If you looked up to see what the biggest stock mover was yesterday, you likely saw GuardForce Ai (NASD: GFAI) at the top of the leaderboard, rising by more than 170% from Friday’s close.

Imagine getting into this on Friday, before the monster run-up.

I actually did.

In fact, I alerted my weekend trader subscribers about this one, getting in at $6.60.

Anytime a stock doubles or even triples so quickly…it’s worth studying.

Here are my three big takeaways from this latest Supernova.

Taking Advantage of A Hot Theme

AI has been the hottest sector in 2023. It sort of fizzled for a few weeks when attention shifted toward the banking crisis. But now that the market is gaining momentum, the AI theme is back in play.

The three leaders lately have been ticker symbols AI, GFAI, and BBAI.

When I say leaders, I’m referring to price action and nothing to do with the company’s fundamentals.

The reason why I liked GFAI on Friday was that it was closing relatively strongly. In addition, it was a laggard among the AI stocks.

If the AI theme were to continue, I felt that GFAI had some catching up to do. I often pick the laggard stock in a hot sector because they are safer plays.

Why GFAI Had Supernova Potential

There were several reasons to get excited about GFAI.

- The float was relatively low. There are roughly 1-1.5 million shares available.

- The stock has a history of spiking. Its previous highs were above $23

- After its February high of $23.60, the stock hit a low of $3.81 in March. This recent spike would likely bring in a lot of short-sellers.

The stock made a wild move in February and then spent several weeks giving it all back. That type of price action likely got the shorts excited.

The fact that GFAI spiked on Friday with no real news only helped add gasoline to the fire.

And likely what caused the stock to squeeze so hard on Monday.

Of course, I didn’t know it would run up so much. If I did, I wouldn’t have taken profits in the after-hours on Friday.

But I continue to trade conservatively. We haven’t experienced a lot of multi-day runners lately, so I figured it made sense to book my profits early and reevaluate on Monday.

More Breaking News

- MNTS Stock Surges Amid Strategic Expansion and Financial Insights

- QuantumScape Takes a Big Leap with New Battery Line

- Jumia Faces Market Headwinds Amid Rising Costs and Strategic Challenges

- Huntington Bancshares Faces Earnings Miss, Market Considers Impacts

And while acting conservatively sucks when you realize you left money on the table… it doesn’t suck when it’s helping you survive by cutting losses quickly.

Study…Study…Study

One of the main reasons why I didn’t hesitate to play GFAI on Friday despite its massive runup is because I did my homework.

I have seen the pattern play out countless times.

And that’s exactly what I want my students to do.

I tell them to study the watchlist and the trades and learn from them.

Go through my past trades and learn from my mistakes.

Check out my winning trades and determine what I did right.

Take a look at Jack Kellogg’s most recent trades and then go back to his earlier trades to see how his thought process has developed and matured.

When you’re reviewing trades, don’t forget to look at the variables that made the trade good, bad, or ugly.

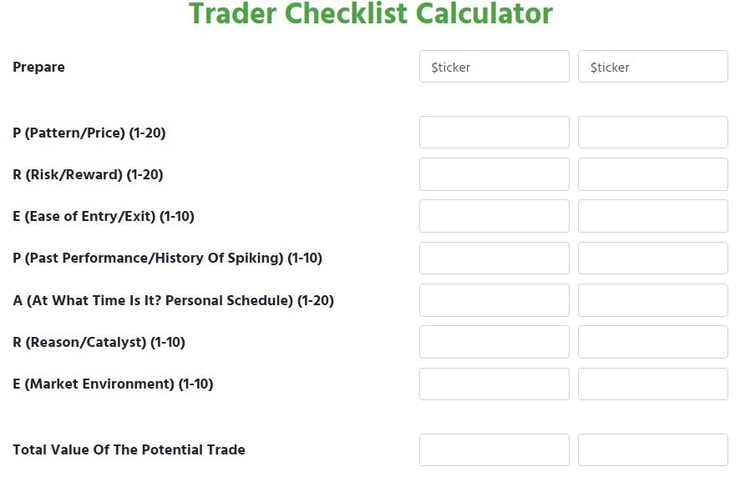

The Trader Checklist Calculator can help you better understand what to pay attention to.

It allows you to comb through the important details one must consider before placing a trade.

Here’s a link to the Trader Checklist Calculator.

Practicing this exercise, you’ll start to develop a better understanding of what makes good trades.

No one knows when a stock is going to go Supernova.

All we can do is try to find plays with good risk vs. reward setups.

Keep studying. It might not seem fun now, but if the market picks up again, I think you’ll be happy you spent your time wisely.

If you want to learn more about how I trade Supernova’s, check this out.

Leave a reply