Inflation is on everyone’s mind these days.

It’s no longer just traders waiting on government reports. Every household is worried about how much worse things will get.

Sure, main street cares about stocks. But they feel inflation every day when they fill up at the pump or can only afford half of their grocery list.

Yesterday, I put together this video for my members to discuss CPI, what it means for stocks, and how I’m trading around it.

Normally, I never post their exclusive content for the public

However, with talking heads offering terrible advice, this issue is far too important for me not to speak up.

A lot of market promoters will tell you everything is fine, buy the dip, yada, yada, yada.

Clearly, they aren’t looking out for you and me.

Because if they were, they’d tell you what I tell everyone who will listen right now…

If you can only take away one thing from this newsletter, make it those two words.

Contrary to popular belief, markets crash from lows, not highs. What happened in 2020 was an anomaly.

Typically, markets cycle through phases as they push lower until everyone throws in the towel, purges their portfolios, and creates a bottom.

This means all it takes is one news catalyst to push stocks over the edge.

Everyone has their hackles up, with their trigger finger ready to click the mouse at a moment’s notice.

The last few times we saw a bad CPI reading, had a Fed rate decision, or one of the Fed members spoke, markets moved.

So it’s easy to see how markets could crater no matter what the CPI says.

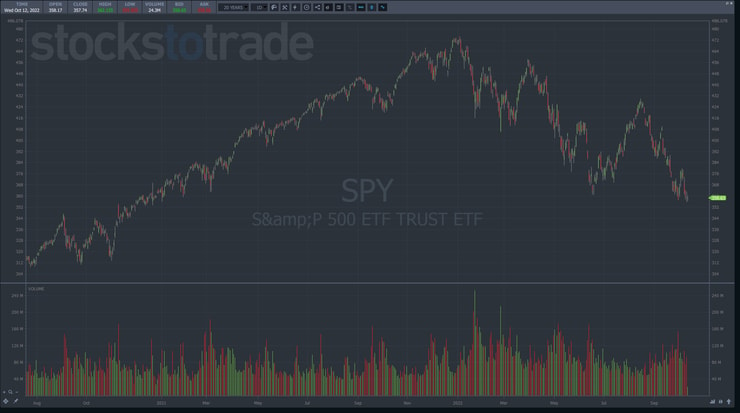

I’ve seen younger traders on Twitter and YouTube point to a daily chart of the S&P 500 ETF (NYSE: SPY) like this…

And say something like, “We’re already down so much, the market is definitely going to bottom soon.

The problem is they discount all the world’s real problems that didn’t exist before the pandemic.

More importantly, they don’t take a broader view of the market using a longer time frame.

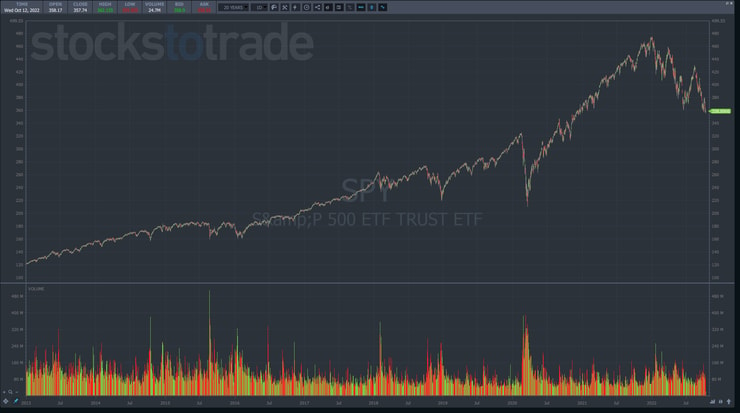

Because if they did, they would show you something like this…

Looking at markets this way gives you an entirely different perspective.

More Breaking News

- Quantum Buzz: D-Wave’s Extraordinary Leap in Fiscal Bookings – Is it the Start of a Transformational Era?

- Rivian Automotive’s Stock Surge: Will It Continue or Fizzle Out?

- CleanSpark Inc.: Unraveling the Stock’s Recent Plunge

Every single rally faded as sellers overwhelmed buyers.

Now, I can’t tell you WHERE we’ll hit a bottom.

But I can tell you likely WHEN we do.

In one of my recent blog posts, I wrote about capitulation and signs of market bottoms.

These are common, simple ways to identify market bottoms.

The thing is, I don’t need to pick off the lowest print.

I find it far easier to wait until I get confirmation before stepping in.

Since I don’t trade large-cap names, I rarely discuss the broader stock market.

However, even as a penny stock trader, it’s important to have a sense of what’s going on.

Penny stocks are my favorite because they create tradeable opportunities even when the major indexes are in free fall.

However, they are still susceptible to being pulled along when we see huge selloffs or rebounds.

Unlike large-cap names like Apple, which may drop only 5%-10%, penny stocks can lose 50% in a matter of minutes.

This past week, I haven’t traded all that much. And when I did, it was with small positions.

Frankly, I had a great first six months of the year that I don’t want to blow trying to swing for the fences.

Because even though I’m cautious, some great names are still out there, like Global Tech Industries Group Inc (OTC: GTII) or Protext Pharma Inc. (OTC: GTII).

Nonetheless, I wait for the setups to form and don’t force the trades, much to the chagrin of my Twitter haters.

And I can almost guarantee you I won’t hold anything overnight into the CPI announcement.

Now, there could be some juicy setups that form after the news release.

But trying to guess what will happen beforehand is a fool’s game, or at least one I’m not very good at.

So, take the time to study the patterns, design your setups, and prepare so that WHEN the opportunities come, and they will, you’re ready to jump on them.

My goal isn’t to make people a millionaire overnight. It’s to make them millionaires in their lifetime.

Take the first step and join my Millionaire Challenge.

—Tim

Leave a reply