The 2020 and early 2021 stock market showed us what’s possible in volatile penny stocks — HUGE moves.

So how can you trade the most volatile penny stocks? We’ll get into all the details here, including how to find them, pros and cons of trading them, and how to wisely approach these stocks.

I love to trade volatile penny stocks. But you have to be prepared. As I’ve learned over 20+ years in the market, preparation is everything.

Now, let’s get to it…

Table of Contents

- 1 What Is Stock Volatility?

- 2 What Are High-Volatility Penny Stocks?

- 3 Why Volatility Is Important

- 4 What Affects Stock Volatility?

- 5 3 of the Most Volatile Penny Stocks of 2024

- 6 Examples of High-Volatility Penny Stocks

- 7 Key Benefits of Trading Volatile Stocks

- 8 How to Find Volatile Penny Stocks

- 9 Trading Challenge

- 10 The Bottom Line on Volatile Penny Stocks

What Is Stock Volatility?

Stock volatility is extreme price fluctuations in a short amount of time. A volatile stock has a wide swing in price throughout a day, a few days, or maybe longer.

So instead of a stock that moves 50 cents to 51 cents in a day, volatile penny stocks might move 50 cents to $1 a day or more. (I’ll show you some great examples in a bit.)

These stocks can be a great way to grow a small account. But they also can mean staggering losses if you’re not careful. Always remember to follow rule #1 and cut losses quickly.

What Are High-Volatility Penny Stocks?

So … what is high volatility in penny stocks? To help you understand, let’s break it down piece by piece.

High: Greater quantity than normal.

Volatility: This refers to a stock’s price change within a finite period of time, such as a day, week, or month. If a stock price is spiking high and low and moving quickly and erratically, it’s considered volatile. And volatility can move in either direction.

Penny stocks: Low-priced stocks. They’re not all sold for pennies. Personally, I consider a penny stock anything trading for $5 per share or less.

In a nutshell, volatile penny stocks are low-priced stocks that experience unusually rapid and significant price fluctuations. Typically, this is within a short period of time — these big shifts can occur in a single day, within hours, or even in minutes.

Why Volatility Is Important

Trading volatile penny stocks can potentially be important for growing your account.

I use the volatility of these stocks to my advantage. And here’s the thing … I don’t have to catch the bottom and the top of the price moves. I can be in and out within a few minutes for a profit.*

(*My results are far from typical. Individual results will vary. Most traders lose money. I have the benefit of years of hard work and dedication under my belt. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

That’s why I love volatile penny stocks for day trading. I take the meat of the move, then I’m on to the next opportunity. Taking small gains can add up over time — as long as you keep your losses small.

As you get more confident and comfortable with your strategy, you can potentially increase your position size over time.

What Affects Stock Volatility?

Two things that create volatility in a stock are the float and volume — or supply and demand.

The float is the number of shares available to be traded by the public — or the supply. And volume represents demand.

A low float means there’s a limited supply. If demand for the shares increases due to a catalyst, the stock price can increase quickly.

On the flip side, if there’s low demand for shares and a lot of sellers, the stock price will drop.

If a stock has a large number of shares available to trade, it will take more volume to get the price moving. It can still happen. Especially with low-priced stocks — traders can get more bang for their buck.

Volatility can also be caused by stop losses. A stop loss is an order you place to sell at your risk level. It sits as a sell order but doesn’t execute until that price is hit by the bid or ask.

Traders use it to protect themselves from large losses if they can’t monitor their position during the day … I personally don’t use stop-loss orders.

The problem? Most traders put them in at the same level. So when the stock dips down to that level, tons of sell orders get executed. All that selling can create a steep drop in the stock price FAST.

How fast? Let’s look at some examples of volatile penny stocks from 2020…

3 of the Most Volatile Penny Stocks of 2024

Again, we saw crazy volatility in 2020’s market. There were tons of opportunities — if you were prepared.

