Win or lose, you can learn from every trade. No matter how long you’re in this game, you can always get better. But THAT means putting in the time to review EVERY trade.

How often should you review?

We’re all different. I’d guess that most of my top students review their trades on a daily basis. But at first, you might need to review your trades right away.

I’m not saying get stuck or attached to a trade. “On to the next …” is a good mindset, especially for experienced and consistent traders. But remember: win or lose, the lesson is more important than profit or loss.

Keep reading for three ways to increase your knowledge, win or lose. But first…

Table of Contents

Giving Back: An Honor and a Duty

You may already know I donate 100% of my trading profits to charity. Some people wonder why I post about my donations on social media. They say, “Tim, just donate quietly. Why do you have to brag about it?”

First, it’s not to brag. It’s to bring attention to important issues and the charities trying to help. Here’s an example…

Warning! Graphic Images: Some people may find the following content disturbing or offensive.

View this post on Instagram

That’s why I share — to help spread awareness. Enough is enough. But only when enough people join together and say it, will things change.

Want to help? Follow Karmagawa on Instagram and visit our sustainable merch shop here.

Let’s talk trading…

Trading Mentor

Win or lose, you need to learn from EVERY trade. In the heat of battle, it might seem difficult. After a win, you get that rush. After a loss, there’s a little sting. If it’s a big loss … you feel downtrodden.

For new traders, there’s nothing more important than reviewing your trades. If not immediately, then at the end of the day. Learn from your wins AND your losses.

Losses Are Part of Trading

“I never lose. I either win or I learn.” — Nelson Mandela

I love that quote. But you need to understand that you will lose. Losses are part of the game. And most traders take big losses at some point. The key is to keep refining, keep improving, and keep getting better.

So take the spirit of Nelson Mandela’s quote and apply it to your trading journey. Your goal is to see each loss as a part of your education.

You learn NOTHING from only seeing someone else's gains, if you want true & lasting success, pick apart EVERY trade, including the losers, & learn EVERY last detail possible. Picture yourself as a chef trying to learn a new recipe, you MUST have all the ingredients not just some!

— Timothy Sykes (@timothysykes) January 21, 2021

That’s why I’m so transparent about my trades. In an industry full of fakes, I share all my trades here. Learn from them. Don’t just study wins — pick apart my losses. If you’re new, spend more time on the losses than the wins.

Since we’re focused on learning from wins and losses, this week’s trade review shares one of each.

Trade Review: Win or Lose, Find the Lesson

To make it fun, I’m sharing last week’s biggest win and biggest loss in dollar terms. Notice where I was right, where I was wrong, and how I managed risk.

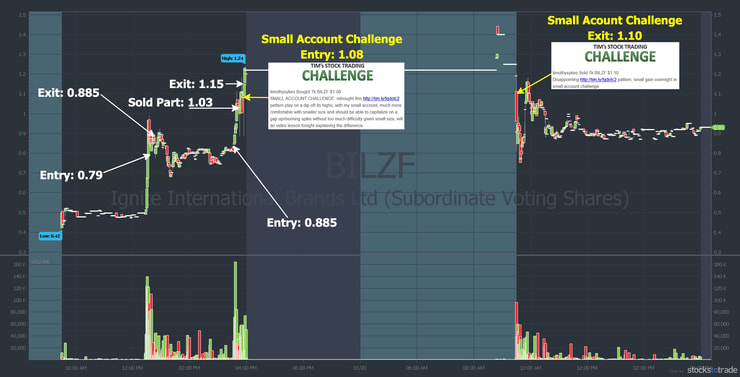

Ignite International Brands, Ltd. (OTCQX: BILZF)

Ignite International Brands is Dan Bilzerian’s CBD company. In September 2019, I traded BILZF during my annual conference. The stock spiked after Bilzerian posted about being able to invest in his company in the U.S. It was a perfect first green day setup.

BILZF has been on my radar ever since. And to be honest, I wasn’t sure how the company would do. On January 19, the company issued this press release with positive earnings news.

And again, Dan Bilzerian posted on his social media accounts. But this time it was kind of an “I told you so…”

I traded BILZF a few times that day — both with my big account and as part of the Small Account Challenge.

Check out the BILZF chart from January 19–20, with my entries and exits:

*Past performance does not indicate future results.

As you can see, BILZF was already spiking by the time I got in. It was moving so fast I got in and out for a quick $1,758 win.* Then it started to consolidate. My original thesis was that it could spike over $1 if Bilzerian shared it on Instagram. That’s where he has the most followers.

When it didn’t immediately spike over $1 per share I was a little surprised. But it set up nicely for the breakout going into the close.

(*Please note that these kinds of trading results are not typical. Most traders lose money. It takes years of dedication, hard work, and discipline to learn how to trade. Individual results will vary. Trading is inherently risky. Before making any trades, remember to do your due diligence and never risk more than you can afford to lose.)

