Is watching 500 Tim Sykes video lessons the gateway to smart trading? Recently, I challenged a student to quit complaining and give it a try.

I confess: My teaching style is definitely on the ‘tough love’ end of the spectrum. But sometimes, that’s what it takes to get students motivated.

My goal isn’t to make friends. It’s to create self-sufficient traders.

Too often, people get into trading because they wanna get rich quick. They see traders like my newest millionaire Challenge student Roland Wolf and think that they’ll start making $1K a day right away.*

They don’t realize that it took him four years and a lot of studying to turn his $4,000 trading account into over $1 million.*

Starry-eyed newbies see what they wanna see. They think it’s as easy as opening up the first no-fee broker account they come across, then raking in the big bucks.

If you think that’s how trading works, have fun blowing up your account. But don’t waste my time.

Most new traders are lazy, unmotivated wannabes and degenerate gamblers. That’s why I’m a tough teacher. It’s why I make potential students apply for my Trading Challenge.

It’s my way of making sure that they’re ready to put in the effort necessary to find consistency in the market. If they don’t have the right mindset, if they’re not dedicated, they’re not worth my time.

Profit.ly user haafamillion is a dedicated student. She’s not profitable yet, but she’s an incredible example of the mindset that all new traders should have. I want more students like this! Here’s her story, in her own words…

Table of Contents

500 Tim Sykes Video Lessons: Haafamillion’s Story

It took two years of saving before I spent half my net worth on Timothy Sykes’ Trading Challenge. The last thing I needed was to be called stupid…

Or was it?

A week into the Challenge, I’d already watched three of the 10- to 20- hour DVDs — “Pennystocking,” “Pennystocking Part Deux,” and the “New Rules of Penny Stocking.” I was working on “Tim Fundamentals” and, for reasons I’m about to share, still am.

I don’t know whether I was frustrated, amused, or both. Sykes describes in these videos parabolic moves of stock pumps. He details his classic short strategy.

Mind you, this is in “Pennystocking” and “Pennystocking Part Deux,” so he hadn’t yet formulated the “Pennystocking Framework” and all the viable plays therein.

Time and again — on more than one occasion — he’d point to what would become number 5 and number 6 in his “PennyStocking Framework.” Then he’d say, “There’s no play here.”

I wanted to go back in time, kick in the door to the conference, and yell at the top of my lungs: “Dip buying morning panics will one day be your favorite pattern!”

It’s frustrating. Time is valuable. I’m burning through these ancient DVDs where past Sykes is telling everyone, including me, that there’s no play where future Sykes is playing.

Of course, I took it with a fat grain of Himalayan sea salt and kept watching. Because those DVDs have gold in them.

The Catalyst

On Monday, August 25, 2020, the alert went out. Sykes had exited his position in GreenPower Motor (OTCQB: GPVRF) for a $4,350 profit.* He called it a “perfect” morning panic dip buy in his exit comments, but he said something else in chat…

“You’d have to be deaf, dumb, blind, and stupid not to make money on this play.”

I wasn’t upset or personally offended by the comment. Trading is an individual thing. All traders have their own patterns, set of rules, and ways of trading. My way isn’t making me any money — but I have one.

I’ve been practicing on listed stocks exclusively because the commission-free structure allows me to take small position sizes. And unlike paper trading, it puts some skin in the game. So I get emotional exercise while practicing trading and looking for patterns. Sadly, I’d been using it as a crutch … I didn’t realize it at the time.

I wanted to tell Sykes, “Look, I’m new to this. I’m studying. I’m trying to figure all this out. I’m not stupid. I just haven’t learned yet.”

That seemed a bit long-winded for a comment during the morning rush. Instead, I quipped, “rude.”

He quipped back, “honest.”

I was mad. How many hours did I waste watching DVDs where he told me not to do the exact thing that he just did? How many times has he said to trade to your comfort level?

I called him out. “Or maybe you have other reasons for not trading OTCs? Like, you haven’t studied them enough and know that it’s not your strong suit?”

The Teacher I Need

Some people in the chat tried to come to my rescue. I don’t need rescuing — not then and not now. Sykes knew what I needed. “Study up then, no chatting in chat until you watch 500 video lessons … go.”

So I did. I took it to heart. I was on fire. I’m chatty and not being able to talk about ideas, processes, or trading is like being locked in a cage for me. But I took it a step further. I was determined, resolute. Yeah, I was going to NOT talk in chat until I watched those videos, AND I was also going to stay off Twitter and Reddit.

I was going to burn through those videos and learn it all.

