While most of the financial media are focused on the debt ceiling and its implications on the economy…

I’m out here trading stocks that are screaming up by +100% …

And that’s something a lot of newbie traders don’t understand.

The stock market isn’t the economy.

And when it comes to small-cap penny stocks, they are in a league of their own.

That’s why we consistently see stocks move 80%, 100%, and even 200% in a single day…

But how do you take advantage of stocks like OCEA, which opened at $7.30 yesterday and traded at $12 before lunchtime?

After all, stocks like OCEA are volatile and scary…it’s VERY easy to lose money trading them if you don’t have a plan or strategy.

I’ll show you how I profited off the trade successfully and share with you the rules I use for trading crazy volatile stocks like OCEA.

Table of Contents

How I Find Plays Like OCEA

2025 Millionaire Media, LLCIt’s no secret that I’m constantly on the move. My charitable obligations have me traveling across the globe all year round.

And when it comes to trading under these circumstances, it’s just me and my laptop.

Most of the time, the WiFi is spotty…which just adds to the challenge.

I’m not one of those traders who has 8 screens, listens to various squawk boxes, and watches the talking heads discuss stocks on TV.

I have to be super-efficient with what I put on my screen.

That’s why I’m using the StocksToTrade Breaking News Chat to help me stay informed on what’s moving markets and the latest stock catalysts.

You don’t need to spend a lot of money on fancy equipment and tools.

The reason why I like StocksToTrade Breaking News isn’t that it gives me the latest stock market news and catalysts in real-time.

But it doesn’t something even more important.

It curates the news for me.

In other words, the two analysts who run the service utilize their experience and provide “color” to the headlines.

Imagine how helpful that is for newbies who are just learning about catalyst trading.

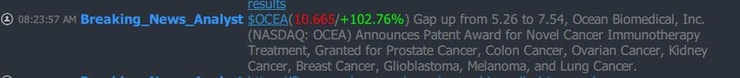

Anyways, here’s the news that set off:

Ocean Biomedical, Inc. (NASDAQ: OCEA) Announces Patent Award for Novel Cancer Immunotherapy Treatment, Granted for Prostate Cancer, Colon Cancer, Ovarian Cancer, Kidney Cancer, Breast Cancer, Glioblastoma, Melanoma, and Lung Cancer.

The stock rallied from $5.40 to $7.54 in the pre-market.

Here’s the Breaking News Analyst mentioning the stock:

Source: StocksToTrade Breaking News

Putting Context Behind Your Trades

The other great thing about the StocksToTrade Platform is that gives me all the important stock structure information I need.

For example:

I know that OCEA has a float of around 33 million shares and was once a high-flying stock trading at $26.60. I also know that the average trading volume is 1.6 million shares.

This is all very super helpful information to have before you decide to place a trade.

How I Traded OCEA

2025 Millionaire Media, LLCThe market going into Tuesday was hot. Specifically, the Nasdaq has seen non-stop buying in mega-cap tech stocks like NVDA, AMD, GOOGL, and META.

And although I don’t usually trade those kinds of stocks…it’s good for my trading style.

A good, strong market will boost traders’ risk appetite. And spill over to the more speculative small caps and OTC names.

We’ve witnessed it recently, with triple-digit movers in HEPA and AVRO this week.

My plan for OCEA was to watch.

It’s hard not to get FOMO when you see a stock skipping 50 cents higher with every blink of an eye.

But it’s soo EASY to get wrecked taking a trade like OCEA without a plan.

I planned to wait for a dip in the morning…

With the stock selling off from $9, I thought it would be a good place for me to take a shot.

I got in at $8.10, and before you knew it, I was peeling off the trade at $8.81.

So how did I trade this “safely?”

First, I was in the trade for small size. I only had 700 shares. That’s small for me. It might not be for you, so try to think in relative terms.

But one of the easiest ways to protect myself against highly volatile stocks is by position-sizing the trades small.

Second, I had a plan. Get out fast if it doesn’t move or work. And take profits near $9 if it did.

I aim for quick, consistent profits. And stacking small wins can lead to substantial profits over time. It’s how I’ve gotten to $7.4 million in career trading profits.

And it’s how I teach my students how to approach trading.

Third, I don’t believe in chasing these types of plays.

If you’re patient, you’ll find another opportunity, there’s no reason to chase any single trade in this market.

Being first offers the best chances to profit. But if you missed the Breaking News Catalyst…then I find it best to wait for a morning panic…and try to buy on a sizeable dip.

One last note about how I trade these types of stocks…

I don’t fall for the hype. I don’t trust these companies at all. That’s why I’m aiming for quick in-and-out profits. Newbie traders love falling in love with the story and catalyst…which can lead to making emotionally chaotic choices.

OCEA closed at $6.74…a significant drop from its highs of $12.08.

Take it one trade at a time…and learn from your losses and wins.

I believe I’ve developed the best stock trading mentorship program in the world…But despite all the millionaire students, my program has helped…I’m ready for the next class of traders to step up and embrace the challenge.

Leave a reply