As a teacher, I have no desire to create a legion of mini-me traders. I want to help traders become self-sufficient, which is why I took notice when I received an email from 26-year-old trader Grant.

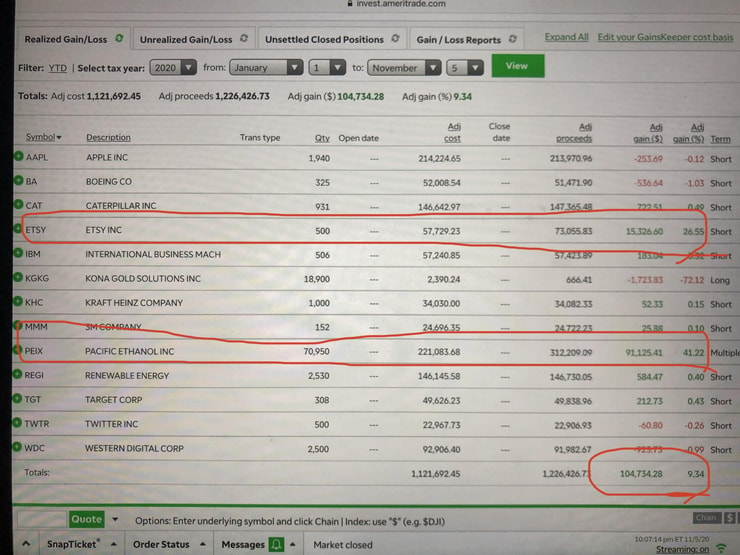

In the email, he said he’d just made a series of trades totaling over $100K — he’s over six figures in profits for the year.*

He wanted to thank me for inspiring and teaching him about trading. As it turns out, his recent trades were the result of a strategy he developed combining elements of long-term investing with my penny stock trading strategy.

Obviously, I love it when my students are killing it. I’ve got a ton of students breaking records this year, like Jack Kellogg, who just passed $1 million in profits*…

But more importantly, I’m proud that Grant followed one of my most important lessons — he learned from my strategies then adapted them into a trading style that works for him.

Let’s take a look at Grant’s story, strategy, and trading goals — get inspired, study hard, and learn from him!

(*These results are not typical. Individual results will vary. Most traders lose money. My top students have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

Grant has done a lot in his 26 years. He’s lived in California, New York, and currently, Texas. He ran his own beekeeping business for years. And he’s committed to community involvement and volunteering. Oh, and he’s fluent in Chinese.

Grant’s also been trading since he was 15.

What can I tell you? My students are many things, but they’re never boring.

Beekeeping: Grant’s First Business

At the tender age of 12, Grant learned that the bee population was dwindling in his hometown of Lodi, California — and saw an opportunity. With a little financial backing from his parents, he created a small beekeeping and swarm removal business.

Due to the bee population shortage, exterminating bees was prohibited. So Grant called around to exterminators, seeing if they could use his safe swarm removal services.

As Grant recalls, “because I was a kid, they all thought, ‘Oh, wow. Of course we’ll help out a kid.’ And so that’s kinda how I grew it. I would go charge people to take the bees away. I did that for five years.”

Opportunities are everywhere. You just have to be in the right mindset to be able to see them and capitalize on them.

This concept extends to the stock market. Regardless of whether it’s a bull or bear market, there’s always a hot sector or a stock that’s spiking. Finding the most promising trading opportunities is a matter of being able to adapt to what’s working in the market right now.

My Trading Challenge is all about getting new traders in the right mindset. If you’re ready to put in the work to become a self-sufficient, smart trader, consider applying.

Starting to Trade at Age 15

Grant opened his first brokerage account at age 15.

In addition to his beekeeping business, he was active in his community. One day, while volunteering with his uncle, something unexpected happened. It cemented Grant’s future as a trader…

His uncle got a call from his broker. A stock he held, Caterpillar Inc. (NYSE: CAT), had apparently gone up to his target price.

As Grant recalls, “His broker said, ‘Do you want to exit?’ And my uncle said, ‘Yeah.’ It was a quick phone call and my uncle looked at me and he said, “That’s how you make $30 grand.’”

