Did you hear the news?!

McDonalds and Krispy Kreme just announced a new business deal.

Krispy Kreme will offer fresh daily donuts at McDonalds’ locations nationwide. You can expect to find a Krispy Kreme at the McDonalds near you by the end of 2026. If not sooner …

This is huge! I still remember when Krispy Kreme was all over the United States. The donuts were really popular. But in the early 2000s a lot of stores proved to be unsustainable and closed down.

This is what the people want.

I’m excited about tasty donuts. But I’m even more excited about the tasty profit opportunities. Business partnerships can be great catalysts for penny stocks.

Krispy Kreme Inc. (NASDAQ: DNUT) technically isn’t a penny stock. Prices were above $10 before yesterday’s spike. But that’s a far cry from the McDonald’s Corp (NYSE: MCD) share price of more than $200.

The business partnership adds obvious value to DNUT’s stock.

But I’m not buying it at random.

- We don’t know how far it will spike.

- How long it will spike.

- Whether the gains are sustainable in the short term.

- Etc.

There’s still risk involved. That’s why I use trading patterns to capitalize on the market’s hottest price action.

Get in. Get out. Move to the next hot stock.

And, might I add, in 2024 there are A LOT of stocks running. That means there’s A LOT of opportunity.

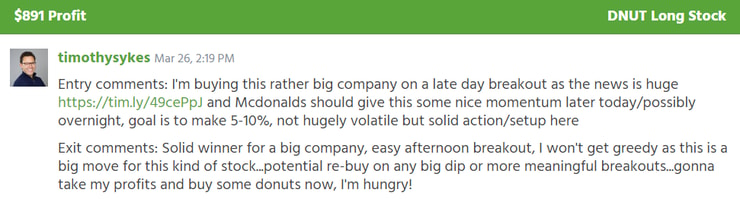

See my Tweet below.

SOLID day of trading for me in a SOLID month of trading for me too, just riding the trend and taking profits safely/too early like usual….you have to avoid thinking so negatively, definitely don't listen to toxic short sellers who would have you believe the world/America is…

— Timothy Sykes (@timothysykes) March 26, 2024

Here’s how I bank on the hottest stocks in the market:

Key Price Action

I already snagged profits from the DNUT spike.

This ticker is still in play!

But it helps to have eyes on it early. My students and I were watching this stock right when it started spiking. The price action was unmistakable.

Look how quickly the stock reacted to the news when it broke in pre-market hours:

This price action isn’t random. We can clearly see a catalyst that starts the spike.

And as for the intraday price action …

The most volatile stocks in the market can follow popular trading patterns because people are predictable. Especially during times of high stress, particularly when it comes to fear and greed.

We can take advantage of that predictability IF we recognize the possibility that it could all fall apart. That might sound dramatic … But anything can happen at any time in the stock market.

Don’t let that scare you, let it influence a proper risk/reward ratio.

Here’s what that means: We only trade the best setups. Plays where the potential profits outweigh the potential losses.

Trading patterns help us identify those setups.

Here are my trade notes from yesterday’s DNUT spike, my starting stake was $40,900:

A mere 2% from the 40% total spike.

But I’m proud of my 2%!

It’s not about making $1 million on a single stock. It’s about honing this process to trade for my whole life. I don’t want a different job …

My Process For Profits

The stocks that I trade, the stocks that my millionaire students trade, they all follow a framework.

But the pattern that we use to trade them depends on where the stock is WITHIN the framework.

Plus, every day there’s a new spiker that exhibits price action a little differently than the last runner. This is an inexact science. But it’s a science nonetheless.

I’ve used this process to build $7.6 million in trading profits. Some of my students are doing even better. Jack Kellogg has $12.4 million in recorded trading profits. And he’s been trading a fraction of the time.

What can I say … I’m a better teacher than a trader.

This is the process you should learn as a small-account trader. Forget about ETFs, mutual funds, and blue-chip stocks. Those are all slow-moving assets used by hedge funds. And don’t settle for some YahooFinance post telling you about the hottest small-cap stocks. Spoiler alert: If you read about it on YahooFinance, you’re already too late.

My students and I show traders how to use this process LIVE. Right here.

We’re tracking the DNUT price action right now. Don’t miss out!

Cheers.

Leave a reply