Hey trader. Tim here.

If you trade stocks the same way you did last year, or God forbid, 2020…

You’re in DANGER!

Markets created incredible opportunities when they bounced…

But they also led to some terrible habits.

Don’t worry.

If you’re reading this then you’ve already taken the first step towards avoiding these pitfalls.

Because I’ll let you in on a little secret.

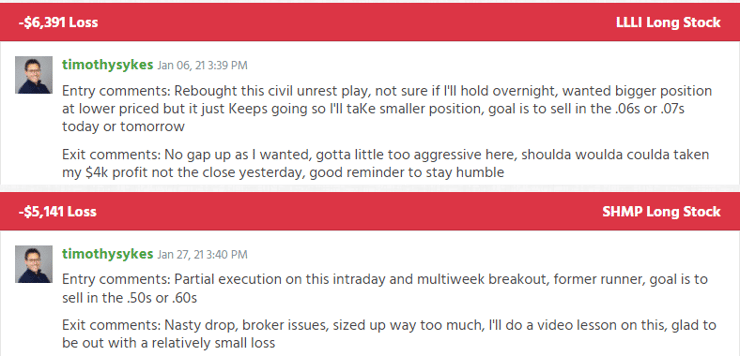

My largest losses for 2021 were caused by one single problem…

Just read the comments above and you’ll see how I broke my own rules.

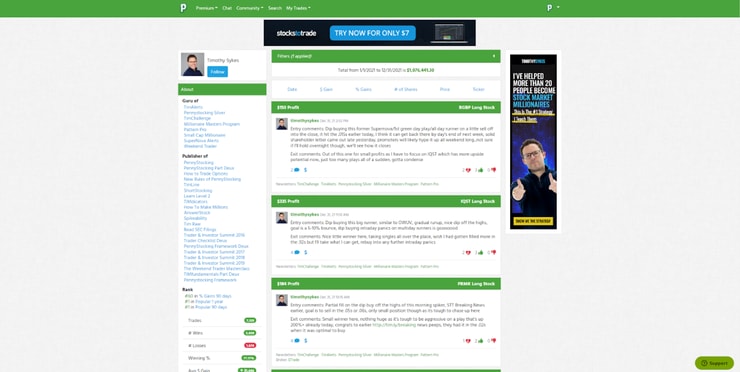

Yet, I still managed to pull in over $1 MILLION for the year.

You see, over the years, I managed to make these occurrences smaller and rarer through discipline.

The best part – I didn’t have to give up too much of my profits.

Discipline isn’t something that comes naturally to me. I’ve had to work hard at developing it.

But if you want to climb the ranks and become a seven-figure (or even eight-figure) trader, then it’s something you’ve gotta master.

Below you’ll learn what my best practices are and how I’ve been able to stay consistently profitable for nearly two decades.

Recognize

Markets aren’t the same as they were in 2020, let alone six months ago.

In fact, we haven’t had to face a hawkish Federal Reserve since the Great Recession over a decade ago.

Now, they’ll raise interest rates even if stocks take it on the chin.

Markets go through cycles. They can last months, years, or even decades.

The last time we faced inflation like this was in the 1970s.

Take a look at how the S&P 500 performed during that decade.

That is a whole lot of nothing for those buy-and-hold types.

We could easily see that kind of market again.

2020 was so unique because the very moment that markets bottomed was when everyone was stuck at home.

With not much going on, folks decided to buy stocks, and rode one of the best rebounds in market history.

It didn’t really matter what you bought, everything went higher.

In 2021, meme stocks took their turn, burning shorts and sending garbage names into the stratosphere.

Those who wanted to bet against AMC Theaters (NYSE: AMC) or GameStop (NYSE: GME) couldn’t afford their positions.

All of that is gone.

We will probably see a time when buy-and-hold does work again.

But the meme, cannabis, and even high-growth tech stocks aren’t coming back any time soon.

This market is different, and we need to trade it differently.

Prepare

Recently, I’ve cut my position sizes substantially for almost all of my trades.

I’m more focused on testing the waters and collecting data than I am on swinging for the fences.

Once I recognize the shift in markets, I begin to prepare.

Honestly, I have no idea what the hot sectors will be next year.

That doesn’t really matter.

By making small bets and trades, I probe different areas of the market, looking for clues to the next move.

But I want to make one thing very clear…

I am NOT taking trades at random. This is a methodical approach. In fact, I could do it with a simulated account.

That’s why I keep a trading plan at all times.

This is one of the hardest things for my students to keep up with.

Believe it or not, it takes practice. Yes, I actually practice making and reviewing my trading plan.

Seriously, once you put together a trading plan, all you need to do is practice a few times a week.

That’s it.

Discipline isn’t about beating your head against the desk for hours.

It’s about doing the right things consistently.

With my trading plan, I can accomplish this in 30 minutes just a few days a week.

All I need to do is sit down, screen for stocks, write out a handful of trade setups, and trade a couple each week.

More Breaking News

- NVIDIA’s Big Moves: Investor’s Playbook Amidst New Announcements

- Tenaya Therapeutics Faces Volatility: Is This a Buying Opportunity?

- Is It Time to Rethink Marathon Digital Holdings Amidst Crypto Turmoil?

That’s it.

Patience

These aren’t easy markets to trade.

Watching stocks chop back and forth makes you feel like you’re missing a setup in there somewhere.

Discipline means keeping yourself out of the market as much as it means staying in the market.

I have a lot of students eager to watch me signal my next trade.

But I learned the hard way, as I’m sure many of you have, that forced trades don’t usually work out.

Patience isn’t easy. It takes practice just like a trading plan.

We all slip up from time to time. So cut yourself some slack.

The goal isn’t to be perfect 100% of the time. It’s to keep getting better.

With that in mind, I want to teach you the #1 pattern in my library.

This pattern is so powerful it works in ANY market, bear or bull.

And it’s simple to find once you know what to look for.

Click here to find out more about my Supernova Pattern.

—Tim

Leave a reply