If you want to be a smarter, self-sufficient trader, you have to work every single day to improve your trading.

There are no shortcuts — but there are a ton of resources. You can start with “The Complete Penny Stock Course” by my student Jamil. I wrote the forward. I’m amazed more people haven’t read it. It answers so many common trading questions.

No matter who you choose to learn from, always vet your resources. I see so many fakes and newbies on social media trying to be ‘gurus’. They lure in new traders with false promises of big profits.

And too many newbies oversimplify. They think “made money — good trade. Lost money — bad trade.”

I disagree. For me, it’s about so much more than how much money you can make on a trade. It’s about how well you know the game.

How well are you adapting to the market? Are you sticking to your trading plan and process? Are you giving into FOMO or greed when you’re in a trade?

Look at the bigger picture. Don’t just focus on the profits. Here are five things you can start doing today to improve your trading.

Table of Contents

#1: Focus on the Process

Every trader’s process should start with studying. Watch all my video lessons and DVDs on Profit.ly … Not just one or two. You can’t learn everything about the market from one lesson, one DVD, or one trade.

My top student Mark Croock watched all my 6,000+ video lessons three times each. He even categorized them for everyone. His dedication is awe-inspiring.

I teach my Trading Challenge students to be self-sufficient. I don’t want anyone following someone else’s trades, including mine. I teach the trading process, not how to get rich quick.

Looking for a no-cost resource? Access my FREE penny stock guide here.

Don’t fall for fake newbies who promise huge profits but don’t share the details of every trade. Anyone can get lucky and profit from a random, risky trade. But you gotta keep your risk in perspective.

Don’t take yourself out of the game by risking more than you can afford to lose or jumping into bad trades.

Focus on learning the process, not on the money and potential profits. Take the time to study and learn the patterns and the market. Find patterns that make sense to you and watch how they perform in the market.

When you’re ready to start trading, it’s key to…

#2: Trade Small

I trade with a small account to show my students the process. Again, trading isn’t just about the profits. Especially in the beginning. Build your knowledge account first.

You need to learn how to make a plan for every trade. Know exactly what your risk is and where you’ll cut losses.

You should also have a goal for the trade — that’s where you’ll take profits if everything goes well. But don’t base that goal on how much money you want to make. Look at the resistance level or risk/reward from your entry to set your profit target. My goal is usually 10%.

Always stick to your plan. If you’re wrong, get out. Rule #1 is to cut losses quickly. Never hold and hope thinking the stock will bounce back.

If you’re only focused on money and profits, it can be hard to control your emotions in a trade. You might be shaking and sweating … maybe your stomach’s in knots … That’s because you’re scared to lose money.

Trading with a small position can help you get more comfortable being in a trade.

Learn and refine your strategy over time by meticulously executing trades with a small position. Your goal should be consistency, not big profits.

#3: Analyze Your Trades

If you analyze your trades, it’s easier to see what’s working in your trading and what’s not. You don’t have to wait for a big loss to show you what you’re doing wrong. You can see when you’re making mistakes.

Trades can move fast and your emotions can skew your mindset. That’s why it’s so important to track every aspect of the trade and then go back and review it all with a clear head.

Record what you did right and what you did wrong. What was your mindset — did it affect your execution?

You may find you’re overtrading, chasing stocks, or taking random trades. That’s a sign it’s time to take a break and go back to studying. Review the basics and work on your discipline.

Don’t think you’ll ever perfect it. I’ve been trading for over 20 years and I still slip up here and there. It’s OK. You’re human. Take a step back and find your focus.

If you review your trades regularly and refine your strategy, you can get better over time. But remember, it’s a marathon, not a sprint. It won’t happen overnight…

I review my trades in video lessons on Profit.ly for my students. Yep, I still make mistakes. But my experience and knowing the nuances of trading help me avoid big losses.

The Breakout

My trade in Blink Charging Co. (NASDAQ: BLNK) was a sympathy play on Tesla, Inc (NASDAQ: TSLA). It was also a breakout. On February 4, I saw the stock spiking in the morning and wanted in. But I didn’t get a good entry.

It was the second green day, which isn’t ideal. I chased and got in at $2.47. I got out quickly and sold at $2.53 for a small profit.*

But just because I made money doesn’t mean it was a good trade. Here’s the BLNK chart from February 4:

The ideal entry was at the multi-month breakout level in the $2.20s. But I was busy with another morning trade and cutting a loss on an overnight position in mCig Inc (OTCPK: MCIG).

Getting in around $2.20 and selling where I was buying in the $2.40s — that’s a great trade. It was a fantastic breakout in a hot sector. But I didn’t wait for the trade to come to me.

Don’t Make This Mistake

I saw all these plays and was thinking about potential profits. I missed the good entry at the breakout level … and I chased it anyway. It was risky. I could’ve been buying right at the top. I was also overtrading.

This is what I mean when I say trading isn’t just about the profits. It’s about the process. Yeah, I managed to get out with a small gain, but it wasn’t a good trade. I was being sloppy and undisciplined.

It’s a slippery slope when you start losing discipline and forcing trades. It’s worse if you profit from risky trades. You can learn the wrong lessons. A new trader would probably be happy with the profit and think they made a great trade.

