You need a trading mentor. Some people say, “Oh, Tim, I don’t want to learn from you. You teach old patterns.”

I teach patterns that still work after 20 years of trading. Don’t get fooled by shiny new objects.

Before we get to it, last week was a wild one! So much happened. First, there was all the election uncertainty…

Then there were two big milestones…

Trading Challenge student Jack Kellogg hit the $1 million milestone. And I hit $6 million in trading profits.* Crazy.

(*These results are not typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

Jack worked as hard as anyone learning how to trade. And he’s become a great trading mentor in his own right. Every day he’s in the Challenge chat room as a moderator. He freely shares not only his trades but also his thought process.

But even Jack had the advantage of a trading mentor. And I’m not just talking about myself, I’m talking about Mark Croock and many others. Jack used to share his watchlists with Mark — to see if he was on the right track.

I didn’t have a trading mentor when I started. And I made a ton of mistakes because of it. Costly mistakes. Six-figure mistakes. In this edition of the update, I’ll explain the value of a trading mentor, both in time and money…

But first…

Table of Contents

Find What Fulfills You in Life

Aside from teaching my students penny stock trading, charity is my biggest passion. It’s my life purpose. There’s nothing I love more than building schools for communities. Opening my first school in Bali was so gratifying that it made me want to build more.

Now, through Karmagawa, my goal is to build 1,000 schools. So far we’re at 70, so there’s a long way to go. 2020 has been tough as construction got halted on nearly all our schools worldwide. But we will get through this, and we will get to 1,000 schools.

I’m excited about the possibilities. And I’m excited about making the world a better place. But there are a ton of issues right now, from animal and human rights to the environment and hunger.

Karmagawa has a blog where we keep up with recent events in these areas. Check out the Karmagawa blog today — stay up to date.

While you’re there, why not do some of your holiday shopping? When you or your loved ones wear Karmagawa gear, it helps us spread the word. And 100% of the profits from Karmagawa merch is donated to charity. Together we can change the world.

Now it’s time for a dose of tough love…

You NEED a Trading Mentor!

It’s one of the best feelings in the world for me when students DM or tweet about how my lessons help them. Again, I didn’t have a mentor or guide. I believe it cost me millions in potential profits. And I know for a fact it cost me in opportunities and time.

Please congratulate my hardworking https://t.co/EcfUM6l2S3 student: 10:46AM Rak: YEESSSSSSSSS, my first +$1K day

10:48AMRak → timothysykes: My win is 100% credit to you, the awesome mentors and all of the materials. Thanks a ton for being a no BS tell it how it is teacher.— Timothy Sykes (@timothysykes) October 6, 2020

No great trader has learned everything on their own. It takes too long and you waste SO much time. Sadly, too many people learn the hard way about the value of investing in education.

Whatever you do…

Choose Your Trading Mentor Wisely

You have no idea how many fakes there are in this industry. If I took the time to expose all the fakes, I wouldn’t have any time for anything else.

This video explains how to know if the trading mentor you’re considering is real…

How to Spot a Real Trading Mentor

I may not be professional at times … and I might swear sometimes … but I’ll always be real with you. No matter what, when you’re considering potential trading mentors, ask these questions…

Dear Trading Mentor, What’s Your Real Name?

Do me a favor, if you’re gonna learn from somebody, ask for their real name. There are so many fakes out there with random screen names and random profit screenshots.

You wouldn’t believe the horror stories I hear. People DM me and say, “I paid thousands to learn trading from this guy, and then he just disappeared. I never heard from him again.”

Dear Trading Mentor, Can I See All Your Trades?

There are some shady characters out there who put up a good front but aren’t willing to answer this question. Ask them to show you every trade — not just their wins. See all my trades here.

Today I took some small losses & accepted that I was off on my $BRTXQ analysis, it happens…small gain on $OPTI too. I'm currently down on the day a few hundred but I'm so thankful I cut losses quickly & didn't get stubborn or else I'd have a BIG loss now: never be a sore loser!

— Timothy Sykes (@timothysykes) November 6, 2020

Why should a trading mentor be willing to show you all their trades? Why is it crucial for YOU?

Because…

More Breaking News

- Why Opendoor Technologies Faces Challenges After Latest Financial Moves

- Surprising Decline of Quantum Computing Stocks: Investigating the Market Ripples

- Bitcoin’s Surge: Can Marathon Digital Keep Up?

A Transparent Trading Mentor Can Teach You What NOT to Do

There are a lot of ingredients for trading success. Hard work, patience, persistence, and the right strategy are all important. But a key part of your journey is to learn what NOT to do.

Hard work, persistence, patience, the right strategy, ideally a mentor & a little luck too are all ingredients for massive success, but even if you fail/lose at first, it's still an important part of your journey to learn what NOT to do so you can be more knowledgeable later on!

