I have 20+ millionaire Trading Challenge students now. Wanna be like them? If so, there’s something you should know…

My top students didn’t get where they are by accident. They all knew there were no guarantees in trading. But they worked hard anyway. Some took extreme steps to make their goals a reality.

It paid off for them. Are you willing to work that hard?

If you’re serious about trading, start doing these five things TODAY. They’ve contributed to my top students’ success…

Table of Contents

1. Study Harder Than You Did at School

Trading isn’t a high school history exam that you cram for the night before. If you want to make it work, you’ve got to dedicate yourself to the process.

I know it’s hard — especially when studying doesn’t directly make you money. But think about it this way…

My millionaire student Mariana joined my Trading Challenge in 2018, right after she graduated high school.

She studied for an entire year before she started trading with no profits … But she was making a serious investment in her knowledge account.

When Mari finally started trading, her learning curve was a lot faster than many students. This allowed her to scale up faster — she became a millionaire by the age of 20.

This is why I constantly tell my students to study hard and why I send out these late-night study checks:

Who’s still up studying, making your watchlist or reviewing your @StocksToTrade scans? Retweet this if you’re still up putting in the time to hone your craft that most lazy people wouldn’t dream of doing, its why lazy people go nowhere in life so YOU choose your dedication level!

— Timothy Sykes (@timothysykes) April 5, 2022

I know it’s hard — but I also know that studying pays off!

2. Learn From the Past and Do Better

My student Sandeep is currently up over $1.3 million in trading profits.

But before he was a millionaire, he blew up two accounts.

He blew up his first account by making typical newbie mistakes: holding and hoping, cutting losses too quickly, and an ongoing series of papercut losses.

Sandeep learned from those mistakes — but still had plenty more to make.

He blew up his second account by making another newbie mistake. Sandeep was trading too many patterns and strategies. He lacked focus.

These account blow-ups taught Sandeep a lot about how NOT to trade…

More Breaking News

- Nestlé Stock Rises on the Back of Analyst Confidence: Is It the Time to Dive In?

- BITF’s Sudden Plummet: What Investors Need to Know Now

- Coinbase Faces Market Challenges Amid Cryptocurrency Decline

And the third time was a charm. Sandeep started again with a $3K account. He reviewed his mistakes daily to avoid repeating them. Within two years, he became a millionaire.

3. Cut the Cord on Toxic Relationships

My student Dan is currently over $1.9 million in trading profits. But it was a long and sometimes painful journey.

Dan started trading with about $30K to be over the PDT rule. Like so many newbies, he didn’t think he’d lose, but he did. Within about three months, he’d lost over a third of his account.

Dan knew he needed to make some major changes if he wanted to become a successful trader.

But it wasn’t just changing how he traded. He also needed to make some life changes.

One of them was to cut ties with naysayers.

As he puts it, “An unfortunate part of my success story is that I had to become selfish. I stopped being friends with a lot of people. I stopped doing what people thought was best for me.”

It was hard to do, but Dan says the experience was freeing. Dan became a full-time paper trader for eight months and focused on studying. (Fun fact: Dan estimates that he’s devoted over 12,5000 hours to his trading career.)

When he started trading with real money, Dan focused on small gains. He’s further proof that small gains can add up — he passed the $1 million mark in April 2021.

4. Give Back However You Can

In the summer of 2020, my student Tim Grittani, who’s up over $13.5 million in trading profits, traded CytoDyn (OTCQB: CYDY).

LOL damnnnnnnnn @kroyrunner89 just revealed in his https://t.co/EcfUM63rtt webinar that he got one more short in on $CYDY in the afternoon to finish +$272,000 today, if that doesn't inspire you to study hard you're lost. Funny people say you can't short these promoted stocks LOL

— Timothy Sykes (@timothysykes) June 30, 2020

What did he do to celebrate?

He gave a webinar for up-and-coming Trading Challenge students to learn from his trade.

Then there’s my student Jack Kellogg. He’s made over $9.6 million throughout his trading career.

Even with those insane profits, he’s still an active member of the trading community. He helps traders through his Breakouts & Breakdowns chat room.

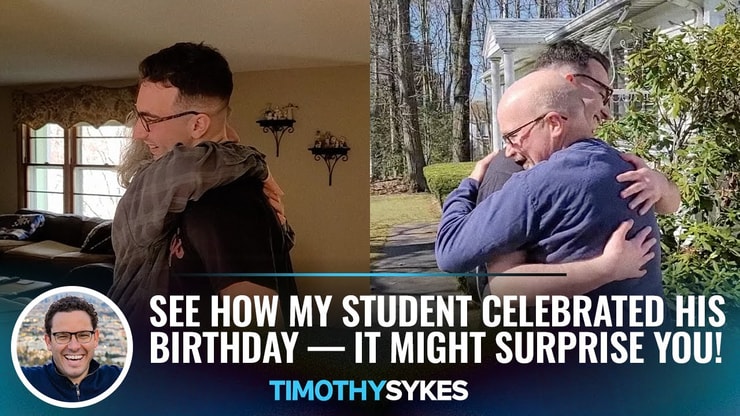

And on his birthday, he even surprised his parents with $100K to thank them for their support over the years. Check out the video:

And then there’s Paul, who bought his mom a house with his trading profits.

These students didn’t NEED to give back. But they did because they appreciate the community and people that helped them attain their success.

Will giving back make you a better trader? Not necessarily. But I believe it’s a crucial part of the winning mindset that many of my top students share.

5. Don’t Get Complacent

In early 2021, the market was on FIRE. I had several Trading Challenge students pass the million-dollar mark in the same WEEK, including Matthew Monaco and Kyle Williams!

But a few months down the line, some of the same students were complaining about how they weren’t making as much money.

I didn’t have much sympathy…

Luckily, I was able to talk some sense into them. I reminded them that top companies don’t just keep doing the same thing forever. They reinvest in research and development and keep growing. Traders need to do the same — they need to adapt to the current market conditions.

They listened to my advice. For example, Matthew branched out into crypto and more recently, into NFTs — and he’s killing it. Read about how he made $63K (over two trades, here and here) on a Pudgy Penguin NFT in this blog post…

Ready to Go the Distance?

All of my 20+ millionaire students come from very different backgrounds and have distinct trading styles. But they have a lot in common, too.

They all share an incredible work ethic, patience, and resolve.

They were all willing to take extreme measures to work toward trading success.

And of course … they all got their start in my Trading Challenge.

Want to be my next top student? Apply today. It’s your opportunity to learn — not just from me, but from my top students, too. Use what you learn to develop your own trading strategy. And maybe I’ll be talking about YOU in an article like this one day.

Are you willing to work hard to make your trading goals a reality? How many of these five things are you doing? Leave a comment — I read every single one!

Leave a reply