In this edition, let’s talk about when the best trade is no trade. (This is super important! It could potentially save you thousands of dollars and a whole lot of grief.)

No matter where I am, I’m grateful for the opportunities life gives me.

As always, I have to acknowledge the freedom trading and teaching brings me. It all started 20 years ago when I saw patterns in the way low-priced stocks move. I see those same patterns today. If you’re ready to learn the patterns and the nuances of trading, apply for the Trading Challenge today.

Table of Contents

Relaxing in Europe

Recently I’ve spent quite a bit of time in Positano, Italy. I’ve also been in Mont Saint-Michel, France where I filmed some video lessons. I won’t give all the details but I’ll give you a hint: it’s about traders who just follow alerts. That never makes for successful students or traders. (Spoiler Alert: There might be sheep involved.)

I love trading from Europe as long as I have good Wi-Fi — it’s a great time zone for trading. The U.S. stock market opens at 3:30 or 4:30 p.m. depending on my exact location. It’s also a great place to have fun and relax. I’ve been staying up late and sleeping in since I don’t need to get up early.

Trading Lesson of the Week

Over the past month the stock market has been on a roller coaster ride. As I write, the markets have been getting crushed the past few days. The Dow Jones Industrial Average dropped 800 points on August 14 — the biggest one-day drop this year.

Sometimes the Best Trade Is No Trade

With the stock market going through such wild swings, I’m reminding students to stay safe. It’s better to sit on the sidelines and watch than blow up your account. That brings up one of the most basic trading lessons you need to learn…

You don’t have to trade. Sometimes the best trade is no trade.

Trading Strategy: Earnings Winners

I have been doing some trades. Mostly dip buying earnings winners. That strategy has been working well for me recently.

Stocks like SigmaTron International, Inc (NASDAQ: SGMA) and Smith Micro Software, Inc. (NASDAQ: SMSI) are examples of earnings winners, but I didn’t trade these. Another recent earnings winner — which I did trade for a small gain — is Quantum Corporation (OTCPK: QMCO).

So, I’ve been focusing on earnings winners but at the same time trading very small positions. I’m trading conservatively because the overall market is scary. Remember, three out of four stocks follow the market.

We’ve seen that the markets can drop big on one tweet or one news article. For example, news of Argentina’s stock market collapse, the Hong Kong protests, or the China deal collapsing. There are a lot of big risks right now.

In my opinion, in August — which is typically the slowest month of the year — with all these big, scary things happening…

… sometimes the best trade is no trade. Say it: Sometimes the best trade is no trade.

My Biggest Recent Trading Win: (OTCPK: PCTL)

Paradigm Convergence Technologies Corp Ltd (PCTL) is a tech licensing company. They specialize in environmentally safe decontamination systems serving a variety of industries. The long-term chart is terrible, and PCTL is a true penny stock.

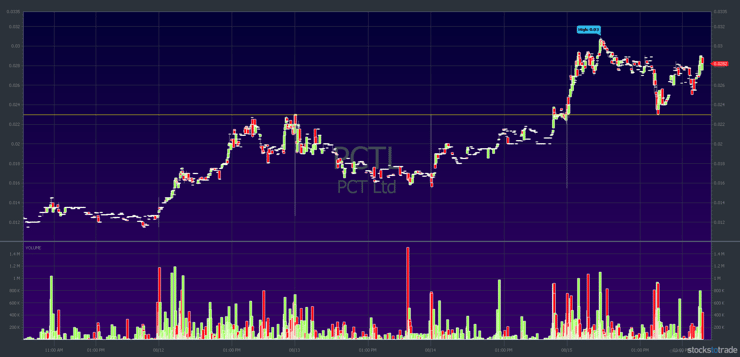

I dip bought PCTL on August 15. It spiked early in the day, and then there was an afternoon selloff. I had a lot of questions in chat about why I bought this one. Take a look at the five-day chart below. It tells part of the story. I’ve added a yellow support line to make it clear. Remember, resistance becomes support.

Here’s the five-day PCTL chart with support line:

As you can see, I based my entry on support from the previous few days. Resistance became support. Plus, the open price on August 15 was right near the support level.

Normally I don’t trade afternoon panics, but this one had several things going in my favor. You can’t see it here, but watching the level 2 data showed the dip wasn’t caused by a wall of sellers. It was one or two big sell orders. At almost the same time, the S&P 500 was falling. My guess is, the sellers were taking profits from the morning spike.

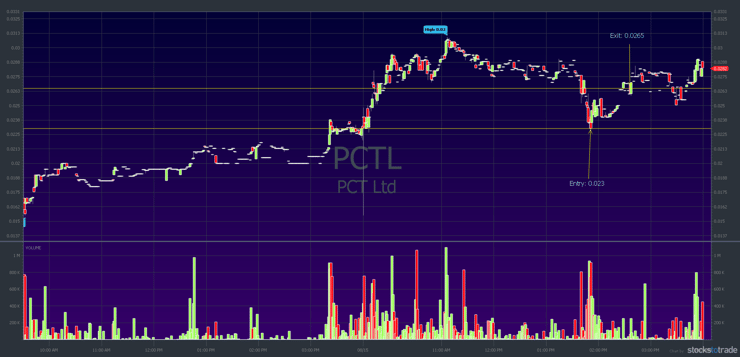

Now take a look at the PCTL two-day chart:

My goal on this trade was to make 7%–15% on the bounce. It was speculative, so I took a small dollar position. I sold into strength, right on my target for a 15.22% gain. It was a solid gain that wiped out a few small losses earlier in the day.