Grant was blown away. He’d always had an interest in stocks, but they remained “a big mystery” to him. Now, he wanted to know more.

His uncle didn’t hesitate — they hopped in the car and went to the bank. There, his uncle “withdrew a $2,000 cashier’s check and he said, “OK, we’re going to open up a brokerage account.”

Grant’s uncle was his first trading mentor. But he gave Grant permission to use the account as he saw fit.

Grant didn’t take this responsibility lightly. In the time between opening the account and moving to New York at 19 for an extended volunteering stint, he grew that $2,000 to “$20,000 or $25,000.”

More Breaking News

- Vizsla Silver Corp US Market Rift: Challenging Times Ahead

- Ichor Holdings Upgrade Boosts Stock Amid Strong Earnings

- Morgan Stanley’s Bold Moves Boost Cipher Mining’s Prospects

- HUMA Stock Shows Volatility Amid Speculation and Economic Factors

Grant’s Initial Strategy

Initially, Grant was guided by his uncle to “learn about the world around you … learn where things come from, learn why they came about that way … learn the history behind the company.”

Instead of focusing on blue-chip stocks, he focused on “undervalued stocks, like Chiquita Banana before they got bought out … smaller companies that had cash on hand, low debt.”

He was always on the lookout for potential trades — even a trip to the grocery store was like navigating a minefield of opportunities.

For instance, if his mom commented that the price of milk had gone up, he’d hit Yahoo! Finance to see if the manufacturer was a publicly traded company.

But it was all about finding value for Grant. “I never really got into OTC stocks, pink sheets, stuff like that. Just because it was kind of like, whoa, that’s a mystery … unknown day trader stuff, you know?”

Adapting His Strategy

But suddenly, in 2013, his strategy suddenly wasn’t as effective.

“I saw that the strategy was kind of phasing out, I was kind of like ‘What do you do now? If people aren’t interested in just a solid company or a solid product, what are you supposed to invest in?’”

He hit the internet, and that’s how he found me.

Trading Education: Learning the Rules

Like many potential students — including my first millionaire student*, Michael Goode — Grant was wary of me at first.

He says, “I did my research. It was like, OK, who is this guy? Is he some lowlife, washed-up Wall Street guy who’s just trying to get your money?”

This is a good thing — there are so many fakes out there. It’s smart to be suspicious until you do your research!

Grant was willing to put in the time, and he saw that my transparency was for real. He liked how my teaching is “not about hot stock picks or following the crowd … It’s about you having to do your own due diligence.”

It was eye-opening to realize that he could trade instead of invest for five or 10 years.

He signed up to be a student. “I would watch the daily video recaps … I was watching Tim Grittani. He was just passing a million in profits.*”

Even though Grant is more of an investor than a trader, it still changed his approach to the market. “Having seen the underbelly of Wall Street and reading the SEC filings and not believing the chat rooms … it’s a totally different perspective when it comes to investing.”

Honestly, I wish my 30-Day Bootcamp had been around when Grant was first getting started — it’s the perfect starting point for new traders, and one of my top-selling educational tools right now. But luckily, he was able to navigate my other offerings and learned a lot.

Grant’s $100k+ Trades

Let’s take a closer look at Grant’s killer trades. Learn from what he did right … and what he did wrong!

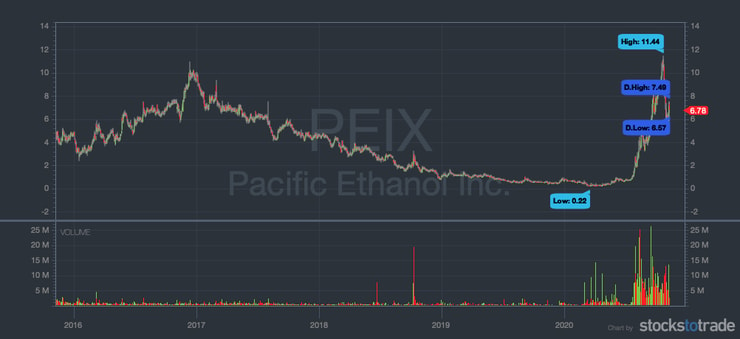

Pacific Ethanol Inc (NASDAQ: PEIX)

Grant’s beekeeping career actually led to his biggest trades to date.

