31 students I helped cross that $1 million threshold.

He’s the latest in a line that stretches back over a decade.

In a remarkable coincidence, it’s also almost 9 years to the day one of my first students, Tim Gritanni, cross that threshold and got a nice writeup on CNN.

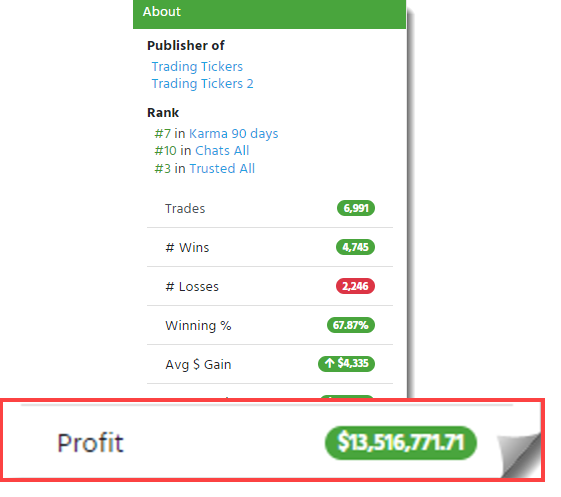

Last I checked, this family man, who started with $1,500, is up well over $13 million…

Looking back, it’s remarkable what they and my other students achieved.

For as much as folks like to talk about change, so much has stayed the same.

You could take my 7-Step Penny Stock Framework, look at any of the last 20 years, and have a blueprint that works in every time.

How is this even possible?

Do I have some sort of magic touch to endow traders with special insights?

Hardly.

It’s the same practical advice I’m about to share with you.

Let Promoters Do The Work

Promoters make trading much easier for me.

They’re the reason stocks stick to my 7-Step Penny Stock Framework so well.

Some of these folks are legit public relations employees.

Others are pure pump-and-dump scammers.

You’ve probably seen or heard about the Wolf of Wall Street.

I sat down with him for a podcast a few months ago.

This guy went to prison for the scams he ran.

And even he was surprised at not just how promoters still operate but how many there are.

He knows all too well the devastation these promoters cause.

They suck regular folks in, juice shares, and sell out their holdings for a profit, leaving everyone else holding the bag.

I call these guys out when I see them.

But I also know they exist and how to exploit them.

It’s much easier to do this with small caps and OTCs than large-caps.

Small caps and OTCs are simply easier to manipulate.

I teach my students two very important lessons.

First, how to spot promoters.

If nothing else, I want my students and anyone that will listen to stay safe.

Second, my students learn to take advantage of their tactics.

That’s how and why my 7-Step Penny Framework works.

Follow The Framework

Once my students understand promoters, I teach them the ins and outs of my infamous framework.

It’s truly amazing to see it work month after month, year after year.

My students can use this framework and the setups I teach to match their style and preference.

For example, on the front side of a Supernova, breakout trades and dip buys work great.

My personal favorite is to take morning panic dip buys on the backside after a stock starts to crash and promoters work to prop up a stock.

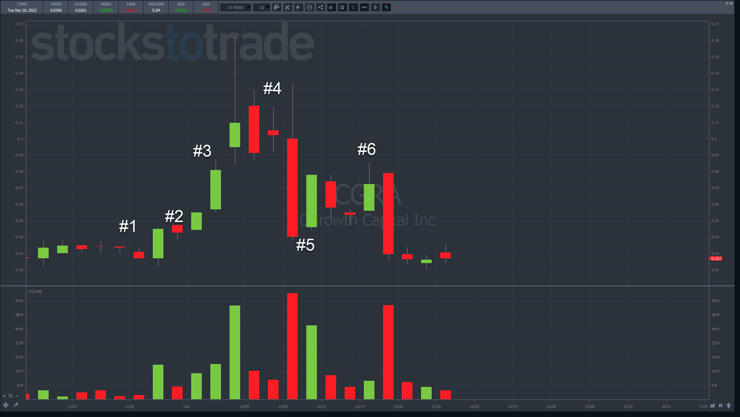

Here’s an example from a recent runner, CGrowth Capital Inc. (OTC: CGRA).

I participated in this one several times with panic dip buys.

I combined Breaking News Catalysts with this framework and setup selection to create powerful, repeatable trades that follow a straightforward process.

It’s like cooking.

With a recipe, ingredients, and a kitchen, you can whip up some fantastic dishes.

More Breaking News

- BigBear.ai’s Journey in the Stock Market: Rising Trends and Challenges

- Top Bitcoin Stocks to Watch Under “Crypto Emperor Trump”

The more you do it, the better you get.

Lose Small and Fast

Unlike cooking, traders who bet too much can burn the house down.

One of the hardest lessons to learn is also one of the most important.

No trader can succeed without risk management.

I keep it simple for myself.

My setups either work quickly or I cut them loose.

If I know what to look for when I buy a morning panic dip, anything that doesn’t meet my expectations gets tossed.

Initially, it feels like defeat to rack up a bunch of small losses.

But when you hit just one decent winner, you quickly realize it pays for all of those losses and then some.

Heck, many of my profitable students make a few grand on each trade and lose a few hundred.

If you look at my profile, you’ll see the same thing.

There’s no reason to hold and hope. That’s what promoters want you to do.

Stick with a process that manages risk and you’ll quickly find that not only are decisions easier, they make more sense.

And the best part…once you get good, it will last you a lifetime.

That’s why the Millionaire Challenge is a great place to start.

—Tim

Leave a reply