The energy sector is what makes the economy go. So it makes sense that the sector takes a hit when the economy isn’t moving as swiftly.

However, there’s more to these stocks than the gas — or lithium batteries and electricity — you put in your car. Natural gas is used to make ammonia, which is one of the main ingredients in plant fertilizer. Hydrogen may be the fuel of the future, or it may be a short-lived trend. Wind and geothermal energy are looming wild cards — and government legislation can turn them into the next hot thing!

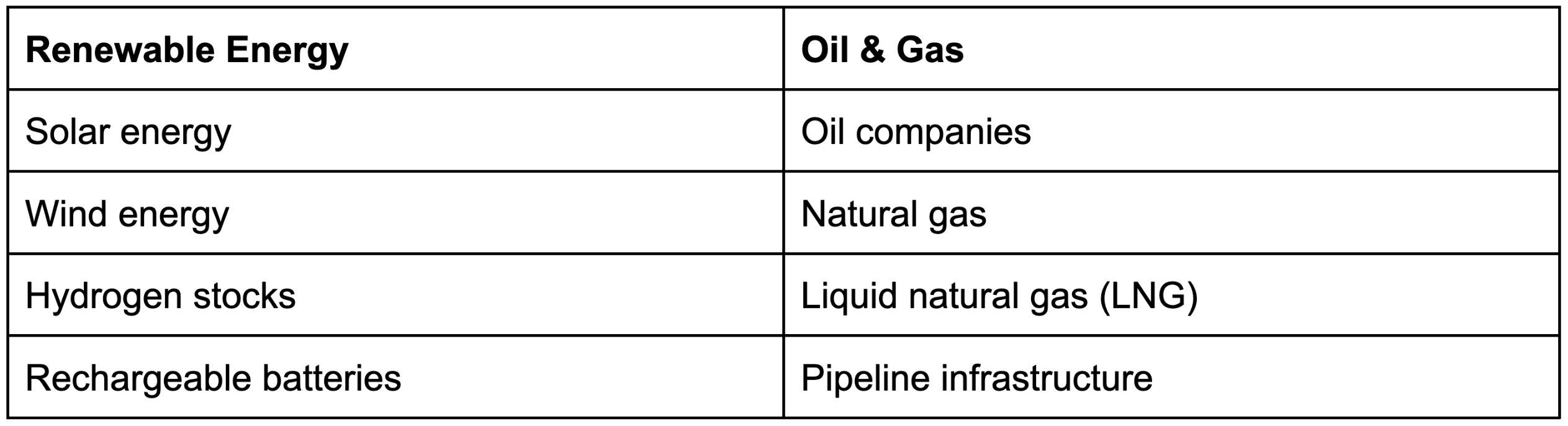

Energy stocks include all of the following, as well as electric utility companies:

The energy stock sector is sometimes called a ‘sensitive’ sector. Some energy stocks, like oil, are cyclical, which means that their value tends to fall when interest rates are up and the economy slows down. Other energy stocks, like electric utilities, are defensive, which means they’re resistant to economic turbulence and higher interest rates.

So stock analysts split the baby and call this sector sensitive… But really, it’s weirder than that. In 2023, oil prices fell in spite of heightened demand, and the Saudi Minister of Energy said it was due to the futures market falling into “a self-perpetuating vicious circle of very thin liquidity and extreme volatility.”

For traders, volatility is good, but low liquidity is bad. That translates to a sector that’s worth watching, and sometimes trading — carefully!

Table of Contents

The Best Energy Stocks in November 2024 — Sector Leaders

Let’s unpack what the ‘best energy stocks’ should mean to you. I definitely don’t mean that they’re the best stocks to invest in.

I don’t think that any stocks are ‘safe.’ What I look for is volatility, and the best energy stocks have plenty of it!

Your job as a trader is to profit from volatility, do NOT fall in love with any trade or asset as a trade is not profitable until you lock in your profits & getting emotional can muddy the waters. Similarly, it's difficult to cut losses fast if you become too emotionally involved

— Timothy Sykes (@timothysykes) December 7, 2021

When you’re learning about a sector, pay attention to the sector leaders. Their charts can tell you a lot about the health of the sector.

When they’re running, their momentum can affect their entire sector and create the sympathy plays I like to trade!

While we’ve highlighted some of the best energy stocks to trade in 2023, it’s important to remember that the stock market is vast and dynamic. There are numerous other top-performing stocks across various sectors that could potentially offer lucrative trading opportunities. Diversifying your portfolio by investing in different sectors can help mitigate risk and increase your chances of earning profits. If you’re interested in exploring more top-performing stocks, here’s a list of 10 top stocks to invest in.

Exxon Mobil Corp. [NYSE: XOM]

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2022, it produced 2.4 million barrels of liquids and 8.3 billion cubic feet of natural gas per day. At the end of 2022, reserves were 17.7 billion barrels of oil equivalent, 65% of which were liquids. The company is the world’s largest refiner with a total global refining capacity of 4.6 million barrels of oil per day and is one of the world’s largest manufacturers of commodity and specialty chemicals.

Linde plc [NYSE: LIN]

Linde is the largest industrial gas supplier in the world, with operations in over 100 countries. The firm’s main products are atmospheric gases (including oxygen, nitrogen, and argon) and process gases (including hydrogen, carbon dioxide, and helium), as well as equipment used in industrial gas production. Linde serves a wide variety of end markets, including chemicals, manufacturing, healthcare, and steelmaking. Linde generated approximately $33 billion in revenue and $5.4 billion in GAAP operating profit in 2022.