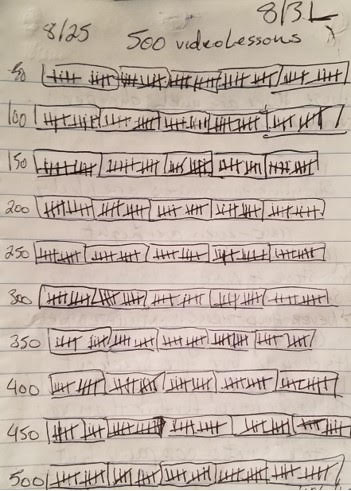

On day one, I wrote Sykes a note at the bottom of my tally card. What I said in that note doesn’t matter now, but I’ll tell you it wouldn’t have been helpful. And as I went through those videos, tallying and taking notes, what I wanted to say to Sykes changed.

It took me seven full days to watch 500 video lessons.

At the end, I sent him a picture of my tally page and thanked him. He is the teacher I need.

Prospectus

Through my video lesson journey, I took haphazard notes, scrawling thoughts and questions as I often do. It took me hours to categorize and organize them into comprehensible and repeatable statements.

There are dozens of things to learn in each video. I’ve been studying for a while, no matter what my P/L tells you. A lot of it was review for me. I mostly collected things that I didn’t already know or found to be so fundamental that they merit repeating over and over…

Say it with me now: “Cut. Losses. Quickly.”

I did and am still doing this for myself. This is to help me learn and remember facts and details. And since I’m already doing it, if someone else can benefit, they may as well. So here’s what I’ve learned from watching 500 Tim Sykes video lessons…

Study!

Sykes can get upset and impatient. That’s because he’s been putting up with students not studying for over 10 years now. And that’s why in every video he says to watch his other videos.

Stop asking dumb questions in chat that he’s answered in a thousand videos and go watch the videos. They’re all neatly categorized thanks to Mark Croock! If I want to know anything about anything trading related, I can find it in the video lesson library.

The video lesson library is SO cool. Just watch videos until you find a trade you like. Then go back in history, find the beginning of that trade, and watch it from start to finish. Watch it play out!

Check out all your favorite tickers. See which ones survived, where they are now, and if they’re still in play. In doing this, you get to see Sykes’ experience in fast forward. You can have years of experience in hours. Do it.

Seriously. If you paid the tuition, get your money’s worth. Get Sykes’ time’s worth, and watch all the Tim Sykes video lessons.

Be Self-Sufficient!

All of Sykes’ top students study on their own. They learn how to handle the markets on their own.

They don’t ask for other people’s opinions on stocks, what everyone’s trading, or if there’s news. Top students know to look on their own because they’ve studied and learned how to do it on their own.

Studying leads to competence, wisdom, and comfort. I have to learn so I can earn.

No one is studying. If you look at a lot of people on Twitter — the questions they ask, the way they behave — they’re clueless! All you have to do is be 10% smarter than they are. Is that enough? I’ll answer that in a second. First…

More Breaking News

- Texas Pacific Land Eyes New Heights: Strategic Movements Signal Change

- Beneficient Stock Surge: Is it Time to Jump on the Bandwagon?

- Nano Nuclear Energy Inc.: A Rising Star or Bubble Waiting to Burst?

Treat Your Trading Like a Business

Treat this like a business. So many consistent traders say it. Almost to the point where it doesn’t make sense anymore.

It’s like when someone asks how we are. As long as we’re not dying, most of us say, “Good.” It doesn’t mean anything anymore…

But I had a moment when I was watching 500 Tim Sykes video lessons and he said it again. “Treat this like a business.”

I realized I’ve run a successful business. It was tireless — ironic since one of the things I did was changing tires. You have to think about your overhead, the best tools, investment, capital management, and profit margins.

You have to think.

When you own a business, it doesn’t matter if you make $1,000 in a day. That’s not your money. It belongs to the business. You can’t go out and spend it. You can’t pay rent with that money.

You grow a business by reinvesting your capital back into the business. Until your business reaches critical mass and you start earning more than you’re investing, nothing you make belongs to you. You have to remember…

Most Traders Fail

70% of small businesses fail. It’s said that 90% of traders fail. It’s not a coincidence!

Every business has clients or customers. If I treat my trading like a business, who are my customers?

I’m my number-one customer. I’m the only customer and the product is both my trades and me as a trader. So I have to be someone who I’d go to for these things and focus on the product.

I have to be the most excellent trader I can be. That means focusing on the craft and being a trading master. Don’t just be someone who’s 10% better. Be 100% better … Better than Tim or Tim or Tim or Tim (more on Tims shortly.)

Being competent and meticulous are my edge. I have to be my own best customer.

And if you don’t like trading, don’t trade. Trading is finance, filings, numbers, charts, hype, and press releases. It’s being awake and prepared. Trading is learning and growing.

You have to study and develop yourself as a person. If you don’t want to do it — if you’re not into these things — that’s OK. Find the thing you are into and do that.