One day, while working a swarm removal gig, he noticed a company across the street called Pacific Ethanol (NASDAQ: PEIX.) He googled it. “I saw Pacific was traded publicly… at 80 cents a share.”

He waited until after the company did a reverse split, then bought in at “about $2.40 or $2.50.” Both he and his dad traded — his dad sold at about $20, and made “at least $70 grand on it.”

Until this point, Grant’s parents “didn’t really like me investing, especially as a kid, so they were like, ‘Hey, you’re gonna get craned.’” But after the PEIX trade, they got interested.

In retrospect, the stock had gone supernova then dipped. Unfortunately, they started thinking they were invincible.

So when it popped back up, Grant and his dad went in big — “about $30 grand worth.”

Unfortunately, it timed out with the end of the Obama administration. When Democrats leave office, renewables tend to take a hit. The stock price plummeted.

Holding … With a Strategy

Grant knew that knowledge is power in trading, so he started “doing the research, looking at the SEC filings, looking at the insider buys, too, kind of gauging, ‘If we were to hedge this position, what do we need to get it down to?’

“We got it from $10.50 to like low $5s, and then we got it from the $5s to $2.33, but at that point, we put another $30 grand in it. So total like little over $70,000 investment. And then it dipped to 25 cents a share.”

As my students know, this is very different from my strategy — I’m all about finding the biggest gainers on StocksToTrade, trading based on patterns and catalysts, and cutting losses quickly. But Grant had a plan.

He recognized that there would continue to be a need for ethanol, which is federally contracted.

He also recognized the tricks that companies play. “Their management was kind of sketchy. So once it dropped below a dollar, I was thinking ‘They’ve got to pump it or a lot of management, when they did their buys in the high threes, they’re going to lose money too.’”

It took quite a bit of time, but Grant was right. Eventually, the stock took off.

That’s when he took action. The first trade resulted in an approximately $30K profit. The second resulted in over $62K.*

After four years of holding, Grant was able to exit the trade profitably. But he’d learned some huge lessons: “OK, never gonna hold and hope, and … cut losses quickly.”

I couldn’t agree more, Grant!

Etsy Inc. (NASDAQ: ETSY)

Etsy (NASDAQ: ETSY) — aka the ‘eBay for handmade goods’ — has taken off during the pandemic. Turns out, there’s a huge market for quirky homemade masks.

When the stock dipped big after earnings — from $141 to $115 — Grant saw his entry. But as he held the position, he wasn’t sure if swing trading had been the right decision.

“It kept bouncing between like $110 and $115 for like a week straight. And I was like, man, if I just would’ve day traded it, right?”

But then things changed. “It just took off — I think it hit $150. And I thought it was going to go to at least $160. But then I had a really big pullback back down to like $130 and I was like, “Something’s not right here.” After a bounce, he got out — for a $15,327 profit.*

What’s Next For Grant?

What’s next for Grant? Continued trading … and continued learning.

Right now, he’s working for a mechanical contractor, doing logistics. But he concedes, “I definitely make more trading on my lunch break.” He just had a $5K trade* as I write this…

Currently, his trading strategy involves looking at morning dips and looking for potential double bottoms from the morning that he can buy during an afternoon run.

He also started a small hedge fund with his dad.

Ultimately, he wants to turn his trading career into investments that provide passive income, but he’s not out for insane riches.

“My wife and I live simply. We’re not impressed by flashy cars and stuff. That’s just not who we are or how we were raised. Not that those things are bad, but we know what makes us happy.”

A trader after my own heart! I’m not into flashy cars anymore … I’ve found a bigger purpose in donating my trading profits to charity. I think Grant has a lot of promise — he’s got the right mindset.

Never Give Up…

Grant’s strategy is very different from mine. I’m a day trader, and he holds for months or, in some cases, years. Yet he’s learned from my strategy and found a way to apply it to a very different type of trading. That’s the beauty of being a self-sufficient trader!

It just goes to show that while there are endless ways to approach the stock market, certain principles are universal — like having a plan and knowing when to cut losses.

Are you inspired by what you learned here? Will you learn from Grant’s experience and cut losses quickly?

Leave a reply