Tesla Inc. [NASDAQ: TSLA]

Founded in 2003 and based in Palo Alto, California, Tesla is a vertically integrated sustainable energy company that also aims to transition the world to electric mobility by making electric vehicles.

While Tesla is itself a consumer discretionary stock, it’s effectively the sector leader for the lithium-ion rechargeable battery sector. When Tesla has battery news, the entire sector tends to run.

The Best Energy Penny Stocks in November 2024

The best energy penny stocks are constantly changing. Most of these companies won’t become the next Apple. I’m keeping them on watch to see if they match my preferred setups.

NOTE: I have NO intention of trading these stocks unless they suit my favorite setups. This is only a watchlist.

To find the best energy penny stocks requires a top-level stock screener. I use the one in StocksToTrade — I helped design it, so it has all the tools and customizations I look for to create my stock watchlists.

Try StocksToTrade for 14 days and see how it helps your watchlist skills — only $7!

These are the penny stocks I’m watching in November 2024:

Sunnova Energy International Inc. [NYSE: NOVA]

Sunnova Energy International Inc is a residential solar and energy storage service provider company. It offers services such as operations and maintenance, monitoring, repairs and replacements, equipment upgrades and onsite power optimization. The products and services offered by the group include Add-on battery storage, Home solar protection plans, New solar battery storage, and various other solar systems.

Denison Mines Corp (Canada) [AMEX: DNN]

Denison Mines Corp is a uranium exploration and development company with interests focused in the Athabasca Basin region of northern Saskatchewan, Canada. The company has an effective 95% interest in its flagship Wheeler River Uranium Project, which is the largest undeveloped uranium project in the infrastructure rich eastern portion of the Athabasca Basin region of northern Saskatchewan. The company is also engaged in mine decommissioning and environmental services through its Closed Mines group, which manages its Elliot Lake reclamation projects and provides third-party post-closure mine care and maintenance services.

SunPower Corporation [NASDAQ: SPWR]

SunPower is a leading solar technology and energy services provider that offers fully integrated solar, storage, and home energy solutions to customers primarily in the United States and Canada through an array of hardware, software, and financing options and smart energy solutions. The company’s sales channels include a network of both installing and noninstalling dealers and resellers that operate in residential and commercial markets as well as a group of in-house sales teams in each segment engaged in direct sales to end customers. SunPower is a majority-owned subsidiary of Total Energies Solar.

How To Trade Energy Stocks

Learning how to trade energy stocks starts with your education. You need to learn what penny stocks are, how they work, and how to identify their patterns.

My FREE penny stock trading guide is a good start.

From there, if you want to take it to the next level, consider joining my Trading Challenge.

Before diving into the world of energy stocks, it’s crucial to understand the different types of stocks that exist in the market. Each type comes with its own set of characteristics, risks, and potential rewards. From blue-chip stocks to growth stocks, from dividend stocks to penny stocks, the variety is vast.

Having a solid grasp of these differences can significantly enhance your trading strategy and decision-making process. To get a comprehensive understanding of the various types of stocks, check out this detailed guide on different types of stocks.

Once you’re ready to start trading, you need a few key things…

Choose the Right Broker

To trade stocks, you need a brokerage account. Your broker is the gateway between you and trades. Choose a good one … Do your research and check out this guide for more tips.

Check out this quick startup guide to choosing a broker:

Get a Powerful Stock Platform

A stock screener can help you narrow down the many stocks available to trade. I use StocksToTrade, which can also help with the next item…

Build Your Watchlist

Before every trade, you need to perform a detailed stock analysis.

There are two key types of stock analysis: fundamental analysis and technical analysis.

See how I build my watchlists every Sunday by signing up to my NO-COST weekly watchlist!

StocksToTrade can help you do both: it has awesome charting software and links to stock news, SEC filings, and even social media mentions.

With day trading penny stocks, technical analysis — reading the charts — matters more. Chart patterns show me how a stock’s performed over weeks, months, or even years. That helps me on the next step…

Follow Your Trading Plan

A trading plan is where you plot out entry and exit points, risk, and profit goals. Ideally, you base the plan on careful research and stick to it.

Choosing the right broker is just the first step in your trading journey. To be successful in the stock market, you need a solid day trading strategy. This strategy should encompass everything from risk management to identifying potential trading opportunities, from understanding market trends to knowing when to enter and exit a trade. A well-planned strategy can be the difference between success and failure in the volatile world of day trading.

If you’re looking to build or refine your day trading strategy, here’s a comprehensive guide on day trading strategies that can help you navigate the market more effectively.

Track Every Trade

You need to keep a METICULOUS trading journal. This is where the science of trading comes in.

How do you know what strategies work for you, and which don’t? You look at your trading journal.

How do you know when you’ve been overtrading and need a timeout? You look at your trading journal.

If you’re not careful, your emotions can determine your trading approach. Before long, you’ll be wearing the same socks that you were wearing on your “big day.” That isn’t trading anymore — that’s gambling.

Rinse and Repeat

Real trading is a job. It isn’t a boring, 9-5 job, but it’s still something that rewards consistency and discipline.

Follow these rules throughout your trading career. That will separate you from the constant flow of newbies trying to get rich quick, and protect you from the scammers trying to sell trading shortcuts.