What a day. The stock market sell-off this morning caused a trading halt right out of the gate.

I’ve been warning about this for weeks. My students were ready. Why? Because I teach my students to study stock market history. What we’re seeing is not unexpected. It’s not even unique. Check this out…

This $DIA chart was from a few days ago, but now with today’s big drop we’re matching up even closer with The Great Crash nearly 100 years ago…whatcha think? Remember, history and patterns repeat #history #studythepast pic.twitter.com/yt1Nlbl0FM

— Timothy Sykes (@timothysykes) March 9, 2020

For all the haters out there who say my patterns and rules are too old school … ignore me at your own risk.

For those of you who aren’t sure what to do, remember that sometimes the best trade is no trade.

In this edition of the millionaire mentor update…

- Millionaire Mindset: Get my response to Jubilee’s highly edited ”Do All Millionaires Think the Same?” video.

- Trade of the Week: Check out this near-perfect morning panic dip buy.

- Questions From Students: This week I’ll get into why I didn’t buy the first dip on my trade of the week.

- Penny Stock Case Study: Learn why penny stocks exist and how you can ride the momentum of informational inefficiencies.

But first…

Table of Contents

A Secret Project and a Scary Market

My schedule the past week has been crazy.

We’re working on a secret project I can’t talk about publicly yet. We’ll share it in a few weeks. But I traveled from Bali to Miami, then to Europe, and back to Miami.

Some people ask if I feel safe traveling. I’m taking extra precautions. Thank you for your concern, however. I really appreciate it.

Add market volatility to the mix and it’s been a wild week.

The coronavirus is causing a lot of concern — from conspiracy theories about U.S. testing accuracy to how SARS-CoV-2 will affect the economy. Then the Fed tried to stem the tide by lowering interest rates. The Fed’s move all but backfired, spooking markets more.

Heading into the week, the overall market is getting crushed. It’s not just the coronavirus … Now oil is crashing over 20%. Treasury yields are crashing, too. It’s a full-blown market sell-off.

Futures on the $DIA $SPY $QQQ opening down 4%, oil down 20%, our laughable political leaders pretend there’s no problem at all, what a fucken mess….it adds up to the perfect recipe for all out stock market crash, I’m glad I’m in cash and prepared for this, are you?

— Timothy Sykes (@timothysykes) March 8, 2020

I’m proud of my students who are staying safe and also taking advantage of the market volatility. We could see some great dip-buy opportunities this week.

Remember during this market turmoil — it’s OK to sit on the sidelines if you’re not sure. Use the time to watch and learn. Also, read “The Complete Penny Stock Course” so you’ll be better prepared next time.

Before I get into trading talk this week…

Millionaire Mindset

Last week, I appeared in this Jubilee episode. They asked whether all millionaires think the same. It was highly edited. They left out important parts of my answers which made me look like a jerk.

Here’s my response:

It blows my mind the laziness that’s out there. My goal is to be the mentor to you that I never had. But for me to have any hope of helping you, you have to have the right mindset. I’m trying to give you useful strategies and tips that get you out of your ‘normal’ life into a life of freedom.

Mindset is such an important part of gaining your freedom. So if you want more millionaire mindset content in these updates, let me know in the comments below.

Now, let’s take a look at the…

Trade of the Week

There are SO many coronavirus-related plays right now it’s tough to keep track. My email inbox and DMs are blowing up. I can’t keep up with questions from students…

So I’ll cover two at once here. Someone asked a question about this trade and it also happened to be one of my best-executed trades last week.

TOMI Environmental Solutions (OTCQB: TOMZ)

TOMI specializes in decontamination and infection prevention. The stock’s been in play since late January/early February after issuing a series of press releases. The company’s SteraMist products use something called Binary Ionization Technology. The product is a decontamination mist used in various places like China and South Korea.

