In one of the craziest markets ever, there’s one sector that’s stayed strong through it all — technology. And that means opportunities in tech penny stocks.

Think about it. During the pandemic, many states locked down. A lot of people moved to online shopping, food delivery, remote work, and distance learning…

It’s why a lot of tech stocks weren’t hurt too badly by the 2022 market crash. Some of the giants even made crazy gains.

But who wants to pay top dollar for a stock that might return 20%–30% in a year? If you have a small account, that either ties up your money or it’s not in your budget.

That’s why I don’t teach my students how to invest in big-name companies. There are ways to potentially make 20%–30% in a single day.

But to do that, you gotta find the hottest movers, usually in hot sectors … like technology.

So let’s talk about the top tech penny stocks to watch in 2024. I don’t recommend you invest long term in any of these — or even necessarily trade them…

For the rare penny stock that makes it, countless others fail. Instead, I want you to keep these on a watchlist or use it to start your own watchlist.

With the right news, these could provide some killer spikes to play. Let’s get into it!

Table of Contents

- 1 What Exactly Are Technology Penny Stocks?

- 2 Why You Should Consider Trading Tech Penny Stocks in 2024

- 3 Top Tech Penny Stocks to Watch in 2024

- 4 Top Hot Tech Penny Stock Under $1

- 5 AI Penny Stocks to Watch in 2024

- 6 Conclusion

- 7 Tech Penny Stocks FAQs

- 7.1 What Are Key Considerations When Investing in Tech Penny Stocks?

- 7.2 How Do Financial Metrics Influence Investment in Penny Tech Stocks?

- 7.3 Can You Trust Analysts’ Ratings on Penny Stocks in the Tech Sector?

- 7.4 What Risks Should Be Considered When Trading Penny Stocks in Tech?

- 7.5 How Do Major Tech Companies Influence the Penny Stock Market?

What Exactly Are Technology Penny Stocks?

2025 Millionaire Media, LLCThis is a two-part question.

Let’s first define what a penny stock is…

(New to penny stocks? Start with my FREE guide here.)

Technically, a “penny stock” is a stock that trades under $5 per share. When most people think of penny stocks, they think of the “Wolf of Wall Street” and OTC stocks…

But there are also penny stocks on the Nasdaq and NYSE … A lot of them, actually.

Now let’s get into what a technology penny stock is…

Tech stocks as a whole refer to any type of stock involved in technology. Yes, I know that sounds self-explanatory. But I say that to tell you how widely varying these companies may be.

For example, some might provide software, while others develop semiconductors.

Now, let’s put two and two together: a tech penny stock is a stock under $5 in the technology sector. These are the types of stocks I’ll talk about today.

Ready to learn how to make your own watchlists and think for yourself in the market? My 30-Day Bootcamp is designed to take you step by step through the process of building a solid foundation for trading. It’s for traders of all levels — and you work at your own pace. Get into the 30-Day Bootcamp here!

Why You Should Consider Trading Tech Penny Stocks in 2024

2025 Millionaire Media, LLCWhy tech penny stocks?

When an entire sector is hot, penny stocks tend to follow the same momentum. Often, all these companies have to do is release a strong press release, then wait for a killer spike.

It’s all about building up the hype. In fact, it’s what I base a lot of my trades off of these days.

I use the Breaking News Chat feature on the StocksToTrade platform to get the hottest news that can move penny stocks. It’s better than any news scanner I’ve ever used.

When a sector’s hot, news catalysts become more important than ever. This is the perfect time to get the Breaking News Chat with StocksToTrade to help you develop your edge.

After I find the news for these tickers, I love to see that it’s in a hot sector — like technology. So long as the overall tech sector stays hot throughout the coming months, you should consider trading tech penny stocks in 2024.

Get your 14-day trial of Breaking News Chat and StocksToTrade now — only $17!

Top Tech Penny Stocks to Watch in 2024

These are my top tech penny stocks to watch in 2024:

- NASDAQ: WISA — WiSA Technologies — The Wireless Sound Penny Stock With Partnership News

- NASDAQ: HOLO — MicroCloud Hologram Inc — The Meme Stock With an AI Pump in its Past

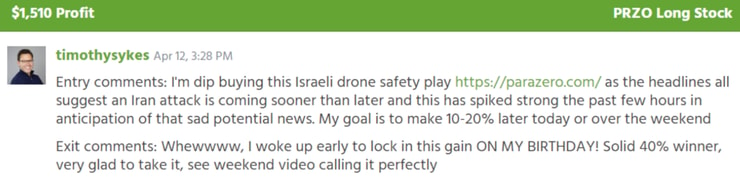

- NASDAQ: PRZO — Parazero Technologies Ltd — My 40% Birthday Drone Safety Penny Stock Winner

