Have you ever considered what motivates you? I’m not talking about superficial motivation. I mean deep down.

Most of you who read my blog want to learn to trade penny stocks to make money. I assume that’s why you’re here. But there’s more to it than that. It sounds cliché, but money doesn’t make you happy. (New to penny stocks? Start with my FREE penny stock guide.)

So when you’re staring hundreds or thousands of study hours in the face … you’d better know what motivates you. The money is only a means to an end.

My newest millionaire student, Roland Wolf, is a great example.* He studied 17 hours per day in his first six months in the Trading Challenge. That’s crazy. I’m proud of my work ethic, but when I heard about Roland I was actually worried.

So why did he do it? What motivated Roland to become obsessive about learning to trade? Keep reading for the answer.

First, let’s take it to another level. Because once you find what motivates you and get the money to be free … you’ll be able to pursue your true passions. And THAT’S when things get real…

Table of Contents

- 1 What Are You Passionate About?

- 2 Trading Mentor: Questions From Students

- 2.1 “Tim, in a video lesson you likened the $RLFTF 52% gap down to a morning panic. To the untrained eye that seems crazy. How is a big gap down like a morning panic?”

- 2.2 What Motivates You to Take a Trade?

- 2.3 Your $GAXY dip buy on August 10 was your classic morning panic pattern, except it was midday. Are you more comfortable with midday panics in the current market?

- 3 Trading Lesson of the Week

- 4 Life Lesson: Find What Motivates You

- 5 Millionaire Mentor Market Wrap

What Are You Passionate About?

August has been nothing but long days for me. Don’t get me wrong — I’m not complaining. Actually, I’m very proud of how hard I work. I’ve achieved my dreams and goals faster than I ever imagined due to my crazy work ethic.

I’m not trying to brag. There’s a point to this…

And to be honest, I’m exhausted. When the market closes every day, I get to work. I communicate with my team, follow after-hours breaking news, and pursue my passion.

What’s my passion? Charity work. It takes a lot of time to get things right. With Karmagawa’s fundraisers for Yemen, Beirut, and now Mauritius, I’ve been going non-stop.

Please help the victims/families in Beirut, Lebanon here.

Please help clean up the oil spill in Mauritius here.

We’ve raised roughly a million dollars through fundraising. I’m throwing in roughly $500,000 of my own money between all three. We’re working with a bunch of different charities. I’ll have more news about it later this week. Keep an eye on my Twitter account — that’s where you’ll likely get the news quickest.

From Passion to Motivation

For me, I use my passion to help motivate me even more. So it kinda goes full-circle. When I was younger, I wanted fast cars and a luxury lifestyle. Those things motivated me. Now I work hard because there’s so much work to do with our planet. We need to start changing the way we live RIGHT NOW!

Whatever you’re passionate about, use it to help motivate you.

That’s why I prioritize education and protecting the environment. It’s my honor and duty to spread awareness about these issues. And It’s my honor and duty to raise money for good causes.

My passion motivates me to do better and be better every day.

What are YOU passionate about? What motivates YOU? Keep reading for more on the importance of digging deep to find what motivates you.

Trading Mentor: Questions From Students

Every week I answer one or two questions from students in my update. It’s my honor to teach. My goal as a teacher is to be the mentor to you that I never had.

With that in mind, you can find the answers to most basic questions in “The Complete Penny Stock Course.” My student Jamil wrote it as a way to organize what I teach in a simple, straightforward format. (I wrote the forward.) Every trader should read it several times.

First question…

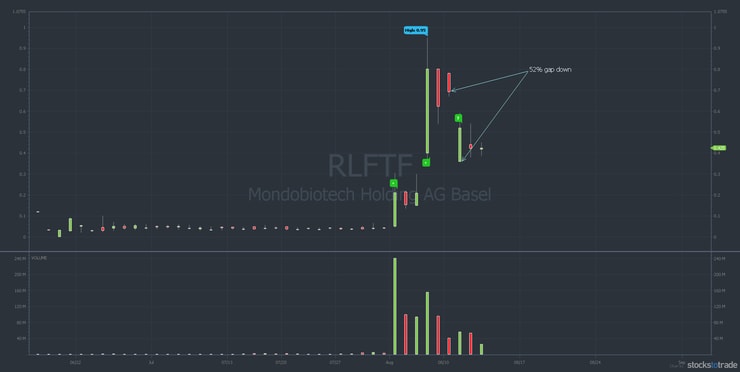

“Tim, in a video lesson you likened the $RLFTF 52% gap down to a morning panic. To the untrained eye that seems crazy. How is a big gap down like a morning panic?”

Relief Therapeutics Holding AG (OTCPK: RLFTF) is a clinical-stage drug company. The company is based in Switzerland, which is why there’s an ‘F’ at the end of the ticker. It’s testing a COVID-19 therapy called Aviptadil. An August 2 announcement of positive results spiked the stock.

