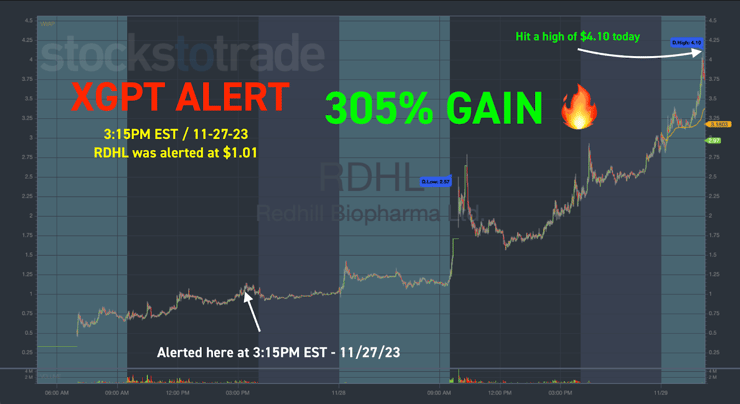

In the last five trading days, Redhill Biopharma (NASDAQ: RDHL) leaped from a low of $0.30 to a high of $4.10.

But the real story is how some of my students stepped into the stock with a complete trading plan while it was still trading at about a buck.

While I’d like to take full credit for the alert … I CAN’T.

Because they received an automated alert from my new proprietary AI system called XGPT at 3:15 p.m.

But this wasn’t the only winner XGPT sent out this week.

In just one day … ONE DAY … XGPT picked up:

Asset Entities (NASDAQ: ASST) for a potential gain of 16.5% …

… Iris Energy Limited (NASDAQ: IREN) for a potential gain of 7% …

… and SpringWorks Therapeutics (NASDAQ: SWTX) for 8.5% …

… while also hitting monsters like Biodexa Pharmaceuticals (NASDAQ: BDRX) for a potential gain of close to 50%.

So, why did XGPT pick up RDHL and how did it know when to step into the trade?

While I’m not going to give away all my secrets, I will share with you a few key criteria that make the whole thing come together.

Table of Contents

Cutting Through the Catalyst Clutter

Dozens of stocks surge in the premarket every day.

Some of them for legitimate reasons … others not so much.

The tricky part is trying to figure out what the best plays are … specifically … what catalysts are likely to drive a stock higher.

You could gamble and guess … Or follow some rando on Twitter.

But why when you can use XGPT.

As an AI, XGPT can spot patterns faster than any human and can quickly determine what’s a real opportunity and what isn’t.

But it’s more than just the price patterns.

This advanced AI system understands which news catalysts qualify as legitimate and which are … well … worthless.

Take RDHL for example.

It had an incredible catalyst for a biotech company — the FDA granted it 5 years of exclusivity for its new H. pylori treatment.

The FDA makes the rules for drug distribution in the U.S … so that was a massive seal of approval.

As mentioned earlier, the stock went from $0.30 to a high of $4.10 in just five trading sessions.

In other words, savvy traders had multiple opportunities to take this long potentially.

And you know what?

XGPT picked RDHL as a potential trade multiple days in a row.

That means even if you missed the first entry, the system saw the potential for the stock to keep churning higher.

Would you or could you buy a stock that’s already ripped as much as RDHL?

Observing Price Action & Beyond

One of the hardest things for a trader to do, especially newer ones, is read the chart.

Sure, it’s simple enough to find support and resistance. But how do you know whether a stock has enough strength to keep running or blown all its energy?

Better yet, what if the stock hasn’t done much at all?

Take a look at the chart below for Asset Entities (NASDAQ: ASST):

The alert that went out on the 27th saw something in the stock that had practically no price action …

… and yet … it knew that if the stock could punch high enough, specifically get to $0.80, it had a shot at $0.93.

These are trades that even I wouldn’t have seen until the stock started moving.

More Breaking News

- **Navigating KULR’s Stock Volatility: Opportunity or Risk?**

- Analyzing GEV’s Trajectory: Rise or Retreat?

- A Surprising Twist: Could Applied Digital’s Leadership and Innovations Shift Market Dynamics?

And this system picked it up the day before.

Short Squeeze Potential

When you look at a stock, can you tell if it’s ripe for a short squeeze?

This is a core concept I teach all my students.

I want them to understand the short squeeze inside and out.

The crazy thing is … XGPT just knows how to find them.

How you liking that $HKD short squeeze ya damn stubborn short sellers? Watch this https://t.co/B6TB1MgtHJ on why I don't short sell anymore & see this important post for short selling basics https://t.co/g9YSGzHBsA as sadly so many shorts are unprepared for this kind of squeeze! pic.twitter.com/WjkvpTiEWl

— Timothy Sykes (@timothysykes) July 28, 2022

You see, XGPT can synthesize the price action and structural data like a stock’s float and determine which are prime candidates for a short squeeze.

It then incorporates this data into the trading plan, which traders can use to inform their own decisions.

Is XGPT the Edge You’ve Been Missing?

Wall Street has always had an unfair advantage over regular traders like us. Thankfully, XGPT is on our side…

🔥 This new AI tool has nailed huge moves — as much as 300%.

🔥 It does high-level analysis in a matter of seconds.

🔥 It’s trained on my strategies — but it can detect them better than me!

🔥 It gives you the high-level forecasting normally reserved for quant funds and mega banks.

I’m not blowing smoke when I call this an AI breakthrough. I really do believe that XGPT is probably the single best tool that you can use. Here’s why:

🚀 Empowered Decision-Making. Its data-driven insights give traders of all skill levels an edge in technical analysis.

🚀 Potential For Higher Probability Trading. AI never gets tired. XGPT will help you spot opportunities when you’re not on top of your game.

🚀 Keep Up in the AI Arms Race. AI is coming to trading. If you’re not prepared you won’t survive.

XGPT is the trading edge you’ve been looking for. Secure your spot now!

Leave a reply