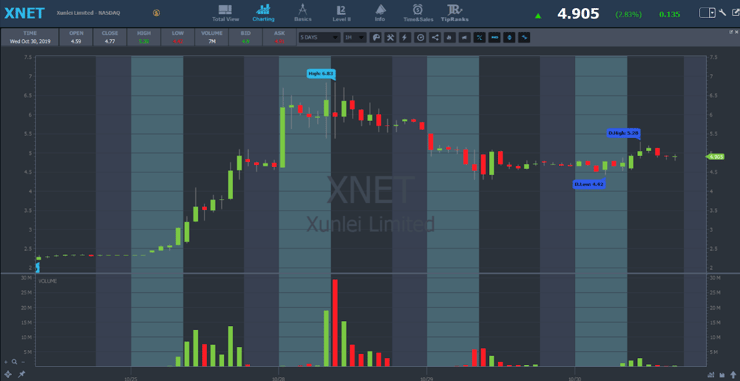

I recently talked about the growing frequency of short squeezes, using the XNET short squeeze as an example.

I want to clarify something from that post … not all shorting is bad. Some of my top students and I have made millions shorting pump and dumps and other penny stock runners.

Here’s the big question: when’s the right time to short?

Table of Contents

The XNET Short Squeeze Aftermath

We’ve seen a lot of short sellers getting involved in the market lately. These newbie shorts think that starting out shorting will help them find success quicker. After all, Tim Grittani and I made a lot of money shorting these scammer penny stocks.

But we didn’t start out as short sellers. We made our first million in profits from the long side, and oddly enough, we both tend to be more long biased.

(These results aren’t typical. Grittani and I each spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

Now, there’s still a case to be made for short selling stocks. XNET will eventually drop. It’s not worth this 200% move. But that’s a risky mindset — and I never try to predict the top.

In fact, XNET spiked again after hours on October 30 after the company announced a $100 million fund to invest in blockchain technology. In less than an hour, it ran from $5.15 to $6.25. And today, October 31, it’s still holding near its highs pretty well. So maybe there’s another leg higher around the corner. I honestly don’t know. I’m merely waiting for the chart to tell me what to do.

Shorting does have its place, but you have to be careful. Let me give you an example of a good short…

CNET Sympathy to XNET

So CNET spiked Friday morning from $1.19 to a high of $2.

Why did it spike?

First, it’s somewhat related to XNET. They have similar ticker symbols, and it’s a Chinese stock.

Also, in the past, CNET and XNET have both gone supernova.

It’s comical how stupid some penny stock traders are with their strategies. When one stock starts to get riled up, any stock remotely similar can start to move. If you check social media, chat rooms, and message boards, everyone hyped CNET as the next XNET.

And guess what? It worked pretty well. CNET spiked from $1.50 to $2 in the first hour of the trading day on substantial volume. But this is a good case of when you should be Check out my verified trade here. I sold 1,000 shares at .10 and covered at .53. People asked me why I covered so quickly. Frankly, I’m scared of short selling … it’s up for all the wrong reasons. It’s up 100% on thin air. All because it’s a former runner and sounds like XNET.

When you short something up for the wrong reasons, that can be a good trade. With XNET, even though it’s up a lot, a case could be made for the long side.

Why XNET Wasn’t a Short

Yes, XNET was a short squeeze, but it had some catalysts behind the run. XNET is in the bitcoin space. Bitcoin ramped up last Friday and continued over the weekend. Also, the company is tied to China, and China’s in the news a lot these days.

So this XNET run isn’t a total stretch. Anytime there’s an underlying factor for a run, short sellers need to be extra cautious.

Tim Grittani learned this lesson the hard way with his largest loss ever on Lakeland Industries, Inc (NASDAQ: LAKE).

Here’s kroyrunner on his epic loss: Humbling week for me. Started “swinging for the fences,” played WAY too big, didn’t cut losses. After first big loss started pushing to “make it back.” Don’t take size and entry/exit prices literally. Many of the trades got smashed together into one postion by profitly

Here’s what happened … During the fall of 2014, there was a large sector run surrounding Ebola. The companies had an underlying reason to spike, but Grittani started shorting too early and too aggressively. Since then, he’s learned from his mistakes and recently passed $8 million in total trading profits.

Shorting in This Market

Remember, I’ve made millions of dollars shorting. A lot of my top students have made millions of dollars shorting. What I want to warn against is over-aggressive shorting or shorting too early.

That’s part of the reason I think shorting is so tough right now. To find shares to short, you have to be up early to locate the shares with your broker. If you wait until the market opens, it can be challenging to find shares of these low-float runners.

Historically, you could short early and accept a little pain on the upside before the inevitable crash where you could take profits. The problem is, it’s impossible to judge how high these stocks will go.

Remember BIMI? I bought this ticker at $2.55 and sold it into the $3s. Check out the trade details over on Profit.ly.

