This student spotlight roundtable focuses on four Trading Challenge students who found a groove in the past year.

2020 was a good year for many traders. Volume poured into the market. There was a lot of volatility, which is a good thing if you know what to do with it…

(If not, you can learn how to trade it in my NO-COST “Volatility Survival Guide.”)

It all led to my first million-dollar year.* And it led these four students to have a standout trading year.*

Don’t get me wrong — it’s not just about the market. And these results are far from typical. And that’s why I want to tell you what these traders did right.

So what do these Trading Challenge students do well? For one, they show up every day. And their hard work doesn’t stop at the closing bell.

I’m really proud of these traders. Read on and learn from their stories.

(*Note that these results aren’t typical. These top traders and I put in the time and dedication and have exceptional skills and knowledge. Most traders lose money. Always remember trading is risky … never risk more than you can afford.)

Table of Contents

- 1 Student Spotlight Roundtable Trader #1: Clay

- 2 Student Spotlight Roundtable Trader #2: Josh

- 3 Student Spotlight Roundtable Trader #3: Nbn707

- 4 Student Spotlight Roundtable Trader #4: Brock

- 5 Why These Top Students Are Still in the Trading Challenge

- 6 Conclusion: What’s Next for the Student Spotlight Roundtable?

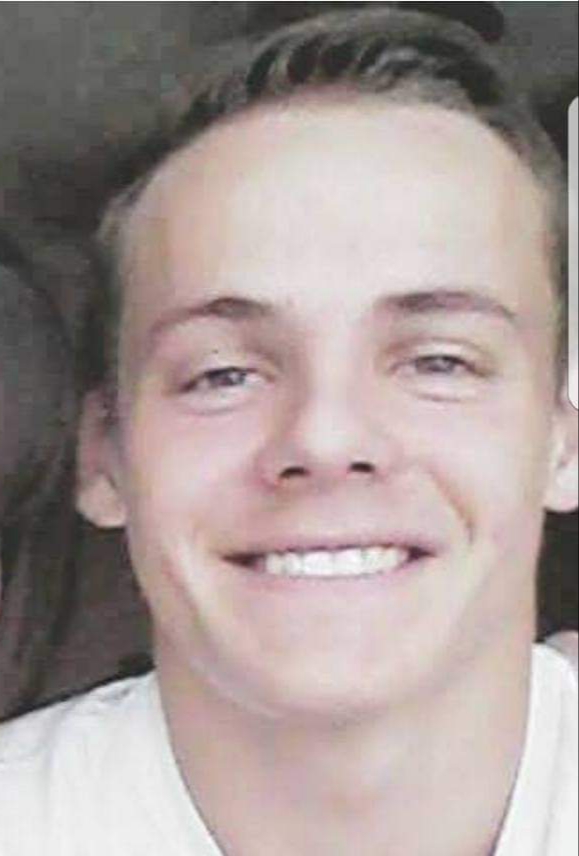

Student Spotlight Roundtable Trader #1: Clay

First on the student spotlight roundtable is Clay. 2020 was the year that Clay’s hard work really paid off for him…

Take a look at his Profit.ly earnings chart … and see how he’s growing a small hill into a mountain.

Clay started 2020 in five figures and ended with six — and almost $200K in profits!*

Not bad for a 20 year old. Even though Clay is just two years out of high school, he’s already learned so much about trading and his market approach. I’m in awe of this mindset and work ethic.

He started out with my Pennystocking Silver package. He dove in headfirst and watched every single one of my DVDs.

He’s realized something that takes most traders years to learn. As he puts it, “The money doesn’t matter. It’s how I perform.”

Clay’s Turning Point

At first, he went through the same challenges that plague a lot of beginning traders. He overtraded and broke his own trading rules. He tried to be a part of everything.

I wish every trader had the kind of discipline that Clay now has. And the humility to know when things aren’t working and it’s time to switch things up.

Clay reflected on his trading record and changed his process. He shook that money mindset. That’s when he stopped looking at trading as a get-rich-quick scheme.

And now he’s already beaten his 2020 gains — six weeks into 2021!*

He’s over $395K as of mid-February 2021*. I love to see how hard he works.

Clay’s Top Trading Tip

Clay does something I want all my students to do: He’s found what works for him and he sticks to it.

