For new traders, finding the best stocks to trade can feel like trying to find a needle in a haystack… That’s why a stock screener is a trader’s best friend.

So that begs the question: What’s my favorite stock screener?

There are dozens out there, with both free and paid versions available … which is right for you?

In this post, I’ll cover the most important considerations when seeking out a good stock screener, AND I’ll share what I personally feel is the finest stock screener on the market today.

Table of Contents

What Is a Stock Screener?

Before we can talk about my favorite stock screener, you need to understand what a stock screener actually is…

A stock screener is the ultimate trader’s filtering device. It’s a tool that lets you screen stocks based on specific criteria that you set.

By applying various filters on a stock screening program, you can narrow down your trading to the stocks that fit your criteria and the setups that work best for you.

How Does a Stock Screener Work?

Curious about how a stock screener actually works? Let’s break it down with a simple example.

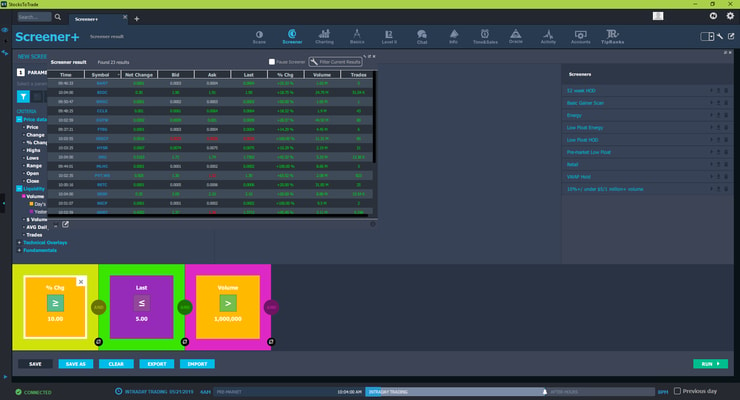

To start, you set up your criteria for the screen. For example, you could set up a filter to find the top percent gainers for stocks priced under $5 per share with a volume of at least 1 million shares being traded.

Of course, that’s just one example of a series of criteria you could set — more advanced traders often get way more specific in their screens as they gain more trading experience. They also log every trade in a trading journal, and better know which setups suit them best.

Once you run the screen, you’ll have a narrowed-down list of potential stocks to trade. That’s your list to work with. Now you can perform more targeted research on the stocks. You might look for things like hot or trending sectors, recent news that could act as a catalyst, or potential future catalysts like upcoming earnings announcements.

To be clear: Yes, you still have to do your homework. By that, I mean performing detailed fundamental and technical analysis and formulating a strong trading plan, which is vital before executing any trade.

However, by using the screener, you significantly narrow down the choices, helping you save a ton of time.

Trading Challenge

Interested in working with a stock screener, but need to better understand what to look for in stocks?

Pursuing a trading education is one of the smartest investments a trader can make for both now and the future. That’s how you build a strong foundation of knowledge — the ultimate trading superpower!

Interested in continuing your trading education in a flexible setting with other like-minded and motivated traders? Join my Trading Challenge.

The Challenge provides a real-life trading education that you can pursue on your own schedule. It includes a comprehensive video library, regular live webinars, and live trading tutorials. The goal is to help you become an educated, calculated, and self-sufficient trader.

Why Do You Need a Stock Screener?

This one’s an easy answer: Modern, efficient traders need stock screeners.

You can pore over lists of stocks and research every single one. But that’s not a smart use of your time — especially if you have a full-time job and can dedicate only so much time to trading.

In short, a stock screener helps you identify opportunities quickly.

Benefits of Stock Screeners

Just to review, here are some of the key benefits of stock screeners:

- Locate promising stocks. With a stock screener, you can filter the thousands of stocks out there to narrow down the choices based on the specific criteria that you set.

- Filter out irrelevant choices. By filtering based on your criteria, the stocks that aren’t relevant won’t even show up in your search and won’t distract you.

- Save time. Sure, you want to be a trader, but you also want to have a life. If you have a full-time job as many new traders do, you probably want to maximize your trading time. Stock research takes time and energy. By filtering with a stock screener, you can make the most of your limited time.

Free Stock Screeners

If you’re new to trading, it’s understandable that you might be hesitant to spend money on a stock screener. You want to spend money on stocks, not a screener, right?

If that’s your mindset, there are free stock screeners out there. But they tend to be more bare bones and less reliable than paid stock screeners. They just may not be the right tool if you want to trade long term.

Why Use a Free Stock Screener?

Well, because it’s free. For new traders with small accounts, this can be a big selling point.

But remember: You get what you pay for. If you don’t pay a dime for a stock screener, you shouldn’t expect too much from it.

Since you haven’t invested in a high-quality program, you’re unlikely to get top-quality scans. Free stock screeners can have bugs and delays. And they can be less comprehensive than more professional, paid screener programs.

They’re also less likely to include features like broker integration where you can actually execute trades from the same platform.

It’s fine to test out a free stock screener to gain a better understanding of how they work. But as you get more serious as a trader, you’ll probably want to upgrade to more serious tools.

Some Top Free Stock Screeners

Ultimately, the best free stock screener for you is a matter of personal preference.

A quick Google search will help you find a variety of free stock screeners. Some, like Finviz, have favorable reviews.

