As I explained in this free video lesson last night I’ve had a MONSTER week earning $152,000 in trading profits…and I made another $8,000ish today for a grand total of $160,000 in profits this week, putting me up a staggering $375,000 the first 2 months of 2014, nearly matching my $393,000 in trading profits for all of 2013, every trade shown and detailed HERE

And remember EVERY trade I make is alerted realtime to these newsletter subscribers

WATCH THESE FREE VIDEOS NOW AND LEARN THESE PATTERNS

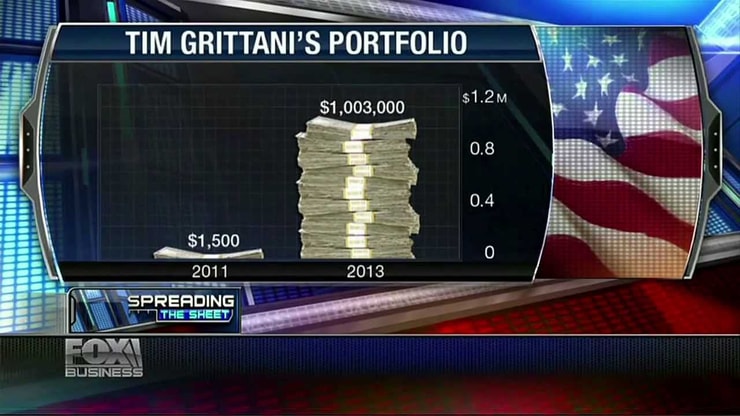

More important than my gains — I’ve been making six figures/year for over a decade — are my students’ gains and this birthday boy today is up $100,000+ this week, bringing his remarkable 3-year journey as my student to $1.4 million in profits, up from having just $1,500 to his name 3 years ago.

Watch this video and remember he became my student in February 2011 so this month is his 3-year anniversary and he’s CRUSHING it, already up $350,000ish

In case you didn’t know, I have now created two millionaire students from scratch.

One of them, Tim Grittani, recently did a webinar for my challenge students as I announced in this blog post “The Priests Of Penny Stocks”

Here are 10 takeaways that I got from listening to an hour of fantastic information and I know the students loved it.

More Breaking News

- Surprising Moves: Innodata’s Stock Twists and Turns Again!

- Can CleanSpark Navigate Market Volatility with Its Recent Results?

- FuboTV Inks Deal with NBCUniversal and Hallmark: What’s Next for This Streaming Giant?

We do Challenge webinars several times per week; it’s just one of the many perks of being one of my trading challenge students.

We have chat rooms, trade alerts, video lessons, and tons of learning materials. If you want to learn how to trade, you have to have learning materials like this.

After all, would you try to fly a plane without taking lessons? Or drive a car? Or operate on a patient in a hospital?

Of course not!

You need to learn from the pros first!

That’s what my team is here for!

Many of the people that sign up for my challenge or trading alerts are people that tried to do it on their own first but lost money since they had no prior knowledge of trading or day trading in particular.

- Don’t get caught up in the news. A lot of times, it is the price action that really matters. “Sure, the stock may gap up on good news, but that is when you need to be watching level II, how the stock reacts to previous closing price. If you do have a green to red move, there is a good chance it falls apart and turns into a morning panic. It’s good to know what the news is, but you always have to be trading price action first. The market is always right.”

- Don’t Be a Sheep: This applies not just to trading pump and dumps but to following Tim’s alerts as well. Just as you shouldn’t buy into a pump because it has a good story, you shouldn’t buy into a stock just because Tim alerts it as one of his trades. Instead, you should focus on Tim’s reasoning behind the trade. Why is this a good opportunity? Why did Tim pick the entry point that he did? Of course, if you watch Tim’s video lessons he makes after each trade or attend his webinars, these answers become much easier to identify, as he lays it all out for you. Learn the strategy, learn the reasoning; don’t blindly follow trade alerts or pump emails and buy just because someone told you to. You will not be consistently profitable with this strategy, if profitable at all.

- Cut Losses Fast — If you’re looking for a specific trading tip, this one is the most important by far. No matter what you’re trading, you have to be willing to admit you’re wrong sometimes and take a quick loss. Letting losses spiral out of control is the quickest and easiest way to take yourself out of the game, especially if you like buying pumps. You can’t worry about stupid things, like snapping a winning streak or going from being up money on the day to down. In the end, your one and only concern has to be sticking to your rules and protecting your account; because if you’re trading on a small account, all it takes is one bad mistake to wipe you out.

- I caution against that mindset of trying to make it big in one year. If you’re trying to think in terms of growing your account really fast, it’s a recipe for trouble. You can’t go into the market thinking you want to make XX amount every day. You need to focus on the opportunities out there and the setups that are available. You’re going to force trades and make mistakes. Don’t fall into the mentality of doing too much too fast.

- When the stock is liquid and there is a lot of volatility, that is when level II is most helpful. When there isn’t much action, level II doesn’t tell me too much.

- In the premarket hours, if a stock is trading a substantially large amount of volume, that is a sign that the stock may be a pump target. Often, people need to buy before the pump emails even come out and then the stock may fall after the emails are sent.

- When a stock fails to stay green, that is a sign that you need to get out. Going red on the day is a key momentum swing. “It all boils down to does it stay green.” Sometimes you can even short it at this point.

- Don’t get stubborn. GNRH is a great example for me. I was short around $0.38, didn’t take my profits after a washout, and the stock rallied after the washout so I was under water about $5,000-$6,000. So then I thought I could average into the spike. I told myself I should cover and start fresh, but I didn’t. It went sideways for a couple minutes at the open, made a bad read of level II, and added to my short and got squeezed when the stock went up to $1.20. I broke a lot of my rules when this was going on. At one point I was down maybe $50,000. I could have gotten out of this thing at break even, but instead when it leveled off after the big spike, I took my losses.

- How do I scan for stocks? I search for pinksheets and OTC stocks that are under $5, have at least 200K volume, a price above $0.03, and are the top percentage gainers. Then I take a look at the stocks that come up. What did their daily charts look like? Was there news? What are the key levels for the stocks? Were there previous breakouts? Based on all of that, I’ll prioritize my watch list for the next day.

- Paid mailers tend to not be lasting now. The SEC is getting more involved and the stocks are getting halted. You’re risking a massive loss if you get stuck in a halt overnight. Be careful in overnight promotions. The ones that don’t have promotional materials sent out are less likely to get halted.

Leave a reply