Here are a few examples of some of the most volatile penny stocks of 2020. Some of them spiked out of penny stock territory for a bit.

But with these sketchy stocks, most will end up where they started when all the hype fades. Remember to take profits and never hold and hope … And even though these stocks are from 2020, STUDY UP. History doesn’t repeat, but it often rhymes. You can learn a lot from these hot market runners.

Genius Brands International, Inc. (NASDAQ: GNUS)

GNUS ran on news of its TV channel in June 2020. The stock had huge ups and downs since the news came out.

The company also did multiple offerings, which resulted in some quick downward moves.

Check out the daily chart. On June 4, the stock was so volatile it was halted multiple times by the SEC on the way up and on the way down. Look at the volume it traded…

Immuron Limited (NASDAQ: IMRN)

On June 9, 2020, Immuron Limited spiked on news that its research partner requested a meeting with the FDA to discuss a new drug to treat infections.

This is a low-float stock with under two million shares available to trade. With low-floats, the moves can be even more volatile. Always remember to sell into strength.

More Breaking News

- Is Lucid Group, Inc. Ready to Bounce Back After Recent Setbacks?

- Riot Platforms Inc. Stock: A Rollercoaster with Cryptocurrency’s Wild Swings

- Trio Petroleum Corp.: An Unexpected Surge and What It Means for Investors

Jiayin Group Inc. (NASDAQ: JFIN)

On June 10, 2020, Jiayin Group stock started running in premarket around the $4s. By 11 a.m. Eastern, the stock was trading at $29!

And get this … there was no news. It was the day before earnings were due.

Maybe it was short sellers covering before earnings or maybe it was insider trading … Who knows. But study this one so you can try understand volatile penny stocks and learn how to trade opportunities like this.

Examples of High-Volatility Penny Stocks

What do you look for with volatile penny stocks? Here are some key characteristics with examples…

Rapid Price Movement

These stocks can spike FAST, even within the course of a day.

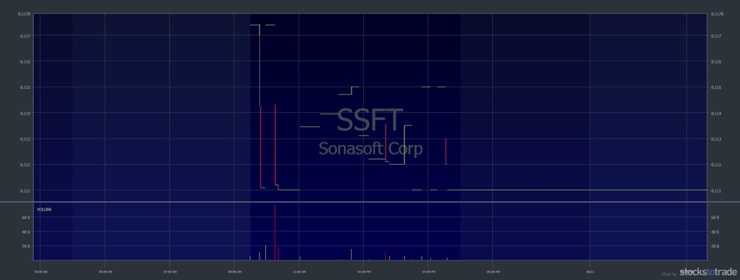

These are the stocks that day traders love, as they provide opportunities for potential gains. Like Sonasoft Corp. (OTCQB: SSFT) on June 11. The stock was running on news of a partnership with Google Inc.

When a 15-cent stock doubles in less than an hour, that’s a good percent gain. Check out the chart:

Biggest Gainers and Losers

A big gainer or loser could be a volatile penny stock. That won’t always be the case … The right catalyst could cause a one-off price fluctuation.

Let’s look at Technical Communications Corporation (NASDAQ: TCCO) as an example. In December 2019, it reported quarterly earnings. The stock traded between $4.80 and $10.49 during regular market hours.

The stock moved $1 in a minute multiple times throughout the day.

Yes, that’s impressive. Again, preparation is everything. Trading volatility can be stressful. Don’t get caught on the wrong side of these moves. Look at the intraday volatility…

Activity

If a stock isn’t moving much, there are few buyers and sellers. For comparison, let’s look at the SSFT chart the day before the news was released …

There’s no volume and no interest. Don’t trade stocks with no volume. If you take a large position, you could find yourself stuck in the trade.

With little activity on the stock, there’s likely little volatility. So if you’re looking for volatile penny stocks, you gotta consider volume and activity.

Key Benefits of Trading Volatile Stocks

This is important: volatile stocks are riskier than more stable and slow-moving stocks.

