I’ve seen a lot of crazy stocks in my day, but nothing quite like GameStop (NYSE: GME).

Could this be a big shift of power in the markets? Only time will tell.

If the short squeeze on GME is an omen of what’s to come, we could see a huge transition from large institutions to young day traders at home. No matter what happens, what we’re seeing in this market is historic, so take the time to learn from it.

We’ve had MANY supernovas since early 2020 … maybe the most I’ve ever seen. But GME is on a completely different level. It rose from the ashes and said, “hold my beer.”

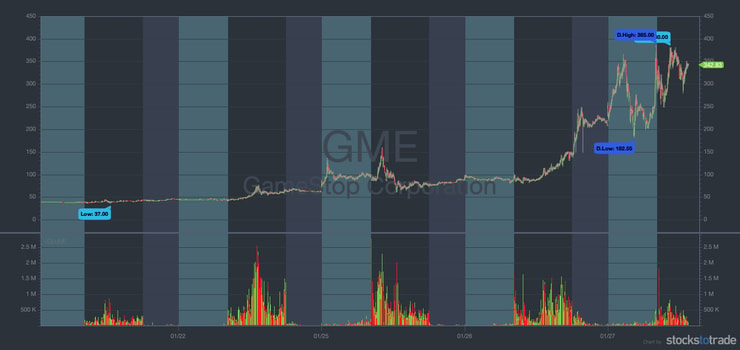

If you’re an active day trader, no doubt you know about its crazy run. On January 11, the price was around $20 per share. As of January 26 at around 5 p.m. Eastern, the stock hit $240 per share. This morning, it went on another tear.

Let’s put this into context … Just a year ago, GameStop was struggling. Now, it’s squeezed entire hedge funds and made thousand percent gains from $20. How the heck does this happen? Let’s get into what drove this run.

Table of Contents

GameStop’s Calm Before the Storm

In March 2020, GameStop was in the gutter. Lockdowns crippled many businesses, and in-store sales were plummeting.

Analysts were trashing GME. People were ditching shares at $5, $4, and even $3. It felt like it could be the next BlockBuster. But some saw this chaos as an opportunity.

Throughout the second quarter of 2020, in-store sales kept diving. But there was a silver lining. In the same quarter, GameStop (NASDAQ: GME) had an 800% increase in e-commerce sales.

Then came a massive catalyst.

In October 2020, GME announced a strategic partnership with Microsoft (NASDAQ: MSFT). A lot of people didn’t believe the company could be saved. Big hedge funds made huge bets the stock would ultimately fail. But the MSFT deal gave GameStop the punching power it needed to punish shorts.

Then there’s the sub-Reddit page r/WallStreetBets for traders both new and experienced. (Update: It’s reportedly since been banned on claims of hate speech.) Some analysts think this page is responsible for creating the GME short squeeze movement.

For months traders and investors have been scooping up GameStop stock. But who could have guessed this network of amateurs could push a $7 billion hedge fund like Melvin Capital to its limits? Check out what StocksToTrade’s Tim Bohen had to say about it…

“Youth is not a time of life, it is a state of mind.”

“Adapt or die”$GME pic.twitter.com/bJYtkUbmcv

— Timothy C. Bohen 🇺🇸 (@tbohen) January 22, 2021

GameStop isn’t some illiquid OTC stock. It’s a legit company. You can’t just round up your buddies and take it over. It can cost millions of dollars to create momentum on a listed stock. But it looks like Reddit traders made it happen.

So what fueled the GME short squeeze?

Don’t Underestimate This Market

Earlier this week, momentum started to build on Reddit. More and more people started adding to the push. As of January 26, there were over 80,000 comments on The $GME Thread and a potential army of buyers for GameStop stock.

This move seems different from other chat room pumps. There’s some evidence that buyers are targeting shorts. With enough pressure, this can create a massive short squeeze.

Then, of course, there was that tweet from Elon Musk. That seemed to only further fan the flames.

Talk about wild volatility! It can be intimidating, but you can learn to navigate volatility and trade safely. Start with my no-cost “Volatility Survival Guide.”

The Battle of the Billionaires

As of January 23, Melvin Capital lost roughly 30% of its $12.5 billion in assets. A significant portion is from squeezes like GME. But it fought as long as it could.