Check out the RLFTF three-month chart. I’ve noted the big gap down:

All the virus stocks have gotten crushed now that Russia supposedly has a vaccine. But it’s very questionable how they developed a vaccine so fast. Did they skip Phase 3 trials? As it turns out, even within Russia there’s an uproar about cutting corners with the vaccine.

The hype surrounding the Russian vaccine reminds me of shady penny stock companies.

RLFTF was already questionable before this. I’ve traded it six times since August 3 with total profits of $6,627.* Five of the six trades were intraday panics that I traded well.

(*Please note: My results, along with the results of my top students, are far from typical. Individual results will vary. Most traders lose money. My top students and I have the benefit of many years of hard work and dedication. Trading is inherently risky. Do your due diligence and never risk more than you can afford to lose.)

But I didn’t trade the gap down. I didn’t feel strongly enough about it, and I don’t trade random stocks for random reasons. In a way, this is similar to determining what motivates you in life. I trade with the mindset of a retired trader. I only come out of retirement for the best setups that I feel comfortable with.

Before you risk your hard-earned money you should know…

More Breaking News

- Rezolve AI Limited: Decoding the Surge After a Year of Strategic Developments

- Can UMC’s Sustainable Achievements Propel Stock to New Heights?

- Will Reddit’s Growth Surpass Expectations in 2024? A Look at Recent Developments

What Motivates You to Take a Trade?

It was like a morning panic, except it was based on a news catalyst. The morning panics I like to dip buy are based on stop losses getting taken out and newbies getting wrecked. It’s similar, but not exact.

As it turned out, it was a good dip buy. It was a similar opportunity but I don’t mind missing trades. Too many newbies overtrade. They try to take everything because they just don’t know any better.

I’ve been doing this for 20 years now. I know better. So I don’t mind missing plays that don’t suit me for whatever reason. Know what motivates you in life… and know what motivates you to take a trade.

Next question…

Your $GAXY dip buy on August 10 was your classic morning panic pattern, except it was midday. Are you more comfortable with midday panics in the current market?

It’s not so much about the time of day. I look for any big intraday panics. Yes, I prefer the morning. I prefer to dip buy panics near the market open. On Galaxy Next Generation Inc. (OTCQB: GAXY) I missed out on a big part of the run-up. But I nailed the intraday panic.

Again, it’s due to stop losses getting taken out. These are the market inefficiencies that penny stocks create.

Check out the GAXY intraday chart from August 10 with my entry and exit:

I love this pattern no matter what time of day it happens. While I’d like it to happen near the market open, it happens other times too. If it happens near the market open, I’ll be more aggressive. Get in the habit of looking for panics every single morning.

30-Day Bootcamp Day 16: Panic Dip Buys

Six-figure Trading Challenge student Matt Monaco* helped me with the brand new 30-Day Bootcamp. The positive feedback has been amazing. Learn more about panic dip buys on Day 16. Get into the 30-Day Bootcamp here.

This is why you MUST watch our new https://t.co/5na3WlyHE9 bootcamp, @mono_trader made nearly $10k today on $GAXY $IGEN and I made $5k+ on $GAXY $MARK $LKNCY straight out out of day 6 and day 16 from our course, study up & reap the rewards over time!!! #ilovemyjob #proudteacher https://t.co/fcE0yws3u6

— Timothy Sykes (@timothysykes) August 10, 2020

There’s so much opportunity in the market right now. Just be sure to follow the…

Trading Lesson of the Week

The market seems a little slower in August. I mentioned in chat that some traders take August off. For example, I mentioned that I think Tim Grittani is out this whole month. People were freaking out…

“Oh, should I study more? Has the market changed?”

Take It One Day At a Time

Typically, August is slower. But … typically there’s not a global pandemic with millions staying home trying to learn how to trade. So maybe this will be a busy August.

To put it in perspective….

In August 2019 I made $9,753 in profits for the entire month.* Halfway through August 2020, I’ve already made $50,284.* If you look at it like that, this is a busy August. I’m doing well. But the important thing is to take it one day at a time.

Life Lesson: Find What Motivates You

I’ve come to realize how important personal development is to my students. Every successful student has found what motivates them and then used it.

So what motivates you? What kind of life do you want with this? Don’t just think about the money.

Some people are criticizing Tim Grittani for taking a month off. He doesn’t care! He’s already made over $3 million this year. He can take a few days or weeks off. He can take a whole year off. He’s made $13 million.*

You don’t want to become a slave to this game.

My Latest Millionaire Student Roland Gets It

Again, what motivates you? Roland got into trading and turned $4,000 into $1 million because he and his wife were expecting another baby. They were both working, but they didn’t even know how they could afford another child. Then they started thinking about saving for college funds and the future.

So Roland got into trading for his family. You have to ask yourself…

What motivates you to succeed in life? What makes you tick? What are you pushing for? What are you studying for?

Leave a comment below this post.

And don’t say, “For the money.”

Millionaire Mentor Market Wrap

Money is just a means to an end. Do you wanna buy nice cars? Do you wanna travel the world? How about treating your parents or family? Maybe you just want freedom and to get out of the rat race.

Leave a comment below and tell me … what motivates you?

Leave a reply