Wanna know how I make money while I sleep?

I just shared my strategy … Did you miss the webinar?

If so, watch the replay here now — before you do anything else!

The next opportunity to trade this setup could be as soon as tomorrow … Will you be prepared?

There’s still time to learn … Keep reading to get started.

Table of Contents

It’s Not Just a Dream…

Imagine this scenario…

You place a trade before the market close on a Friday. Then you walk away from your monitor. You live your life.

When you log back into your account Monday morning you see your position jumped 10%. That’s on the low end…

The whole time you were sleeping in, having brunch, hanging out with friends, you were working toward making money. You made a profit while you weren’t even looking.

It might sound like a dream, but it’s not. This is how my Weekend Trader pattern works. But it doesn’t work with just any stock. It only works with plays that meet VERY strict criteria.

You Can’t Do This With Every Stock…

A lot of traders are lazy and just want shortcuts and hot stock picks.

My Weekend Trader pattern can be an effective strategy, but only if you understand the rules.

You’ve gotta look for the right patterns and criteria.

As a day trader, I look for specific patterns in every potential trade.

I also use indicators to help strengthen my conviction. I have 7 indicators I use for every trade.

Wanna know the real reason why patterns work?

Trading is emotional.

When people get emotional they become predictable. Traders are the same. It’s all about being able to think how your opponent thinks.

When specific things happen in my niche, there are predictable outcomes. But only if you can recognize the pattern. Does that make sense?

The real reason most traders lose is that they’re not prepared.

They haven’t studied enough to recognize the patterns. Then they get emotional. I teach my students to patiently wait until it’s the perfect time to strike.

When it is, trade like a sniper.

How My Weekend Pattern Works

This is one of my most PROFITABLE strategies in this current market.

It keeps happening … I keep making profits.

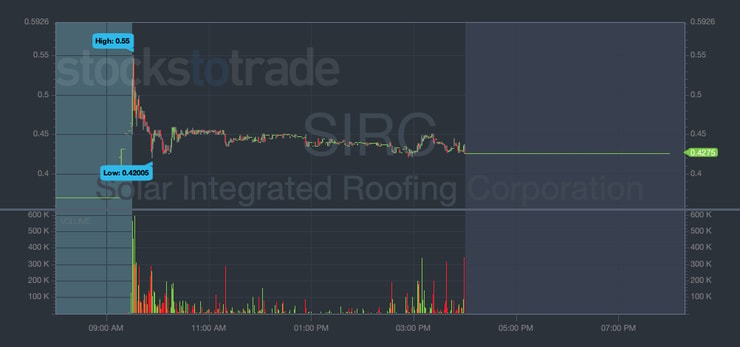

One of my best trades from last month was on Solar Integrated Roofing Corp. (OTCPK: SIRC). This one happened over a holiday weekend.

After solid earnings news, I bought this former supernova on a Friday to hold over the long weekend. Not much was happening yet…

But the hype built over the weekend, and the stock spiked on Tuesday when the market reopened.

On Tuesday, I sold for a $1,150 profit…

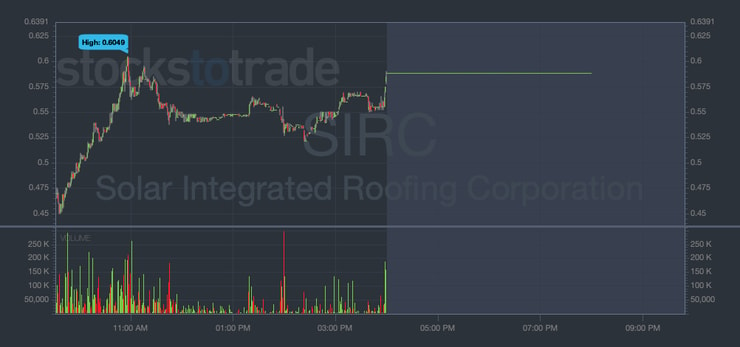

Then there was my most recent win on Sphere 3D Corp. (NASDAQ: ANY).

I bought this crypto play after a Breaking News Chat alert on a Friday.

They announced that they were expanding their bitcoin (BTC) mining operation…

Over the weekend, the hype kept building.

I exited the trade on Monday … Even though it didn’t spike as much as I thought it would, I still made a $1,950 profit.

You can read more about the trade in this post.

But as you can see from the chart, the stock pick wasn’t random — and my entries and exits were meticulously planned…

That’s why I want to teach you this pattern. I want traders to understand how it works and how to make use of it.

That’s why you NEED to see the webinar replay here…

Breaking It Down

I scan for stocks that are up on news every Friday. Here’s why.

Over the weekend, the market’s closed. In the case of OTC stocks, there’s no premarket or after-hours trading.

That allows time for the hype to build. People get excited about the stock. The orders get piled up and execute at the market open at 9:30 a.m. ET.

By entering early, I get to take advantage of the hype and informational inefficiencies that can create massive moves.

But I don’t just trade any stock that’s up on news…

The news and the chart pattern MUST match my specific criteria.

If so, I’ll buy the stock before the market closes.

Then, all I have to do is sell at the open into all the buying pressure. That’s called selling into strength.

How to Stay Safe With My Weekend Pattern

Remember … no pattern works 100% of the time.

Trading isn’t an exact science. That’s why I have two main strategies for staying safe…

Cut Losses Quickly

This is my #1 rule. If my strategy doesn’t work, I get out.

I will NEVER hold and hope.

I’d rather be out early with small losses than have to sit through hours of bag holding. That’s excruciating for me. Also, every minute I waste in a bad position means I’m missing potential spikers.

More Breaking News

- Decoding TransMedics’ Future: Growth Momentum or Overvaluation?

- Is NXU’s Surge Heralding New Horizons or a Temporary Spike?

- The Surge of FTAI Aviation: Investment Opportunity or Overestimated Rise?

Buy on Support

This is my second rule. You’ve gotta know when to buy these stocks. If you buy at the wrong time you could take an unnecessary loss.

Not sure what ‘buy on support’ means? I’m talking about support and resistance lines. Learn more about support and resistance here.

Here’s a video if you’re more of a visual learner.

Keep Learning…

Now that you know about my weekend pattern, go look for more examples in the market. That’s how you can best use the information I’ve given you.

And you can read these past posts to gain a better understanding …

- Friday’s PERFECT Example of My Weekend Trader Strategy

- Solid Lessons from My $6,476 Weekend Win

- How I Made $2,236 on a Friday Afternoon Selling WAY Too Soon!

Knowledge is power in trading.

If you think you’re ready to take the next step in your trading career, apply for my Trading Challenge. Heads up: I don’t accept everybody…

Our private chat is full of dedicated students ready to learn. I can’t risk clogging up our chat channels with newbies who won’t put in the work.

Keep studying every day if you want to attain your goals. It’s true that anyone can become a day trader. But you’ve gotta be able to put in the grit.

What do you think of my weekend pattern? Leave a comment below — I love to hear from you. Don’t forget to catch the webinar replay here!

Leave a reply