In reality, it’s just not worth the risk. Learn to wait for the best setups. If you miss a trade, you gotta be OK with it. If you try to impose your will on the market, you’ll get crushed.

#4: Adapt to the Market

If you plan to trade long term, you’ll eventually have to adapt to the market. It’s always changing. Hot sectors come and go, patterns change, and the market evolves.

You might find a pattern you love and that fits your strategy. Then one day you realize it’s not working like it used to…

Here’s the thing, the market is always right. Don’t waste your time and money trying to force trades and prove you’re right. If you want to stay in the game, you have to adapt.

Pattern Changes

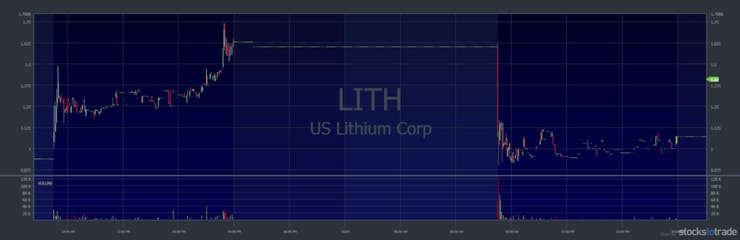

On February 6, U.S. Lithium, Corp. (OTCPK: LITH) was running on news that the company’s getting into the CBD market. I bought in the afternoon at $1.53 when it broke above its morning high of $1.49. It was a first green day play on an OTC.

I could have sold it into the close … These plays have been stronger into the close lately, but I held it overnight hoping for a gap up.

In the morning, there was a small gap up, and I sold within 10 seconds of the market open at $1.60. My total profit was $262.* Because I’m experienced, I knew to get out quickly. The first green days on OTCs haven’t been gapping up as much recently.

I took a bit of a risk just holding it overnight. I could have minimized my risk by selling into strength before the close since it was a bit overextended.

But I stuck to my rules and my plan for the trade. And I protected myself from a huge loss…

A morning panic took the stock down to $1 two minutes later.

After the morning panic, I dip bought at $1.05. It didn’t bounce as much as I wanted, and I sold at $1.14.

I profited less than $1,000 between the two trades.* But again it’s not just about the money. I executed two good trades. I sold quickly at the open and didn’t get greedy.

If I wasn’t experienced and hadn’t stuck to my plan, my first trade could have easily been disastrous. I could have taken a hit $1,500 or more if I got caught in the morning panic. Think about that if you trade with a small account.

You have to stay alert and be aware of changes in your patterns. It’s part of adapting and knowing what’s working in the market.

Some things just come with time and experience, like…

More Breaking News

- Is Rigetti Computing a Falling Star or a Buy Opportunity After Sudden Plunge?

- BigBear.ai’s Journey in the Stock Market: Rising Trends and Challenges

- Can ParaZero Technologies Maintain Its Momentum With Strong Q1 Performance?

Buy the Rumor, Sell the News

On February 6, I bought BLNK in the afternoon. It was spiking on rumors of news with Tesla, which is hot right now. I bought it at $2.88.

I underestimated the spike and sold too early at $3.04 … The spike continued to $3.40. Then I bought the stock again on a dip at $2.72. Check out the chart from February 6:

While I was in the trade, the CEO of the company was featured in a TD Ameritrade video talking about the electric car industry. The tweet about that went out … And it should have been a catalyst for another spike, but there was no reaction.

Because I’m prepared, I know that rumors can sometimes spike stocks more than the actual news. So when there was no reaction, I got out and sold at $2.79.

I sold pretty well. The stock dipped back down to the $2.50s shortly after.

This is a good example of why you should lock in profits. Don’t get greedy. Focus on executing good trades and sticking to your plan.

New traders might not know these nuances like buy the rumor, sell the news. But as you study and gain experience, you’ll see more and more of them happen in real time.

#5: Remember Your Goals

Some of my students come to me because they’re sick of working for someone else. They’re tired of the daily grind. They want more freedom to travel or spend time with their families…

Trading can offer the freedom to work from nearly anywhere. But if you think it’s gonna be quick, easy money — you’re wrong.

Trading is one of the hardest things you can do. It takes hard work and dedication. You’ll make mistakes. That’s OK. What’s key is that you learn from them.

Sometimes you’ll feel like giving up. Especially if you have a big loss or you’re in a trading slump. Focus on your goals, Remember why you want to trade. How can it change your life? What can it mean for you and your family?

Whenever you doubt yourself or what you’re capable of, get back to studying to prepare better & gain more confidence over time!

— Timothy Sykes (@timothysykes) February 14, 2020

Conclusion

You have to go back and analyze every single trade. You can’t base a trade’s success or failure on profit or loss.

There’s so much more to it than that. Be smarter than that. Remember that the market always changes and evolves. What works now may not work in a few months or a year. So pay attention.

Practice, learn, be prepared, and execute your plans for every single trade. It matters.

I had to work to get where I am today — I didn’t have a mentor. And now I love teaching. I want to be the mentor to my students that I never had. Ready for the next step in your trading journey? Apply for my Trading Challenge.

What do you do every day to improve your trading? Let me know in the comments … I love to hear from you!

Leave a reply