“It does not matter how many times you get knocked down, but how many times you get up.” – Vince Lombardi

When I met Paul Delgado, he was in a bad place.

He had $47K in personal debt, recently filed for divorce, and forced to move into his grandmother’s house.

Not only did he feel down about his situation, but he felt like he was failing his son, the most important person in his life.

Trading literally saved his life.

Paul took the Millionaire Challenge and made it a LIFE challenge.

He acknowledged his mistakes and took ownership of his life, one of the HARDEST things anyone can do.

Paul crafted plans for trading and life.

He studied hard while balancing the time he spent with his family.

Today, his debt is cleared, he’s got a new car (and residence), spends loads of time with his son, and many hours giving back to the community.

Paul spoke at our Trading Conference this year, embracing his story in front of everyone in one of the most moving experiences I’ve seen.

His story is so inspiring that I want to take some time and share it with you.

Because we all struggle from time to time.

Knowing and feeling that others are out there just like us is important.

And we can use their stories to help us break down the barriers we each face.

It All Starts With You

Trading chat rooms, like the ones for my Millionaire Challenge students, help folks network, discuss ideas, and become part of a community.

Yet, the only one who controls the mouse clicks to buy and sell is you.

Every trader is responsible for their actions and inactions.

When you find yourself in a trade, unsure of what to do next, recognize that it happened because you failed to prepare.

This isn’t a bad thing by any stretch.

In fact, these are the best learning opportunities.

I can teach you all the trading concepts under the sun. But you cannot ignore basic principles like cutting losses quickly and succeed.

At the same time, you can’t get down on yourself.

Yes, losing trades will make you feel bad. But they don’t own you.

Identify Your Strategy

Paul found his market with one of my favorite setups – panic dip buys.

He loves to grab stocks down 50%-85% off their all-time highs and 25%-50% off their day-highs.

That’s his strategy.

He then designs setups to fit this strategy.

For him, that means buying off previous support areas and higher lows of a previous low set.

He prefers momentum plays with lots of eyes watching.

This is where Paul found his comfort zone and consistency.

Other traders, like Kyle Williams, love to sell short.

You choose the strategy that makes you the most comfortable, fits in with your schedule, and gives you the most success.

Don’t try to copy someone else because they made a lot of money or they hit big wins.

Everyone has to find their own Fleetwood Mac and go their own way.

More Breaking News

- Boxlight Launches Next-Gen Communication Platform After Texas Partnership

- Grab Stock Gains Amid Strategic Moves and Financial Insights

- Nu Holdings: Navigating Challenges in a Dynamic Market Environment

- B2Gold Corporation’s Stock Fluctuations Triggered By Market Events

But that doesn’t mean you can’t have similar ideas.

Stay Humble

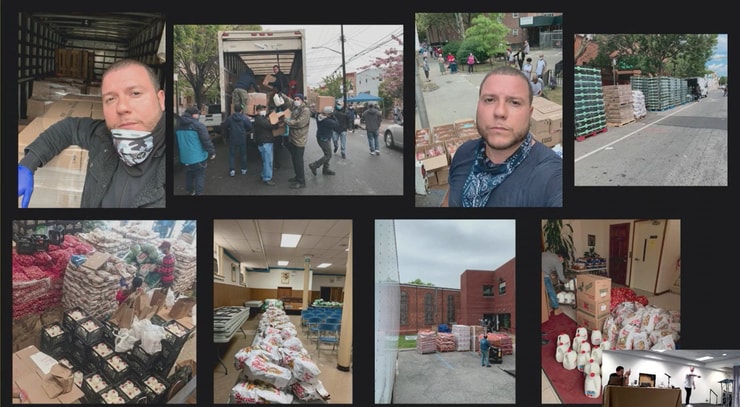

During Covid, Paul lived his life’s mission.

He supported small business restaurants while feeding first responders.

His work with NYC food pantries helped feed tens of thousands of families.

Trading doesn’t care who you are, how much money you have, or where you are from.

Every retail trader is the same.

I’ve seen brilliant people fail as traders and high school dropouts become millionaires.

If you treat trading like a hobby, it will never be anything more than a hobby.

If you treat trading like a business, then take it seriously.

You have to put in the effort and work, knowing that it takes time to become consistently profitable.

But trading should be a part of your life, not all of your life.

Make sure you take time for the things that matter – family, friends, and community.

Every one of my millionaire students knows when to step back from the keyboard.

Don’t be afraid to take a break and miss trades.

The market will be there when you get back.

Be humble and treat every day like it’s your first.

—Tim

Leave a reply