Here we go with another update! Travels, trading, my students’ reported success and the question of the week. This life of freedom comes from trading and teaching others to trade. All my top students are part of the Trading Challenge. Apply Here.

At the time of writing, I’m in Singapore. I’ll tell you a little more about Singapore next week, but check out this view. (Watch the 1-minute video and read the book!)

Table of Contents

More From Phuket, Thailand …

I was still in Phuket last week. I moved from the luxury of Sri Panwa to another resort developed and managed by the same family. It’s a beautiful place right on the beach called BaBa Beach Club. It’s pretty amazing and another one I highly recommend when you get wanderlust.

BaBa Beach Club is renowned for being a music lover’s hang — they have world-class DJs every week. Plus, all the cool things you’d expect from a luxury beach club like restaurants and a fitness center. Which is good because I’m spending more time working out this year. Gotta stay in shape!

I hope you’ll go check out their website and put BaBa Beach Club on your bucket list. You have a bucket list, right? Dream it, set a goal, and get to work.

Another Visit To the Phuket Elephant Sanctuary

I went to the Phuket Elephant Sanctuary again. In last week’s update I told you a little about what we’re doing. I went back to the sanctuary to learn more about the elephants. We’re still gathering information. As I told you last week, we’re planning to do a giant exposé to help reduce the abuse they suffer at the hands of many zoos and fake sanctuaries.

Yes, I’ve also been trading. I’m still on strange hours because the time zone isn’t ideal for the U.S. markets — but it was a great week of trading for me and a lot of students.

My Best Trade of the Week

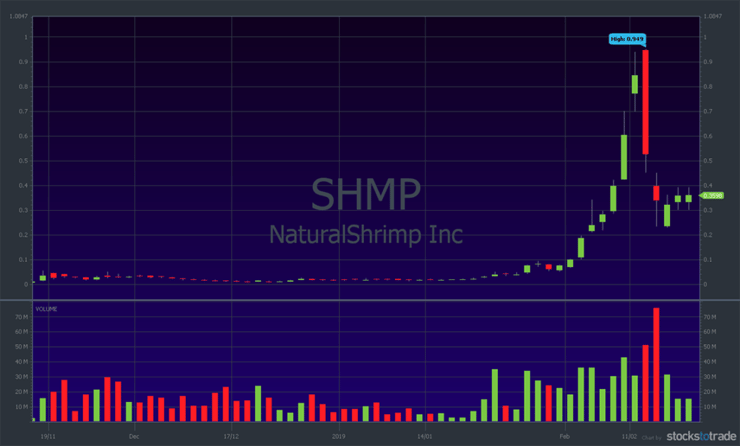

Last Tuesday (February 12) I made $4,092** on a morning-panic dip buy on SHMP. If you’ve been reading these updates you know I’ve been watching and trading this one. As SHMP proved the last couple of weeks, supernovas are alive and well.

My previous trades on this stock were a first green day overnight play on January 28 — featured in the question of the week from the February 8 update — and a dip buy on February 6.

Natural Shrimp Inc. (OTCQB: SHMP) Classic Morning Panic Dip Buy

I was jacked about this as I’ve been waiting for the big morning panic on SHMP for a while. I was even telling my students in the Trading Challenge chatroom to keep an eye on it and be ready for a morning panic.

SHMP bounced even more than anticipated. It’s a case of ‘shoulda, coulda, and woulda.’ I could’ve been up over $10K for the trade if I hadn’t been so conservative. I only took 40% of the potential profits on the bounce. I love dip buying and it’s been working very well.

Take a look at the perfect morning panic on the chart:

I dip bought at $.51 and it was down from $.95 near the market open. That’s my favorite kind of play.

This leads me to a point I’d like to make …

Right now my favorite play is a dip buy into a morning panic. My preferred price range is under $1 but not too low. The stocks trading for $.01 — best case scenario with those stocks I can make a penny per share. I really prefer stocks in the $.30, $.40, $.50, and up to $.70 per share range.

That doesn’t mean I don’t trade stocks outside that range, as you’ll see with my BCCI trade below. But this is my preferred range.

My point? It’s not really a coincidence that my favorite kind of play with my favorite kind of pattern in my favorite price range was my biggest win of the year. This is a great example of preparation. I was fully prepared. I encourage you to keep seeking your best pattern and then learn to wait for the pattern to come to you.

Did you know I have over 700 video lessons on dip buys alone? It’s true. You can access them with a Pennystocking Silver membership over on Profitly. Better yet, get them as part of the Trading Challenge.

In those video lessons, I teach you how to spot the bottom of the dip. Again, it’s not an exact science but my record speaks for itself (my results are not typical) and if you’re willing to put in the effort I believe you can learn this.

Back to SHMP …

I know a lot of students reported nailing the SHMP morning panic. Others missed it. It actually had a morning panic two days in a row. So the next day, on the 13th, a lot of my students who missed the first dip got the second dip. I missed the second dip because I was trading Baristas Coffee Co Inc (OTCPK: BCCI).