Coolers, Closers, and Cleaners

Tim Grover trains athletes to be the best. I didn’t learn this from watching 500 Tim Sykes video lessons, but it applies. In his book, “Relentless: From Good to Great to Unstoppable,” Grover separates professional athletes into three categories: coolers, closers, and cleaners.

(As an Amazon Associate, we earn from qualifying purchases.)

Coolers are great athletes, terrific teammates, and support.

Closers are team leaders. They direct the coolers, and coolers turn to them for support and guidance in a clutch.

Cleaners stand above the rest. They’re a league of their own, beyond comparison. They’re the record makers and breakers. They’re the Michael Jordans, the Tiger Woods, the Kobe Bryants, the Tom Bilyeus. They’re the Tim Grittanis.

They make what they do seem godly, inhuman. The average person thinks it’s impossible. Cleaners don’t tell coolers or closers what to do. They’re too busy doing what needs to be done. No one turns to a cleaner in a clutch because if the cleaner hasn’t done it yet, it’s beneath them.

Coolers wake up, see a hot stock, buy it, and sometimes get lucky.

Closers wake up before them, read the news, mark their charts, and plan their trades.

Cleaners know the name of the CEO, the CEO’s spouse’s name, and where the lawyer who wrote the SEC filing went to college. Does that help them trade? Maybe. They don’t care if it’s important or not. They’re too busy nailing trade after trade.

The average person dismisses their own faults by glorifying the cleaner’s ‘innate gifts’ but there’s nothing innate about it. Cleaners work.

Be hard on yourself. Kick your own butt until you learn your lessons. After that, forgive yourself and move on and…

Don’t Be a Closer

Be a cleaner. If that’s too meta for you, walk away now.

Who do you think of when you think of trading? Tim Grittani?

That dude’s a cleaner. That’s because he’s studied diligently and meticulously. He tracked stats for years. His spreadsheets are legendary. For what? And what did he do with them?

Through studying, you can find what works for you. You can find the setups and patterns that can be your bread and butter. And you can find your comfort zone — and your comfort zone is golden.

Trading outside of your comfort zone can be disarming. It can mess with your psychology and lead you to make questionable decisions, which can lead to catastrophic disasters. So it’s important to study until you find your comfort zone.

Once you find the patterns and setups that you know and feel, you can wait until those patterns emerge in the market and trade them. One challenge, though, is to only trade in your comfort zone — or to at least trade safely outside of your comfort zone with smaller size or paper trading.

Bret Steenberger calls it risk resilience. As you study, as you trade your patterns and grow accustomed to them, you increase your risk resilience. That enhances your ability to avoid emotional decisions.

You should always make your decisions based on the pattern you’re trading. Grittani is the master of this strategy. He doesn’t even have his Profit/Loss column active when he’s trading. Instead, he turns it off so he can focus on the pattern and on the price action.

That guy is a cleaner and doesn’t even look at his profits. He doesn’t know how much he’s up or down — he knows his entry and the moment.

So don’t worry about the money. Play the chart as perfectly as you can.

The process and technique are what attracted me to the Trading Challenge. Yes, I want the money. I know that if I focus on being the best trader and study until I know my best patterns and take those trades, the money will come.

So I need to study and master these setups and patterns, wait for my best setups and patterns, and consistently take advantage of them. Once I do that, in the words of Sykes, “It’s just rinse and repeat.”

Trading Challenge

Tim again.

What makes a ‘successful’ trader is subject to interpretation. But if you ask me, it all starts with the right mindset.

My student haafamillion was willing to watch 500 Tim Sykes video lessons to improve her trading. I don’t see a lot of students with that level of dedication.

I’ve seen plenty of ‘get rich quick’ schemers come and go in the penny stock market. They’re full throttle for a while, then they blow up their accounts and move on to the next hot thing. Forex! Crypto! Options!

They’re on a hamster wheel. Wanna get off the hamster wheel of following alerts? Become self-sufficient.

If you wanna become self-sufficient, knowledge is key.

You’ve gotta understand — as a trader, you have two accounts. You’ve got your knowledge account and your money account. There are no guarantees that you’ll fill up your money account … But experience tells me that filling up your knowledge account gives you a much better chance.

Do you get it? Are you ready to work for it? Consider joining my Trading Challenge. It’s based on my 20+ years of trading experience.

You’ll have access to webinars, my incredible chat room community, thousands of video lessons in the library. All of my current millionaire students* started out as Challenge students. They’ve learned the methods and adapted them into their own trading styles.

My Challenge student haafamillion is a Challenge student who shows great potential. Are you ready to take control of your trading and start working toward making your goals a reality?

Leave a comment! How many Tim Sykes video lessons have you watched? Do you have haafamillion’s dedication? I want to hear from you…

Leave a reply