Hey trader. Tim here.

I know that trading hasn’t been easy lately. But trust me, opportunity is right around the corner…

Some markets are for earning and some markets are for learning.

That’s why I’m so dialed in — teaching my students techniques and strategies to beat the market.

I’m gearing them up for potential once-in-a-lifetime trading opportunities.

Will you be ready to strike when opportunity stares you in the face?

Here’s how to start…

Practice Consistency

Do you know why my Supernova Pattern is so popular?

It’s easy to spot and highly tradeable.

Best of all, it works in any type of market.

And it’s the best way to practice and prepare for the next opportunity.

Some patterns and traders only thrive in bull markets.

I may not pull in millions every year, but I’m not boasting when I say that I’m consistently profitable.

Of course, I occasionally have losing trades that wipe out winners. Everyone does.

What I’m saying is that my style doesn’t rely on a few massive windfalls. I grow my account steadily over time with small losses and better gains.

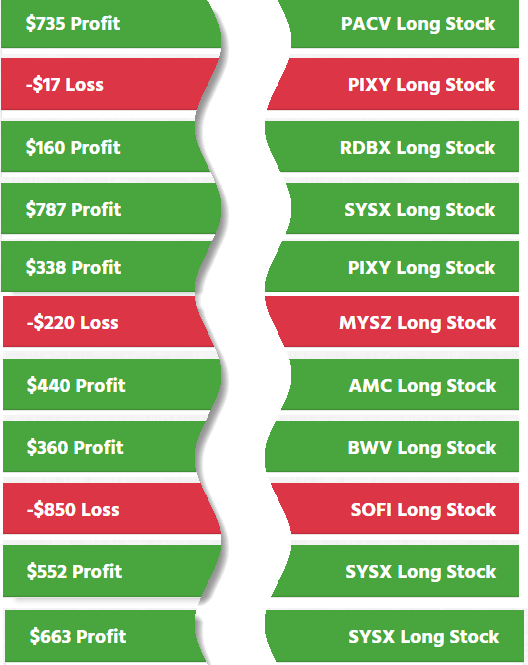

These are the trades I took from May 10-19:

All my trades are posted on profit.ly

As you can see, I don’t win on every trade.

In fact, that SOFI loss was larger than any single profitable trade in the bunch.

But out of the eleven trades, I only lost on three, and one of them was tiny.

Traders need to practice CONSISTENCY.

Even if your account growth relies on a few big wins, they should occur with some regularity.

I want every one of my students to deliver predictability. Your trading should be so consistent that it’s almost boring.

Risk Small, Lose Fast

The $850 loss in SOFI aside … If you look at my trading over months, you’ll notice one constant — I lose small.

When I trade, I trade on MY terms.

If a stock doesn’t act right, you can bet I’ll cut it loose.

Now, you might expect to see a lot more losses in my trading if that were the case.

However, there are two tricks I use to keep strings of losses at bay.

First, I let the stock come to my entry. I never chase.

This ensures I get the right entry price to match my setup.

Second, I want to put the stock’s momentum in my favor.

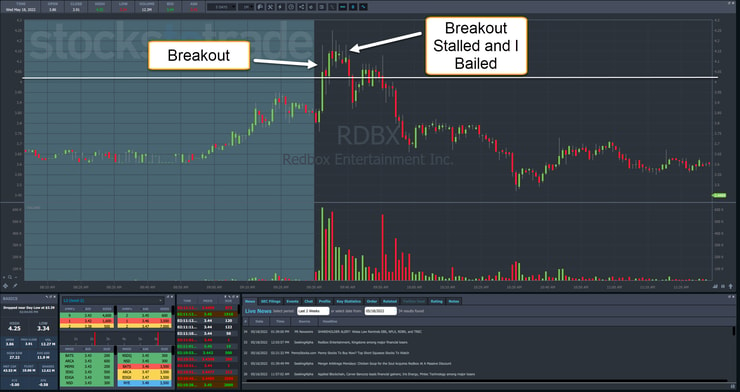

In yesterday’s newsletter, I talked about my recent trade in Redbox Entertainment Inc. (NASDAQ: RDBX).

I pointed out how I used the breakout momentum to gain an entry into a long position.

More Breaking News

- Is SolarEdge Technologies on the Brink of a Comeback?

- Worthington Enterprises Stocks Surge: Are Earnings Driving a Bullish Momentum Shift?

- Can CleanSpark Navigate Market Volatility with Its Recent Results?

Once that momentum stalled, I cut the trade.

Journal the Action

Every successful trader I know keeps a diary of their trades, whether digitally or manually.

A good journal helps uncover problem areas and reveals opportunities.

It also keeps you honest about what’s really going on.

I had one student who, by all appearances, was a great trader. But he couldn’t turn a profit…

When I had him put pen to paper, we found two problems.

First, while he didn’t take many losses, a few excruciating ones had decimated his account.

Second, he had a bunch of stupid, losing side-bets that added up over time. (When I say stupid, I mean they were pure gambles based on emotions, not setups.)

You might think that after making millions I wouldn’t need a trade journal.

But the truth is, journaling helps me stick to my trading and lesson plans.

Even now, I go back and look at my notes on my results over the past several months.

In fact, that’s how I began to see the buildup of the coming market crash I talked about in November.

My journal keeps me from taking on too much risk while helping me identify patterns in the market.

The Bottom Line

It’s tough to stay patient.

That’s why I work my butt off to create content for my students to study.

I want them to get the best possible education and learn the right way to trade the markets.

Leave a reply