More Breaking News

- Credo Technology Unveils AI Innovation and Announces 3M Partnership

- Redfin’s ChatGPT Integration Enhances Home Search, Boosts Rocket Companies’ Market Presence

- Valterra Platinum’s Q4 Forecast Drives Anticipation Amidst Earnings Surge

- TeraWulf’s Strategic Expansion Ignites Market Interest

What to Do When a Trade Meets Your Goals

When BILZF started to spike during power hour, I took a bigger position. Again, it spiked so fast I decided to lock in partial profits with the goal of holding the rest overnight. When it hit all my goals, and more, I got out. The $6,610 win was my biggest of the week.*

That wasn’t the last of BILZF for me. I rebought on a dip off its highs. But because it was already up so much, I sized down considerably. And THAT made it a comfortable trade for my…

Small Account Challenge

In January, I started another Small Account Challenge. Starting with $12,000, I teach new traders how to build a small account. The OTC first green day pattern is one of my favorites for small accounts.

It doesn’t always work, but the pattern is a good setup for anyone trading under the PDT rule. Why? Because holding overnight saves you a day trade. Just be ready to cut losses — or take profits — quickly when the market opens the next day.

BILZF was a solid OTC first green day pattern. It had volume, earnings news, and it was holding the breakout over the high of the day. It finished strong but gapped down at the open the next day. The $140 win saved a day trade, but it was a little disappointing.*

Let’s move on to my biggest loss of the week. Remember, you can learn as much or MORE from your losses.

Astro Aerospace Ltd. (OTCQB: ASDN)

Astro Aerospace is a flying car play that was spiking in sympathy to EHang Holdings (NASDAQ: EH). It was also a nice multiday breakout.

Check out the ASDN chart from January 21 with my entry and exit comments:

As you can see, the stock was up roughly 34% off its morning lows when I bought near the multiday breakout. I thought it could keep going — it didn’t. So I followed rule #1: cut losses quickly.

The –$914 loss was my biggest of the week, but it doesn’t bother me because I followed my rules. Also, I was on the right track. ASDN hit its high of the day about an hour later.

The lesson is that following your trading plan and rule #1 is KEY to long-term success. Yes, I could have held ASDN and made a profit. But what if I was completely wrong and it tanked?

Take comfort when you’re on the right track but get shaken out. Learn to adjust and adapt as the market changes. But NEVER hold and hope.

Watch this video to understand my thoughts on rule #1…

The #1 Trading Rule All My Millionaire* Students Focus On

(*Note: My results, along with the results of these top traders, are far from typical. Individual results will vary. Most traders lose money. These top traders and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

I hope you watched the whole video. If that rule isn’t burned into your brain by now, watch it again until it’s a mantra. Then use it.

Win or Lose, You Have a Choice

What’s the choice? Gain knowledge or let the opportunity pass you by. That applies to most of life, but in trading it’s imperative. You’re playing catch up. The stock market has been going longer than you’ve been alive.

And there are traders out there who’ve been trading since long before you ever considered it. So you have to learn as much as possible every time you stop on the battlefield. Every single trade … And how quickly you learn the lessons is up to you.

So make a choice. Do you want to learn from every trade now or pay the price later? It’s up to you.

Here are three ways to increase your knowledge, win or lose…

Keep a Trading Journal

Start your trading journal today. Use it for every trade. Use it for paper trading on StocksToTrade if that’s where you are in your journey. Keep as many details as possible. Use Profit.ly, too. We designed StocksToTrade and Profit.ly to simplify the learning process.*

(*Note: I’m an investor in both Profit.ly and StocksToTrade.)

As you grow, it’s key to…

Review and Refine Your Trading Process

Successful trading is NOT about how much money you can make the quickest. It’s about how much you can learn…

Learn From Trades That Don’t Go as Planned

Learn from a few of my losses to get a better idea of how to think about trading. Without stats, you have nothing…

Millionaire Mentor Market Wrap

Win or lose … the knowledge you gain every day depends on you. Will you find the lessons in every trade? Will you try to understand the overall market? Are you willing to be obsessed with learning?

Most traders lose because they’re unprepared. Will you be one of the winners? It’s up to you…

How badly do you want it?

Trading Education

If you’re brand new to penny stocks, start with my FREE penny stock guide.

Ready for more?

For all the basics, start your 30-Day Bootcamp today. It’s still only $79 … which seems crazy for what you get. (You get two bonuses — “Pennystocking Framework” and “The Complete Penny Stock Course.”)

Trading Challenge

The Trading Challenge is the most comprehensive trading education we offer. When you apply, come ready to study harder than you’ve ever studied before. Apply for the Trading Challenge here.

Are you ready to learn from every trade, win or lose? Comment below, I love to hear from all my readers!

Leave a reply