Since December, he’s been leaning on OTC dip buys. (OTCs have been on fire lately.)

But this focus traces back to another mistake Clay learned from. In the beginning, he tried out everything … until he found that this lack of focus had likely cost him many opportunities.

“This is actually one of my biggest regrets with trading,” he says. “I intensely studied and tracked breakouts and high-of-day breaks in early 2020. But I switched up focus to options. For trading purposes, especially short selling and trading options right when the market caught fire in June. There’s no telling how much money that made me miss out on.”

That’s a great lesson in not fighting the market. You’ll never bend it to your will. Now, let’s see who’s next on the list…

Student Spotlight Roundtable Trader #2: Josh

Next up in the student spotlight roundtable is Josh. Take a look at Josh’s Profit.ly chart. As he says, it’s been a wild journey.

He was down about $140K at the start of 2020.* That’s in the negative column.

Here’s what Josh says about his progress: “I made roughly $340,000 in 2020 after being down nearly $150,000 to end 2019.*

“I know this is hard to believe but discipline was my downfall. After I kept digging myself deeper in the red, things got tough. I basically was trying to make the losses back too quick. I had to accept the money I made and had to be patient to become profitable again.”

Josh knew he had to start sticking to the rules and the patterns that worked best for him.

More Breaking News

- GGB Stock Hovers as Market Reactions Vary Amid Market Speculation

- Credo Technology’s Blue Heron Surge: What It Means for Investors

- European Wax Center Signals Confidence with Financial Projections Boost

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

What You Can Learn From Josh’s Trading Rules

If you listen to Josh talk about his trading rules, he sort of sounds like me. What’s his top rule?

That’s right — cut losses quickly.

Even better, he owns up to his mistakes.

“I almost ended my trading career breaking rules and not having correct discipline,” Josh says. “I was down over six figures before learning proper risk management. You really have to change your mindset to look at the bigger picture over time. Not just look for instant overnight gratification.”

Of course, his biggest loss has nothing on my biggest loss. And I’m also honest about it. You can read about it for no cost in my book “An American Hedge Fund.”

Even still, Josh has a great perspective on those losses: “Hopefully this can help people learn what not to do in their trading to have discipline and encourage others who have put their account in a negative that there is hope to turn it around.”

Another Dip Buy Defender

Like a few others in this student spotlight roundtable, Josh’s favorite setup these days is panic dip buys. He says that it fits his personality best.

He likes that the trades are usually quick. He’s also found the most success with that strategy. And he’s gotten better at it the more he trades with it.

Just like Clay, he’s more than doubling up his net profits in 2021. As of mid-February, he’s made over $270K.*

I love to see happy endings, especially after a tough beginning. I couldn’t be prouder.

Student Spotlight Roundtable Trader #3: Nbn707

Next up on the student spotlight roundtable: Nbn707. (He wants to keep his real name confidential, so I’m referring to him by his Profit.ly handle here.)

Nbn707 had his coming out party in December 2020. That month, he reports banking nearly $90K in profits.* Best of all — he reports only one red day on the month.

Blessed and grateful for every single dollar. Preparation meets opportunity. +89000 #Dec2020 #NeverForget @timothysykes pic.twitter.com/Rk1tpaXVoi

— NBN (@nbn707) December 31, 2020

Unbelievable! Especially when you consider how far he’s come — literally.

Although he trades from the east coast, Nbn707 comes from a small town in India. I love to hear him talking about the value of opportunity.

“Learning to trade is a blessing,” he says. “Not many people in the world will have the opportunity for this. So everybody who can should make it count.”

How Nbn707 Found His Strategy

Many people just don’t put in the work that Nbn707 does. And they don’t have a full-time job like he does either.

But if you wonder how someone can take a $3,000 account above $500K, learn from this trader.*

Nbn707 has also come a long way in his studies. He started out by learning from my most successful student ever — Tim Grittani. Grittani started with an account size of $1,500 and has grown it to over $13 million!*

Like Grittani, Nbn707’s first few months were choppy. But he was making the right moves.

He started out studying Pennystocking Silver before joining the Trading Challenge. The Trading Challenge gave him access to more than 7,000 webinars recorded by me and Challenge moderators. We’ve got more than 50 Grittani webinars on there too — and they’re essential.

