I’ve gotta shout it out because this guy is so humble … I’m SO proud of my student Kyle Williams, who just passed the million-dollar profit mark.*

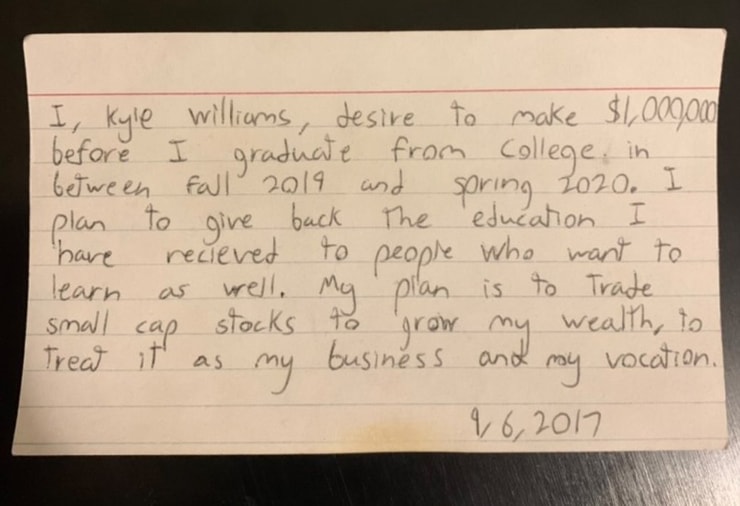

Kyle’s been trading since 2016, and he’s definitely had some ups and downs. In fact, he wasn’t profitable at all for his first 18 months of trading. But he had his eyes on the prize … Check out this artifact from his archives that demonstrates his commitment to the process:

He’s put in the work, and in the past year or so he’s had an exponential growth curve … Now, just shy of his 25th birthday, he’s passed this incredible milestone.*

It just goes to show that when hard work and preparation meet opportunity, incredible things can happen…

(*Please note: Kyle’s results are far from typical. Individual results will vary. Most traders lose money. Top traders like Kyle have the benefit of years of hard work, dedication, and experience. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose. I’ve also hired Kyle Williams to help in my education business.)

Table of Contents

My Latest Millionaire Student!*

Traders who follow me on social media and members of my Trading Challenge are most likely familiar with the name Kyle Williams.

Kyle’s very involved in the trading community. He monitors my Trading Challenge chat room. He’s hosted webinars. He was part of my most recent all-day live trading event.

And Kyle co-hosts the “TWIST: This Week in SteadyTrade” podcast along with two other extremely talented traders and Trading Challenge chat moderators, Jack Kellogg and Matthew Monaco.

Traders are fortunate that he makes himself so accessible because there’s a lot to learn from Kyle.

TO CELEBRATE @traderkylec PASSING $1 MILLION HERE'S A GREAT BLOG POST FROM HIM TO LEARN FROM: https://t.co/fvo2CSJoIL 10 Questions With Six-Figure Student Kyle Williams, LEARN HIS MINDSE/STRATEGY BEFOE HE HIT THIS GIANT MILESTONE!!!

— Timothy Sykes (@timothysykes) January 31, 2021

I recently wrote a post about his 2020 trading success. Now, a few months later, I’m happy to be writing about his million-dollar profit milestone.* Here’s how it happened…

(*These results are not typical. Individual results will vary. Most traders lose money. These top traders and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

So Bearish, He’s Bullish

In my most recent post on Kyle, I wrote about his backstory as a trader — and why he says that he’s “so bearish, he’s bullish.”

Here are the broad strokes:

- Kyle started trading in 2016 after he watched “The Big Short.”

- He started learning about penny stocks and watching free YouTube videos but still didn’t know what he was doing.

- Then Kyle found my Trading Challenge. Like many students, he was skeptical at first. But he did some research and decided to give it a try.

- Within a few weeks, he’d lost $1,000. That’s when he realized if he didn’t get smart, he’d risk becoming one of the many traders who fail.

This all led Kyle to do two important things…

The Mindset Shifts That Changed Everything for Kyle

2025 Millionaire Media, LLCAs I always say, traders have two accounts — a ‘knowledge account’ and a money account. I also suggest that before traders start thinking about money, they focus on education.

Kyle’s first step was to invest in his ‘knowledge account.’ He watched all of my DVDs and every single video lesson.

For him, my DVDs were like trading textbooks. The video lessons put the information in perspective with real-life examples.

Second, he scaled his position size way down. Sometimes, he’d take as few as 100 shares. He recognized that at this point in his career, it wasn’t about making money — it was about figuring out his strategy.

I can’t stress enough the importance of his mindset shift.

In the beginning, traders must look at every trade as a learning opportunity and control their risk. Kyle did this by figuring out how much he was willing to lose — and adjusting his position sizes accordingly.

I also did a great Q&A post with Kyle where he talks about his specific study materials, habits, and favorite resources. Be sure to check it out.

Kyle’s Exponential Growth

Let me be clear: even with the right mindset, there’s no guarantee that any trader will make money.

After Kyle adjusted his mindset, he worked to refine his strategy.

Even so, he lost money throughout his first year in the Trading Challenge. He had to start by grinding his way back to zero … and wasn’t profitable at all for his first 18 months of trading.

But as time went on and he gained confidence, things started to turn around for him.

The whole time, he kept studying and getting better.

Then 2020, with its market craziness, came along. After roughly three and a half years of studying, refining, and grinding, Kyle was ready…

2020: A Game-Changing Year

In 2020, Kyle made $701,167.*

Pretty amazing, right? But I’ve gotta stop right here and say something important.

