The Timothy Sykes ‘Below Deck’ episode aired last night and predictably, they edited it in a way to make me look pretty terrible … no different than the producers on my ‘Miss Advised’ and ‘Wall Street Warriors’ reality show appearances — I KNEW they would going in.

See the trailer here and watch it repeat over and over and over this week on Bravo TV all this week.

Table of Contents

Season Finale of ‘Below Deck’ With Timothy Sykes

The reaction on social media has been swift and harsh with common phrases used such as “douchebag” “arrogant” “egotistical” “asshole” yada yada yada…

It’s mainly in reaction to my focus on money, my younger girlfriend who doesn’t like gourmet food, my confidence which EVERY viewer can see, the fact that I trade penny stocks with “crappy technology”, my teaching others my strategy, and the callous way I decided to take back $5,000 from the original $22,000 tip for the crew.

I knew this would all be televised and edited in the worst possible way, like when I called my mom “a bitch” in Wall Street Warriors (which you can watch HERE on Prime). I said it 100% sarcastically, we joke around every day, but 17 years later I still hear how I should treat her better!

Worst Charter Guest of the Season

So why oh why would I open myself, my girlfriend Bianca Alexa Wilson, and my Trading Challenge students to such criticism?

Because that’s entertainment baby and I WILL DO WHATEVER IT TAKES TO FIND DEDICATED STUDENTS ALL OVER THE WORLD.

NONE of my antics or this show’s editing or my previous shows’ editing or videos like this of my Lamborghini and Miami mansion matter in the long run…

What I Really Care About Isn’t in the Timothy Sykes Appearance on ‘Below Deck’

What matters in the long run is articles like this on CNN featuring my top student Tim Grittani — “Trader turns $1,500 to $1 million in 3 years.” He’s now up to $13.5 million in career earnings!

And videos like these:

Because there is SO much misinformation about stock trading and penny stocks and that’s why 90-95% of traders lose money… not because this game is so difficult but because good information is so rare.

That’s why I promote my NO-COST weekly watchlist and my 1,900+ free videos on Youtube and my Trading Challenge with all my DVDs and weekly webinars — not just from me but also several of my millionaire students.

The reason why I have the one of the best newsletters in the stock world is because I will do EVERYTHING I can to inspire people, and piss people off and get them talking about me and my story because I started with just a few thousand bucks and as anyone knows me can attest I ain’t that smart so if I can become a multi-millionaire, ANYONE can!

What My Millionaire Students Achieved Through My ‘Trading Challenge’ Mentorship Program

And that’s why I’m so proud of students like this guy who was my first millionaire student… which I summed up nicely in a speech at Harvard University:

Here’s the Truth That ‘Below Deck’ Ignored

My critics will say out of thousands of students I only have a few millionaires, but even if you bought ALL my educational products from these study guides to StocksToTrade to joining my trading challenge, it all costs just a few thousand bucks and ALL of it can change your life as it has done not just for my millionaire students, but all of these subscribers too who have made back their investment in their education in 1-2-3 trades and the education I provide lasts a lifetime so I think it’s the single best investment anyone could ever make.

Remember this blog post when I tried warning the #wolfofweedstreet people about their flawed marijuana penny stock thesis — they thought they’d go up forever — most didn’t listen and have lost everything… some did listen though and as my conference attendees have heard my warnings saved them $30,000, $50,000 even $100,000.

I GLADLY took on the whole bunch of marijuana penny stock traders because I knew they were wrong, just as I know how many other traders are wrong every day and I’m here to help.

So I accept the criticism all for tweets like this:

Because as I also tweeted last night when I first began receiving criticism:

I treated EACH of those trading challenge students to the 100% free trip for them aboard the $12 million yacht and it was a fantastic few days of hanging out with them, trading with them and talking about the stock market, life — and of course, reality TV.

I wish the show had shown more of that, but I understand they wanted to position me in a very specific way and never dare show my full character.

More Breaking News

- HTZ Faces Data Breach and Restructuring Woes

- Why TMC’s Stock Is Plummeting

- Is American Rebel Holdings’ Reverse Stock Split A Turning Point?

I Left the Biggest ‘Below Deck’ Tip — EVER

I left the crew a $17,000 tip, which is nearly 25%… and because the chef didn’t listen to my VERY specific instructions regarding the food — not to mention pretty much every group meal was delayed far too long (which they didn’t show) — and the internet didn’t work (I specifically requested they bump it up ahead of time with extra routers, devices, etc. which they assured me would make it very fast) and some of the staff was less than cordial, they didn’t deserve a full tip from me and I made sure to let them know that.

Hey critics did ya happen to catch this tweet?

