Social media is littered with traders who love to brag about their home runs.

They post their wins with snarky quips about how great they are.

But if you look a little deeper, you’ll find out that these same folks rarely show their losses.

If that sounds sketchy, then you’ve got the right mindset.

Everyone should be skeptical of the claims people make on the internet.

Thousands of promoters scam people each year, duping them into trades with FOMO.

Don’t take anything I or anyone else says at face value.

Make people PROVE their claims.

During Monday’s All-Day Market Mastery Webinar, hundreds of people watched Millionaire Challenge student Bryce Tuohey hit $1 Million in trading profits.

EVERYONE CONGRATULATE @TraderBryce ON CROSSING $1 MILLION LIVE ON TODAY’S https://t.co/occ8wKmT5U ALL LIVE TRADING WEBINAR!! WHEWWWWWWW I LOVE TRADING AND TEACHING pic.twitter.com/oT0lv8Tf0v

— Timothy Sykes (@timothysykes) January 30, 2023

The trade, and our mini-celebration, all happened LIVE!

Now, you may not know this, but Bryce has been close to that million dollar mark for a long-time…almost a year!

I’m so proud of his patience and dedication.

He took the lessons from the Millionaire Challenge and applied them every day, one trade after another, until he achieved his goal.

A lot of folks think that he must have some secret read on the market or a special skillset that only experience teaches you.

However, I want to walk you through his Genius Group Ltd. (AMEX: GNS) trade to demonstrate how my teaching core principles can be applied to a simple setup.

Here’s how it works.

News You Can Use

I’ve said it before, and I’ll say it again…

If you want to trade penny stocks, you need to pay attention to the news.

How else would you know why a random biotech is up +100% in the premarket?

For my money, I rely on our StocksToTrade Breaking News Team.

These guys curate the headlines down to bite-sized pieces on the stocks that traders care about.

So, it wasn’t surprising that they were on top of this crazy trend we’re seeing right now.

Company after company put out press releases saying they planned to go after ‘illegal short sellers.’

I’m skeptical there’s any meat to this story or that it’s as widespread as they make it out to be.

More than likely, these companies are using the press to scare shorts and jack up the share price.

And they’ve been pretty darn successful.

It’s helped stocks from Global Tech Industries (OTC: GTII) to Hellbiz Inc. (NASDAQ: HLBZ) run hard and fast.

This fits in nicely with the front end of my 7-Step Penny Stock Framework, where promoters and press work to pump shares.

The key is to find the setup that aligns with this part of the blueprint.

Bullish Consolidation

While panic dip buys are my favorite setups, Bryce likes to play bullish consolidations for breakouts.

They’re not wholly different from what you’re probably familiar with.

The key is Bryce plays these only when they occur in the early phases of a supernova.

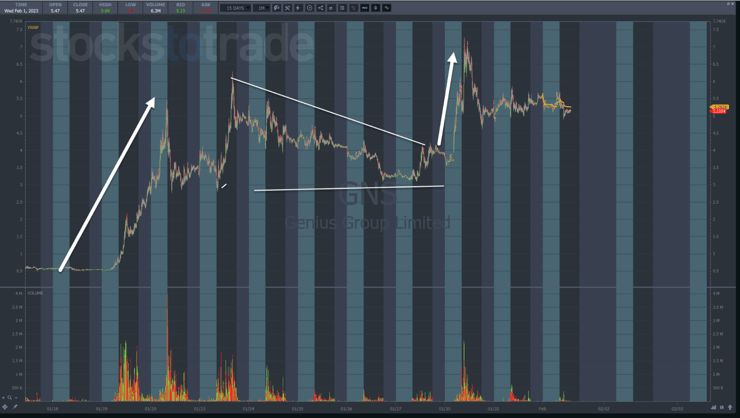

If you look at the chart of GNS over the last 15 days, you can see the pattern form.

After a nice initial run, shares traded in a narrowish range but held their gains for the better part of a week.

This lured in short-sellers, creating another potential short-squeeze.

More Breaking News

- Could Recursion’s Clinical Trials Signal a New Dawn for Biotechnology Breakthroughs?

- From Win to More Wins: Discover How Direct Digital Holdings Inc. Is Celebrating Success

- Baosheng Media Group: Can Investors Capitalize on Recent Volatility?

So, when the stock broke higher in the premarket on Monday, the punch through the recent highs seemed highly likely.

Playing the Breakout

Digging into the Monday price action, we can see the early morning ramp that came close to the recent highs.

From there, shares pulled back, creating a nice panic dip buy opportunity, though not a huge one.

As the morning rolled on, volume suddenly spiked, sending shares into a limit halt up, or a +10% move in less than 5 minutes.

At that point, the stock was clearly looking to break over the premarket and recent highs.

As a trader, you had a few options to enter this trade.

First, you could have bought the panic dip against the lows. That would have required watching level 2 data to make sure there was enough buying pressure.

Second, the sudden move could have been bought. However, it wasn’t a strong signal and you would need to be quick.

The third, and easiest way, is to wait for the breakout over the highs on volume.

That might seem risky to some folks.

But if you apply the lessons I teach my Millionaire Challenge students, then you’ll learn to cut losses quickly.

So, if the trade doesn’t do what you want in short order, then cut it loose.

Far too many traders make things more difficult than they need to be.

Let me show you how to simplify things and get you on the right side of the trade.

Sign up today for my Millionaire Challenge.

–Tim

Leave a reply