I was thrilled with my 20% gain. But the next day, it hit a high of $12! And even now, if I were still holding two weeks later, it’s in the high $4s.

Growing Short Squeezes

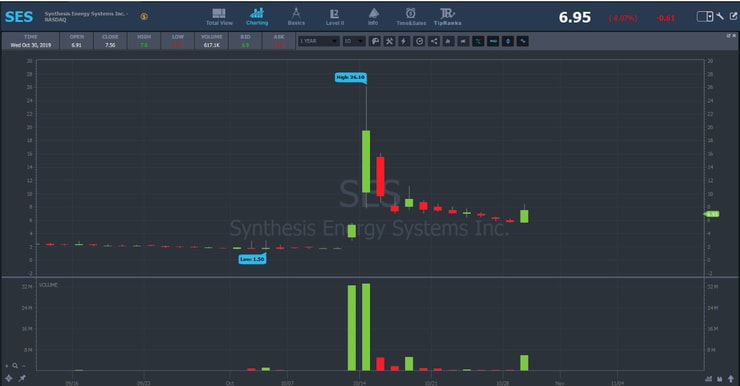

These squeezes are fantastic news for longs and excellent news for patient shorts too. BIMI was a good short when it went from the $1s to the $11s. SES might have been a giant short squeeze from $2 to $27 … But look…

It faded back down to $5. So don’t necessarily say: “Tim Sykes will never short again!”

Just short later. If there are no shares to short, that’s fine.

Again, I talk to so many traders … There are so many short-selling chat rooms and shorts who like to trade together. They post trades together, and it feels very sketchy.

I often call short sellers the new promotors. They don’t talk about the whole story, and they want everyone to think a certain way. I think it’s kinda funny how the entire dynamic flipped.

Long the Short Squeezes

margin account. Unless you really, really know what you’re doing and need a margin account for Short selling carefully — especially after a 1000%, 2000%, or 5000% gain — is possible. But as a newbie, you can’t average up, and you can’t let your losses run.

It’s a scary time to be a short seller. But if you’re a long-biased trader, you can make 500% riding the short squeeze.

These squeezes are great for longs and tough for shorts … at least the over-aggressive shorts.

Recent Tweets, Comments, and Trades from Students

With so many short squeezes lately, there’ve been a ton of opportunities!

From the Trading Challenge Chat Room

From October 28:

9:38 AM GarrisonMorgan: Sold 500 shares of $CNET @1.67 from $1.52. Nice little $76 profit on $1000 account

10:04 AM alii: $CNET sympathy china stock with $XNET?

11:34 AM shotime: Bought 500 $CNET @ 1.79

9:34 AM southbay: all green on $XNET

And even more from October 30:

10:54 AM dead_bonsai: out $XNET 400 +$76 big sell orders at 5.10 would rather eat breakfast than wait for more profits

10:57 AM AL_: All $XNET shorts: “GET OUT. GET OUT NOW”

10:58 AM MoonShot: in $XNET 4.97, out 5.09, 5.19, 5.27

11:33 AM markcroock: $XNET btw is dangerous short all it takes is another comment from Chinese gov etc and this thing can fly again

12:22 PM RD52: In $XNET @5.09 out 5.15. 600 shares. Took forever.

12:29 PM Trade4us: $XNET noticing that on each bounce the low is higher

More Breaking News

- China SXT Pharma Launches AI Supply Chain Overhaul for TCMs

- Breaking News: Ondas Navigates Market with Enhanced Strategy

- Itau Unibanco Announces Q4 Earnings as Investor Interest Grows

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

More Comments from the TimAlerts Chat Room

10/28 7:16 AM TradeHunter710: $CNET perking no news I can find

10/28 11:29 AM CKP111: $CNET behaves a bit like $TROV

10/29 11:53 AM twist89: $XNET short 4000 at 6.01, covered into morning panic and last 1000 shares at 4.78 because I don’t like how strong that bounce was…$4500 profit. Solid day

10/29 3:30 PM Dajarka: $XNET in 6.27, out 4.7

10/30 9:40 AM BiYuYo: is $XNET getting squize?

Not great and super small size but tried the bounce short in $XNET for decent .20 winner. Just gotta learn to trust my plan more before sizing into positions for a while. @timothysykes pic.twitter.com/6eFBqsDwlV

— Sierra3 (@ctrssierra) October 29, 2019

Dip bought $XNET based on tape/morning support level. 2k shares in at 4.57 out 4.77 +$400 on the trade. Stuck to my plan on this so whether it goes higher or not – very happy with the trade. $200 overall on day b/c of morning losses @timothysykes pic.twitter.com/ZitcpXvbgx

— Dan Irish (@DansGamePoker) October 29, 2019

[Please note these results are not typical. These traders have exceptional knowledge and skills that they’ve developed with time and dedication. Most traders lose money. Trading is risky. Do your due diligence and never risk more than you can afford.]

What do you think of all the recent short squeezes? Comment below — I love to hear from all my readers!

Leave a reply