But all trading and investing is inherently risky. I’ve done well in penny stocks because I educated myself on how they move. I trade by a set of rules. And I love volatility, even though I’m a conservative trader.

The 2020 market has been insane with volatility — and I’m having my best trading in years.* Nope, my results aren’t typical. I’ve been at this for over 20 years. To me, the real question is how you can learn to trade smarter through it.

Start with my no-cost two-hour “Volatility Survival Guide.” It can help you in this crazy volatility and in volatile markets to come. Now, let’s look at some pros for trading volatile stocks…

Opportunities for Traders With Small Accounts

If you have a small account, high-volatility penny stocks can provide you the opportunity to grow a small account.

This is how I earned my money, and it’s the method of trading I focus on most as a teacher with my Trading Challenge students.

And it works in bull and bear markets. I’ve had my best year so far even when the markets were at their lows.* That’s because I’m willing to embrace volatility in stocks.

With volatile stocks, it’s about following trends, patterns, and a solid trading plan. This is what I teach in my Trading Challenge. The overall market doesn’t matter. It’s your ability to follow the price action and patterns, mitigate risk, and make smarter trades.

Ride Momentum of Undervalued Stocks

Sometimes, stock prices go down for reasons that have nothing to do with the company in question. It could be the market. Or there could be a negative catalyst affecting one company that brings down other stocks in similar sectors.

You gotta do your research if you want to ride the momentum as undervalued stocks rebound and make huge gains.

Attractive Entry Prices

Let’s be real. One huge advantage of penny stocks is their low price. They’re accessible to traders of all levels.

This can make it not only possible but highly tempting to just buy a ton of shares and see what happens. But I want you to take a more calculated approach.

You need to put together a detailed trading plan. Otherwise, you’re just gambling. It’s important to set up good practices for your very first trade and every trade after.

Scaling Up

The basics of picking stocks are the same no matter the share price.

You need to look at the company with fundamental research and at the stock’s action with technical research. This is part of how you identify stocks to trade.

As your knowledge and account both grow, you can scale up these techniques. This means you can potentially apply the skills you develop trading volatile penny stocks to larger positions in the future.

How to Find Volatile Penny Stocks

Good news: finding volatile penny stocks is not rocket science. Start with these tips…

#1 Figure Out Your Risk Tolerance

This is important when trading volatile penny stocks.

Here are two things to consider regarding risk tolerance and low-priced stocks…

What’s your goal? If your goal is to grow a small account trading with a smart set of rules, volatile penny stocks could be right for you.

How big is your account? If you have a small account, you need to start slow, take small positions, and work your way up incrementally.

Paper trading can be a great tool for traders to explore volatile stocks. It’s a way to virtually trade stocks. It’s just like real trading, but without real money.

You can paper trade to test out techniques before risking your hard-earned capital. This can help you gain confidence and experience.

#2 Use a Stock Screener

A stock screener helps you locate stocks to fit your trading style, risk tolerance, and trading prowess. You can divide stocks by sector, percentage gainers, and focus on float and volatility.

I use StocksToTrade. This platform is intuitive and includes tools to help you find stocks that fit your strategy. And I helped design it, so it’s great for low-priced stocks.

#3 Create Your Penny Stocks Watchlist

Your shortlist of penny stocks you’re considering trading is your watchlist.

How you track your watchlist is up to you. For example, you might choose to maintain and monitor several on your trading platform, like StocksToTrade.

Every trader is different. You can learn more about how my top student Tim Grittani found his own watchlist method in this video.

To clarify, your watchlist is NOT a list of stocks you’ll definitely trade. It’s a list of stocks you’ll consider trading if and when they meet your specific criteria.

Find out which stocks I’m watching every week. Sign up for my no-cost watchlist here.

#4 Technical and Fundamental Analysis

You want to find the stocks that have a reliable pattern, good fundamentals, and high volatility. Your technical and fundamental analysis can help you here.

