six-month chart:

Promoted Penny Stocks: Ask the Right Questions

The point about all of this is not to determine whether Ideanomics is a legit company or not. You could lose an entire day reading press releases, Twitter threads, SEC filings, and the like. And you could still walk away not knowing for sure if this company will make it.

If you wanna have some fun, after you read this, use the StocksToTrade social media search tool to scan for IDEX. Crazy. Again, the longs are finding every reason to hold and hope. The shorts are doing everything they can to crush it. While they all engage in confirmation bias, the best traders ask questions.

So what’s the right question?

More Breaking News

- BigBear.ai’s Journey in the Stock Market: Rising Trends and Challenges

- Top Bitcoin Stocks to Watch Under “Crypto Emperor Trump”

Promoted Penny Stocks: What’s Really in Play?

Here are a few solid questions…

Why was money offered to promote the stock? Shouldn’t the money — whatever was offered — go into the actual company? Shouldn’t it go into manufacturing or products?

I don’t know the details. And I don’t care.

But when you see the stock being marketed you have to ask, ”What’s really in play here?”

What’s really in play with almost all of these pumps is the stock! You get the stock up as much as possible to do a financing at a discount price. And you raise millions — or tens of millions — of dollars.

Then you pay management nice salaries for a few years while they “work on amazing ideas to change the world.” Even though it usually doesn’t pan out they still get paid. And … insiders like to sell into the big spike if their shares are unrestricted.

What Do Promoted Penny Stocks Have in Common?

I see it over and over again. It’s basically 10 times your money — 30 cents to $3. Or 50 cents to $5. Sometimes it’s more — maybe 12 to 15 times your money. And with all the overaggressive short sellers, sometimes you get outliers like GNUS.

But most of the time it’s five, 10, 15 times your money — and that’s the best-case scenario. Then comes the nearly inevitable collapse. I warned longs about the IDEX collapse two days before it happened.

Sound familiar $IDEX longs? I warned you yesterday but you didn’t listen so now after you lose enough of your hard-earned $ go watch my FREE https://t.co/KhqHFIe64c & https://t.co/KON0UFjulH videos & see how this niche actually works! #itsgoodtobereal #experiencepays #staywoke https://t.co/0MJhX7DgKc

— Timothy Sykes (@timothysykes) June 26, 2020

What did I get in return?

Ignorance and Hate Every Time

Promoters don’t like it when I warn about the coming collapse. They tell people to block me on Twitter. Or they say I’m a short seller trying to tank it. I’m not. I wish the pumpers did a better job!

Like I said, IDEX was an alert on one of my newsletters. And it’s been on my watchlist a few times because it was getting pumped. I want promoted penny stocks to go as high as possible because that creates the volatility I love to trade.

But having seen the same playbook as promoters from years ago, I wish I’d had the guts to short it on June 25. Too bad I don’t have any of those old promoter emails. The language is almost identical.

The Weird Way Promoters Do Me a Favor

When promoters tell people to block me on Twitter they’re actually doing me a favor. They don’t even realize it.

I don’t mind getting blocked on Twitter. It’s helpful. Why? Because I don’t have the patience or the tolerance to deal with people who believe penny stock promoters and still do well. I cut through all that BS and teach rules. It’s my honor and pleasure to teach dedicated students.

So when the promoters get people to block me it weeds out newbies and morons who don’t value education.

The irony is that because they block me and because they have such hate against me…

… after they lose enough money, they remember me. Why? Because they finally realize I teach rules, history, and strategies that can help them.

Secret Messages and DMs From Thankful Traders

The interesting thing is, I’ve started getting messages from people who blocked me on Twitter. Some have now unblocked me. But some still have me blocked because they don’t want the chat room they’re in to know. Why? Because I’m still public enemy #1 to promoters since I expose their BS tactics and ethical shortcomings.

Again, I don’t mind. I’m used to the hate. How so?

A History of Promoted Penny Stocks

One of the most important lessons you can learn is that promoted penny stocks happen again and again.

You have this crazy community of promoters and their followers. And you can’t even tell what’s real or not sometimes because there are also bots. But the language they use and the spikes they create look the same as the email promoters back in the day.

It looks just like the Twitter weed stock pumping back in 2014. That was when I called out the Wolf of Weed Street for leading newbies into big losses. Men’s Journal featured it in an article called “Buying High: How to Get Rich on Pot Stocks.”

But it wasn’t just about calling him out. It was getting him to accept responsibility for what he was doing. Sadly, the new promoters are saying the same things … “I’m not making you buy. It’s your decision. I’m not pushing the buttons.”

Worse, they’re saying BS like “It’s not a loss until you sell!” Grrrrrrrr! Seriously?

Technically that’s right. But it’s also not a profit! If you’re holding and hoping your trading capital is tied up. Could it turn into a big win? Could it be the next Microsoft? Good luck with that.