To choose the right one for you, be sure to do thorough research: Read user reviews and be sure to check out what kinds of screens you can run with the software.

Paid Stock Screeners

If you want to get serious about trading, it’s important to have a great screener. And yes, most of the great ones are paid stock screeners.

Paying for a stock screener probably isn’t a waste of money, because once again: You get what you pay for. And if you want a program that offers excellent results, it can be well worth the investment.

More Breaking News

- Why Opendoor Technologies Faces Challenges After Latest Financial Moves

- CleanSpark’s Strategic Growth and Operational Success: Why Analysts Are Bullish

- Bank OZK’s Earnings Surge: Is It Time to Dive in?

Why Pay for a Stock Screener?

Think about it this way. Say you want to start playing guitar. You can buy a crappy cheap guitar. But if it’s hard to play and the sound quality sucks, you probably won’t be super motivated to keep practicing … because you’re not getting quality results.

On the other hand, if you buy a higher-quality instrument, the results may motivate you to stick with it.

A stock screener isn’t all that different. If you use a high-quality stock screener, you’ll probably get high-quality results, and you’ll be more likely to stay motivated.

So if you’re serious about becoming a trader, why not start with a great stock screener?

My Best Stock Screener

This will come as no surprise to readers of this blog, but I completely believe that StocksToTrade is the top stock screener out there.

Full disclosure: I helped design the StocksToTrade software. I was tired of having to source information from various screeners and sites. I wanted to help create a powerful tool where traders could do it all in one place.

I could go on and on about its features, but that would take all day. I’ll just give you a few highlights:

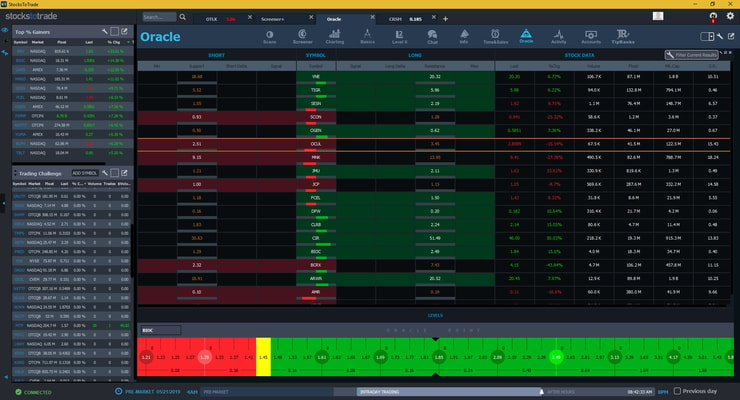

Built-in scans. StocksToTrade has a variety of scans built right into the platform. A lot of them are scans I’ve been using for decades. It’s an easy-to-use program that can help you build a strong watchlist.

Twitter scans. Unlike many stock screeners, StocksToTrade features a Twitter scan. You should never execute a trade based solely on social media buzz … but Twitter can be an invaluable resource for finding trading ideas and news catalysts. News scans like this can help you get an edge on trades.

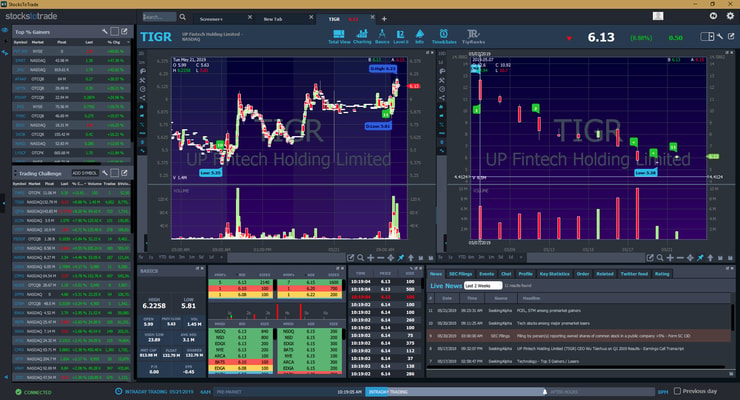

Awesome charting software. StocksToTrade is more than just a screener. It’s also equipped with powerful charting software, so once you do your screening, you can dig right into detailed research part — without leaving the platform. The charting software has tons of indicators and you can tailor your search timelines. You can also look at different types of charts, including candlestick and line charts depending on your preference.

Broker integration. A lot of screeners are stand-alone programs, meaning you have to screen your stocks, then log into a separate brokerage account to actually execute trades.

StocksToTrade has broker integration. You can link a variety of brokers with your account and execute trades right from the same page where you’re screening and charting. You don’t have to toggle from screen to screen, which can help you save time and avoid confusion.

Take it for a test spin! A 14-day trial of StocksToTrade is just $7.

The Wrap

A great stock screener is one of the most vital tools to have in your trading repertoire. It has the power to help you sift through the dizzying number of available stocks so that you can focus those that fit your specific criteria and trading strategy.

There are many different options — both free and paid — for stock screeners. But not all stock screeners are created equal. Think long and hard about which option really suits your needs and can give you the information you need to make smarter, more informed trades.

Regardless of which stock screener you choose, be sure to take the time to thoroughly research all the features before settling!

How do you use a stock screener? Leave a comment and let me know your favorite ways to filter and sort stocks. I love to hear from you!

Leave a reply