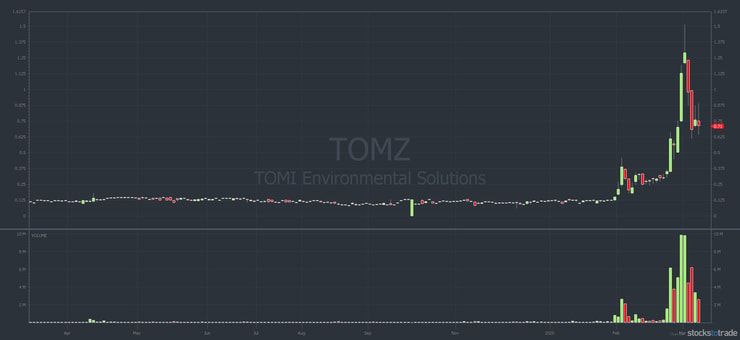

Take a look at the TOMZ one-year chart:

As you can see, TOMZ was a multi-day winner at the end of February. It went up from roughly 30 cents a share to $1.50. That’s a nice five times your money. Arguably, that’s up too much.

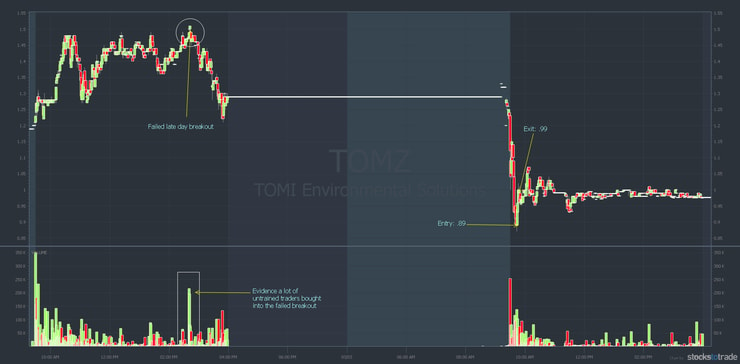

And that opened the door for a fall. Actually, this is another very good lesson. Take a look at the TOMZ chart for March 2–3…

That failed late-day breakout on March 2 was a very good short entry. It broke the morning high, broke the midday high, and then … it failed.

A lot of newbies think this is an exact science. So they were buying the technical breakout. Look at all the buyers (see the rectangle around the volume candle). There were 200K shares traded in that one minute.

There’s a lesson there…

When a stock is overextended — up roughly 500% in a few days — that’s not the best place to buy a technical breakout. With all the short squeezes lately, I can see how someone might try. But if you do try that setup be sure to follow rule #1: cut losses quickly.

For me, I’d rather wait for my favorite pattern — the morning panic dip buy. Which is what I did.

This is where the student question comes in…

“Tim, why didn’t you buy the first dip on TOMZ? What made you wait?”

So for me, the first panic wasn’t enough. Right at the open, the stock failed pretty quickly. And you could have bought it at $1 and flipped it at $1.15. That’s a 15% upside within three or four minutes. Not bad.

Here’s the chart:

Looking at the chart, you can see I bought the dip on the second panic. I really like the second panic. When a stock is up so much, if you can wait for the second or sometimes third panic it can have a better chance of bouncing. When I bought, it was down 30%–35%.

Here’s my thinking … TOMZ has recently been one of the hottest stocks in the market. The main catalyst — the COVID-19 virus — is still going around. So the story isn’t over. The stock being overextended caused the first panic. Then all the initial dip buyers were giving up and that created the second panic.

So I like it when there are two sets of people panicking. That opens some opportunities. Sometimes it’s two panics, sometimes three. But when a multi-day runner is down 35% right near the market open, that’s usually a good time to enter.

What would I have done if it kept falling? Cut losses, of course. But there were buyers at 87–88 cents. It had support. I was watching Level 2 action for support rather than relying on previous support levels. That’s key.

Again, I wouldn’t just dip buy a falling knife. I would’ve cut losses quickly if I was wrong. In this case, I was right.

Time for more…

Trading Questions From Students

I’m getting all kinds of questions while the market’s in turmoil. The first question is directly related to the stock market sell-off and recent volatility.

“Do you pay attention to the volatility index? Should new students pay attention to it?”

The Chicago Board Options Exchange (CBOE) created the volatility index (VIX). It’s often called the fear index, and it’s a way to predict market volatility 30 days in advance. You should be able to view it using the VIX ticker on your trading or scanning software. If not, you can see the VIX here.

Back to the question…

You already know that the markets are going crazy. I wouldn’t pay as much attention to VIX as I would SARS-CoV-2 headlines. (Any headline referring to the coronavirus, SARS-CoV-2, or COVID-19.)

