Update on Challenge Student Evan: Key Takeaways

- Evan joined my Trading Challenge in 2018 and, as of this writing, is now up over $664,000 in profits.*

- Find out how he bounced back after two red months for an incredible July.

- He recently made his first trade from an airport … How’d it go?

Apply for my Trading Challenge now!

I love it when my students’ trading dreams come true…

In 2018, Evan joined my Trading Challenge. He was inspired by my trading-and-traveling lifestyle. Three years into his trading career, he’s making it happen. I’ve talked about Evan’s trading journey in the past, but I’m excited to share his latest milestones…

Table of Contents

Taking Off the Training Wheels

Travel has been tough for the past year or so. But in recent months, Evan’s started getting around again. In fact, he just had his first trade from an airport…

Before I go further, I need to clarify something: Evan’s achievements are the direct result of his own hard work.

As a teacher, I’m just the training wheels. I consider it my role to teach my Trading Challenge students the basics of trading and how penny stocks work.

The idea isn’t for them to copy me. Instead, I want them to learn from my DVDs, webinars, and my trades. (I post ALL my trades publicly.)

I put all of these trading education resources out there so students can create a foundation. From there, they can build their own strategy.

Of course, plenty of students don’t get it — they just want hot picks and to be told what to do.

Evan’s a student who gets it. In April 2021, he passed the $500,000 profit mark. Now, in August 2021, he’s made over $100,000 beyond that — despite having two red months in a row.*

From Trading Newbie to Traveling & $600,000+ Profits

What a difference a year makes. About a year ago, I tweeted about Evan passing six figures in trading profits*…

In July 2021, he had a six-figure MONTH. He’s now over $664,000 in total trading profits.*

It’s been an incredible ride…

Evan’s Trading Story in Brief

Evan was accepted to my Trading Challenge in April 2018.

He’d tried trading on his own during college … But he didn’t really understand what he was doing — and he lost money.

Then, he saw me on TV with Steve Harvey…

He checked me out and decided to give my Trading Challenge a try.

Evan was immediately drawn to short selling and started trading right away — while studying.

Even though he was studying as much as eight to 12 hours per day, his first 20 months were tough. He lost about $10,000…

In retrospect, he should have sized way down.

The good thing is that those losses knocked some sense into him. He got serious about studying.

Evan leaned on my Trading Challenge resources. DVDs like Tim Grittani’s “Trading Tickers” helped him understand trading. (Did you know that “Trading Tickers 2” is out now? Don’t miss it!)

He also learned a lot from top Challenge trader Roland Wolf and the Trading Challenge chat room community.

Tracking data was also huge for him. It helped him figure out what plays had the best odds of working with his style.

Check out his full trading story in this post and read on for his take on…

An Ever-Evolving Strategy

Studying and tracking data are great. But to stay in the game, traders need to keep adapting.

Speaking of adapting, don’t miss these crucial lessons from my student Jack #2, who’s up over $2.6 million in trading profits as of August 2021*…

Evan recently had a big lesson about the importance of adapting when he had two red months in a row.

When Patterns Stop Working

For months, Evan had been cruising with the gap and crap pattern. Not sure what the gap and crap pattern is? Check out this video:

Evan’s got this pattern down. He even shares lessons about it on Twitter…

But then, all of a sudden, his pattern stopped working.

During May and June, it seemed like nothing was failing. For a short seller, this is bad. He got squeezed a few times. It definitely messed with his head.

But two things helped…

More Breaking News

- Is It Too Late to Buy ETN Stock?

- Growth or Bubble? Examining Petrobras’ Unexpected Rise

- FIS Surges with New Financial Innovations

Adopt a Long-Term Perspective

At this point, Evan has years’ worth of data on his go-to pattern. So he understood that in the long run, his pattern still works more often than not.

Knowing that it had worked for years gave him the confidence to wait out a challenging red period.

Ultimately, he was right and things turned around. In July he ended up having one of his best months yet, making over $100,000 in profits.*

That’s the power of patience…

However, it did bring his attention to the fact that a bigger market shift could put his pattern in limbo for longer. It made him aware that he’s got to expand his horizons…

Focus on Other Patterns

Evan’s been expanding his repertoire.

He’s been dabbling on the long side with morning panic dip buys. And he’s been trading and tracking data on the first red day pattern.

He also keeps learning from other traders to get ideas for how to approach the market.

Right now, Evan says he’s learning a lot from my Trading Challenge students Dan and Jack Kellogg. As of August 2021, they’re up over $1.7 million and $8.15 million, respectively.*

In the face of those impressive results, Evan’s modest about his achievements: “I’m pretty good, but these guys are animals!”

Trading & Traveling

Due to unprecedented world events, Evan had a pretty long travel drought.

But in the past few months, he’s been on the road again. Evan’s been to Yosemite and Dallas, and he has several more trips planned in the coming months.

Recently, he made his first trade from an airport and experienced an unexpected moment of gratitude.

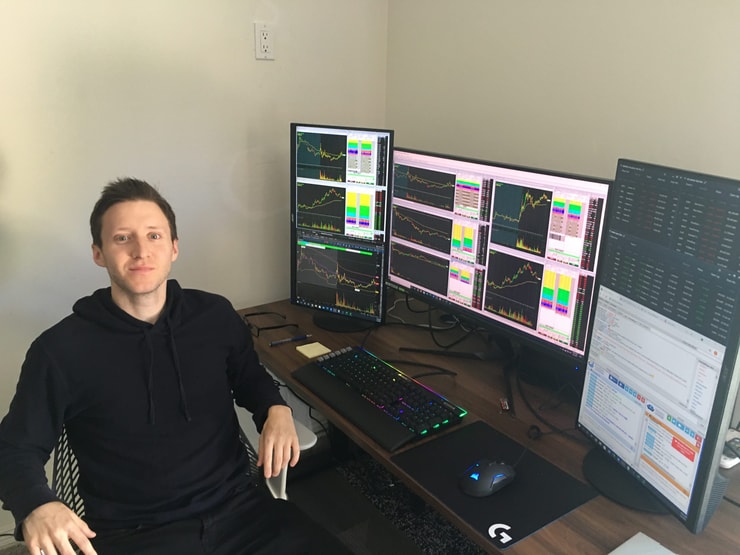

There he was — sitting at a cafe in front of the security gate in the airport. He had two laptops spread across a table. He bought a coffee to be respectful, even though he doesn’t drink it.

This might seem like a small moment in time, but it was a profound moment for him: “It felt so free … It felt good being on the road trading.”

It’s not the cafe setup that was amazing … It was the freedom and ability to do this from anywhere. He tells me he felt so thankful.

I know this feeling well, and I’m so glad Evan got to experience it. I hope there are many more moments like that to come for him.

Freedom, Trading, and Travel

One of the things I love best about trading is that you can mold it into whatever type of career you want it to be.

Evan was motivated to pursue a lifestyle of traveling and trading. Now, with hard work and laser focus, he’s working to make that happen.*

He’s paid his dues. He took the time to learn the basics and go through some bumps in the road. Now, he’s on an amazing trajectory.

Remember: you’ve got to have discipline. You’ve got to be willing to adapt. And you must CUT LOSSES QUICKLY.

I want every trader to explore the freedom that trading can bring. But I want them to understand that it’s going to take a lot of hard work!

What’s your approach to trading … What kind of lifestyle are you hoping to achieve? Leave a comment below!

Disclaimers

*Please note that any reported trading results are not typical and do not reflect the experience of the majority of individuals using our products. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit.

It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose. I’ve also hired Jack Kellogg to help in my education business.

Leave a reply