I sounded a bit nutty talking about the ‘Winter Glitch’…

But I knew from years of trading bull and bear markets that NOW is the time to look for epic plays.

So I wasn’t surprised when our StocksToTrade Breaking News Chat Room called out Ambrx Biopharma Inc. (NYSE: AMAM)…

The results speak for themselves.

Now, I know it’s tough for folks not used to trading the news to jump right in.

It takes practice to understand how to read and interpret the headlines.

But don’t worry, the ‘Winter Glitch’ also comes with a special type of stock for you – multi-month runners.

Multi-month runners are IDEAL for anyone with a small account.

Not only are they easier to trade, but they deliver more predictable setups.

Plus, you don’t need to watch 800 stocks at once.

All you need is a handful to find a quality trade nearly every day.

Today, I want to cover one of my favorite multi-month runners and show you where and how I traded it.

Table of Contents

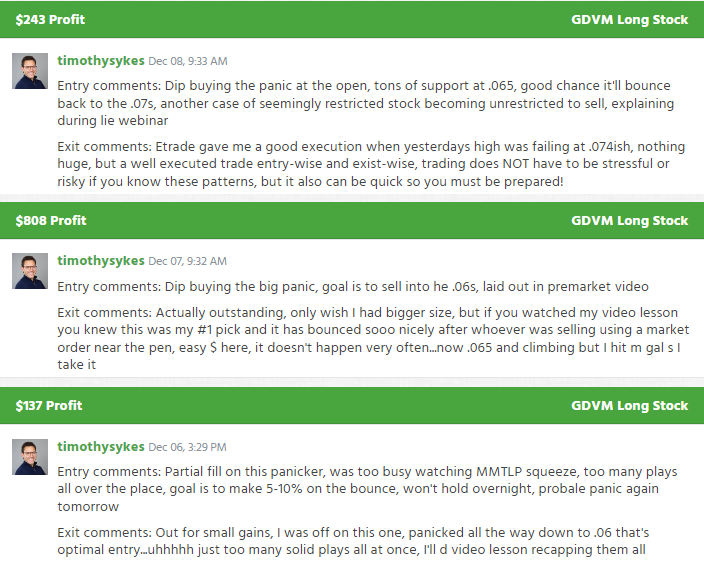

Global Developments Inc. (OTC: GDVM)

This stock treated me very well last month.

In just three days, it provided me with three profitable trades.

Check them out here on Profitly

As I wrote above, all of these were panic dip buys.

You might be surprised to learn where these occurred on the chart.

This stumps a lot of new traders.

Why try to dip buy a stock in free fall?

Isn’t that catching a falling knife?

Why not dip buy a stock ramping higher?

Let’s unpack these questions one at a time.

Why Try to Dip Buy a Stock in Free Fall?

2025 Millionaire Media, LLCOnce a stock goes Supernova, the 3rd phase of my 7-Step Penny Stock Framework, it’s next move is to crash.

Sometimes crashes take a day. Sometimes they take weeks.

A lot of the time, they happen when the folks who pay promoters to juice a stock can finally sell their shares.

That’s why you see huge volume and swift declines.

The thing is, promoters don’t just stop doing their job.

They’ll pump a stock to help their clients get the best exit prices possible.

And they go especially heavy once stock is down huge.

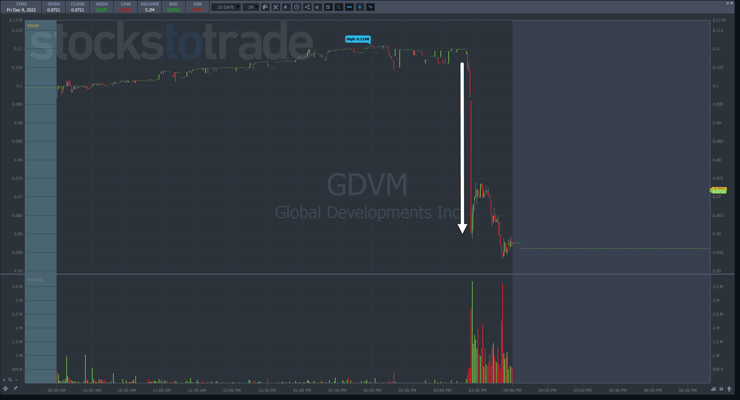

Take a look at this one-minute chart of GDVM on that big red candle down day.

Shares went from $0.11 to less than $0.06 in minutes.

That’s an almost 50% haircut.

And that’s exactly what I look for when I do panic dip buys.

You see, a panic dip buy works precisely because a stock has dropped so much.

It needs that overextension on the downside to give it a hard snap back in the other direction.

For the most part, that doesn’t work on a stock in an uptrend.

While I did trade this afternoon dip buy, I typically wait for the mornings.

That’s when I get the highest probability trades.

Now, imagine the stock didn’t drop 50% in one day but instead slowly bled lower over weeks and months.

The panic dip buy is no longer valid.

More Breaking News

- PTEN Stock Plummets Amid Sector Concerns

- Tempus AI Inc.: New Alliances & Acquisitions Redefine Strength

- Why is Sonoma Pharmaceuticals Soaring?

I need to see price dislocate, not edge lower, and balance itself along the way.

Isn’t That Catching a Falling Knife?

2025 Millionaire Media, LLCYes, but not the way you think.

Catching a falling knife implies buying a stock that’s down a ton simply because it’s down a ton.

Most of the time, folks do this at random.

I’m not so careless.

I only look for panic dip buys when a stock meets my requirements.

That means it’s in the right phase of the framework, drops hard and fast, and comes into a reasonable support.

Even then I still rely on price action and level 2 data to enhance my trades.

But most importantly, I don’t give these trades a lot of time.

Bounces either happen quickly or they don’t.

So, if it doesn’t move up fast enough, I cut it loose which keeps my losses tiny, and often gives me a small profit.

Why Not Dip Buy a Stock Ramping Higher?

2025 Millionaire Media, LLCAs I mentioned earlier, stocks typically don’t drop enough during the ramp and supernova phases to provide a good bounce.

Instead, I prefer to trade breakouts during this part of the framework.

As stocks break their previous highs, you get short sellers stopped out in higher-priced stocks and breakout buyers on all penny stocks.

Each phase lends itself to certain types of trade setups.

Once you understand this and learn which to apply, it makes trading easier and more mechanical.

—Tim

Leave a reply