Why? Because this market volatility is all about the deaths and how fast the virus is spreading. And it’s about misinformation and conspiracy theories. There’s a conspiracy theory in the U.S. about whether we’re actually even testing. There are always conspiracy theories.

So you want to keep track of how fast it’s spreading. There’s an article that says there could be 500 people infected in Seattle — and they don’t even know it. If so, they’re infecting more people. It’s a scary situation.

Rather than the VIX, pay close attention to the headlines that can move the market. It’s not a normal market. It’s not a case of “Oh, we don’t know what’s going on…”

We know what’s going on. We’ve had an 11-year bull market, and this is an example of how bull markets can end. The coronavirus might not kill many people, but it can potentially kill economies.

Now with crude oil crashing as Saudi Arabia starts a price war with Russia, it all gets even more complex. Again, focus on the headlines that are moving the market. Why are we seeing the stock market sell-off?

Next question…

“Your recent watchlists mention possible short opportunities. What market conditions would get you to short again?”

It’s not so much overall market conditions as … what creates a good short play? You gotta take it one trade at a time.

Here’s an example…

Back when I was shorting, I went in search of pumps.

What Happened to Penny Stock Pumps?

The pumpers just don’t do as good a job as they used to. The SEC really cracked down on them in the last few years. But pumping stocks happens in a different way now.

Check this out…

There’s this ridiculous bat bubble that people can wear to protect themselves. Now the designer is using social media to gather interest and get funding to build it.

Now, if that were a penny stock (it’s not) … and the stock went from $5 to $100 … I’d probably short that. Because that pricing would be as ridiculous as the suit.

So look for absurd and ridiculous misinformation. That’s not the same as trying to guess a company’s valuation like all the Tesla shorts did. Guessing valuation is very dangerous. But if you look for extreme absurdist examples … even though they don’t happen as often, they can be better odds.

In Search of Informational Inefficiencies

Stay with me…

Since the coronavirus outbreak started, people are buying and wearing masks. But do they even work? We posted this on Karmagawa last week. (Watch all three short videos.)

The masks aren’t really helpful. It’s just a psychological thing. You think you’re in control. They’re probably worse because people walk around thinking they’re safe wearing a mask. Actually, it’s better to just stay home.

So, what if you want to short these mask plays?

Look for misinformation. Again, when I was short selling, I looked for pumps. Now it’s more about what’s making the stock move. If it’s not being pumped, then what’s happening?

Logic Usually Prevails

With the mask plays, you gotta ask why there’s a stock market sell-off. Why are these mask companies going up so quickly and then coming down so quickly? Start asking questions. It’s not an exact science, but you’ll find that logic usually prevails.

And that leads me to our…

Penny Stock Case Study

Let’s take a look at a recent multi-day runner that went supernova.

Since we’re on the subject of short selling, informational inefficiencies, and coronavirus stocks … let’s stay with a mask company.

More Breaking News

- Why Helius Medical Technologies’ Stock Flew Up 24%! Exploring the Latest Surge

- Ford Stock Faces Challenges Amidst Safety Concerns and Lowered Price Targets

- How Nano Nuclear Energy’s New Acquisition is Powering a Stock Surge

Alpha Pro Tech (NYSE: APT)

I wrote about APT in this recent post about the stock market crash. And also in the last edition of this update about why it’s crucial to study stock market history.

There are some good lessons in how this stock has traded in the last few weeks. Check it out…

Penny Stocks Are Made for This

Penny stocks exist to enrich executives and insiders. These small companies do financings to raise money. Then the executives can make lots of money in salary over time … and they get options. OR … the executives can just sell straight up into run-ups.

Big companies — like Google or Amazon — are different. If C-suite execs at a big company sold all their shares, you’d see endless headlines. Maybe even lawsuits.

But with small companies, you kinda expect it. APT is no exception.

Last week Michael Goode, one of our Trading Challenge mentors, tweeted this:

Congratulations to Alpha Pro Tech $APT executives selling into the idiocy of the stock’s spike e.g. CEO Lloyd Hoffman who exercised options that weren’t expiring for 3 years and sold shares at $34 https://t.co/U604hvjEwE pic.twitter.com/O9FKV90ZiE

— Michael Goode 🦆 (@goodetrades) March 3, 2020

(Thanks to Micheal Goode for being such a valuable part of the team. And for always being on top of this kind of information.)

