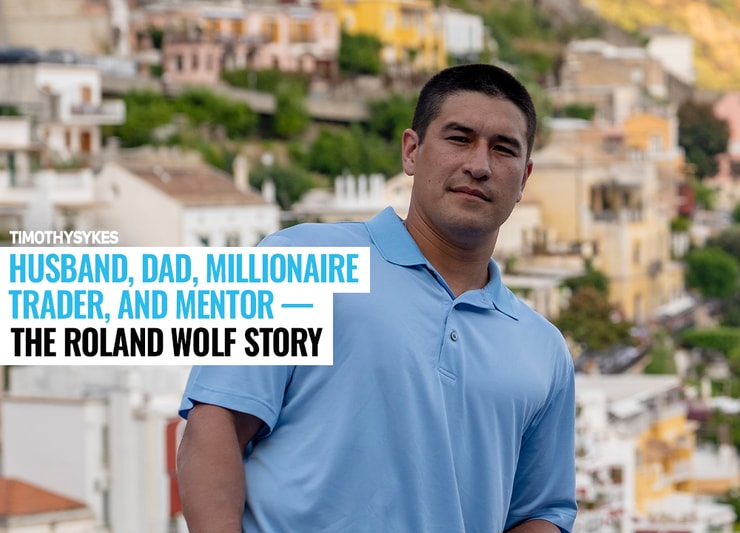

- Learn how this pro soccer player switched careers and turned pro trader…

- Want to trade like this millionaire? Keep reading to see what he trades and why…

- Get into the program where Roland NAILED his trading strategy!

It was never about the money for Roland. Well, it sort of was. Otherwise, why else would he get into day trading?

What I mean is that he never thought he’d become a professional day trader with over $1 million in profits. Check out Roland’s Profit.ly to follow his trading journey.

He always wanted to be a professional soccer player. But an ankle injury destroyed those dreams.

In that way, Roland and I are a lot alike. I hoped to be a pro tennis player until an injury forced me to quit. My dad now affectionately calls it my “million-dollar injury,” because when I was recovering, I started day trading. But let’s get back to Roland.

After a short-lived career in Croatian soccer, he moved back home and married his high school sweetheart.

The problem? He quit college to go pro. He was jobless and without a degree. A 9-to-5 job helped him scrape by and support his family. But he deserved more. And he knew it.

That’s where his trading journey began …

Table of Contents

The Beginnings of a Millionaire

Let’s check out Roland’s story.

2016

- 2016 is the year Roland starts trading. He first gets lucky with an $800 account. But luck isn’t enough. “There must be a strategy to this,” he thinks.

- He finds my Trading Challenge … and ignores a ton of scammers along the way. Roland appreciates my students’ testimonials and my transparency.

- He subscribes to Pennystocking Silver. I encourage students to take it slow. Day trading isn’t for everyone. I’m glad Roland took his time.

- Upgrades to a $4,000 account but keeps losing. Roland admits he tried to follow my trade alerts. That’s what I tell my students NOT to do. I share trade alerts so you can follow my process. Thankfully, Roland picked up the error fast.

- The study grind begins. Roland knows he isn’t doing enough to succeed. He often rolls out of bed a few minutes before the market open. He realizes he has to change his lifestyle, so he starts…

- Studying 17 hours a day

- Making watchlists before going to bed

- Waking up early

2017

- Roland joins the Trading Challenge. So far he’s learned day trading basics but he wants to learn more and study with other mentors, too. That’s the great thing about my Challenge. You get the perspective of multiple millionaire traders.

- This year, his account totals more than $200,000. That’s more than four times his salary working the 9-to-5 job. So he quits. It’s a dream moment for day traders.

More Breaking News

- Riot Platforms Stock Tumbles: What’s Behind the Volatility?

- Can RAPT Therapeutics Defy Today’s Market Trends? An In-depth Look

- Marathon Digital Holdings: Soaring High, But Is It Too Late to Ride the Wave?

2020

- Roland passes the $1 million milestone in 2020.