These results aren’t typical. Even with all the hard work in the world, there are no guarantees.

It took Kyle a long time and a lot of hard work to get to this level.

Several of the top traders who have been through the Trading Challenge — Tim Grittani, Jack Kellogg, Mark Croock — all have this in common.

They all have different strategies, but they all went through a similar learning curve. They made little to nothing at first. But they stuck with it, making small gains and learning all the while.

Then, a few years down the line, they started to become consistent, scale up, and that’s when really great things started happening for them.

When the right opportunities came along, they were ready.

Take a look at Kyle’s profit chart here. It’s amazing to see his exponential growth curve!*

More Breaking News

- Tenet Healthcare’s Rising Tide: Time To Sail?

- Why Applied Digital’s Stock is Making Waves

- Core Scientific’s Bitcoin Mining Success

Traders Can’t Win All the Time

Kyle clearly does a lot of things right as a trader. After all, he’s made over $1 million, right?*

But that doesn’t mean he’s right all the time.

In a recent video, we talked about his biggest loss in 2020 — $13,182 on NeoVolta Inc (OTCQB: NEOV) on December 20.

I’d normally say, “learn from your mistakes” … But Kyle didn’t actually do anything wrong on this trade. He followed his own rules.

But it just goes to show — even when traders follow the rules, not every trade will work.

Kyle’s able to put it in perspective: “That same setup that lost me $13K has made me over $100K.”*

So one loss doesn’t mean the strategy is dead. People want to win every time, but they don’t. That’s just life.

Adapting His Strategy

Another key to Kyle’s continued growth? His ability and willingness to adapt.

Throughout his trading career, Kyle has focused on short selling. But he always keeps learning.

In fact, in 2021, one of his biggest goals is improving his trading on the long side.

So far he’s stepping up to the plate with nearly half of his profits being on the long side in January 2021. Longs were previously only 10% of his profits in previous months.

But he’s not abandoning his old strategy. He did have his biggest gain to date — $48,178 *— short selling SolarWindow Technologies Inc. (OTPK: WNDW.) It was a huge contributor to his first-ever six-figure week during the week of January 11, 2021.*

Learn more about his evolving strategy and approach to the market in this video:

Over the Million-Dollar Mark*

Now, just a few weeks after that record-breaking trading week, Kyle has an even bigger milestone to celebrate.

He’s not even 25 yet — and just passed a million dollars in trading profits.*

Embed (million-dollar profit mark tribute) tweet:

Congratulations to @traderkylec for passing $1 million in trading profits today thanks to $OZSC $AITX after starting with just $6,000 back in 2016, my latest seven-figure https://t.co/occ8wKmlgm student, he’s worked sooooo hard and I can’t wait to see what else he can accomplish! pic.twitter.com/fWYi4IdUzs

— Timothy Sykes (@timothysykes) January 26, 2021

Check out his chart from the period directly following his six-figure week. You can see how he closed in on the million-dollar mark and continued to make profitable trades in the days afterward*…

For example, he went long on GameStop (NYSE: GME) last week when it went into full panic mode. But he knew there was a strong chance it would bounce. He was right, and the trade resulted in a $12,903 profit.*

Still Committed to the Process

Yeah, Kyle’s going to treat himself after reaching this milestone, and he deserves it. He’s thinking about buying a new car. And he loves basketball, so he wants to buy courtside seats to enjoy games with his dad whenever it’s safe again.

But in general, he’s keeping his wits about him and staying humble. Kyle recognizes that he still has a lot to learn as a trader.

Most importantly, he loves the process and trading. I think that’s what can keep him in this game for the long haul!

Go to sleep & dream big, then awake tomorrow, & every day in the future too, ready to study/work your ass off to turn your dreams into reality! If 2020 taught us anything, it's that life is precious & we must make the most of our time on this planet…how bad do you want success?

— Timothy Sykes (@timothysykes) January 26, 2021

Learn From Kyle

Inspired by Kyle’s story? Here top ways traders can learn from him…

Trading Challenge Chat Moderator

As I mentioned earlier, Kyle’s a Trading Challenge chat room moderator. He’s there every day, answering questions, alerting trades, and inspiring traders.

But remember that he’s a trader first and foremost. He may not get to urgent questions during trading hours. So save them for webinars, premarket, or after hours.

Monthly Recap Videos

How cool is this? Kyle records a recap video every month, where he shares commentary and trade statistics.

Check out his most recent recap video here.

“TWIST: This Week In Steady Trade” Podcast

Kyle also co-hosts the TWIST podcast, along with Jack Kellogg and Matthew Monaco.

On a weekly basis, they cover all sorts of great trading topics, from specific trades to interviews with key traders.

Don’t miss the latest episode. It’s all about how top traders got their start in the market and has a killer lineup with Q&A.

Webinars

Kyle has also hosted webinars for Challenge students. (Don’t miss my most recent post about Kyle where I recap the most important points from his last one.) And he was also part of my most recent Market Mastery live trading event. Don’t miss the next one!

Get Inspired. Study Hard!

Kyle is the seventh millionaire trader to come out of my Trading Challenge.* I’m SO proud of him. I hope traders who are inspired by his story will consider applying!

It’s not easy. It requires hard work. Traders need to build consistency and knowledge over time. It’s not about getting rich quick. It’s about learning and refining a strategy.

Apply for the Trading Challenge Here.

Again, congratulations to Kyle, my latest millionaire student!* I can’t wait to see what the future holds for him.

Please, leave comments to congratulate Kyle or ask questions about his trading journey … I love seeing what readers think!

Leave a reply