Why Penny Stock Promoters Hate Me: Key Takeaways

- The big lies penny stock promoters will tell unsuspecting newbies to lure them in…

- I’ve seen this movie before — find out how it always ends…

- Promoters hate me for giving away the ending. But that’s how I’ve made millions*…

Learn my top patterns for trading promoter hype!

I’ve made a career out of teaching small-account traders how to survive in the stock market. And I’ve donated over $5 million to charity in my trading career*…

So why do some people in the market hate me?

because I expose penny stock promoters & they have their bot teams spread hate campaigns, same as during the https://t.co/QTYT7tytOA it's not actual hate, its just promoters trying to discredit so people don't short their pumps, read the https://t.co/KszAsxBm84 educate yourself

— Timothy Sykes (@timothysykes) June 21, 2020

I’ll give you a hint — it isn’t because they care about YOU. Look, I don’t like being ‘that guy.’ I don’t want to pooh-pooh your hopes and dreams. But will I speak up if you’re about to blow up your account? Absolutely.

Here’s what you must know about promoters.

Table of Contents

Show Your Trades!

How can you tell real traders from newbies and promoters? Ask to see their trades.

If the trader you’re following on Twitter has the position they say they do, let’s see it.

That shouldn’t convince you to buy what they’re selling. You should only trust your own research.

Because giving you FOMO is a promoter’s job.

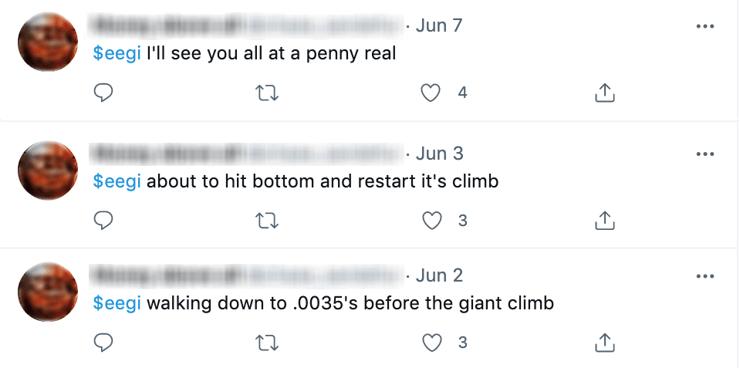

Is this a promoter … or just some dummy with a Twitter account?

I don’t know.

What I do know is that the market would be a better place if everyone showed their trades. If this promoter actually traded EEGI, they’d have to own up to their mistake.

Dealing with promoters is like playing a game of Whac-A-Mole. That’s why I’m giving you a cheat sheet on the hate campaigns that promoters wage.

Why I Don’t Short Penny Stocks

This is one of the biggest lies you’ll read about me.

Why else would I call out their pumps? I must want the stock they’re pushing to tank, right?

I don’t blame promoters for lying about my motives. Lying is their job.

Here's some midnight comedy from the penny stock promoter busted today, he's one of several promoters who claimed I shorted their pumps when in fact I've NEVER shorted any stock trading at 1-2-3-4-5 cents/share & haven't shorted ANY PLAY IN MONTHS! Welcome to how BS promoters lie pic.twitter.com/iO6g81H3FB

— Timothy Sykes (@timothysykes) March 16, 2021

That’s why I started Profit.ly and why I show ALL my trades.

You can see every one of the trades that have brought me to $7.2 million in lifetime profits.*

I show all of my trades so my students can see how a self-sufficient trader works.

It isn’t by shorting sub-penny stocks or holding onto penny stock pumps…

More Breaking News

- Lucid Group’s Stock Performance Amid Market Volatility: An Investor’s Dilemma

- Can Coinbase Global Inc Survive as Digital Assets Fluctuate?

- Can MicroVision Keep Up Its Momentum After Latest Sensor Expansion?

It’s by playing the same patterns that I’ve been using for the past 20 years.

What Promoters Don’t Want You to Know

I call out promoters because they’ve also been using the same playbook for the last 20 years. And some people still haven’t caught on!

I don’t know when these stocks will collapse. And I don’t short them. I don’t like the risk/reward in this market.

Yes, 99.9% of the time these stocks tank. My 7-step pennystocking framework shows the pattern they usually follow.