So APT had a huge run-up — all the way to the high $30s — and four top execs bailed. They sold tens of millions of dollars worth of stock. I don’t blame them. They knew their stock was crazy overvalued so they cashed-in.

Which leads to another lesson…

Penny Stock Run-Ups Are Unsustainable

When a penny stock has a multi-day or multi-week run, there are a couple of great positions to be in…

You could be like an executive in the company and sell into strength, or…

… if you have no position you can sell short. Which is what a lot of my students reported doing. So consider shorting these kinds of crazy stocks when they’re up 10–15 times. Caveat: I don’t recommend short selling for newbies or those with small accounts.

I didn’t consider shorting APT because I didn’t know if it was going from $3 to $40 … or $3 to $100. During the Ebola outbreak, it only went from $3 to $12. This virus is spreading much faster — and the stock spiked three times more than during Ebola.

Now APT is back down because the news is starting to get out that masks don’t really help. So look for those informational inefficiencies.

Millionaire Mentor Market Wrap

That’s another update in the books. The stock market already got halted once today. A lot of investors aren’t prepared. But I’ve been warning my students for weeks about potential coronavirus consequences.

Everyone wondering how my students & I are achieving record profits even as the $DIA $SPY $QQQ crash due to the #CoronavirusOutbreak the key is preparation, here’s a video I posted February 8th, 1 month ago when the markets were hitting altime highs! NAILED IT #experiencepays pic.twitter.com/6ew36UqOmA

— Timothy Sykes (@timothysykes) March 8, 2020

If you feel unprepared for what we’re seeing, apply for my Trading Challenge. I’ve been working hard to prepare my students for this.

Now, check out these…

Profit.ly Chat Comments From Students

So many students report crushing it* while the market tanks. Here are just a few comments from chat this morning:

9:37 AM aprovenzano → timothysykes: First trade of the challenge with SPEX and made $97.

9:39 AM juniet: ohhh my gfod $spex bought 3.73 an dropped 3.36 and i was down 5 k i wasss sooo mad and thinking to buy more and booomn skyrocketed 5.5 sold at 5.10ish with market order wowwww love it.

9:40 AM usmarine2daytrader: Made 8% on $IBIO pre-market in at 2.17 out 2.35 then 13% on $SPEX pre-market in 3.35 out 3.80 let too much money on the table there but nice start to the week before a total market halt.

9:41 AM Familyguy: I grew my entire small account by 39% today! Feeling sssooo blessed!

9:45 AM TradingMama: Took 15% win on $IPIX just before the halt…whew!

9:47 AM scottsaylor11: locked 2k $SPEX from 1.53 this morning. sold at 3.7, 4.7, 5.44 and still have 100 shares left. also nailed it from .9-1.5 on friday. best trade to date by farrrr. hope everyone banked!

9:54 AM TradingMama: Bought $AIM at 3.2598 before the halt, and sold after the halt at 3.48. Nice win, but sold WAY too soon.

10:21 AM Kriminator → timothysykes: $apt Sorry tim I was busy dip buying APT in at 10.9 out at 11.8 2k shares another grand or so.!!! BOOM!

10:35 AM suhwateeze: Locked in over $700 on $CURLF and $GTBIF bounces. Wouldve netted way more if I didnt get wick stopped out of my 3rd position. Sucks that I am making good gains on a day where my long term is losing soo much.

A Special Shout Out to One Very Hard-Working Student

9:57 AM Frenchie: OMG. I feel like I’m going to vomit. I’m all out $SPEX for a profit of 20,156.49$

9:57 AM kroyrunner → Frenchie: hot damn! Congrats!!!

09:58 AM selkelli1 → Frenchie: woot woot!

09:58 AM islande85 → Frenchie: That is awesome!! Congrats!!

09:58 AM redwagonrider → Frenchie: woooooowwwwwwwwwwww awesome.

09:58 AM TickerJesus → Frenchie: nice job.

09:58 AM yaretz → Frenchie: choking on all the dollar bills lol.

[*Students’ results aren’t typical. These students put in the time and dedication and have exceptional skills and knowledge. Most traders lose money. Always remember trading is risky … never risk more than you can afford.]

If you want more millionaire mindset content in the future, let me know in the comments below. Either way, let me know your thoughts on the current market. I love to hear from all my readers, so comment below!

Leave a reply