Challenge students can check them out here.

Once Nbn707 was in the Challenge, he studied his butt off. Now take a look at his profits in 2021. They’ve gone parabolic!*

Nbn707’s Trading Edge

Take a look at Nbn707’s winning percentage. It’s over 70%!* This is the best percentage on this student spotlight roundtable.

He values precision and tries to not overtrade.

Here’s his top tip for newbie traders: “I think the best quality a trader needs to learn is execution and timing,” he says. “And a major component of execution is risk management — aka cutting losses.”

This is one of the most unique things about this trader’s dedication. His style isn’t just about trading … It’s about screen time, understanding the market, and knowing himself.

Student Spotlight Roundtable Trader #4: Brock

Brock has another underdog story in this student spotlight roundtable. This trader took his time getting to where he is — over $500K as of mid-February 2021!*

But look at his trading in 2017, 2018, and 2019. Most of that time, he was under breakeven.

Since March of 2020, he’s been killing it.* What did he do to change his trading outcome so drastically?

Brock’s Lesson Plan

When Brock started out, he had a full-time job. But he says he still made time to study six to 10 hours every day. He’d even watch video lessons in between helping customers at work.

And Brock hasn’t eased up. He knows that this current market insanity is rare. He wants to know all the possible angles, so he’s still studying eight to 10 hours per day.

A lot of that is screen time and watching as many DVDs and video lessons as he can manage.

He’s also read “The Complete Penny Stock Course.” This is a book written by my student Jamil. He took all my lessons and organized them into a book! It’s essential reading for every trader.

Brock’s Favorite Patterns

Brock sticks with what he knows works. For him right now that’s going long. He feels like it makes the most sense given this bull market.

The first setups he says he found success in were OTC first green days and OTC multi-day breakouts. After that, he added in Nasdaq multi-day breakouts.

But lately, he’s been most focused on panic dip buys. He didn’t feel comfortable trading them at first, so he sat back and studied them. Now he says that’s his number-one pattern.

He likes to size in on dips that are reaching support. This makes for some big winners — and losers.* Not exactly going for singles, Brock.

That’s not how I trade or what I teach (singles add up!) … But it seems to be working for him. And he says he’s learning how to ride his style’s strengths.

Why These Top Students Are Still in the Trading Challenge

These student spotlight roundtable traders have all hit big milestones in their trading journeys.* This is why I started the Challenge in the first place. I get to share my knowledge to help traders find their own strategies.

It’s NOT easy. But these traders did the work. So after reaching incredible strides, why are they still in the Trading Challenge?

For one, they all have one thing in common — they want to keep getting better.

Like Nbn707 says, “I’ll never get good enough to stop studying and reanalyzing. And that’s how I like it to be.”

That’s a good thing because the rest of the market will never stop. So these traders know it’s imperative to keep working to improve and learn.

They want access to the 7,000+ videos in the Trading Challenge archive. And they want to watch and rewatch all of my DVDs.

They want to see how the Challenge moderators, top traders, and I all trade the market. (Challenge students can see all my trades with commentary in our chat.)

And they want to be surrounded by a great community of traders. Many top traders got their start in the Challenge and now help newbie traders. I’m so proud of this community of traders who love to give back. I think it’s the best place to learn and share your trading journey!

If you think you have what it takes to study as hard as the group of traders in this student spotlight roundtable, I’d love to hear from you. We don’t accept everybody. But if you have the passion and work ethic to overcome the challenges of trading, you might be a fit…

Apply for my Trading Challenge today!

Conclusion: What’s Next for the Student Spotlight Roundtable?

These traders all have rules, goals, discipline, and commitment — that’s what’s gotten them to where they are now. What’s next for them?

Nbn707 says he wants to save up enough to go full-time … and one day buy a fleet of sports cars!

And Clay wants to have his first six-figure day.

But there’s one thing they all have in common … They want to keep growing and improving.

And that’s why I invited them to this student spotlight roundtable. Constant self-improvement is the one thing I demand from my students. These guys have it.

Give these traders some love — please congratulate them in the comments below! Then let me know what you’ll take from these stories to apply to your trading today.

Leave a reply