These simple patterns are a big part of what I teach. But when I point out the inevitable crash — Step #4, The Cliff Dive — that’s when promoters start attacking.

They tell their brainwashed followers that I’m responsible for the crash. How else could such a great stock have failed?

How to Tell Promoters From Actual Traders

First of all, watch out for ANYONE telling you to buy a stock…

Do me & yourself a favor & NEVER believe any penny stock's story or the promoters who advertise them. Expect the absolute worst from every stock, from every "trader" on $TWTR giving tips, never follow ANY alerts from anyone else & instead learn to refine your own trading process!

— Timothy Sykes (@timothysykes) October 15, 2020

Here are some promoters’ greatest hits:

- “The DD on [insert junk stock here] is stunning.”

- “Only the weak sell.”

- “We’re in it together. Hold on and this will eventually go back up.”

Real traders know that they can only be responsible for themselves.

How can you be responsible for yourself? Always follow rule #1 and cut losses quickly.

How I Trade Stocks I Don’t Believe In

The second thing I teach my students is to go for small gains.

Promoters rip on this strategy. They want you to get greedy.

But we know how the story ends EVERY SINGLE TIME.

Look at this small win from last year:

I made $2,960 by dip-buying after a big spike.* It bounced (Step #6 from my framework) and I sold into strength.

This is how professional traders do it.

Sure, I left money on the table. Following my trading plan and not getting caught up in home-run dreams — that’s how I play it safe.

The Dreams You Should Focus On

Promoters make their money by selling hopes and dreams.

Dreaming about a better life is a beautiful thing. But you can’t get there by just hoping.

Look at these awesome students … Some of them now teach alongside me!

I am SO proud of so many of my newest https://t.co/occ8wKDW7U students like @traderkylec who not only have made millions, but now they’re also treating their family & donating to charity too! Please retweet & congratulate Kyle & check out https://t.co/BDIdIRjAQm his new chatroom! pic.twitter.com/MsSlI2SYPC

— Timothy Sykes (@timothysykes) September 25, 2021

Kyle Williams is a millionaire trader who took ALL my ALL lessons to heart — from trading to giving back.*

Not the one to get super emotional or anything. But since the age of 17 I grew up working too many jobs to support my parents while trying to complete my education. While do so I had landed myself in -60k of debt in the year 2017 and struggled to pay it off for years. (Cont..)

— Karan Khanna (@karanakhanna25) September 25, 2021

Check out Karan’s amazing story… He’s less than two years into his trading journey but has already shown that hard work can pay off!*

MUST READ NEW BLOG POST: https://t.co/2ImG8wWt3N Discipline, Perseverance, and Crazy Pumps: Tim Lento’s $1 Million Trading Milestone! There's SO much to learn every time one of my students crosses $1 million in trading profits, its happened 20x+ now so learn from @TimLento too!

— Timothy Sykes (@timothysykes) September 25, 2021

I also want to mention my long-time student Tim Lento. He started following me in 2006. He’s got more tenacity than pretty much anyone I know.

Lento also built his strategy around OTC pumps. Instead of dip-buying, he prefers to short.

He just got over the $1 million mark in a BIG way.*

Please retweet & congratulate one of my oldest students turned masters and chat moderators @TimLento on his awesome $400,000+ profit on $SNTG here https://t.co/uKsaQXqpUd putting him at nearly $1.4 million in total trading profits & pushing him over the big $1 million milestone!

— Timothy Sykes (@timothysykes) July 26, 2021

But the script was the same….

A stock spikes on sentiment. 99 times out of 100, it crashes just as quickly.

Lento hosts webinars for my Trading Challenge regularly. He brings something different than I do to the community.

His style is a bit more technical than mine. It’s not a contest. You become a self-sufficient trader by learning as many different styles as you can…

Think you have the discipline it takes? Apply to my Trading Challenge today.

Do you understand the mind games that penny stock promoters play? If you do, leave a comment saying, “I don’t buy the hype!”

Disclaimer

*Results are not typical and will vary from person to person. Making money trading stocks takes time, dedication, and hard work. Most who receive free or paid content will make little or no money because they will not apply the skills being taught. Any results displayed are exceptional. We do not guarantee any outcome regarding your earnings or income as the factors that impact such results are numerous and uncontrollable.

Leave a reply