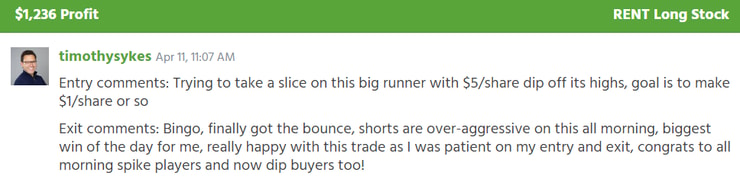

- NASDAQ: RENT — Rent the Runway — The AI-Powered Fashion Stock

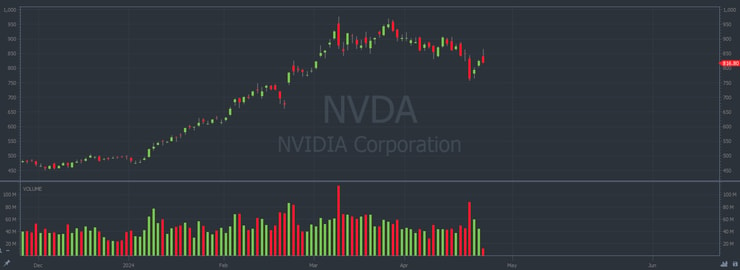

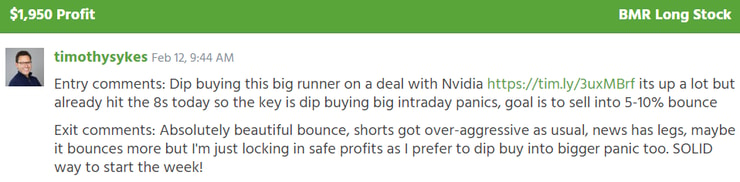

- NASDAQ: BMR — Beamr Imaging Ltd — The NVIDIA Catalyst AI Penny Stock

I’m breaking these tech penny stocks down by potential and then price.

Plus, I’m adding some bonus tech stocks to watch in 2024’s hottest tech sector.

Don’t trade these stocks before they make a move. But keep these stocks on your watchlist in case they run in the near future.

Get my FREE weekly stock watchlist here.

WiSA Technologies (NASDAQ: WISA) — The Wireless Sound Penny Stock With Partnership News

My first tech penny stock pick is WiSA Technologies (NASDAQ: WISA).

I traded this runner multiple times when it started to spike on April 16.

The company announced an additional license with a “multi-billion dollar revenue company” for its immersive audio technology. And I had eyes on it before the market opened thanks to the Breaking News alert.

Take a look at the chart below with alert details. Every candle represents one trading day:

These plays CAN run for multiple days, but it pays to have eyes on them early. For example, WISA spiked higher after April 16. The total move measures 920%.*

We’re seeing runners like this every week in the 2024 market!*

Here’s where you can find the next Breaking News trade alert.

Right after the market opened on April 16 I snagged some profits — my trade notes are below.

The first was with a starting stake of $8,760:

I traded it again midday for another profit. With a starting stake of $15,325:

Why I Like It

The stock is still holding some of its gains. That’s a hint that it could push higher!

Take a look at the chart below that shows support at the $4 level, every candle represents five minutes:

Plus, StocksToTrade shows that the stock’s float is only 1.4 million shares.

Anything below 10 million shares is considered “low float” … also known as a low supply of shares. The low supply helps the share price spike higher when demand increases.

It essentially increases the volatility of the stock.

Keep an eye on this runner as it works back toward the breakout level.

MicroCloud Hologram Inc (NASDAQ: HOLO) — The Meme Stock With an AI Pump in its Past

My second tech penny stock pick is MicroCloud Hologram Inc (NASDAQ: HOLO).

This is one of the most legendary short squeezes of 2024 … so far.

I’ve already written multiple blog posts about this stock and filmed a handful of videos tracking the price action …

Like the one below:

The most exciting thing about this stock right now: Past spikers can spike again.

Why I Like It

There were HOLO spikes in January and August 2023 as well — 610%* and 350%* respectively

But unlike the most recent 2024 short squeeze, the spikes in 2023 had roots in the AI industry.

The volatility in 2024 just happened to turn HOLO into a massive squeeze. Forget the 610% and 350% 2023 spikes … in February 2024, HOLO launched 6,400%.*

It went from less than $2 to $98.

The chart below shows all of the moves since 2023. Each candle represents one trading day:

I don’t expect HOLO to run back to $98. That’s an unrealistic prediction. And besides, I don’t predict price action.

Instead, I react to it.

Here’s what I’ve noticed recently:

- HOLO tried to spike in March.