Speaking of BCCI — this one was below my preferred price range. I didn’t get the full position I was going for because it was moving so fast. But I made 34.85% on it.** You can’t complain about a nearly 35% gain.

While the SHMP trade was my biggest dollar gain of the week (and of the year), the $575** I made on BCCI was my biggest percentage gain. I was sad I had such a small position!

What My Students Have Been Doing and Sharing On Twitter

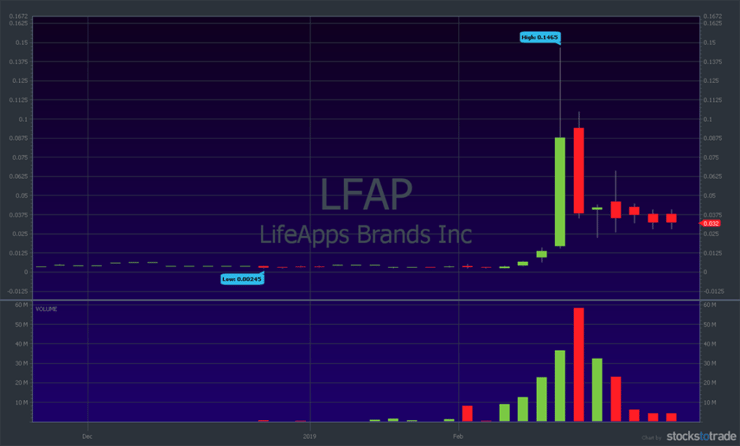

I think this might have been a record week for my students — both long and short. I mentioned the supernova being alive and well up above. It wasn’t just SHMP. It was ALYI, BCCI, VYST … LFAP, there’s so many of them playing out as classic supernovas.

Check out these 4 charts. Each one is a 3-month chart with daily candlesticks. Long live the supernova!

The first is another look at SHMP. Perfect supernova — big spike and big crash.

Our next chart is Alternet Systems (OTCPK: ALYI) — a stock I’ve traded more than once in the last couple of weeks. Another classic Supernova:

Another example of a recent supernova, Vystar Corp (OTCPK: VYST):

To drive home the point the supernova is alive and well (and you can learn how to trade it), here’s a chart of LifeApps Brands Inc (OTCPK: LFAP):

If you’re looking at these charts thinking “OK, I see there’s similarity but I don’t know what a supernova is,” then you need to get back to basics. This is my latest Penny Stocks 2019 Guide. You’ll find the supernova and a lot more there. It’s foundational material.

Back to my students. As you can see, there are SO many spikers. Another was Electrameccanica Vehicles Corp. Ltd. (NASDAQ: SOLO) which jumped over 100% on the 13th. So my students are just trading.

They’re buying breakouts, morning spikes, and morning dip buys. They’re shorting some — SHLDQ, which I put in my Valentine’s Day post as one to watch, is an example. That’s Sears. With the bankruptcy issue, it tanked again. I know some of my students made money on that.

It’s time for …

Question of the Week

This from Mitch Martin, who asked this question in the comments of a recent YouTube video:

More Breaking News

- Hecla Mining’s Surge: What’s the Real Story?

- Why Did Baytex Energy Drop?

- Will American Airlines Stock Continue Its Ascent?

“Tim, When doing your due diligence, what are the signs you look for when determining whether a penny stock is a legit company or a scam?”

I don’t really care if it’s legit or if it’s a scam. Just expect the worst out of all companies that are penny stocks and you’ll never be disappointed. Be cynical. Expect the management to lie and hype themselves up. Expect them to pretend they’re the next Microsoft even though they never are …

So if you go in with a cynical attitude …

… I know it’s not what you want to hear. I know it’s not fun.

But statistically, it’s the best way to look at it because most of these companies fail. So I don’t care whether the CEO goes to prison or if they sign off on bankruptcy court — all these companies will likely fail in the long run.

You have to not believe the hype but meanwhile …

… also ride the hype.

Here’s an example. Baristas Coffee Co Inc (OTCPK: BCCI) has this new hemp coffee. Sure, maybe it’ll work out. Odds are, it won’t. But when they introduce a new product you don’t know if it’s going to succeed or not for the first few days, weeks, or months. So the stock is probably not going to collapse right away.

I don’t think I’ve ever seen a company introduce a new product and then collapse the next day. So if you recognize these new products and new plays early enough — even if they’re gonna fail eventually — you can still ride them up.

Thank you, Mitch Martin, for the question.

About the questions coming in from all over the place …

… get and read “The Complete Penny Stock Course” written by my student Jamil. (I talked about it in the video on this Instagram post) Jamil’s book has everything you need to get started — it covers all the basics. It answers most of the questions I get asked. Go get it.

That’s another Millionaire Mentor Update wrap!

Make sure you look for these every Friday so you don’t miss the trade of the week and, I hope, get inspired to study harder. The places I like to visit are expensive, and I want to see you there! Study up.

Are you a trader? What did you learn in today’s post that you can use right away? Comment below. If you’re new, put ‘I will study’ in the comments below. DO IT!

Leave a reply