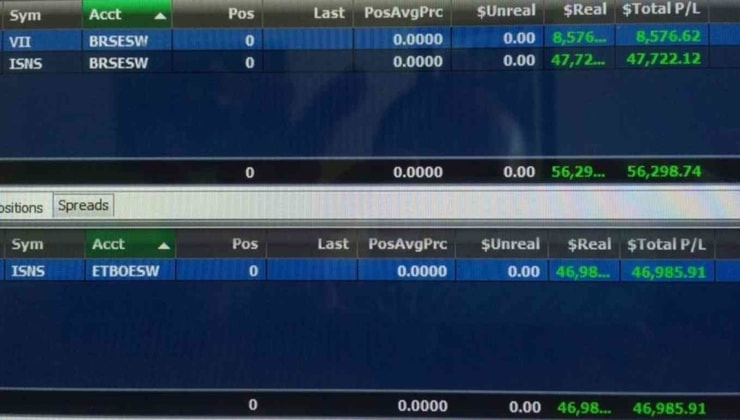

Yup, on the stock trade done on crappy wifi the ‘Below Deck’ episode didn’t show I made $70,000 a friggin’ home run for ALL my students and me and a GREAT lesson to show that you can trade stocks and bank from ANYWHERE in the world no matter the conditions.

Remember I am 100% self-made and DAMN proud of it:

And the hot stocks my students and I trade daily HAVE THE EXACT PATTERNS AS OUTLINED IN MY DVD STUDY GUIDES MADE SEVERAL YEARS AGO!

Because of that my top trading challenge students are BANKING:

Sometimes $200,000 in profits in just one day as I outlined here:

And lately this guy has been making $100,000 in a day a few times (big props to my chatroom for extra education that has taken Eric’s game a WHOLE new level)…

Long story short I understand what grabs people’s attention and gets them WANTING to study hard in order to get rich.

Bottom Line: ‘Below Deck’ and the Real Story

Money is not the end all at all, but its acquisition is what I teach and I took a few thousand and turned it into a few million bucks, see EVERY trade HERE and now more and more of my top Trading Challenge students are doing it too.

Bring on the haters, as I create more millionaires the hate will get even worse until at some point there’ll be a tipping point once everyone realizes what I teach is real and useful and it works…and my drill sergeant-like teaching style isn’t always pleasant, but it works.

If you think I only care about making $ off trading and teaching you’re wrong, money is just a byproduct of my hard work and I talk about it and show it off since it’s what a batting average is to a baseball player… I truly don’t understand the traders and investors who dedicate their lives to building their portfolios/accounts and then keep the #s secret and worse their strategies secret too so the dark ages in financial education has continued unabated… until me.

In the next few weeks I’ll be launching my own non-profit foundation which I expect to raise over $2 million in 2015 (that’s the goal anyway) and once I tell you all the details, you’ll understand my priorities MUCH better.

Until then, feel free to hate on me, I can take it… leave my girlfriend alone though, she’s incredible and doesn’t deserve any of this, she’s unlucky enough to have fallen in love with me and didn’t realize how committed I am to teaching and creating millionaires and changing this whole screwed up industry. I love her to death and you guys owe her since she keeps me sane enough so that I might just be able to pull this whole thing off.

Captain, #belowdeck crew, I’ll see you again, hopefully for season 3 and I’ll bring even more Trading Challenge students and we’ll see if you perform better to earn a bigger tip 🙂

Do you see through the hype and gossip? Let me know if I motivated you below — I love hearing from my readers!

Frequently Asked Questions

Who Is Millionaire Trader and Entrepreneur Timothy Sykes on ‘Below Deck’?

Timothy Sykes, known as a successful penny stock trader and entrepreneur, made a memorable appearance on the ‘Below Deck’ franchise. He is recognized for his expertise in the penny stock market and his educational initiatives in teaching trading strategies. His presence on ‘Below Deck’ highlighted not just his financial success but also his unique personality, making him one of the more notable Below Deck charter guests in the show’s history.

How Does Timothy Sykes Make Money?

Timothy Sykes makes money primarily through his expertise in the penny stock market. Starting with $12,000 in Bar Mitzvah gift money, he turned this initial investment into millions by trading penny stocks. He is also an educator, teaching others his trading strategies through courses and video lessons. His focus on potential stocks, including crypto penny stocks, and his ability to make smart investment decisions have set him apart as a successful penny stock trader.

What Are the Advantages of Timothy Sykes’ Trading Challenge Course?

Timothy Sykes’ Trading Challenge Course offers numerous advantages for aspiring traders. It includes access to a comprehensive video lesson library, weekly video lessons, and sophisticated tools for making smarter decisions in trading. Participants also gain access to chatrooms for real-time discussions with other traders. The course covers various aspects of trading, helping students learn the art of trading, from identifying potential trades to executing successful exit trades.

How Did Tim Sykes Get Rich?

Tim Sykes became rich by mastering the art of penny stock investing. Starting with a sum of Bar Mitzvah money, he invested in the penny stock market, identifying and capitalizing on potential stocks. His journey from a 24-year-old stock trader to one of the most recognized American stock traders showcases his skill in making investment decisions that led to substantial profits. His success story is not just about trading but also about his educational endeavors, such as the Millionaire Challenge, which have further solidified his status in the trading community.

Leave a reply