- It tried to spike twice in April.

I zoomed in on the daily chart below, take a look at the beat-down spike attempts:

It’s only a matter of time until the stock tries to spike again …

Top Hot Tech Penny Stock Under $1

The stocks above are generally in the higher-end price range of penny stocks.

But there’s another great tech penny stock that I’m watching this year…

More Breaking News

- Upexi Stock Unexpectedly Surges: Here’s Why

- AAL: Navigating Market Turbulence or More Trouble Ahead?

- Micron Technology Faces Challenges Amidst Semiconductor Maze

Parazero Technologies Ltd (NASDAQ: PRZO) — My 40% Birthday Drone Safety Penny Stock Winner

My third tech penny stock pick is Parazero Technologies Ltd (NASDAQ: PRZO).

I bought shares of PRZO on Friday, April 12. The next Monday, my Birthday, April 15, I celebrated by selling those shares for a profit.

Unfortunately, that weekend the Middle Eastern conflict escalated, specifically between Israel and Iran. Israel had attacked an Iranian consulate early in April, and we learned of an incoming Iranian retaliatory strike the Friday of April 12.

But my experience in the stock market allowed me to take advantage of volatile price action related to the event.

There’s a chart below of the price action, every candle represents one trading day:

PRZO is an Israeli owned AI-drone company. And this isn’t the first time we’ve seen it spike.

In October 2023 — during the initial Hamas invasion of Israel, the stock spiked 460%.*

Interestingly enough, the company announced bullish news on Friday, October 6, the day before the Hamas attack. That’s why on the chart below, you can see the spike starting a day early.

Every candle represents one trading day:

Why I Like It

The spike in October ‘23 is the reason I had the foresight to snag profits on the most recent weekend gap up. And any follow up Middle East tension could cause it to spike again.

My trade notes are below, with a starting stake of $6,565:

PRZO is one of the latest weekend trades that I’ve made in 2024 …

Every Friday I watch for very specific price action! Here’s the framework I followed for PRZO.

Are AI Stocks Considered Tech Stocks?

Let’s go back to what I talked about earlier…

Any stock with a primary business function in the technology field is a tech stock. Since AI is a type of technology, the companies that work in AI are also considered tech stocks.

AI is a popular upcoming technology. And I know a lot of traders and investors are looking for the next hottest AI tech penny stock. When they run, that can mean volume. Also, a lot of the “best” AI stocks usually aren’t penny stocks, so I found two hot AI penny stocks to watch in 2024.

AI Penny Stocks to Watch in 2024

2025 Millionaire Media, LLCThese AI stocks might not be in penny stock land halfway through 2024…

But in terms of the crazy moves they make, they fit my penny stock patterns to a T.

Rent the Runway (NASDAQ: RENT) — The AI-Powered Fashion Stock

My fourth tech penny stock pick is Rent the Runway (NASDAQ: RENT).

On April 10 during after hours, RENT announced Q4 financial results for the 2023 fiscal year.

The earnings per share (EPS) missed expectations by $1.13. But the company’s revenue beat projections by $1.3 million.

That week the stock spiked 430%.* I snagged a cool profit the day after the announcement.

See my trade notes below on RENT, with a starting stake of $22,296:

After the spike, prices sold off. That’s to be expected in this niche. We play the short-term volatility before the prices crash.

Always remember that these are trash penny stocks. Some of the worst stocks in the market can spike hundreds and thousands of percentage points. Our goal is to identify price action that could push higher.

When I look at RENT’s chart now, we can see obvious consolidation above the $10 level. Every candle below represents five minutes:

There are still quite a few bag holders from the last few weeks. Wait for the chart to show us some bullish volatility.

That’s when we’ll know it’s time to plan a trade.

StocksToTrade shows a float of only 1.9 million shares. That works in our favor!

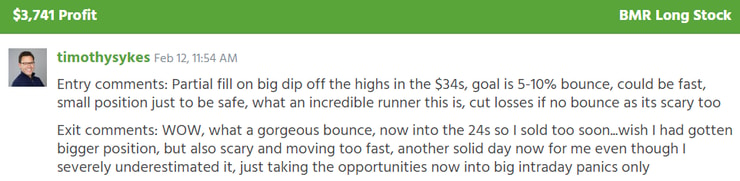

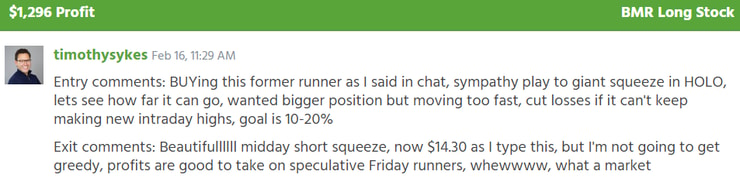

Beamr Imaging Ltd (NASDAQ: BMR) — The NVIDIA Catalyst AI Penny Stock

My fifth tech penny stock pick is Beamr Imaging Ltd (NASDAQ: BMR).