Ken Griffin (Citadel LLC) and Steven A. Cohen (Point72 Asset Management) are some of the biggest names on Wall Street. When they throw their weight around, a lot of people pay attention.

On January 25, they injected roughly $2.75 billion into Melvin Capital to potentially help stabilize a short position on GME. But with GameStop hitting $240 a day later and going even higher after that, that plan seems to have backfired.

Even stock analyst and TV talking head Jim Cramer was blown away. At one point in a recent Halftime Report, he mentioned how he’d react if someone said, “GameStop is going to $250.”

Then a day later, it hit $240. As of midday trading on January 27, the stock’s well over $300.

The Big Lesson From the GME Short Squeeze

This is a near-perfect example of why I hate shorting. For one, you have no idea in this market how far stocks like this can run. And you’re always on the hook with your broker. Remember, you don’t own the shares … you’re borrowing them. If you can’t cover, you could be screwed.

Think of it this way … If a giant hedge fund can get squeezed, so can you.

These hedge fund billionaires are feeling the pressure. Covering a large short position during this madness is often hard. And in this case, there are seemingly endless buyers. When a perfect storm like this happens, the price is bound to go up.

Just look at that chart.

This is why I prefer to trade long in this kind of market. Check out some of my top trading patterns in my FREE guide to penny stocks.

Now for the question so many are dying to ask…

More Breaking News

- Is It Too Late to Jump on Ambev S.A.’s Rising Stock?

- Is TeraWulf Inc.’s Stock Worth the Hype After Its Recent Moves?

- Canaan Inc. Experiences Volatility: Deciphering the Dynamic Market Changes

Is There Still Time to Trade GameStop?

Squeezes like this can grab attention. In hindsight, it all looks easy, right? Just find a runner like GME and ride the wave to big gains.

That’s the problem. Too many traders want fast, ‘easy’ gains. They don’t want to do the years of work that top traders like Jack Kellogg or Matthew Monaco put in.

So should you trade GameStop? Nope. It’s too late now. If you chase, you’re asking for trouble.

There’s no telling what could happen next. But one thing is for sure … this isn’t a pattern. There’s no precedent for this, which means there’s no history you can study to prepare for GME’s moves.

If you want to become a self-sufficient trader, steer clear of this type of action. Situations like this separate disciplined traders from the majority of traders who fail to prepare and ultimately lose.

Stick to your trading plan. Never break your rules — no exceptions!

Apply to My Trading Challenge

I created the Trading Challenge to be a mentor and teach students how to trade. The Challenge is for traders who are dedicated to learning the process and committed to becoming self-sufficient in the market.

And I only accept hard workers, so you must apply.

If you’re accepted, you’ll have access to everything I’ve learned in 20+ years of trading and 10+ years of teaching — and so much more. You can access my video lessons, webinars, DVDs…

And you’ll be a part of the Challenge chat room where you can network with other traders and study different strategies. I know trading is hard, but you don’t have to go it alone.

I’m dedicated to transparency as a trader and teacher. I post all my trades on Profit.ly. Study my wins and my mistakes — I want you to learn from it all.

In 2020, I passed $6 million in profits using just a handful of day trading strategies.* And I’m proud to have taught seven traders in the Challenge who’ve hit millionaire status.* In the Challenge, you have the opportunity to learn from them and how they became self-sufficient.

I’m amazed at this community every day, and you can be too. Apply today and make a real commitment to your trading journey!

(*These results are not typical. Individual results will vary. Most traders lose money. These top traders and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Always do your due diligence and never risk more than you can afford to lose.)

The GameStop Conclusion

Every once in a while, we see a stock make insane moves like GME. Some traders refer to these as black swans.

But we haven’t seen many like GameStop.

The story behind this short squeeze is pretty epic. Truthfully, I kind of love seeing an army of traders stick it to a big Wall Street institution. There’s a lot of shady business on Wall Street. To me, it’s karma.

But for new traders, this isn’t a stock you should trade. If you chase GameStop over $200 or $300 per share, your risk is huge.

Don’t lose focus. If you have a solid trading plan, stick to it and find the next stock that fits your setup. That will serve you better in the long run. The smartest thing to do with GameStop now is to sit back and watch the show.

What do you think about this GameStop madness? Let me know in the comments!

Leave a reply