Huddie’s Million-Dollar Year: Key Takeaways

- What Huddie started during college … I bet his classmates wish they’d done this!

- See how when the markets exploded in 2020, Huddie was primed for action…

- Huddie’s top lessons for overcoming the woes of a beginning trader…

Apply for my Trading Challenge today!

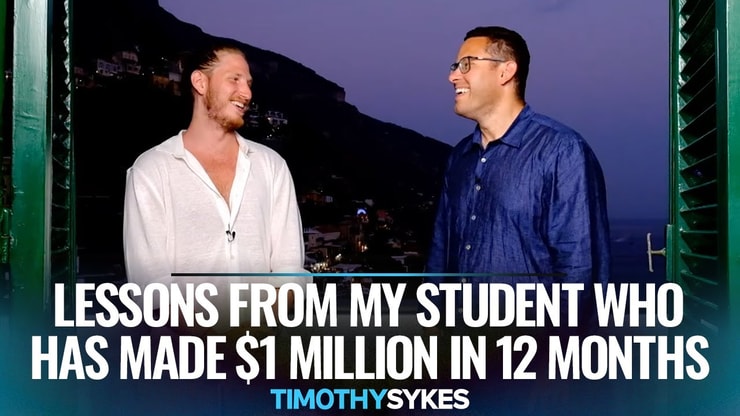

In August, I joined six millionaire students in Italy to celebrate some big milestones. Mike “Huddie” Hudson was in that group. So we had a chance to discuss his incredible million-dollar trading year.

Check out the video below! And read on for Huddie’s top tips for traders.

Table of Contents

Huddie’s $1 Million Year

In this video, you’ll learn…

- Who Huddie answers to in his trading — no matter what

- How Huddie took advantage of the crazy 2020 markets

- The importance of finding low downside/high upside opportunities

- Why IQ doesn’t determine a great trader

- The goal Huddie had as a younger trader

Let’s dive in!

5 Trading Tips With Millionaire Mike “Huddie” Hudson

More Breaking News

- Bitcoin Crash Sparks Sharp Decline in Cryptocurrency Stocks

- Bitmine Immersion Technologies Secures Strategic Edge with $14 Billion Crypto Holdings

- Under Armour Battles Data Breach Amid Revenue Challenges

- Pagaya Technologies Sees Stock Fluctuations Amid Strategic Moves

Let’s break down Huddie’s tips for traders…

#1. Remember Who’s in Control

Who’s in control of how much you risk? YOU.

Remember that. It’s important. A lot of people like to blame their problems on others. But you’re in control!

If you lose more money than you wanted, it’s because you chose to risk more than you should have.

Be accountable. Stay safe and learn how to trade with the right rules. And again, remember that you’re in control of how much you risk.

Huddie says he found more success in trading once he learned to manage his risk.

#2. Adjust and Adapt to the Markets

Huddie was one of many students who took advantage of the influx of new traders in 2020…

“The first time we had to adjust to the market was 2020 and 2021. The stimulus checks came into the market, and it just seems like everyone was a day trader all of a sudden. And that provided a lot of opportunity.

“When dumb money comes on the market, that’s when we succeed. That’s why we trade penny stocks. We don’t want to trade against hedge funds. We don’t want to trade against algos. We want to trade against Joe Schmo.”

Huddie saw such a great opportunity that he sized up. It taught him how to deal with larger trades and provided that “level up” that traders see along the way.

The time of year can help, too. Huddie finds that he struggles in the summer months when the markets are typically choppier. He takes more time to study charts and find setups he likes.

This means not trading every day. Patience is a big part of trading, too. I don’t like being patient. I like to be there when the big moves are happening…

And that’s what’s great about trading. Some people have said that if I teach too many people, everyone will trade the same and the great opportunities will go away.

But my 7-step framework still works after all these years. And traders like trading different steps.

Everyone has their own way of playing the game.

#3. Focus on Risk/Reward

I asked Huddie about the number one problem he sees with traders. Here’s his response…

“I think it’s focusing on risk/reward instead of percent gain, percent loss…

“I think what boils down to all the great traders is we know how to manage risk/reward, how to risk a penny and make 10. And you can scale that any way you want.”

A lot of traders get hung up on making or losing a certain percentage. But the most successful traders focus on how to make a lot by risking a little.

To figure that out, you have to learn by losing first.

There will be opportunities where you can risk a small amount and still see a lot of potential upside. But you have to know how to find those situations. That’s where hard work and studying come into play.

This can also push traders into a fear-driven mindset. They don’t stick to their plans because they don’t want to lose money.

Trading with some level of fear can be helpful.

Being scared of great loss & failure is GOOD since it's more realistic that you'll make mistakes & lose in the beginning of your trading career, just like any industry. The great news is those early lessons will help teach you what NOT to do & are crucial to your eventual success

— Timothy Sykes (@timothysykes) October 7, 2021

But losing and the lessons that come with it can help you nail down a plan that works FOR YOU. You just have to be willing to stick with it.

#4. Don’t Think You’re Not Smart Enough to Trade

Huddie watched me succeed and knew he could do it too.

As he gained experience, he says it was “also recognizing that the millionaires weren’t the smartest people. And that’s not an insult … but we’re not geniuses. We’re not mathematically insanely smart. We don’t have this crazy IQ.”

I won my fifth-grade spelling bee, and it’s been downhill since then. I still can’t spell the word algorithm without spell check…

Trading isn’t rocket science. A lot of it’s pattern recognition and learning.

Trading in the markets is similar to how athletes train. The top dogs don’t show up to the NBA Finals with no preparation. They spent years doing work when the lights were off and nobody was watching.

You’re building muscle memory over time. You recognize the patterns because you’ve stared at the same charts for months or years.

Slow times in the market can be great for that reason. Learning during those slow months helps during the crazy times when you have amazing trades left and right.

Huddie and I were just like you at one point! He was in sales and didn’t want to be locked down in the 9-to-5 life. Now he’s here.

See what’s possible — and be willing to work for it.

#5. Ask Questions, Be Teachable, Set Goals

Huddie came up on stage at our last Trader & Investor Summit with one of his old journals.

He read a goal he’d written when he was a younger trader: “Sit next to Tim on stage.”

See how setting goals can be powerful! Wouldn’t it be cool to look back a few years from now and see how you reached the goals you set? That’s what he did…

Huddie says, “It’s so achievable. It’s actually doable. And it doesn’t take anything but your hard work. You get what you put in.”

Huddie’s results aren’t typical. Neither are mine. But they are real and possible. So stop saying you can’t do it and get studying!

Want the same education as Huddie? Apply to my Trading Challenge now … but only if you’re ready for this same level of commitment.

Which of Huddie’s lessons helped you the most today? Comment below — and congratulate Huddie on his awesome year!

Leave a reply