On February 12, at 7 A.M. Eastern during premarket hours, BMR announced a partnership with NVIDIA Corporation (NASDAQ: NVDA).

NVDA is arguably the most popular company in the world right now. Definitely within the tech sector.

The stock is surging to new heights as businesses scramble for NVDA microchips. The massive tech stock is smashing company value records.

Take a look at the NVDA chart below, every candle represents one trading day:

A hook up with a sector leader like NVDA is huge news for a penny stock.

BMR spiked 1,500%* in less than 24 hours after the announcement. Since then the stock has lost 70% of its value.

But there’s a possible squeeze brewing.

Why I Like It

It reminds me of another intense spiker that started running only a few days earlier on February 7. Another stock that we already covered …

MicroCloud Hologram Inc. (NASDAQ: HOLO) managed to spike 2,600%* in a similarly spectacular fashion.

The price slid lower, like BMR, but it consolidated for a few days and broke out to reach $98 per share!

HOLO was trading below $2 less than two weeks before … That’s a 6,400%* move. And BMR was trading below $3 before its recent spike …

This stock could wake up any day!

I’ve already traded it 3 times since the spike on February 12.

A starting stake of $16,575:

A starting stake of $16,710:

A starting stake of $15,696:

It’s not a 100% guarantee that BMR will push to new highs.

Nothing is guaranteed when it comes to the stock market.

But we know that volatile stocks can follow popular patterns. And we know that past spikers can spike again.

The next time BMR goes on a run, there are patterns that we can use to trade the price action.

Conclusion

2025 Millionaire Media, LLCRemember, I don’t invest in any of these companies … Instead, I trade penny stocks with a strategy. A lot of newbies want the hottest picks to blindly invest in a company.

But that’s not what I teach. I made this list to help you build your own watchlist. This list is not a recommendation to buy. I never recommend you follow anyone’s alerts. Not even mine. All my alerts and watchlists are to help you learn the process.

Blindly following alerts is a surefire way to blow up your trading account.

But if you made it all the way through this article and took away the key concepts like building a watchlist and looking for sympathy plays, congratulate yourself.

Even if you didn’t take away the key concepts, you made it farther than most. That shows a level of dedication to learning.

Those are the types of students I want in my Trading Challenge — those who are dedicated to learning. I don’t care how much or little you know about stocks…

The only thing I ask is that you’re dedicated, disciplined, and driven. If you’re not, you won’t make it into the Challenge. Think you have what it takes? Consider applying to my Trading Challenge.

Tell me what you think … How hot do you think the AI market will be? Let me know in the comments below!

Tech Penny Stocks FAQs

What Are Key Considerations When Investing in Tech Penny Stocks?

When considering investment in tech penny stocks, such as those of Artificial Intelligence or Self-Driving Cars sectors, potential investors should analyze the revenue growth and earnings per share. Technical analysis can help assess market potential and identify penny stocks with significant upside potential, though careful planning is needed due to the volatile nature of these stocks.

How Do Financial Metrics Influence Investment in Penny Tech Stocks?

Financial metrics like earnings per share and revenue growth are crucial in assessing the viability of penny tech stocks. Investors should look for companies showing consistent annual growth rate and positive news, which are indicative of explosive growth potential in the fastest growing tech sectors.

Can You Trust Analysts’ Ratings on Penny Stocks in the Tech Sector?

While analysts’ ratings can offer insights, they must be scrutinized, especially for penny stocks in the tech sector, such as Artificial Intelligence stocks or companies like Palantir Technologies Inc. The presence of market manipulators and the nature of low-volume stocks mean that even the rarest exceptions touted by analysts require independent verification.

What Risks Should Be Considered When Trading Penny Stocks in Tech?

Trading penny stocks, particularly in tech sectors like Artificial Intelligence or self-driving cars, involves understanding the risks of market manipulators and the potential for being a playground for scam artists. Regulatory oversight and the nature of pink sheets where many penny stocks are traded also pose additional risks.

How Do Major Tech Companies Influence the Penny Stock Market?

Major tech companies like Apple Inc., Amazon.com Inc., and Alphabet Inc. influence smaller tech penny stocks through market trends and technological advancements. Their activities can create exciting opportunities for penny stock investors looking for growth in related smaller-cap companies, but the influence can also lead to increased volatility.

*Past performance does not indicate future results

Leave a reply