Check out this video where I surprise him for his big milestone…

Roland’s Favorite Strategies

I teach my students to trade penny stock patterns, but we all have a different sweet spot. If you join my Challenge, you’ll see that each of my students trades these stocks a little differently.

That’s the beauty of this niche — there are so many ways to profit if you put in the work.

Here’s what Roland likes …

- Listed penny stocks. He’ll trade OTCs every now and then, but only when they’re liquid enough.

- Multi-day breakout

- Gap and crap reversal

- Panic dip buy

And his education continues. Lately, he’s been looking at long-term strategies for big parabolic moves.

3 DVDs That Changed Roland’s Trading Forever

- “How to Make Millions” by Tim Sykes

- “Trading Tickers” by Tim Gritanni

- “Pennystocking Framework” by Tim Sykes

Read More About Roland’s Journey

Watch and Learn With Roland

- My Student Roland Who Turned $4,000 Into $170,000 In 7 Months

- Tim Sykes Millionaire Challenge Review: How To Turn $4,000 Into $300,000+

- The Hottest Stock Now And How My Student Roland Made $40,000+ Trading Penny Stocks

- How My Student Roland Turned $4,000 into $230,000 Trading Penny Stocks | The Tim Sykes Show Part 1

- How My Student Roland Turned $4,000 into $230,000 Trading Penny Stocks | The Tim Sykes Show Part 2

- 2 Of My Top Students Share Their Top Tips

- How You Can Develop the Right Trading Mindset

- How to Overcome Your #1 Trading Mistake

- My Trading Student Turned $4000 Into $1.8 Million in 4 Years

- How To Spot The Pattern Of Sector Momentum

- This Millionaire’s Favorite Pattern Broken Down Step-By-Step

- Ep 226: NFTs, Cryptomania, & When to AVOID Trading: The Roland Wolf Update

What Does He Do Now?

Since passing $1 million in profits, Roland has slowed down — a bit. He’s a mentor with his own trading education program.

And above all else, he’s a family man with a wife and four kids to look after.

No trading for me today… instead welcoming the newest member of my Wolfpack, Roxy, to the world! Heart is so full right now. You are loved baby girl. pic.twitter.com/ADBhiwkpi4

— Roland Wolf (@RolandWolf86) December 9, 2021

Trading is still his passion, and it allows him to live the life he wants.

When the markets are slow, he goes golfing. And thanks to the flexible schedule, he’s able to put his family first. They’re the reason he got into day trading in the first place. It wasn’t about wanting a million bucks for himself. He wants to support his loved ones.

You can learn from Roland by joining his Trading Accelerator. You’ll be able to study alongside him to help shorten your learning curve. Learning to day trade is all about filling in knowledge gaps … Why not learn from one of the best?

How to Trade Like Roland

Roland is a careful trader.

He took my #1 rule to heart from day one: cut losses quickly.

He lost a bit in the beginning. But that’s part of the process. The good thing is he worked hard to control his losses. He never let his position fall too much.

That’s a great lesson!

The longer you can stay in the game, the more you can learn. Roland learned to become self-sufficient because he was so cautious.

He’s cautious now too, only taking a trade when he has an edge.

That’s how I teach all of my students. I call it trading like you’re retired. Don’t come out of retirement unless there’s a setup too good to miss.

The Trading Challenge

I feel honored to have helped pave the way for Roland and so many other millionaire students. But I can’t take all the credit.

It takes a lot of work to become a self-sufficient day trader. Sure, the right mentor makes a huge difference. But I don’t hold anyone’s hand.

Always remember that 90% of traders lose.

When it comes to the stock market, it’s do or die. If you want to make it in this niche you’ll figure that out sooner or later. No one’s here to push you to work harder. You’re on your own.

So what do you say? Think you’re ready for the journey of a lifetime?

Apply for the Trading Challenge today!

You could be my next millionaire student. But we won’t find out until you start studying.

What do you think? Can anyone do this? Comment below!

Leave a reply