— Timothy Sykes (@timothysykes) May 23, 2020

Like this…

Trading Mentor: Confessions of a Win

This is gonna sound weird, but I want to review a trade — a winning trade — that I should never have taken. It wasn’t the ideal trade for me.

The reason I want to share it is to show you what NOT to do. But I also want you to understand what could have happened if I’d gotten stubborn when it was clear I was wrong. By taking a step back, reviewing my position based on my rules, and getting out, it was a win.

Check it out…

Daniels Corporate Advisory Co. Inc. (OTCPK: DCAC)

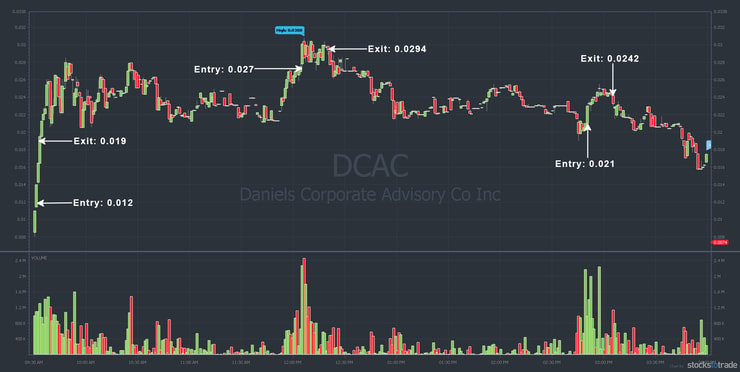

The day after the election, I had an all-day live trading webinar. DCAC spiked right at the open on rental truck news as explained in this SEC filing. I traded the stock three times that day. The second trade is the one I should never have taken.

Here’s the DCAC intraday chart from November 4 showing my trades:

Looking at the chart, the first trade was solid. I bought the morning spike and sold into strength. Yes, I underestimated it and sold too soon, but it was a 58% win, so I’m not complaining.*

The second trade, even though I profited, broke my rules. I hate midday trading.

I was afraid of missing out on a big run-up. It started to rebound just before noon and was testing morning highs. I bought — thinking it could go above 3 cents. I know better, but because I underestimated it in the morning, I had some FOMO.

So I gave in to the FOMO and a lack of discipline.

It was a weak breakout — a fakeout. I didn’t want to chase, which is why I took the trade. But when it couldn’t hold the breakout, all I could think was, “I should never have taken it.”

Use All 7 Indicators for Best Results

For me, time of day is huge. It’s one of the seven indicators in my “Trader Checklist Part Deux” guide. I shouldn’t trade midday, and neither should you. It’s just too risky. And as you can see, it would have been a loss if I’d held much longer.

Look at the chart again, the first and third trades were much better reward vs. risk. You can’t judge a trade only by profit or loss.

How to Find a Trading Mentor

I’ve already given you two questions to ask any potential trading mentor. And I’ll say straight up, I want to be the mentor to you that I never had. But just in case, watch this video…

How to Find the Right Trading Coach or Mentor

Again, I’ll never claim to be perfect when teaching you. But I will be real with you. I had to learn everything I teach the hard way. The stock market is NOT friendly. And it’s not an easy-to-understand teacher. It will cost you a lot of time, money, and opportunity.

One thing you should know…

My top students all have slightly different strategies. I’m proud of that. It means they’ve taken everything I teach and refined it based on their own experience. It shows their willingness to test and adapt to the market. And THAT is why they’re mentors in the…

Trading Challenge

It’s so cool that my top students give back to the community as trading mentors. It expands the realm of possibilities far beyond what I could teach alone. It makes the Trading Challenge the ideal place to figure out what works best for you.

Fair warning: I’m not looking for more students. I’m looking for more dedicated students. I’m looking for students who see the potential. And students willing to learn — and follow — the rules. Like rule #1: cut losses quickly.

If you ignore the rules, you’ll fall into the 90% of traders who lose money. So if you’re gonna apply — be willing to follow my rules and my instructions to a T.

Apply for the Trading Challenge here.

Millionaire Mentor Market Wrap

That’s another one in the books. I hope you understand the value of a trading mentor. Jack Kellogg does. He took advantage of the mentors in the Trading Challenge. He studied his butt off.

He even spent a year trading with fellow Challenge student Dominic Mastromatteo. (Dom, I know you’re out there. Bring it back home.) Then, once he’d mastered Dom’s favorite strategy, he started working on other strategies.

Now Jack trades the seven-step “Pennystocking Framework” as well as anybody. He deserves his success. Wanna be like Jack? Yes? Then you need a trading mentor.

Do you understand the value of having a trading mentor? Comment below, I love to hear from all my readers!

Leave a reply