Fundamental analysis is all about the company’s financials, news releases, and future plans. You look at things like earnings reports and its overall stability. This can affect the stock price now and in the future.

Technical analysis is where you hit the charts and look at the historical data behind the stock’s price movement. When you look at its chart, can you see distinct patterns? I love patterns and consider them one of the most important things when choosing stocks.

Be sure to look at daily, weekly, and yearly charts to try to discern any patterns that look like they might be repeating.

Do this for all of the stocks on your watchlist, you probably have some favorites emerging. Hopefully, they have high volatility and clean patterns.

If you have a few really strong contenders, you may want to outline a trading pattern for each stock. That way if the setup is there, you’ll be ready to execute the trade. You gotta be prepared.

#5 Follow Your Stock Indicators and Favorite Patterns

Next is the hard part: the watchful waiting. You have a strong watchlist with a few strong contenders and trading plans with entries, exits, and stop losses.

Now, you wait and see if the stocks hit your criteria.

It’s important to keep monitoring what happens with a stock — the market is ever-changing. A stock could move and be more appetizing as a trade, or it could make you want to walk away.

Here’s what’s really key: Even if you never trade a stock on your watchlist, you can always learn something from watching it.

#6 Look for News Catalysts

Volatile penny stocks have catalysts. So you gotta keep up with the news.

Trading platforms like StocksToTrade link to the latest headlines right on the ticker’s page.

If you love catalysts and how they can move stocks, you’ll love StocksToTrade’s newest add-on feature, Breaking News Chat. Two highly seasoned market pros watch all the news and alert members on the news that matters. Learn more about that here.

Now, if you’re waiting for an entry point for a trade and you hear big news that the company has a big new merger or an exciting new hire, this could be the time to execute your trade.

On the other hand, negative news might make you rethink the trade or consider going short.

Just because a stock is on your watchlist doesn’t mean you ever have to trade it.

Sometimes a catalyst will disrupt the pattern. It’s OK to walk away. Sometimes the best trade is no trade.

#7 Improve Your Trading Skills

When you improve your trading skills, it’s like a rising tide that lifts all boats. So the caliber of your trading techniques, including finding worthwhile highly-volatile penny stocks, will improve.

I have tons of educational resources on day trading. A lot are even free, like this penny stock guide and my YouTube channel. Take the time to learn the basics so you can focus on trading smarter every day.

And if you’re ready for the next step in your trading, apply for my…

Trading Challenge

Can you teach yourself how to trade without assistance? Yes, but be prepared to make a lot of mistakes. I say this with confidence — I’m self-taught.

Not all mistakes are bad, especially if you learn from them. But you don’t have to learn every mistake the hard way.

My Trading Challenge is a mentor-based program where I teach students how to trade. My students can benefit from my trading techniques and experience. They can find out how to avoid the mistakes I made while I was learning.

It’s an immersive approach where you learn as you trade (or paper trade). I want to teach you how to set up a strong foundation as a trader.

You’ll learn the art of creating a watchlist and how to identify patterns. Most importantly, you’ll find your own trading style.

You’ll never be right all of the time, but by taking part in my Challenge you can establish smart trading practices. It takes a ton of dedication, commitment, and discipline. Up for the Challenge? Apply now.

The Bottom Line on Volatile Penny Stocks

Volatile penny stocks can provide opportunities to grow your account — but you gotta be smart about it.

This can be enticing for traders at any level, but it’s particularly appealing to traders with small accounts.

But as the name implies, these stocks are volatile and risky. It’s easy to make mistakes that can cost you capital if you don’t do your research. And if you don’t cut losses quickly — my #1 rule — you can take yourself out of the game all too fast.

Before you begin trading penny stocks, it’s extremely important to take the time to build your knowledge account. It’s how my top traders started, and it’s how you become a self-sufficient trader.

What do you think about volatile penny stocks? Are you a fan? Leave a comment below and tell me what you think!

Leave a reply