This one is a great reminder to keep losses small and be picky. One good trade can wipe out a bunch of little losses. But big gains don’t always wipe out big losses.

Now, on to some…

Trading Questions from Students

This week I’ll answer two general questions. If you’re a newbie, pay attention. If you’ve been around for a while but you’re struggling, pay attention. If you’re not already profitable, pay attention.

Sometimes it pays to get back to basics…

“Tim, I’m new. What actions would your dream student take before taking any trade?”

They’d go through all seven indicators on my Trader Checklist guide. They’d make a plan and study it. If you’re not familiar with the Trader Checklist guide, I urge you to watch it. Take notes. It’s nearly 12 hours of material explaining the Sykes Sliding Scale.

Did I mention it’s FREE? Seriously. It’s 12 hours of content that can help you decide whether a trade has potential, what to look for, and how I think…

Sykes Sliding Scale

What is the Sykes Sliding Scale? It’s a way to grade a trade before you risk your money. If you use it, you’ll be using seven indicators. Not one … not six. Seven. You’ll learn to score each indicator to see if it’s a trade you want to take.

Want to know something? If you go through the entire Trader Checklist guide, you’ll be one of the few. I encourage all my students to go through it. I link to it every day in my watchlist. Sadly, many students ignore me.

Then, they ask questions based on one indicator without considering the other six. It frustrates the hell out of me sometimes. No question is a bad question — but you can do yourself a big favor by watching the guide.

That way when you ask a question about a pattern or setup, you can include more and better information. Then you’ll get an idea of how I think — my process.

Also, they’d recognize that one of those indicators is their own personal schedule.

Personal Schedule Is An Important Trading Indicator

Part of the reason I share my life is because so many different things can influence your trading. I share my travels, when I have good or bad Wi-Fi, and even when I feel like crap. Like when I hurt my back getting off the plane in Hawaii back in June. You have to be aware of these things because it can influence your trading.

As for more general advice:

- Study the past to prepare for the future.

- Study all the patterns I teach and learn to recognize them.

- Start with a small account and small position sizes. Don’t be a gunslinger.

Going back to the theme of sometimes the best trade is no trade…

Why not practice using the Sykes Sliding Scale without trading? Or better yet, get StocksToTrade and paper trade. But use the indicators you learn going through Trader Checklist before every trade. After a while, it can become second nature.

The key is to use the indicators before you do anything else. Then — pay attention — go back after the fact and review the indicators. See whether you were right or wrong. Re-tabulate the scores.

The next question is interesting because it could apply to more than just trading. For trading longevity, the answer is essential…

More Breaking News

- Top Bitcoin Stocks to Watch Under “Crypto Emperor Trump”

- BigBear.ai’s Journey in the Stock Market: Rising Trends and Challenges

“What does the mindset of a successful trader mean to you?”

A successful trader has a testing mindset. What do I mean by that?

Testing different indicators. Testing different strategies to find what works best for you. Find what works best for your strengths and weaknesses. What works best for you in a changing market?

Success as a trader is kinda like hitting a moving target. You find what you’re good at — whether you’re dip buying breakouts on earnings winners — or some other strategy. Then understand the strategy might work for you but it doesn’t work for the current market.

So ideally, in a perfect world, you’d have two to four strategies that work best for you and your personality. But to find those strategies you have to try out a dozen or more.

I try to narrow it down to what works best for me. That’s how I trade and what I teach.

The great news is that Trading Challenge students now get access to Huddie, Mark Croock, Michael Goode, Tim Lento, and Tim Grittani. It’s good to take a little something from each trader. Then figure out what you can utilize for your process.

Then you wait until your strategy works. It’s about what’s working and what’s not working. You’re trying to get in tune with yourself and in tune with the market.

It’s never gonna be a perfect scenario. But you can get pretty close. And when you get close…

… when you start feeling it…

… and when there’s a hot sector, you recognize the pattern, and the pattern is working in the present market …

… trading can feel easier.

When it doesn’t click, trading can be very hard. That’s why I say you should spend so much time studying the past. As much as possible. I believe it can help you get in tune with yourself and the market.

Millionaire Mentor Market Wrap

That’s another update in the books. I love writing these updates and sincerely hope they give you inspiration and ideas. Remember, the stock market is a battlefield. Stay safe, study hard, and make your dream life a reality.

Are you a trader? At what point do you decide the best trade is no trade? New to trading? Comment below with “Sometimes the best trade is no trade.” I love to hear from all my readers so comment below now.

Leave a reply