Promoted Penny Stocks Over the Years

I’ve been writing about promoted penny stocks for a long time. This has happened with plenty of pumps. Sometimes the companies have big names backing them…

Like Shaq’s involvement with NXT Nutrionals Holdings, Inc. (OTCPK: NXTH) Read about it in this Business Insider article. Note: NXTH is now ‘Dark or Defunct’ according to OTCMarkets.

Or Justin Bieber’s involvement with Options Media Group Holdings. (CVEM: OPMG) I wrote this blog post about it. Note: CVEM means the stock is given ‘caveat emptor’ status by OTCMarkets.

And there are more. A lot more. Check out this list of promoted penny stocks starting with SpongeTech. This press release from the SEC explains how the SpongeTech scam turned out.

Will something like that happen with one of these recently promoted penny stocks? I don’t know. Who knows who got paid what … Apparently an investigation was just launched into IDEX. Maybe the promoters will have to testify.

None of that really matters. What matters is that you understand the big fight between the shorts and longs misses the point.

IDEX only ran from 30 cents to $3 because it’s a promoted penny stock.

Stop Making the Same Mistakes Over and Over

Penny stocks are not bad. Ignorance and lack of preparation are bad. Go back and look at the weed stock charts from a few years ago. Or any of the hundreds of other promoted penny stocks over the years … It’s exactly the same as IDEX.

Unfortunately, it usually takes a big loss for people to realize that my rules are right.

You’re Preaching to the Choir

When supporters of these stocks say, “This company has billionaires aboard. They have solid technology …” I just have to shake my head.

You’re preaching to the choir. You’re talking about stuff that doesn’t matter. It’s like someone complaining about the food in the first-class car on a train when the upcoming bridge is out. The food doesn’t matter. The train is about to crash because the bridge is out.

I am wrong 1/3 of the time, but since my giant loss over a decade ago, I’ve learned to trade like a wuss & I still make big gains thanks to all the volatility. So, which do you choose, a lot of action but no millions or far more strict disciplined trading & millions in profits?

— Timothy Sykes (@timothysykes) June 26, 2020

It took me losing half a million dollars on one company to figure it out. But I’ll never forget that loss. You can read about it in my book “An American Hedge Fund.” It’s 100% FREE because I don’t want you to have any excuse not to study and learn from it!

Understand the Pattern

I don’t really care about IDEX. I don’t care about the technology or the billionaires. What I care about is teaching students how to recognize what’s really happening. You MUST understand the pattern. It’s the same pattern every time.

It blows my mind that it takes losses and crashes for people to realize it.

Pump collapse update: $IDEX is now down 43.85%, $GAHC is now down 46.99%, $RSPI is down 41.98%, $DLOC is down 40.04%. New poll: how much in losses do newbies need to not hold & hope & instead cut losses quickly/trade like a sniper? LEARN THE RULES: https://t.co/ZB6EtRjpli ASAP

— Timothy Sykes (@timothysykes) June 26, 2020

It shouldn’t surprise me. I’m glad I saved a few people from unnecessary 50% losses. And I’ll keep teaching. Because promoted penny stocks aren’t going anywhere any time soon.

Learn How the Penny Stock Niche Works

Remember those haters I told you about? The ones who blocked me on Twitter but then sent me introspective DMs saying, “I should have listened to you…”

A few actually listened and cut their losses. Some of them became my students. Now they’re learning how to trade the right way.

But too many people still don’t understand this is a battlefield. And I’m not here to be your friend. I’m your drill sergeant.

People tell me to be nicer & I’ll have more students, IDGAF about being nice, I’m your drill sergeant in this war & warm/cuddly fake ass gurus will doom you when it’s time for battle. 90%+ of traders lose & no amount of manners, praying & luck will save you…you need KNOWLEDGE!

— Timothy Sykes (@timothysykes) June 26, 2020

The best thing you can do to protect yourself from the promoters is to learn — really learn — how to trade. Don’t follow some promoter with the hot pick of the week. Especially when they say “every stock is a pump” after they’ve been telling you to buy and hold for days.

Following people like that is for degenerate gamblers.

My goal is to be the mentor to you that I never had. To that end, you need…

The Complete Penny Stock Course

Get “The Complete Penny Stock Course” by my student Jamil. He took my lessons and strategies and put them together in an easy to understand format. It’s essential reading for penny stock traders.

Trading Challenge

Apply for the Trading Challenge. It’s the most comprehensive trading course I offer. You get access to DVDs, webinars, video lessons — and what I consider the best chat room with some of the best traders in the business as mentors.

Final Thoughts on Promoted Penny Stocks

I’m proud to be able to help some people understand the blatant pumps we’re seeing. If you study history it’s obvious that these pumps are NO different from the past. Learn how the game works and the predictable patterns the promoters create!

Promoters come and go. The tools they use to promote might change. But what they say and how they say it … it’s the same. Whether you learn from me or the hard way from giant losses is up to you.

What do you think of this post about promoted penny stocks? Comment below, I love to hear from all my readers!

Leave a reply